Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Tenant Super Relax Plan

Enjoy Hassle-Free Renting

Full RM + FRM support

Full RM + FRM support Instant alerts & premium filters

Instant alerts & premium filters Rent negotiation & relocation help

Rent negotiation & relocation helpUlhasnagar Property Tax: Online, Offline Tax Payment, Bill View, Receipt Download 2025

Table of Contents

Ulhasnagar Property Tax is an important tax imposed on property owners by the Ulhasnagar Municipal Corporation. The tax is collected to ensure the smooth running of civic amenities like roads, sewage systems, street lights, and other public services.

UMC Property Tax can be paid online using the official website and through the designated municipal offices. Various modes of payment, including credit/debit cards, net banking, UPI, and cash payment at counters, are also available. The house tax Ulhasnagar property rates vary based on the property size, usage and location. The article below will guide you through the processes of tax payments, rebates, penalties, and more.

Ulhasnagar Property Tax Quick Info 2025

In the 2025-26 budget, the Ulhasnagar Municipal Corporation (UMC) announced a slight increase in water tax but kept property tax rates unchanged. Property owners can pay their taxes online through the UMC's official portal. Timely payments help avoid penalties and support city services.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

| Information | Details |

| Official Website Link | https://www.umconlineservices.in/Payment/ |

| Tax Payment due date | March 31, 2025 |

| Early bird scheme | waive100% of tax penalty for property owners who pay between 24 Feb to 6th March |

| Penalty for late payment | 25% penalty on the outstanding amount if payment is made between 7 March and 12 March |

| Method for Tax Calculation | Unit Area System(UAS) |

| Tax Rates | The tax rate is based on the location, property type, and usage. |

| Payment method | Payment methods include online payment via UMC’s official website, credit/debit cards, net banking, UPI and more |

| Properties for tax payments | Residential, Industrial, commercial & vacant lands |

| How to check Status | Visit the UMC’s Property Tax website and check using the property number |

| Contact Details | Address: Ulhasnagar Municipal Corporation,Near Chopda Court,Ulhasnagar - 3.Contact Number: 0251 2720150Toll Free No: 18002330319Email: umctax@gmail.com |

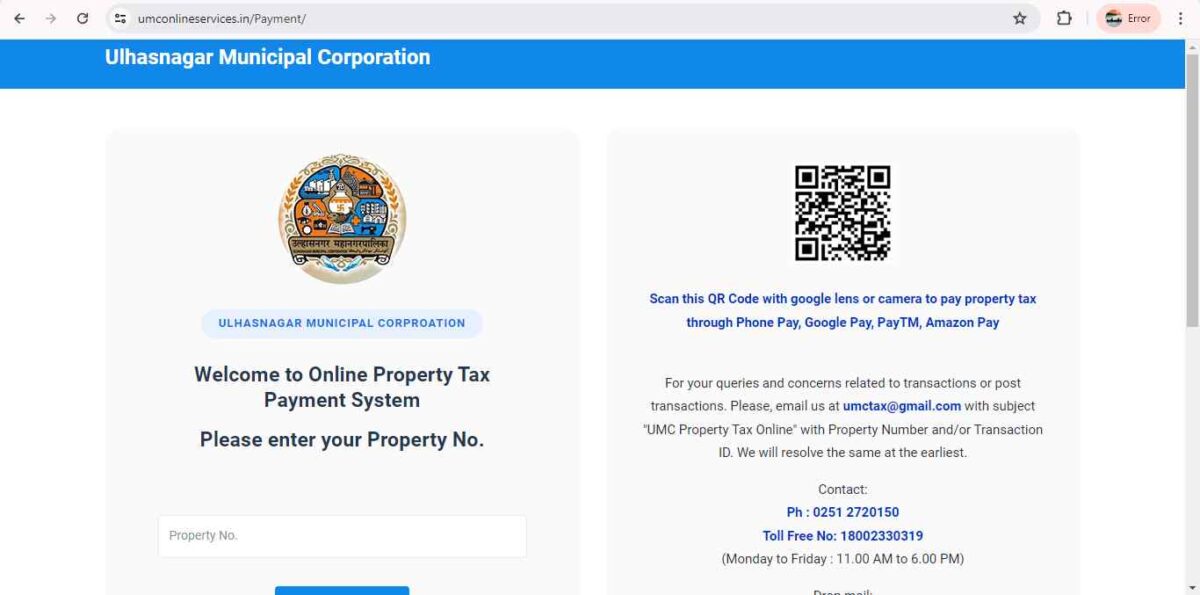

How to Pay Ulhasnagar Municipal Corporation Tax Online in 2025?

