Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

SDMC Property Tax Online and Offline Payment: Bill Download, Tax Rates, Rebates and Calculations 2025

Table of Contents

SDMC Property Tax 2025 is a mandatory tax that property owners must pay to the South Delhi Municipal Corporation. This tax helps ensure the smooth running of public services like roads, street lights, sanitation, public schools, parks, hospitals, and more. For people's convenience, the SDMC collects this tax, and payment can be made offline through designated ward offices or SDMC property tax online.

South Delhi Property Tax Quick Info 2025

| Information | Details |

| Official Website Link | https://mcdonline.nic.in/ptrmcd/web/citizen/info |

| Tax Payment due date | March 31, 2025 |

| Rebate | 2%. A rebate of 30% is available for the differently abled, senior citizens, and women property owners. |

| Penalty for late payment | 1% |

| Method for Tax Calculation | Annual Rental Value (ARV) |

| Tax Rates | The tax rate is based on the location, property type, and usage. |

| Payment method | Payment methods include online payment via SDMC's official website, credit/debit cards, net banking, UPI, offline payment via designated banks, demand draft, and cash at counters. |

| Properties for tax payments | Residential, Industrial and commercial lands |

| How to check Status | Visit the SDMC Property Tax website and check using the registered mobile number of email ID |

| Contact Details | Address: Dr. S.P.M. Civic Centre, Minto Rd, SKD Basti, Press Enclave, Ajmeri Gate, New Delhi, Delhi, 110002Call Center Number: 155305ithelpdesk@mcd.nic.in |

Who is Liable to Pay?

Anyone who owns real estate property in the South Delhi Municipal Corporation (SDMC) jurisdiction is liable to pay SDMC property tax. This applies to residential and commercial properties, regardless of whether occupied or vacant.

Here's a breakdown of who typically needs to pay:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

- Owners of inhabited or rented-out houses and apartments.

- Owners of commercial establishments like shops, offices, and factories.

- Owners of vacant land within the SDMC area.

Types of Properties Covered under SDMC Property Tax

The SDMC property tax applies to many real estate properties within South Delhi Municipal Corporation limits. Here's a breakdown of the most common types:

- Residential properties: This includes individual houses, apartments, bungalows, and flats.

- Commercial properties: Shops, offices, commercial spaces in buildings, factories, and warehouses all fall under this category.

- Industrial properties: Land and buildings used for industrial purposes come under this bracket.

- Vacant land: Even undeveloped plots or vacant land holdings attract property tax from SDMC.

Importance of Timely Payment of SDMC Property Tax

Paying your SDMC property tax on time is crucial for several reasons:

- Maintains essential services: The tax revenue collected by SDMC is used to fund vital services like sanitation, road maintenance, street lighting, and public parks. Timely payment ensures these services continue to function smoothly.

- Avoids penalties and interest: Late property tax payment attracts penalties and interest charges, significantly increasing your financial burden.

- Smooth property transactions: A clear property tax payment record is essential for a hassle-free sale or transfer of your property in the future.

Calculating SDMC Property Tax

Understanding how your SDMC property tax is calculated allows for better budgeting and transparency. Here's a breakdown of the factors involved and a step-by-step guide:

Factors Influencing Property Tax Calculation

- Annual Rental Value (ARV): This is an estimated yearly rent your property could fetch in the open market. SDMC determines ARV based on location, size, and property type.

- Tax Rate: The SDMC council sets a tax rate as a percentage of the ARV. This rate varies depending on property type (residential or commercial).

Step-By-Step Guide

- Step 1: Find your property's ARV: You can usually obtain this information from your property tax bill or through the SDMC website.

- Step 2: Identify the applicable tax rate: The SDMC website or your bill will specify the tax rate for your property type (residential or commercial).

- Step 3: Calculate the property tax: Multiply the ARV by the tax rate. (Property Tax = ARV x Tax Rate)

(Note: This is a simplified explanation. Actual calculations might involve additional factors)

Examples Illustrating Tax Calculation

Example: Residential Property

- ARV: ₹ 50,000

- Tax Rate for Residential Property (assumed): 10%

Calculation: Property Tax = ₹ 50,000 x 10% = ₹ 5,000

Important Note: These are simplified examples. The actual calculation process might involve additional factors determined by SDMC, such as the property's age, occupancy status, and construction type. It's advisable to refer to the official SDMC website or contact them for the most accurate calculation method.

Payment Process for SDMC Property Tax

Paying your SDMC property tax is convenient with various online and offline options available. Here's a breakdown of the methods and important details:

How to Pay SDMC Property Tax Online?

The preferred method is through the Municipal Corporation of Delhi (MCD) website, which covers the South Delhi area. By paying your SDMC property tax online, you can skip the hassle of queues and easily manage your contribution to your city. You can access the portal and pay via internet banking, debit, or credit cards.

