Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2026-27

Table of Contents

Buying property involves legal obligations beyond signing the ownership papers. GHMC Property Tax in Telangana is crucial to avoid land seizure. GHMC, Greater Hyderabad Municipal Corporation, collects taxes from residents. It's one of India's largest municipal corporations, serving 7.9 million people across 650 sq km.

Both residential and commercial property owners must pay the GHMC property tax annually. If you own a residential property whether to live in it or rent it out, you are liable to the yearly tax to the state government. Similarly, properties used for commercial purposes need to pay the amount of tax levied on them.

GHMC Property Tax - Quick Details

| Information | Details |

| Authority | Greater Hyderabad Municipal Corporation (GHMC) |

| Who Pays | Owners of residential and commercial properties within GHMC jurisdiction |

| Tax Base | Annual Rental Value (ARV) for residential properties and market value for commercial properties |

| Rate | Varies depending on the ARV/market value and property type (residential/commercial) |

| Payment Options | Online payment portal, designated banks |

| Last Due Date | Typically two instalments - July 31st and October 15th (subject to change, refer to official website) |

| Official Login Link | https://onlinepayments.ghmc.gov.in/ |

What is GHMC Property tax?

GHMC stands for 'Greater Hyderabad Municipal Corporation' and is responsible for collecting house and property taxes from the people of Hyderabad. The state government earns a major portion of its revenue through the property tax paid by the citizens of this area. Municipal bodies use these taxes to improve the living conditions of the city by ensuring that public facilities are well maintained.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

The municipal corporation uses the total tax collected to repair potholes, install street lights, build parks and footpaths, and focus on the overall development of the city's infrastructure. It is also responsible for smooth garbage disposal and maintaining the city's cleanliness. The corporation also takes care of the health and sanitation department.

How to Make GHMC Property Tax Online Payments in 2026?