You can pay your Ulhasnagar Municipal Corporation property tax online for 2025 through the Ulhasnagar Municipal Corporation website. Here’s how:

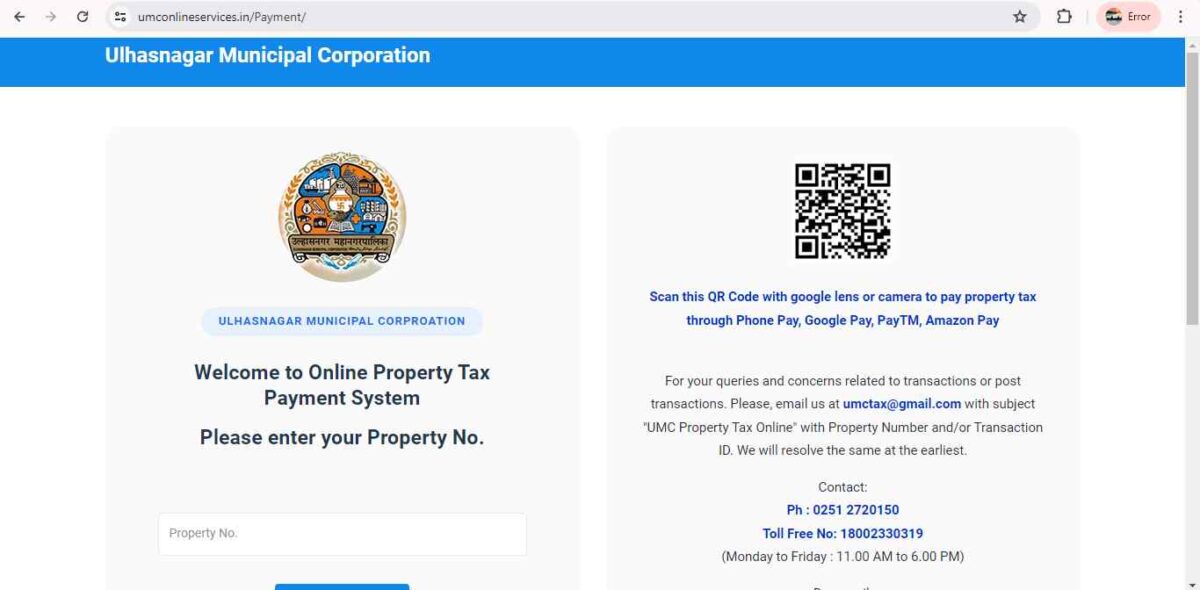