Steps for Online Payment (General Guidance):

- Step 1: Visit the MCD website and select "South Zone" under the "Select your Service Area" section.

- Step 2: Locate the "Pay Property Tax" option and proceed to the designated portal.

- Step 3: Register or log in using your existing credentials (mobile number/ User ID and password).

- Step 4: Find your property details and choose the financial year for payment.

- Step 5: Select your preferred online payment method (internet banking, debit card, or credit card) and proceed with the secure transaction.

How to Pay SDMC Property Tax Offline?

For those who prefer a physical approach, SDMC provides alternative offline payment options:

- Designated Banks: You can visit specific branches of partner banks like HDFC Bank or Axis Bank and make the payment through cash, cheque, or debit/credit card.

- ITZ Cash Counters: SDMC has designated ITZ cash counters where you can make cash payments for your property tax.

What is the Due date and Penalties for Late payment of SDMC House Tax?

Paying your property tax on time or before the due date is important to avoid penalties and legal action from the SDMC government. The due date, or the last date to pay the tax, is generally decided by the government and is typically March 31, 2025. If the property owners fail to pay the tax within the last due date, a penalty of 1% is charged on the outstanding amount per month until the due tax is fully paid.

SDMC Property Tax Rates 2025

For the South Delhi Municipal Corporation Property rates, check the below table:

| Category | Unit Area Value | Residential | Commercial | Industrial |

| A | ₹600 | 12% | 20% | 15% |

| B | ₹500 | 12% | 20% | 15% |

| C | ₹400 | 11% | 20% | 12% |

| D | ₹320 | 11% | 20% | 12% |

| E | ₹270 | 11% | 20% | 12% |

| F | ₹230 | 7% | 20% | 10% |

| G | ₹200 | 7% | 20% | 10% |

| H | ₹100 | 7% | 20% | 10% |

How do you download the SDMC Property Tax Receipt online?

It is important to download the property tax receipt paid online for further processing. It is generally advisable to keep the receipt for a minimum of 5 years to avoid any legal action. Follow the below step-by-step instructions to pay the tax online:

- Step 1: Download the Municipal Corporation of Delhi Mobile application from PlayStore of AppleStore

- Step 2: Now enter the registered mobile number, validate, generate OTP & Login

- Step 3: Now click on ‘PayTax’ and enter the UPIC number, select the financial year you want to pay and then click on ‘Submit.’

- Step 4: Now use your tax paid details option and then click on ‘Download Receipt’ to download the receipt

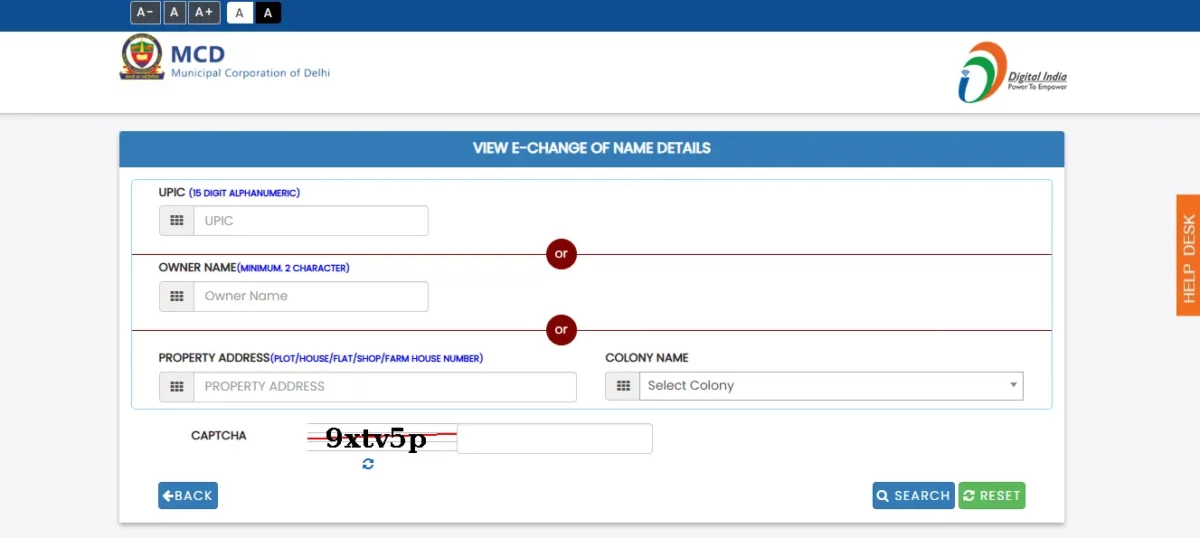

How do you change the name in MCD Property Tax?

If there are any updates and you want to change the name in your property tax, then follow the below steps:

- Step 1: Visit the official website of the Municipal Corporation of Delhi

- Step 2: Then click on ‘Pay Property Tax.