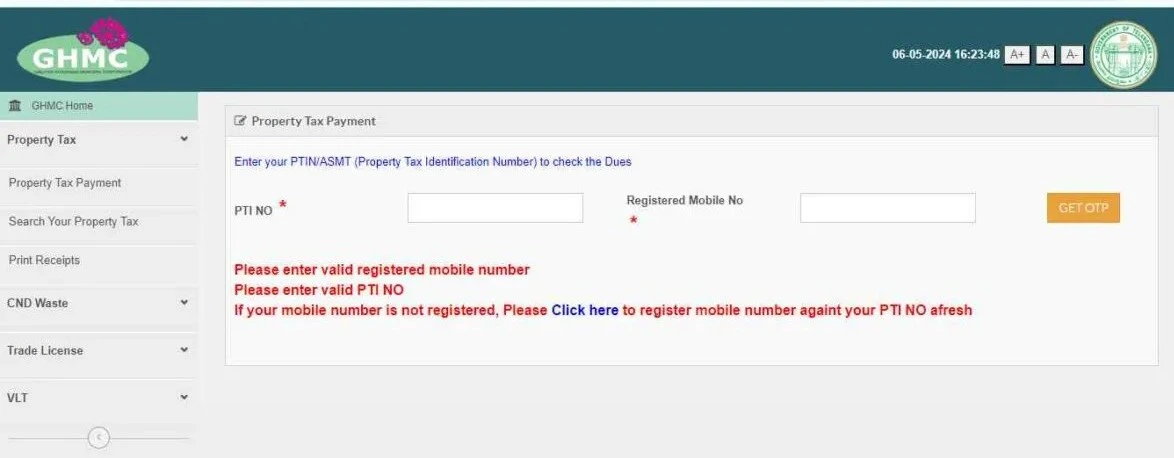

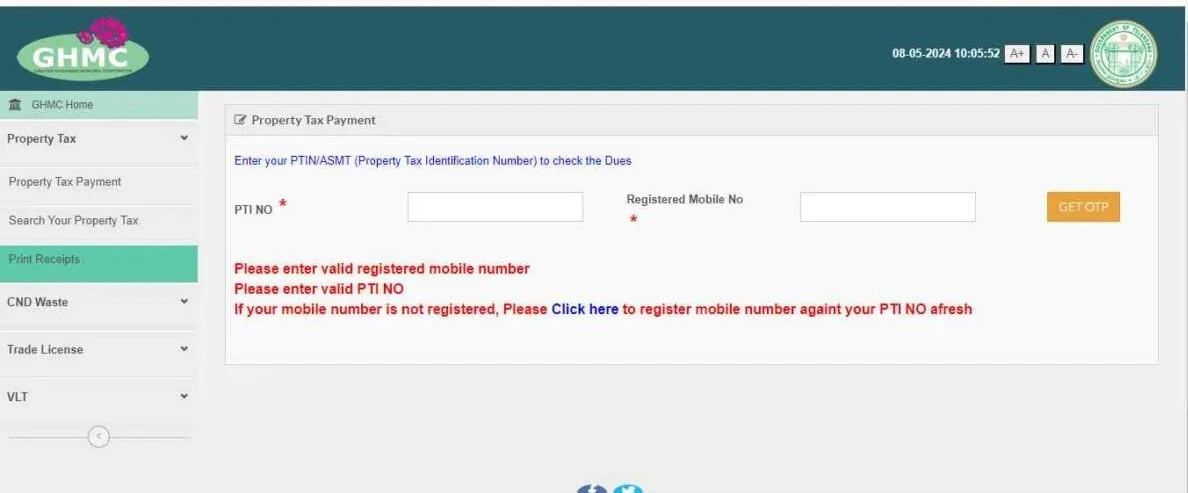

You can make GHMC property tax payments online for 2026-27. Here's what you need to know:

- Online Portal: The Greater Hyderabad Municipal Corporation (GHMC) website has a dedicated portal for property tax payments: GHMC Property Tax Online Payment: https://onlinepayments.ghmc.gov.in/

- Payment Process:

- Visit the portal and enter your PTIN (Property Tax Identification Number) and registered mobile number.

2. You'll receive a one-time password (OTP) on your phone. Enter the OTP to proceed.

3. The portal will display your property tax details, including current dues and any arrears.

4. Choose a payment gateway and complete the online payment.

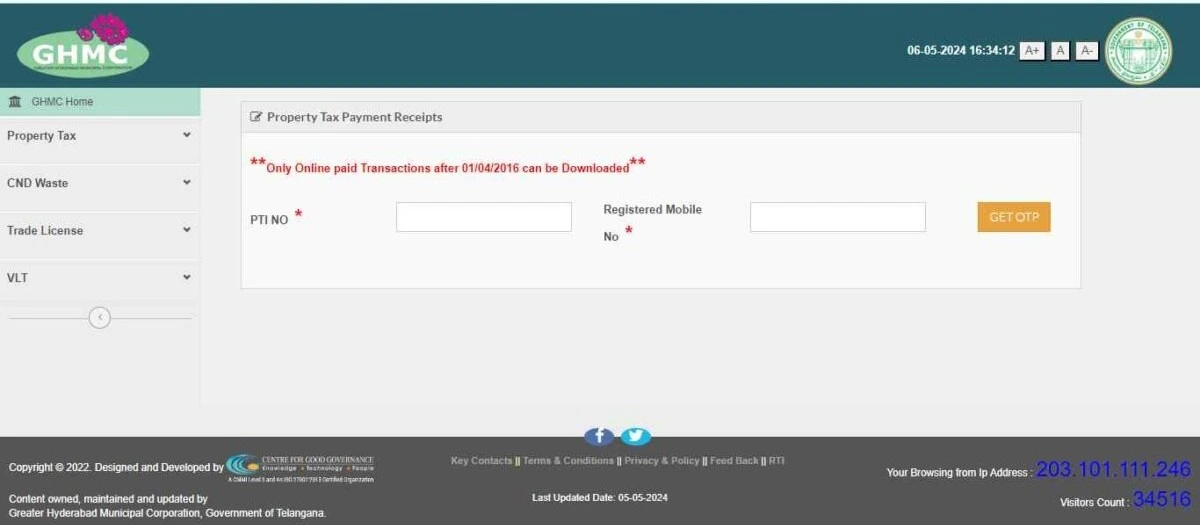

How to Download GHMC Property Tax Receipt for 2026?

You can only download receipts for online payments made after April 1, 2016, on the GHMC website. Here's how to access your receipt:

- GHMC Online Portal: Go to the GHMC Property Tax Online Payment portal: https://onlinepayments.ghmc.gov.in/

- Access Receipts: Click on the "Print Receipts" section.

- Login: Enter your PTIN (Property Tax Identification Number) and registered mobile number.

- Verification: An OTP will be sent to your phone for verification. Enter the OTP to log in.

Download Receipt: If you've made a successful online payment after April 1, 2016, you should be able to view and download the receipt here.