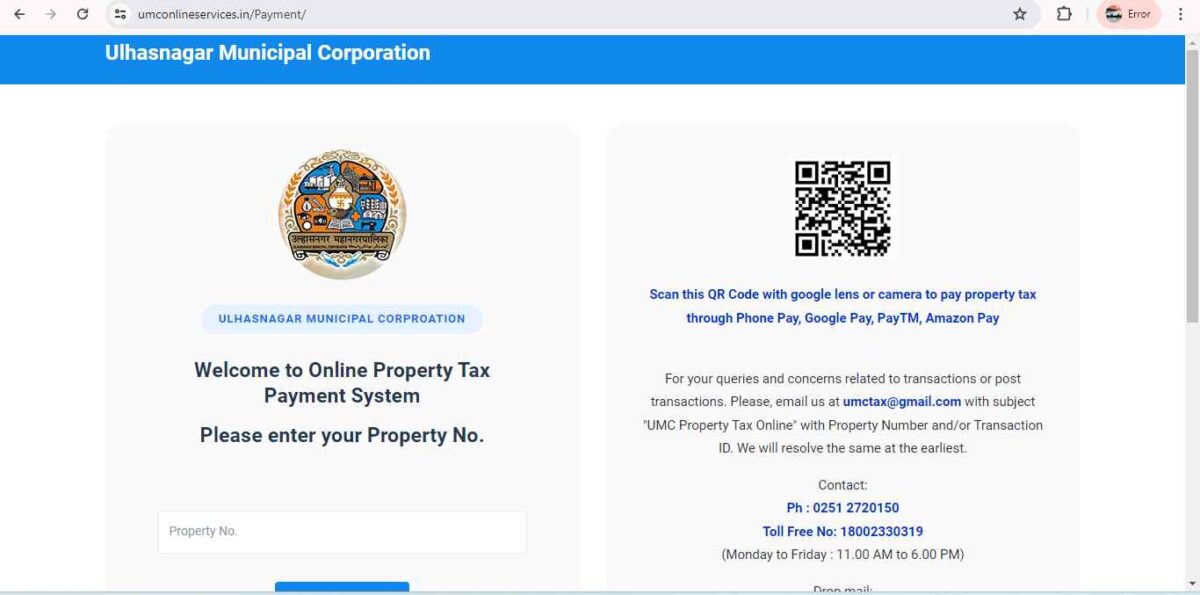

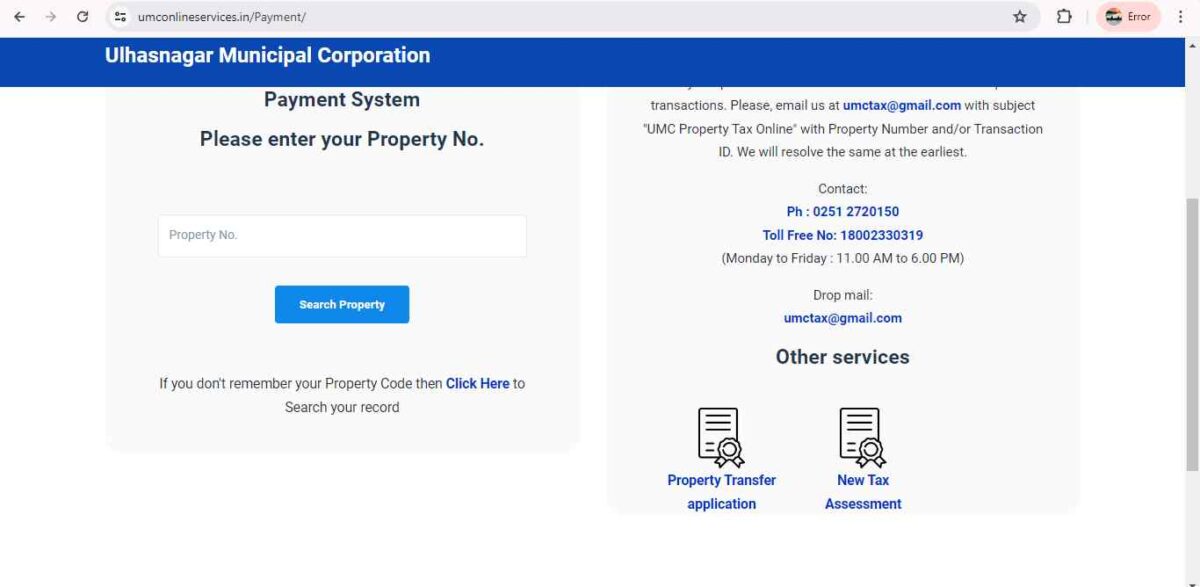

- Visit the Ulhasnagar Municipal Corporation payment website: https://www.umconlineservices.in/Payment/

