Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

PCMC Property Tax Online: Download E-Receipt, Name Change, Rebate and More

Table of Contents

Do you know what Pimpri Chinchwad Municipal Corporation Property Tax is and why it is important? If not, this blog will help you understand it in simple steps and how you can pay the PCPM Property tax online. This tax is a mandatory tax that property owners have to pay to PCMC, Pune. The tax paid is important for maintaining roads, street lights, public toilets, sanitation, and other public services.

The Property Tax PCMC online system is easy to use and offers various modes of payment, including credit/debit cards, net banking, and UPI. Citizens can also check their dues from the online portal and pay before the due date to avoid penalties. It falls under the Maharashtra government, and the property tax rate is based on property type, location and usage.

PCMC Property Tax Quick Info 2025

| Information | Details |

| Official Website Link | https://publicptaxpcmc.in/ |

| Tax Payment due date | 31st May, 2025 |

| Rebate | 10% on taxes above ₹25,000 and 5% on taxes below ₹25,000 |

| Penalty for late payment | 2% |

| Method for Tax Calculation | Capital Value System (CAS) |

| Tax Rates | The tax rate is based on the location, property type, and usage. |

| Payment method | Online via PCMC's official website, credit/debit cards, net banking, & UPI, and offline via the allotted wards |

| Properties for tax payments | Residential and commercial lands |

| How to check Status | Visit the PCMC Property Tax website and check using the property number |

| Contact Details | Address: Pimpri Chinchwad Municipal CorporationMumbai-Pune Road,Pimpri - 411018,Maharashtra, INDIAContact No: +91-020-67333333/ 020-28333333 |

Calculation of PCMC Property Tax 2025

Calculation of property tax varies from one region to another. However, commonly there are three ways in which the property tax is determined.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

- The first one is based on the market value of the property—for example - Mumbai.

- The second one is where the property tax is calculated based on the per square feet valuation of the property—for instance - Kolkata.

- In the third case, property tax is calculated based on the rent amount fetched by the property.

PCMC property tax payment is calculated on the market value. Follow these steps to find out the amount of PCMC property tax you will have to pay -

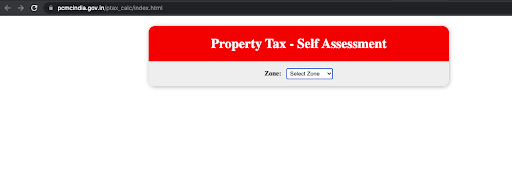

- Visit the PCMC Web Property Tax Self-Assessment Portal here.

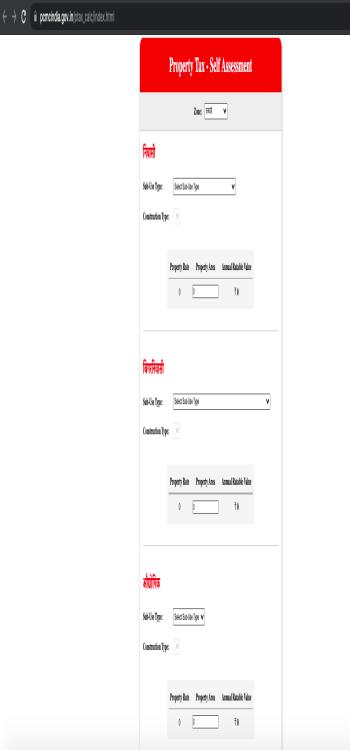

- From the pop-up list, choose the zone your property is located in. Scroll down further for calculating the tax on a commercial property or for options of calculating PCMC property tax as a resident or NRI.

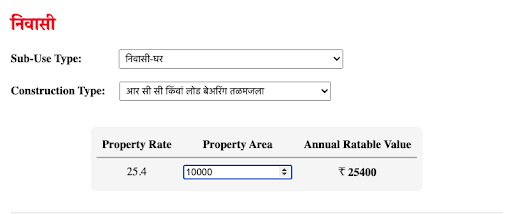

- Select the appropriate option for sub-use type and construction type.

- Enter the property area for which tax is to be calculated.

- The amount payable will be displayed on your screen.

How to Pay PCMC Property Tax Online 2025?

Here’s how you can pay PCMC property tax online and offline modes 2025. To pay your property tax digitally, follow the below-mentioned steps.