What Are the GHMC Property Tax Rates?

The GHMC website doesn't directly publish the property tax rates in Telangana for 2026. However, the property tax amount is calculated based on a formula that considers two key factors:

- Monthly Rental Value (MRV): GHMC assigns a pre-determined monthly rent to your property based on location and property type (residential or commercial).

- Area of your Property (Plinth Area): This is the built-up area of your property.

Here's a simplified breakdown of the calculation for both residential and commercial properties:

- Residential Property Tax:

- Annual Property Tax = Plinth Area (sq. ft.) x MRV (Rs./sq. ft.) x 12 months x Rate (between 0.17 and 0.30)

- The rate depends on your property's monthly rental value. Some resources mention a range (between 0.17 and 0.30), but the specific rate applicable to your property isn't readily available online.

- Annual Property Tax = Plinth Area (sq. ft.) x MRV (Rs./sq. ft.) x 12 months x Rate (between 0.17 and 0.30)

- Commercial Property Tax:

- Annual Property Tax = 3.5 x Plinth Area (sq. ft.) x MRV (Rs./sq. ft.)

How to Find the Applicable Rate and Monthly Rental Value (MRV) for GHMC Property Tax?

Unfortunately, no single online resource provides the applicable rate and MRV for your specific property. Here are some ways to find this information:

- GHMC Property Tax Search: The GHMC website might offer a search option where you can enter your property details to find your MRV. However, information on the specific rate applicable to your property might be limited.

- Previous Year's Demand Notice: If you have a copy of your property tax demand notice from the previous year, it might mention the applicable rate for your property.

- Contact GHMC: The most reliable way to get the currently applicable rate and MRV for your property is to contact GHMC directly through their website or contact information.