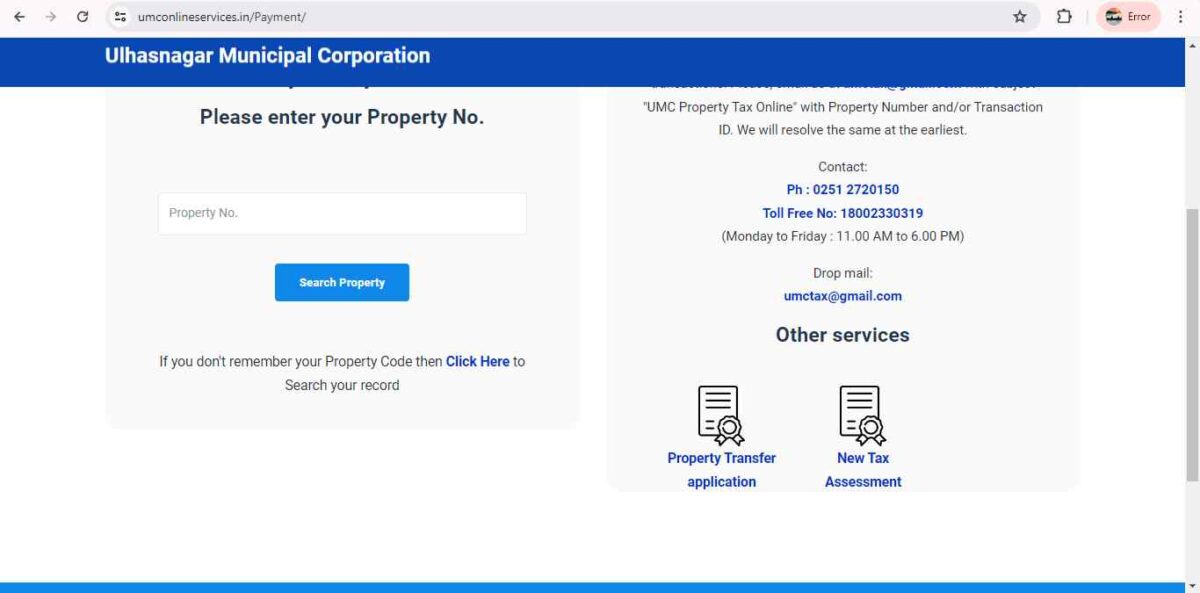

- Enter your Property Number (found on your last payment receipt). If you don't remember it, click on "I don't remember my Property Number, please help me to search it."