- Step 3: You will be redirected to the property tax page. Under search property details, click on view ‘e-change of Name Details.’

- Step 4: Fill out all the details, such as UPIC or owner name or property address, fill in the Captcha, and then search.

Benefits of Paying SDMC Property Tax

Fulfilling your responsibility to pay SDMC property tax goes beyond just a civic duty. It offers several advantages for you and the community:

1. Contribution to Local Infrastructure Development

Your property tax contributes directly to developing and maintaining essential infrastructure within South Delhi. This includes:

- Road construction and maintenance: Ensures smooth transportation and accessibility within the area.

- Cleanliness and sanitation services: Regular garbage collection and waste management promote a healthy environment.

- Street lighting: Provides better security and visibility during nighttime.

- Public parks and facilities: Create recreational spaces for residents to enjoy.

By paying your tax, you're directly investing in the improvement and well-being of your locality.

2. Access to Civic Amenities and Services

A well-functioning municipal corporation relies on property tax revenue to deliver essential services to residents. These include:

- Water supply: Ensures a reliable source of clean water for households.

- Sewerage disposal: Proper drainage and sewage management are crucial for sanitation.

- Public health facilities: Supports local health centres and dispensaries.

- Education and libraries: Contributes to public educational institutions and community libraries.

Paying your property tax ensures continued access to these vital services that enhance your quality of life.

3. Legal Implications of Non-Payment

Ignoring your SDMC property tax obligations can lead to legal repercussions:

- Penalties and interest charges: Late payment incurs significant financial penalties and additional interest on the outstanding amount.

- Legal action: Persistent non-payment can escalate to legal action from the SDMC, potentially leading to property seizure or forced sale in extreme cases.

Staying compliant ensures you avoid these hassles and potential financial losses.

4. Maintaining Property Records for Future Transactions

A clear record of timely SDMC property tax payments becomes an important document when dealing with your property in the future:

- Selling or transferring property: A clean tax record is essential for a smooth sale or transfer of your property. Potential buyers often verify tax payment history before finalising a deal.

- Loan applications: Banks or financial institutions may consider a consistent tax payment record a positive factor.

Rebates and Exemptions for SDMC Property Tax

The SDMC offers some relief to specific categories of property owners through rebates and exemptions. Here's a quick overview:

Rebates

- Senior Citizens and Women: A 30% rebate is available on property tax for self-occupied properties with an area of up to 100 square metres, solely owned or co-owned by senior citizens (aged 60+) or women.

- Online and Early Payment: An additional 2% rebate (maximum Rs. 10,000) is offered for online payments made during the financial year's first quarter (before June 30th).

Eligibility and Application

- Senior Citizen/Woman Rebate: Proof of age and property ownership documents might be required. Contact SDMC for the exact application process.

- Online and Early Payment Rebate: The rebate is automatically applied during online payment within the specified timeframe.

Explore Property Tax Payment Options City-Wise in India

How NoBroker Can Help?

Understanding and fulfilling your SDMC property tax obligations is essential for you and your community. Following this guide, you can navigate the payment process, explore potential benefits like rebates, and ensure a smooth experience. Remember, timely SDMC property tax contributes to a better living environment for everyone in South Delhi.

Still confused about SDMC property tax? Enjoy hassle-free tax payment with NoBroker Pay. With NoBroker Pay, you can be assured of a secure and convenient way to pay your property tax. Also, track all your payments conveniently in one place. Our secure and convenient platform simplifies the stamp duty process. Avail exclusive offers, track payments conveniently, and download the app today!

Frequently Asked Questions

Ans: You can conveniently pay your SDMC property tax online through the Municipal Corporation of Delhi (MCD) website, which covers South Delhi.

Ans: Ans. After logging in to the MCD portal for SDMC property tax (as mentioned in question 1), you should be able to access your property details and view your current tax bill. The bill will likely display details like your property address, Annual Rental Value (ARV), applicable tax rate, and the total amount due.

Ans: Once you've successfully made your SDMC property tax payment online, the portal should offer an option to download your payment receipt. Look for functionalities like "Download Receipt" or "Payment Confirmation" after completing your transaction. This downloaded receipt serves as proof of your SDMC property tax payment.

Ans: The SDMC property tax is calculated by multiplying the Annual Rental Value (ARV) of your property by the tax rate set by the SDMC council. The ARV is an estimated yearly rent your property could fetch in the open market. You can usually find your ARV on your property tax bill or through the SDMC website.

Ans: Late payment of SDMC property tax attracts penalties and interest charges, significantly increasing your financial burden. It's best to pay your tax on time to avoid these additional fees.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

61959+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2026-27

March 25, 2025

50439+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

44546+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

39976+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

34324+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116860+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

200707+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

145375+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135810+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!