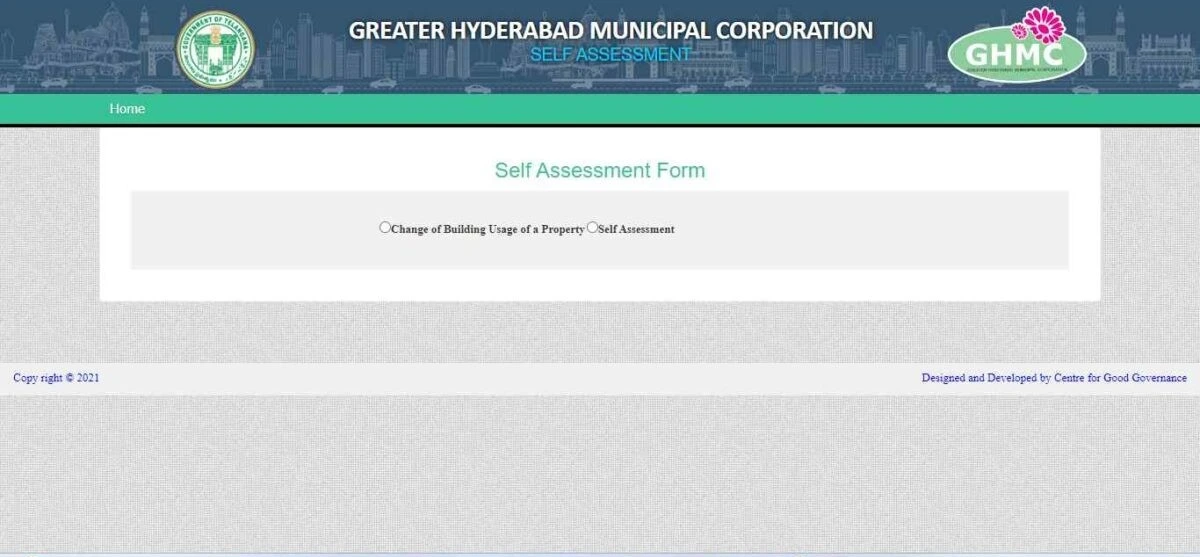

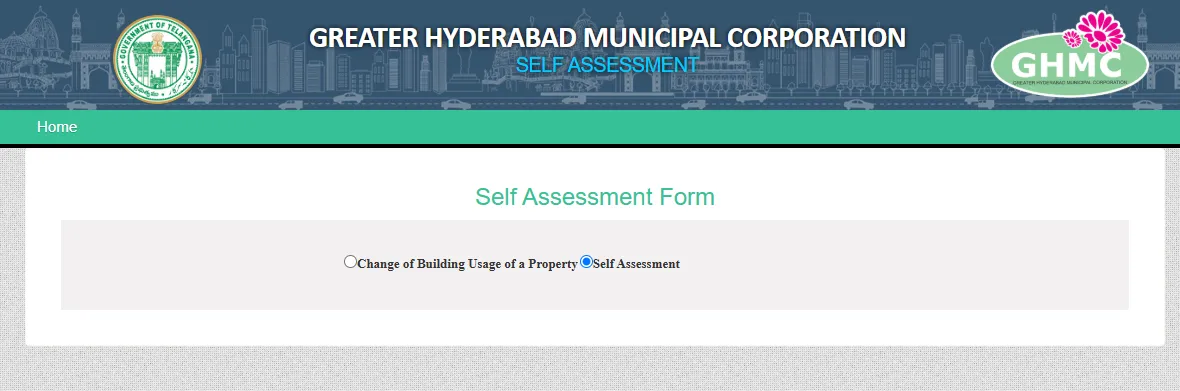

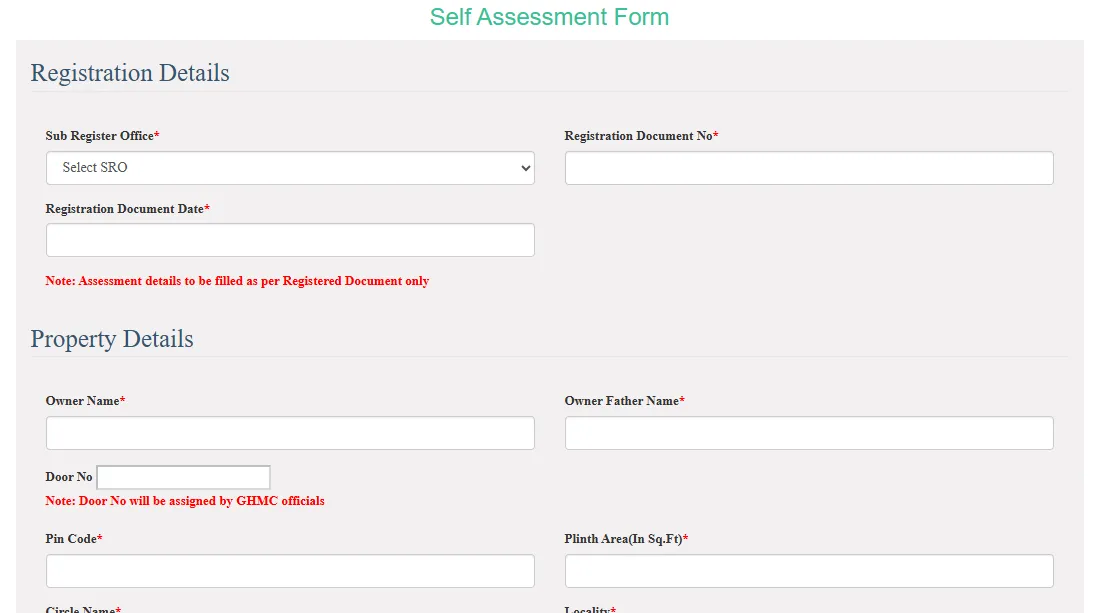

How to Perform GHMC Property Tax Self-Assessment?

You can self-assess your GHMC property tax for 2026 through the GHMC website. Here's what you'll need to do:

Website:

- Access the GHMC Self Assessment portal: https://sa.ghmc.gov.in/

Process:

- The website is designed to self-assess structured properties, so it might be best suited for recently constructed buildings.

- Explore the portal to see if it allows entering property details for calculating the tax amount.

- If the portal facilitates calculation, enter details like property type (residential/commercial), area (sq. ft.), and any other required information.

- The portal might give you an estimated property tax amount based on your input.

