Greater Visakhapatnam Municipal Corporation is responsible for the administration of the territories that formerly fell under the jurisdiction of the Visakhapatnam Municipal Corporation (VMC) as well as the Gaju Waka Municipality and 32 more villages (GVMC). On November 21, 2005, the GVMC was officially put into force. The Greater Visakhapatnam Municipal Corporation (GVMC), which has authority over an area of 540 square kilometres, is an essential component of the planning body that constitutes the Visakhapatnam Urban Development Authority (VUDA). Additionally, the Corporation is responsible for the imposition of the GVMC property tax in the regions that fall within its purview.

Things we covered for you

GVMC Online Property Tax Registration Process

To log in to the GVMC website or establish an account, you will need to complete the procedures that are listed below:

● To access the GVMC website, navigate to the following URL: https://www.GVMC.gov.in/.

● To sign in to the GVMC website, go to the website www.GVMC.gov.in and look for a button labelled “Login/Register” in the upper right-hand corner of the page.

● If you have not yet registered on this site, you may do so by selecting the “register now” link and filling out the required information, which includes your username, password, name, email address, and cell phone number.

● After clicking on the button labelled “create OTP,” you will be sent an OTP to the cellphone number you have on file to have access to the online GVMC house tax services.

● The official government website for making an online payment of GVMC property taxes

Calculation of GVMC Property Tax Online

Do you know how to compute the value of the property tax Visakhapatnam in India? Property tax is governed in a manner that is unique to each state. The Annual Rental Value of a property is used by the state of Andhra Pradesh as the basis for calculating property tax (ARV). The actual amount of rent collected from a property is not the same as the ARV of a property, which is generated from several different criteria.

Read: PCMC Property Tax: E-Receipt, Name Change, Rebate and More

Do you find yourself curious about the components that go into calculating the yearly rental value of your property? Let’s take a look at the factors that determine how the ARV of a property is calculated.

● The GVMC house tax status online payment indicates whether the property is intended for residential or commercial use.

● The age of the property: In Visakhapatnam, a greater rate of tax is levied on newly constructed properties in comparison to older homes.

● The term “plinth area” refers to the amount of a property that is covered by buildings. The plinth area encompasses the whole of the occupied space inside a building, including the interior as well as the outside walls.

The GVMC property tax online is broken up into a total of eight different zones, which are as follows:

| Zone | Name |

| 1 | Madhurawada |

| 2 | Asilmetta |

| 3 | Suryabagh |

| 4 | Gnanapuram |

| 5 | Gajuwaka |

| 6 | Vepagunta |

| 7 | Anakapalle |

| 8 | Bheemunipatnam |

Additional aspects: A property’s property tax is affected by additional aspects, such as the kind of construction it has, its size and condition, as well as its proximity to well-known landmarks and other important facilities.

How to Pay GVMC House Tax Online?

Do you understand how to access your Vizag property tax bill on the website provided by the GVMC tax online payment? Let’s take a look at the individual steps involved in being able to see and pay your GVMC tax online payment.

- Navigate to the Greater Visakhapatnam Municipal Corporation’s official website by going to https://www.GVMC.gov.in/. This will take you there.

- To make an electronic payment, go to the website’s bottom left-hand corner and look for an option labelled “e-Payment.”

- Select the “Property Tax / Vacant Land” option from the drop-down menu.

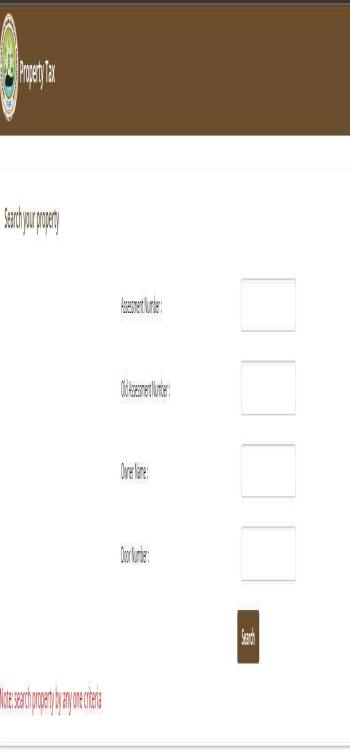

- The site will take you to the website of the Greater Visakhapatnam Municipal Corporation, which is dedicated to the collection of property taxes. The next step is to fill in the information, including the owner’s name, the door number, the assessment number, and the previous assessment number. After you have provided all of the necessary information, choose the “Search” option.

- You will then be able to see the GVMC property tax payment dues for your property tax and pay the GVMC property tax payment online. The following methods may be used to make a payment: credit card, debit card, internet banking, Bharat QR, Paytm, Pura Seva app, Smart Vizag app, or any EMI.

- Download the receipt for the GVMC house tax payment online. You are free to take a copy of this receipt as well if you may need it for future reference.

Instructions for making an Online Payment of the GVMC Property Tax

In addition, you may use a mobile app known as the Pura Seva mobile application to make an online payment for the GVMC municipal tax. The Commissioner & Director of Municipal Administration, which is part of the Government of Andhra Pradesh, is in charge of managing this application.

The following is a list of the steps that you need to follow:

● The first thing you need to do is download the Pura Seva app on your mobile device.

● In the second step, you will need to provide the specifics of your property, including the district, municipality or corporation, and manner of payment.