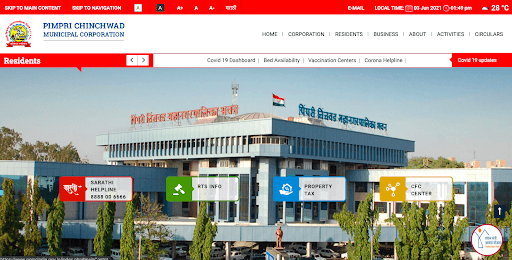

Step 1 - Access the PCMC web portal for PCMC tax payment.

Step 2 - Select residents from the options available in the top menu.

Step 3 - Click on the Property Tax option, which will further direct you to an external link.

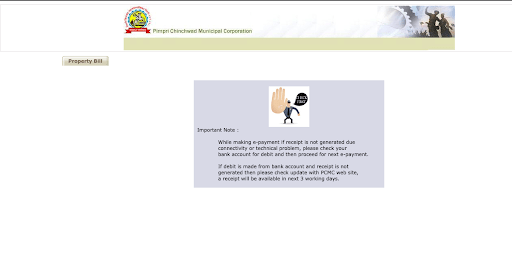

Step 4 - On the resulting page, click on the Property Bill option.

Step 5 - You will be allowed to check the property details based on these options - 'By Property Code,' 'Search in Marathi,' 'Search in English,' and 'Back to Home page.'

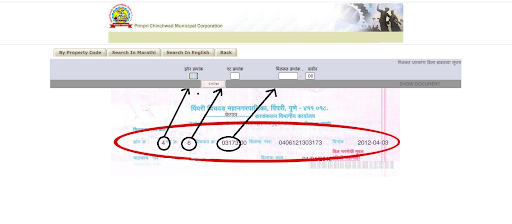

Step 6 - Carefully enter the following details - zone, Gat No., owner name, and address to get your property bill.

Step 7 - Enter the payment details.

Step 8: Input your email ID and mobile number, choose the payment option and proceed.

View PCMC Property Tax Bill 2025

As discussed in the previous section, you can search your PCMC property tax bill by name by following the below-mentioned steps.

Step 1 - Access the PCMC property tax web portal here.

Step 2: Click on the 'property bill' option in the upper left corner of the screen.

Step 3 - Enter the following data to access your property details - zone, Gat no., and owner's name and address.

Step 4 - By clicking on the 'show' option, you will be able to view your property tax property bill. You cannot search for PCMC property tax by name alone; you'll need the property ID or a combination of zone number, Gat number, and owner's name.

What documents are needed for PCMC Property Tax?

For a smooth online process, it is advisable to always keep a few important documents in hand. Below is the list of documents:

- Sale deed/gift deed

- Registration certificate

- Previous property tax receipt, if any

- ID Proof- Adhaar card/voter ID

- Property ID number

PCMC Zone List for Property Tax

Below is the list of zones responsible for property tax:

| Department | Zonal Officer | Admin Officer | Office Address | Phone Number | |

| NIGDI- PRADIKARAN | Shri.Padmakar Gulabrao Pawar | Smt. Sunetra Narhar Phatak | S.No. 25, Bhel Chowk, Nigdi-Pradikaran,Pune – 411044 | 27656621 | Nigdi.tax@pcmcindia.gov.in |

| CHINCHWAD | Shri.Ramkisan Kachru Latpate | Shri Balasaheb Murlidhar Sutar | Gavde Colony, Opp. Lokmanya Hospital , Chinchwad, Pune – 411 033 | 27453310 | chinchwad.tax@pcmcindia.gov.in |

| AKURDI | Shir.Shivaji Daulatrao Mashale | Smt. Sunetra Narhar Phatak | Dr.Babasaheb Ambedkar Sanskurtik Bhavan, Akurdi Gaon,Pune 411 035 | 27243298 | akurdi.tax@pcmcindia.gov.in |

| SANGVI | Shri. Ananda Dnynoba Jadhav | Shri Balasaheb Murlidhar Sutar | Opp. of Gajanan Maharaj Madir, Sangvi, Pune – 411027 | 27280023 | sangvi.tax@pcmcindia.gov.in |

| THERGAON | Shri.Shankar Sitaram Chinchwade | Shri Balasaheb Murlidhar Sutar | Opp. of Mahapalika School, Thergaon, Pune – 411033 | 27273490 | thergaon.tax@pcmcindia.gov.in |

| PIMPRIWAGHIRE | Shri. Chabu Shankarrao Landge | Smt. Sunetra Narhar Phatak | Bharatratna Dr.Babasaheb Ambedkar Bahya Rugnalay Imarat, Shivaji Putala Chowk, Pimpri pune – 411017 | 27410336 | pwaghire.tax@pcmcindia.gov.in |

What is the Due Date of PCMC Property Tax?