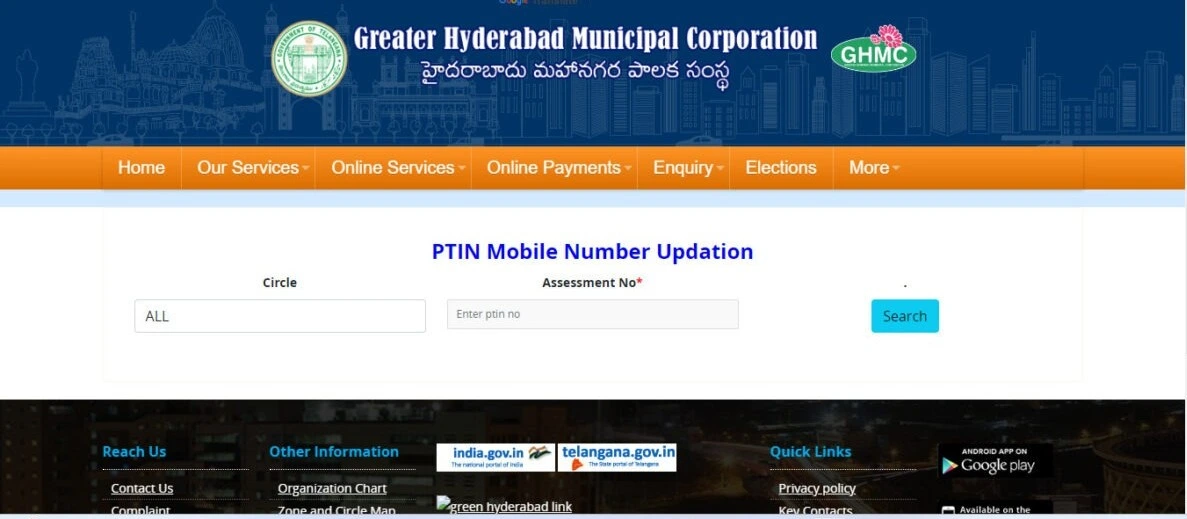

How to Update Your Mobile Number for GHMC Property Tax?

You can update your mobile number associated with your GHMC Property Tax for 2026 online. Here's how:

GHMC Website:

- Visit the GHMC Mobile Number Updation webpage: https://www.ghmc.gov.in/MobileUpdate.aspx

Update Process:

- On the webpage, select the circle your property belongs to from the dropdown menu. [Circles are administrative divisions in GHMC]

- Enter your Property Tax Identification Number (PTIN).

- Click on "Submit."

What Are the GHMC Property Tax Due Dates for 2026?

The last date for the bi-annual payment of GHMC Property Tax is 31st July and 15th October. An interest of 2% p.m. will be charged if you delay the payment of GHMC Property Tax.

How to Calculate GHMC Property Tax in Hyderabad?

- Step 1: Note down the Plinth Area (PA). The Plinth Area can be defined as the total area of the house, including all covered areas like storerooms, balconies, and garages.

- Step 2: If the property is in use by you, find out the recent rent-per-square-foot for other properties in your area's real estate market. If the property is rented to someone else, consider the rent-per-square-foot mentioned in the rental agreement drawn at the time of renting. The final amount will be your Monthly Rental Value (MRV) per square foot.

- Step 3: Apply the below-mentioned formula to find out the exact amount of GHMC property tax details by door number.

Annual Property Tax for Residential Property = PA x MRV (per sq.ft.) x 12 x (0.17 – 0.30) depending on the monthly rental value in the table below – 10% depreciation + 8% library cess.

For GHMC property tax calculation, follow the below-mentioned steps

Step 1 - Find out the Plinth Area (PA).

Step 2 - In the case of commercial properties, you will have to check the Monthly Rental Value (MRV) for the specified monthly rent per square foot for various circles in various taxation zones, as mentioned in the official notifications by GHMC. You can check any GHMC property tax details on the GHMC Website and the Proposed Division of Zones (https://www.ghmc.gov.in/proposed_div_zones.aspx).

Step 3 - Apply the below-mentioned formula to find out the exact amount of GHMC property tax payment.

Annual Property Tax for Commercial Property = 3.5 x PA in sq. Ft. x MRV in Rs. /sq. Ft.

Note -

- The maximum monthly rent per square foot for taxation of commercial properties like ATMs and cellular towers/hoardings is limited to ₹70 and ₹50, respectively.

- The minimum monthly rent per square foot for taxation of commercial properties like educational institutions and hospitals is set at ₹8 and ₹9.50, respectively.

How to Generate PTIN to Pay Tax?

Property Tax Identification Number (PTIN) is a crucial identification number every taxpayer must possess to pay the GHMC property tax online. According to GHMC, Hyderabad city is divided into five zones (North, South, Central, East and West) and 18 Circles. For new properties, GHMC has a 10-digit PTIN, and for old properties, GHMC has a 14-digit PTIN. GHMC property tax by house number has speeded up the entire process of assessment, calculation and payment of property tax in Hyderabad.