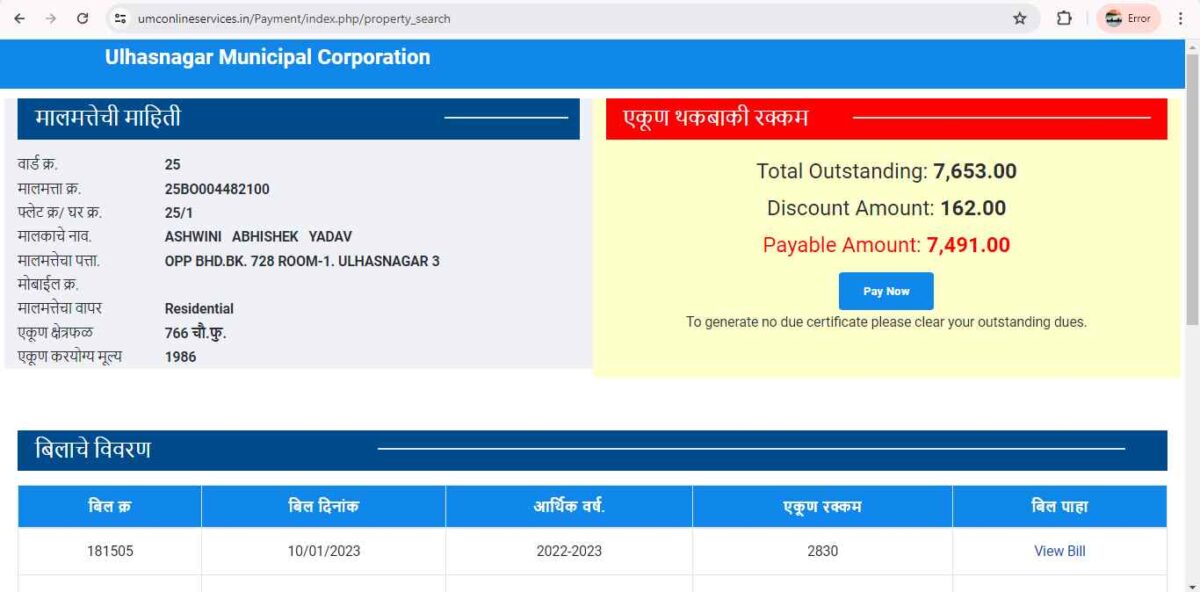

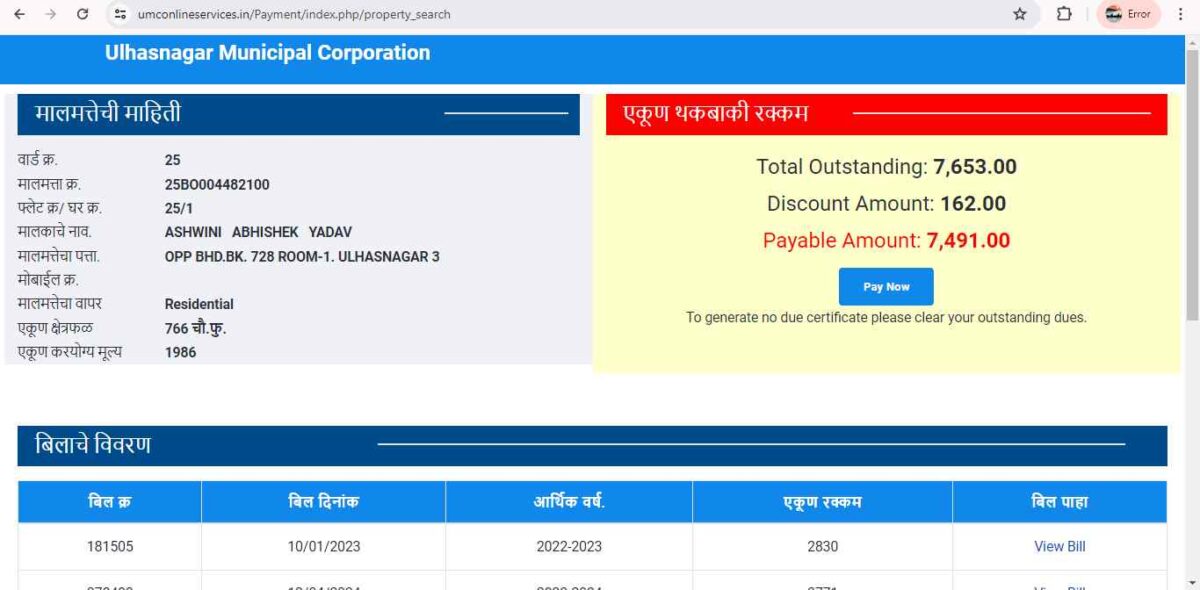

- The website will display your property tax bill.

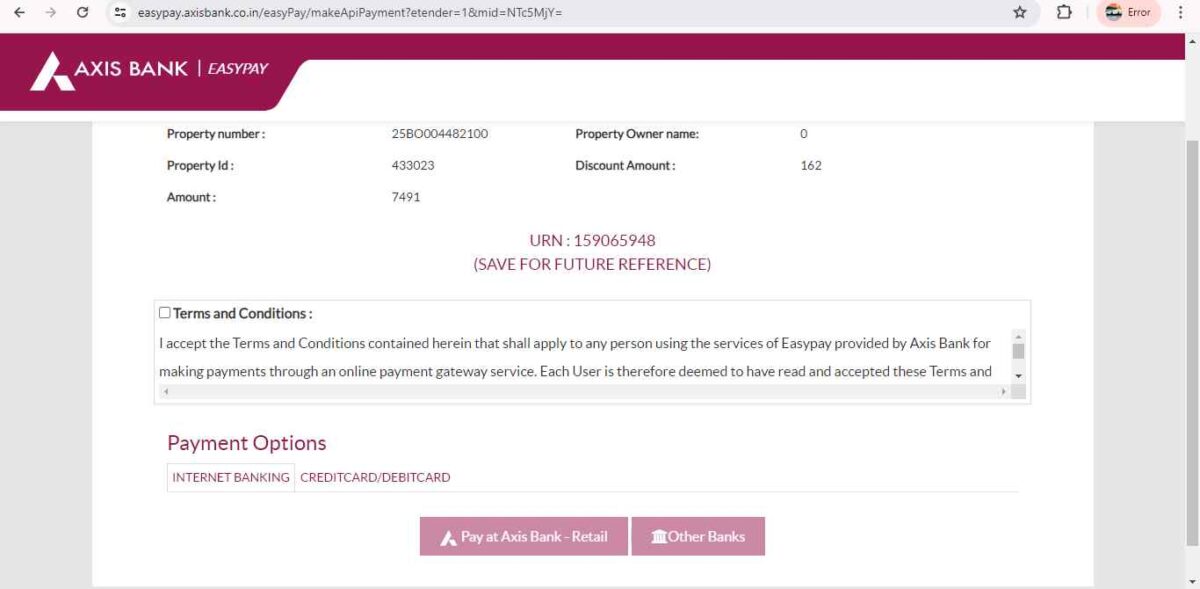

- Review the bill and proceed to make the payment using the available options.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