Read: SMC Property Tax for New Property Owners: What You Need to Know

● At this point, choose the “Submit” option from the menu.

● On the next page, submit the specifics of your property, such as the assessment number and the owner’s name, among other information

● After you have entered the information, go to Step 5 and choose the “Search” option to search property tax GVMC.

● The specifics of your property will be shown on the current page depending on the information that you have supplied. After confirming that the information shown here is accurate, you may proceed to pay your greater Visakhapatnam property tax online payment by using the “Pay Tax” button. You have a selection of payment choices available to you, including online banking, debit cards, and credit cards.

● At this point, you should check the status of your greater Visakhapatnam municipal corporation house tax payment, and it should reflect that the payment was completed. After that, a GVMC property tax receipt will be sent to you. You are free to save a copy of it on your computer for later use.

Filing GMVC Property Tax Alteration

There are many different ways to modify a property tax application. In the case of GVMC property tax, the majority of people file for an alternative for conversion of property from vacant land tax (VLT) to house tax (HT).

Read: Floor Space Index (FSI) in Bangalore: Everything You Need to Know

- Visit cdma.ap.gov.in and select “Online Services” to submit a request to change a VLT to HT.

- Choose the property tax option under “Online Services,” then from the drop-down menu, choose “File You Addition/Alteration (Including Conversion from VLT to HT)”.

- The window will provide a place for you to type in district and corporation/municipality information. Choose the suitable corporation or municipality and the relevant district.

- A new window will open and request the assessment number. You can file for the change by entering the necessary information.

Filing for GMVC Property Tax Revision

Under the general revision petition section, residents may petition for a revision of the property tax assessed against their property. After fifteen days have passed since the Special Notice is generated, a general revision petition for the GVMC property tax may be submitted.

- Click on “online services” at cdma.ap.gov.in to submit a general revision petition.

- Select “submit your general – revision petition” from the drop-down menu under the tab “property tax.”

- You will then be prompted to provide information about the district and municipality in the window. Once updated, it will take you to a popup that asks for the “assessment number” before continuing.

- When you provide your assessment number, the system will direct you to submit a general correction request.

Payment of Taxes on Real Estate Conducted Offline

If you want to submit your payment for the property tax in a manner other than online, please proceed as follows:

Read: RERA Complaints: Safeguarding Your Real Estate Interests in 2024

● Step one is to go to the Purvaseva Center or Citizen Service Center that is located closest to you.

● In the second step, you will need to provide the relevant papers, such as the property assessment slip, its holding number, or its corresponding unique number. Make sure that your GVMC property tax is paid.

● After that, you will be sent a property tax receipt from the greater Visakhapatnam municipal corporation water tax online payment. You should save this receipt somewhere secure for use in the future.

● If you have any questions or concerns about the tax payment, you may get in touch with the GVMC by calling the hotline number that is provided for that purpose. If you choose to make your payment using the digital platform, you must monitor the progress of your GVMC property tax payment through the online portal.

Important Information on the GVMC’s Online Approach for Paying Property Taxes

The property tax for GVMC shouldbe paid twice a year on the appropriate dates. By the end of June, you need to have paid the first instalment of the tax. Before the end of December, you need to have paid the second instalment of the property tax. You will be considered a defaulter if the tax is not paid within the allotted period. After then, you will be compelled to pay the amount of back taxes that are owed in addition to a penalty. The amount of the fine is equal to 2% of the total amount that is due. If you want to get a refund of 5% off your property tax, you have to pay it by the 30th of April of each fiscal year. The age of the structure is another factor that is considered when determining GVMC house tax online payment by bank atm rebates. Examining the connection between the age of the structure and the amount of the refund is the next order of business.

● Up to 25 years: a ten per cent discount on the ARV

● Above the age of 25 and up to the age of 40: a discount of 20% on ARV

● Above the age of 40, a discount of 30% will be applied to ARV.

Managing and understanding your GVMC property tax is essential for residents in the Greater Visakhapatnam Municipal Corporation. With a user-friendly website and convenient online registration process, the GVMC makes it easy for you to access and pay your property tax bill.

By following a few simple steps, you can complete the online payment process hassle-free. Additionally, the Pura Seva mobile application offers an alternative and convenient method for making online payments. If you prefer offline payments, you can visit the nearest Purvaseva or Citizen Service Center to submit your payment.

It is important to remember timely payment is crucial to avoid penalties, and you may even qualify for rebates based on the age of your property. By staying informed and fulfilling your GVMC property tax responsibilities, you contribute to the overall development of the region. Take control of your property tax obligations today and ensure a smooth financial experience with the GVMC.

FAQs

To get your new assessment number, visit the GVMC website, input your previous assessment number, and make a note of your new assessment number when it appears.

You may pay the GVMC property tax via the citizen services of the GVMC house tax online payment by debit card web, the Pura Seva app, or the Smart Vizag app on your mobile device.

The Pura Seva mobile application may be used to make an online payment for GVMC property tax.

You can pay the GVMC property tax online by going to the Purvaseva Centre or the Citizen Service Center that is located closest to you.

Credit cards, debit cards, internet banking, the Bharat QR code, Paytm, the Pura Seva app, the Smart Vizag app, and any kind of instalment plan are all acceptable methods of making an online payment for GVMC property tax.