If you are a new property owner and need to get your PTIN allotted, you will have to write a house tax Telangana application to the city’s deputy commissioner along with the official documents like the sale deed and occupancy certificate. After the authorities physically cross-check all the details, you will be assigned a house number and PTIN to file the GHMC Hyderabad property tax.

You can generate the PTIN online by using the ‘Online Self-Assessment Scheme’ started by GHMC.

- Visit https://www.ghmc.gov.in/Propertytax.aspx and go to the ‘Online Services’ section and then choose ‘Self-Assessment of Property’.

- Mention all the personal and property details like the locality, Plinth Area, usage, occupancy certificate number, and building permit number. Now you will see the approximate annual property tax mentioned on your screen.

- Your application has been forwarded to the city officials, who will visit and verify the property before issuing a PTIN.

Steps to Pay GHMC Property Tax Online

- Visit the GHMC official website and sign in.

- Click on the 'Property Tax' option mentioned under the Online Payments section.

- To ‘Know Property Tax Dues’, fill in the PTIN.

- Now, you will see all your details like arrears, interest on arrears, property tax amount, and adjustments. Verify them.

- Select the mode of online banking for paying your GHMC property tax dues. You can select either a credit card, debit card or some other format of net banking.

- You can enter the PTIN and download the GHMC property tax receipt.

Note - Through this portal, you cannot generate the receipt for the tax paid via offline methods.

How to Pay GHMC Property Tax Offline?

For making the GHMC Hyderabad property tax payment offline, you can visit either of the below-mentioned places -

- 72 MeeSeva Centres in the GHMC boundary.

- The Citizen Service Centre is present in all 19 circles.

- GHMC Bill Collectors

- Any branch of the State Bank of Hyderabad

Official documents you must carry to pay the property tax in Telangana via offline channels –

- Sale deed of the property.

- Occupancy certificate that you received from the builder before moving in.

- The architect drew up a copy of the building plan.

- A cheque or demand draft should be in the name of the GHMC commissioner.

How to Download the GHMC Self-Assessment Certificate Online?

Here is how to download the GHMC self-assessment certificate:

1. Visit the official website of GHMC - https://www.ghmc.gov.in

2. On the home page, under the online services, click on the property tax assessment option.

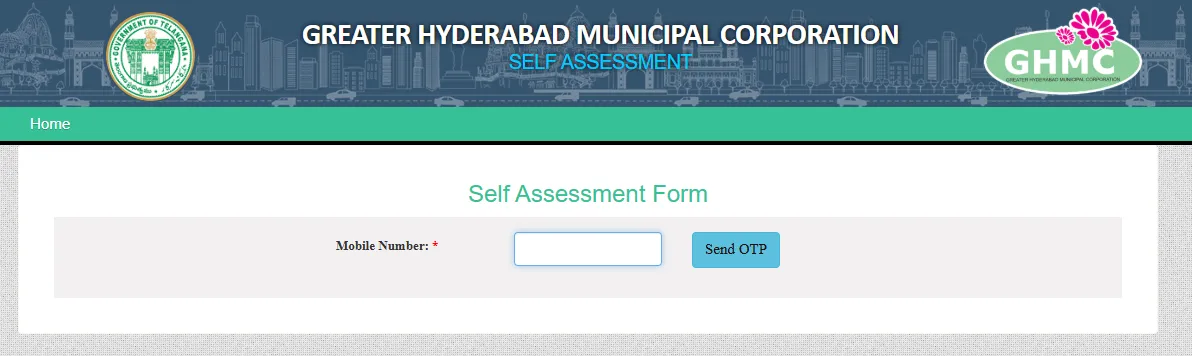

3. You will be directed to another tab. Click on the self-assessment option and proceed to the next steps.

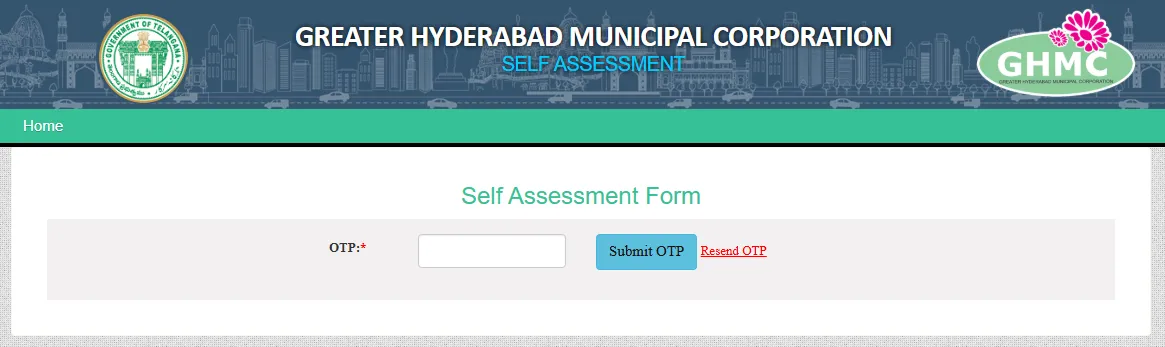

4. Enter the mobile number and OTP sent to your phone.

5. Fill in the property details and click on the submit option.

6. Generate the tax calculation and proceed.

7. Make the payment via Internet banking or UPI payments.

8. The Telangana Municipality will verify your application. After verification, you will receive a notification to download your GHMC property tax assessment certificate.

9. Finally, download your certificate from the official website.

Penalty on Late Payment | Due Dates to Pay GHMC Property Tax

If the taxpayer fails to pay the GHMC property tax by the given due dates, he/she will have to pay an extra 2% per month on the outstanding amount as the penal interest.

Greater Hyderabad Municipal Corporation Circles and Zones

| Sl.No. | Circle No. | Name of the Circle | Name of the Zone |

| 1 | Circle-1 | Kapra | L.B. Nagar |

| 2 | Circle-2 | Uppal | L.B. Nagar |

| 3 | Circle-3 | Hayathnagar | L.B. Nagar |

| 4 | Circle-4 | L.B.Nagar Zone | L.B. Nagar |

| 5 | Circle-5 | SaroorNagar | L.B. Nagar |

| 6 | Circle-6 | Malakpet | Charminar |

| 7 | Circle-7 | Santoshnagar | Charminar |

| 8 | Circle-8 | Chandrayangutta | Charminar |

| 9 | Circle-9 | Charminar | Charminar |

| 10 | Circle-10 | Falaknuma | Charminar |

| 11 | Circle-11 | Rajendra Nagar | Charminar |

| 12 | Circle-12 | Mehdipatnam | Khairathabad |

| 13 | Circle-13 | Karwan | Khairathabad |

| 14 | Circle-14 | Goshamahal | Khairathabad |

| 15 | Circle-15 | Musheerabad | Secunderabad |

| 16 | Circle-16 | Amberpet | Secunderabad |

| 17 | Circle-17 | Khairatabad | Khairathabad |

| 18 | Circle-18 | Jubilee Hills | Khairathabad |

| 19 | Circle-19 | Yousufguda | Serilingampally |

| 20 | Circle-20 | Serilingampally | Serilingampally |

| 21 | Circle-21 | Chandanagar | Serilingampally |

| 22 | Circle-22 | RC Puram, Patancheruvu | Serilingampally |

| 23 | Circle-23 | Moosapet | Kukatpally |

| 24 | Circle-24 | Kukatpally | Kukatpally |

| 25 | Circle-25 | Qutbullapur | Kukatpally |

| 26 | Circle-26 | Gajularamaram | Kukatpally |

| 27 | Circle-27 | Alwal | Kukatpally |

| 28 | Circle-28 | Malkajgiri | Secunderabad |

| 29 | Circle-29 | Secunderabad | Secunderabad |

| 30 | Circle-30 | Begumpet | Secunderabad |

Concession/ Exemption from Paying GHMC Property Tax

Although the law states that all non-agricultural lands, buildings and structures are subjected to a certain property tax rate, some properties are granted special concessions or exemptions. Some of the examples are -

- Up to the 10th standard, registered in government records, educational institutes are 100% exempted from paying taxes.

- Landlords with an annual income Property Tax Exemptions 2025 of less than Rs 5 Lakh.

- Places of worship (Temples, Churches, Mosques, Gurudwaras, Monasteries and others) are 100% exempted from tax.

- Properties that are owned by military personnel or former servicemen are non-taxable.

- Owners residing in their properties that have an annual rent of less than Rs 600 do not have to pay property taxes.

- Owners with unoccupied properties get a 50% concession on the yearly GHMC Hyderabad property tax.

GHMC Property Tax Exemptions 2026

Although the law states that all non-agricultural lands, buildings and structures are subjected to a certain property tax rate, some properties are granted special concessions or exemptions. Some of the examples are -

- Educational institutes registered in government records up to the 10th standard are 100% exempt from paying taxes.