43934+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

32632+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

29881+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

28466+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

23705+ views

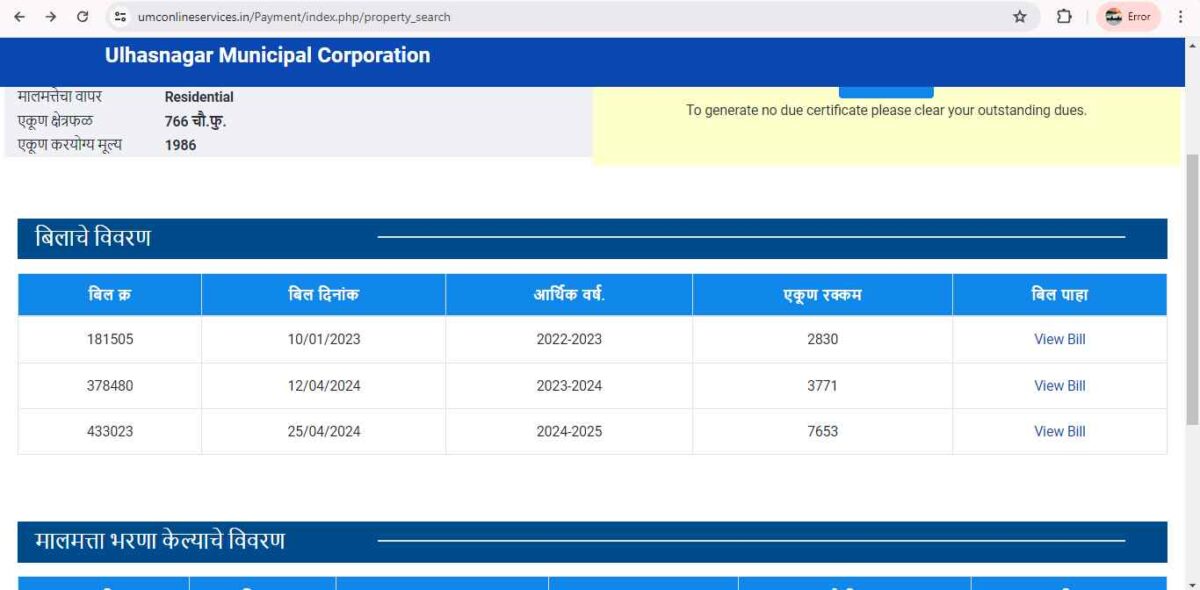

Ulhasnagar Property Tax Bill/Receipt Download 2025

You can download your Ulhasnagar Municipal Corporation property tax bill or receipt for 2025 through their official website:

- Go to the Ulhasnagar Municipal Corporation payment website.

- Enter your Property Number.

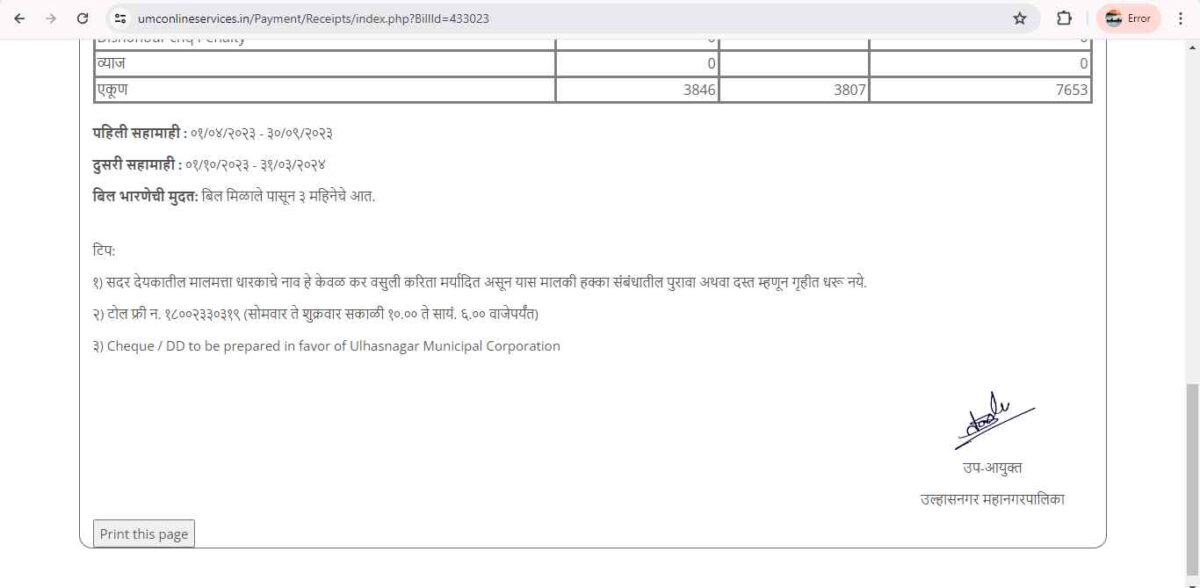

- Click on "View Bill".

- You should be able to view and print your property tax bill for 2025.

Benefits of Online Payment of UMC Property Tax

Online payments continue evolving in 2025, offering even greater advantages for consumers and businesses. Consider these key benefits:

Convenience:

- 24/7 Accessibility: Make payments anytime and from anywhere with an internet connection. No more waiting for business hours or mailing checks.

- Faster Transactions: Payments are processed instantly, eliminating delays associated with checks and cash deposits.

- Simplified Budgeting: Easily track expenses with digital records of all your online transactions.

Enhanced Security:

- Advanced Encryption: Protects sensitive financial information during transactions using secure protocols.

- Fraud Detection: Many platforms have real-time monitoring systems to identify and prevent fraudulent activity.

- Dispute Resolution: Easier to track and challenge unauthorised charges than traditional methods.

Additional Advantages:

- Reduced Costs: Businesses save on check processing fees and cash handling, while consumers might benefit from lower transaction fees with certain payment methods.

- Improved Customer Experience: Faster checkout processes and a wider array of payment options make shopping more convenient.

- Global Reach: Online payments enable businesses to reach a broader customer base across borders and facilitate international transactions.

- Rewards and Loyalty Programs: Many online payment platforms offer reward points, cashback, or other benefits with each transaction.

Ulhasnagar Property Tax Offline Payment 2025

You can pay your Ulhasnagar Municipal Corporation property tax for 2025 offline through the following process:

- Obtain Challan Form: Visit your local Ulhasnagar Municipal Corporation ward office. You can enquire about the location of your ward office on the Ulhasnagar Municipal Corporation website or by calling their helpline. Once there, request a challan form for property tax payment.

- Fill Out Challan: The challan form will require details like your property account number, assessment number, and the year you're paying. Fill out the form accurately to ensure proper credit for your payment.

- Authorised Banks: Identify the banks authorised to collect Ulhasnagar property tax payments. This information might be printed on the challan form or available at the ward office.

- Make Payment: Visit any authorised banks and submit the completed challan form and your property tax payment. Ensure you have the exact amount or slightly more to cover any potential charges.

Ulhasnagar Property Tax Transfer Online in 2025

Here’s how to transfer Ulhasnagar property tax online in 2025:

- Visit the Ulhasnagar Municipal Corporation payment website.

- Download the application from the website.

- Submit the application form along with the required documents to the Ulhasnagar Municipal Corporation.

- UMC will process the request and update its records, which might involve a nominal fee.

Ulhasnagar Property Tax Transfer Charges 2025

The stamp duty applicable to property transactions in Maharashtra is 5% for properties located within municipal areas and 3% for properties situated under gram panchayat jurisdictions. For more information related to fees associated with property tax record updates, check

Check the Ulhasnagar Municipal Corporation website.

Ulhasnagar Property Tax Calculator 2025

The Ulhasnagar Municipal Corporation calculates property tax based on several factors.

The formula for calculating Ulhasnagar property tax is as follows:

Property Tax = Base Tax + Cess

Where:

- Base Tax: Determined based on the built-up area, type, and property usage.

- Cess: Additional charges such as education cess and water tax.

Ulhasnagar Property Tax Last Due Date 2025

Paying your taxes on time is important to avoid penalties and legal action. The last due date to pay Ulhasnagar property tax is March 31, 2025. You can pay the tax online using the official website or visit the designated office.

Ulhasnagar Property Tax Rebate 2025

The Ulhasnagar Municipal Corporation offers rebates to encourage property owners to pay taxes on time. They have launched the Amnesty Scheme, under which they have decided to waive 100% of the tax penalty if the tax is paid between 24 February and 6th March, 75% when it is paid between March 7 and March 12 and 50% when it is paid between 13 March to 18 March. This means that if the tax is paid between February 24 and March 6, only the outstanding amount is paid with no penalty, a 25% penalty on the outstanding amount from March 7 and March 12 and a 50% penalty on the outstanding amount between March 13 and March 18, 2025.

How to change the name in Ulhasnagar Property Tax?

If there are any changes and you need to change the name in Ulhasnagar Property tax, then you need to follow the below steps:

- Download the form from the official website of Ulhasnagar or visit the UMC office

- Submit the required documents

- You need to submit the form to the office

- Once the form is submitted, the UMC will verify the documents to make changes

- Make the payment

Documents required for name change

- Ownership proof, like a sale deed

- Previous tax receipt

- Non-Objection Letter (NOC), if required

- Identification proof like an Adhaar card or PAN card

- Affidavit for Name Change

Ulhasnagar Property Tax App 2025

The UMC App is a user-friendly mobile application designed to streamline the property tax payment process for residents of Ulhasnagar. This app provides a convenient and efficient way to manage property tax obligations, ensuring timely payments and access to essential information.

Key Features:

- Easy Registration and Login

- Property Tax Payment

- Payment History

- Tax Calculations

- Notifications and Reminders

- User Support

- Secure Transactions

How to Pay Ulhasnagar Tax Bill Using NoBroker Pay

NoBroker Pay offers secure and transparent ways to pay your bills. Here are the simple steps you have to follow:

- Download the NoBroker Pay app.