- Landlords that have an annual income of less than ₹5 Lakh.

- Places of worship (Temples, Churches, Mosques, Gurudwaras, Monasteries and others) are 100% exempted from tax.

- Properties that are owned by military personnel or former servicemen are non-taxable.

- Owners residing in properties with an annual rent of less than ₹600 do not have to pay property taxes.

- Owners with unoccupied properties get a 50% concession on the yearly GHMC Hyderabad property tax.

What are the Current Rates of Property Tax in Hyderabad?

Current Slab Rate for Property Tax Hyderabad

| Monthly Rental Value | General Tax | Conservancy Tax | Lighting Tax | Drainage Tax | Total |

| Up to ₹50 | Exempt | Exempt | Exempt | Exempt | Exempt |

| ₹51 – ₹100 | 2.00% | 9.00% | 3.00% | 3.00% | 17.00% |

| ₹101 – ₹200 | 4.00% | 9.00% | 3.00% | 3.00% | 19.00% |

| ₹201 – ₹300 | 7.00% | 9.00% | 3.00% | 3.00% | 22.00% |

| ₹300 and above | 15.00% | 9.00% | 3.00% | 3.00% | 30.00% |

Age rebate on building

| 0-25 years | 10% |

| 26-40 years | 20% |

| More than 40 years | 30% |

Being a property owner brings significant responsibilities. GHMC property tax in Hyderabad must be paid annually to avoid negative outcomes. Managing this can be mentally challenging. Choose NoBroker's legal department for assistance, ensuring satisfactory results at an affordable price. They handle all the technical work and address your questions, simplifying property ownership for you.

Recent Updates and Developments of GHMC Property Tax 2026-27

The GHMC has announced GHMC property tax discount 2025, a One-Time Settlement (OTS) scheme that provides a 90% waiver on interest for outstanding property taxes if taxpayers clear the principal amount and 10% of the interest in a single payment by March 31, 2025. This initiative is expected to generate ₹300-₹500 crore in revenue. The scheme applies only within GHMC limits and excludes other urban local bodies in Telangana.

For those who have already paid their dues, 90% of the interest or penalties will be adjusted against future property tax payments. GHMC, with 19.5 lakh property tax assessments, aims to collect ₹2,000 crore this year, having already collected ₹1,550 crore by March 7, 2025.

Additionally, GHMC is conducting Property Tax Parishkaram sessions at all circle offices on March 8, 15, 22, and 29 to address taxpayer grievances.

Source: The New Indian Express

Explore Property Tax Payment Options City-Wise in India

Pay Your Property Tax Easily with NoBroker Pay

GHMC Property Tax is crucial in developing and maintaining Hyderabad’s civic infrastructure. With the GHMC Property Tax Discount 2025, taxpayers can clear their dues with a 90% interest waiver under the One-Time Settlement (OTS) scheme. To make payments easier, NoBroker Pay provides a stress-free way to pay GHMC Property Tax online in Telangana.

With secure transactions, cashback offers, and multiple payment options like credit cards, UPI, and net banking, NoBroker Pay ensures a convenient tax payment experience. You can also choose NoBroker's legal department for assistance, ensuring satisfactory results at an affordable price. They handle all the technical work and address your questions, simplifying your property ownership. Download the NoBroker app today!

Frequently Asked Questions

Ans: The telangana house tax levied on a residential property ranges from 17% to 30% based on monthly rentals and age of the building.

Ans: Renovated building that has an additional floor or some outer space like a garden or garage will undergo an increase in ghmc property tax. However, the house number and PTIN for the property remains the same.

Ans: You can retrieve your forgotten PTIN by simply logging on to the official website and checking the 'Enquiry' section. Here you will spot an option for 'Property Tax' which will further lead you to the 'Search your PTIN' option. Here you can enter all the correct details and get your PTIN.

Ans: Due dates for payment of the GHMC Property Tax are July 1 and October 15.

Ans: Of course, you can. You can visit any one of the four above mentioned places to pay your ghmc property tax.

Ans: The property tax for apartments in Hyderabad ranges from 17% to 30%.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

61959+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2026-27

March 25, 2025

50439+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

44546+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

39976+ views

Stamp Duty and Property Registration Charges in Hyderabad

January 31, 2025

34663+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116860+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

200707+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

145375+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135810+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!