- If you are a first-time user fill up your bank details and set up the account.

- Then select the type of property tax from the options.

- Enter your property tax details.

- View the bill.

- Select the mode of payment.

- Confirm the property tax payment and download the receipt.

Legal Services Offered by NoBroker

NoBroker offers comprehensive legal assistance tailored to property transactions. Here’s an overview of our services:

- Document Scrutiny: Our legal team carefully examines essential documents such as title deeds, property documents, and sale agreements to identify potential issues before finalising the property deal.

- Protection Measures: We protect you from fraud by checking for existing property legal disputes and verifying ownership.

- Service Packages: NoBroker provides various legal service packages, including:

- Buyer Assistance: Guidance and support throughout the buying process.

- Registration: Handling property registration to save you time and hassle.

- On-Demand Services: Specific services such as property title checks, guidance on market value, assistance with missing documents, and verification of occupancy certificates for those who do not need a full package.

- NoBroker Pay: Using NoBroker Pay ensures a secure and convenient way to make your Ulhasnagar property tax payments. Plus, you can track all your payments in one location.

How to Book NoBroker Legal Services

Here are the simple steps to follow for a smooth and secure NoBroker service:

- Get the app on your phone or visit the NoBroker website.

- Find and click on the NoBroker Legal Services section.

- Look through our various services, such as drafting agreements, property verification, and legal consultations.

- Select the needed service, fill in your details, and complete the form.

- A NoBroker expert will contact you via phone or chat for more information. If you have any questions, you can also book a free consultation call.

- The legal services page offers online rental agreements you can buy and customise directly on the NoBroker website.

Why Choose NoBroker Legal Services

Here are some key reasons to choose NoBroker legal services:

- Convenience: NoBroker makes it easy to handle legal tasks from home, so you don’t need to visit a lawyer's office.

- Affordability: Our legal services are competitively priced, offering cost-effective solutions compared to traditional lawyers.

- Experienced Lawyers: We work with seasoned lawyers who have at least 15 years of experience and are qualified by the Bar Council.

- Streamlined Process: NoBroker simplifies the legal process with pre-defined packages and manages communication with the lawyer for you.

- Technology-Driven: We use technology for tasks like document management to improve efficiency and service delivery.

Explore Property Tax Payment Options City-Wise in India

NoBroker: Streamlining Legal Processes for Your Property Transactions

Paying your Ulhasnagar property tax is now more convenient and efficient than ever. Managing your property tax obligations is simpler with various online payment options and dedicated support services. Stay informed, avoid penalties, and ensure timely payments with the resources provided by the Ulhasnagar Municipal Corporation.

For reliable help with property tax management and expert legal advice, book a free consultation with NoBroker’s skilled professionals. Use NoBroker Pay for a secure and easy way to make your Ulhasnagar property tax payments and track them in one place. Our platform also simplifies the stamp duty process. Download the app today!

Frequently Asked Questions

Ans: You can go to the official website of Ulhasnagar and then click on search your record option. Now, if you don’t remember the property ID, choose the owner's name, and you will be able to see the property tax bill.

Ans: You can pay your property tax online on the Ulhasnagar Municipal Corporation website ([http://umconlineservices.in/Payment/ ].

Ans: While there isn't a dedicated Ulhasnagar Municipal Corporation app, you can use other online platforms like the Bajaj Finserv app and pay using a debit card, credit card, net banking, e-wallet, or Paytm.

Ans: The last due date to pay the property tax bill is March 31, 2025, for the 2025 financial year. Pay the tax on time to avoid penalties.

Ans: The Ulhasnagar Municipal Corporation property tax helpline is 1800-233-0319. You can also email them at umctax@gmail.com.

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1103462+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Supreme Court Verdict on Society Maintenance Charges

January 31, 2025

130893+ views

Revenue Stamp in India: Meaning, Types, Uses, Legal Value & Where to Buy in 2025

January 31, 2025

95834+ views

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

92915+ views

Recent blogs in

Rectification Deed Charges in Andhra Pradesh: Fees, Stamp Duty, Documents & Process in 2025

June 20, 2025 by Kruthi

Rectification Deed Charges in Maharashtra: Registration, Fees, Documents and Stamp Duty in 2025

June 20, 2025 by Kruthi

Rectification Deed Charges in Telangana: Regiteration, Fees, Documents and Stamp Duty in 2025

June 20, 2025 by Kruthi

Join the conversation!