Paying the tax on time is important to save yourself from penalties. The due date for PCMC property tax is May 31, 2025. If you pay the bill on time or before this date, you can get a rebate of 10% if the tax amount is ₹25,000.

Download PCMC Property Tax Receipt (PDF) 2025

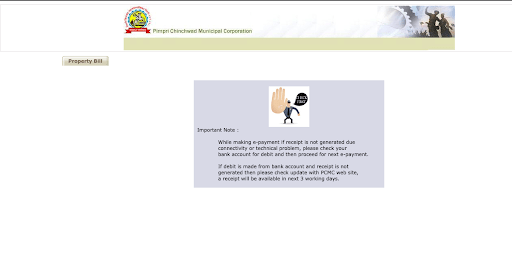

PCMC Property Tax E-Receipt (PDF) 2025 is an official document generated online after the successful payment of your property tax. This receipt acts as proof that you have paid the required tax amount to the PCMC via online mode and can be presented in tax assessments or any legal disputes concerning that property.

According to the PCMC portal, if you face specific technical or connectivity issues and can't view the generated E-Receipt, you must check your bank account for debit information. If the money is not debited, proceed with the next e-payment. However, if the amount is debited, you can check the update with the PCMC website and view your receipt within the next three working days.

Track PCMC Property Tax Payment Status 2025

Here’s how you can track your PCMC property tax payment status in 2025:

1. Reviewing your Payment Gateway:

- If you made the payment online via credit card, debit card, net banking, UPI, or wallet, you should be able to track the status through your respective payment gateway or bank account.

- Look for the transaction around the date you made the payment and see if it's marked as successful or completed.

2. Checking your Property Tax Bill Online:

- Follow the steps mentioned earlier to view your property tax bill on the PCMC website using your property ID/mobile number or property details.

- Once you access the bill, look for any updated information or payment confirmation message. If the "Amount Due" section shows "Paid" or "0", it suggests your payment has likely been processed.

How to Change Name in Property Tax Records?

In case of transfer in the property ownership, the property owner's name should be updated in the official records immediately. This process can be carried out by submitting the following documents.

- E-Receipt for the latest property tax paid.

- Copy of the sales deeds in the applicant's name (new owner), duly attested by the concerned official department.

- No-objection certificate generated by the housing society, which also approves the property transfer.

- Application form received from the property tax office.

Enter the details in the application form and submit all the mentioned documents to the Commissioner of Revenue, present at the PCMC office. Keep a xerox copy for all the records. The ownership transfer will occur within 15-20 working days after the government officials verify your application.

PCMC Property Tax Rebates & Rates 2025

Even though every property owner must pay the property tax to the municipal corporations, certain rebates or discounts are permitted in exceptional cases. PCMC offers a property tax rebate under the following conditions -

- If you own any residential property or a plot of land registered as residential property or non-residential property and the amount of annual tax payable is less than Rs. 25,000, you are eligible to claim a 10% rebate on property tax. If the yearly tax owed is greater than Rs. 25,000, you are eligible to claim a 5% rebate on property tax.

- Residential properties that use solar power or have an efficient rainwater harvesting or vermiculture system get a 5-10% rebate based on the number of active projects. This is to encourage the construction of environment-friendly and sustainable households.

Post 8th March 2011, PCMC also allows special rebates if a woman is the property owner and has no pending civic dues. Women are required to fill out the MAHILA REBATE PROPERTY FORM and download it. Then they must submit the form along with a stamp paper for Rs. 100. The request will be processed within 2-3 weeks.

PCMC Property Tax Helpline Number 2025

The PCMC Property Tax Helpline Number for 2025 is +91 020-67333333.

Here are some additional contact options you might find useful:

- SARATHI Helpline: 8888 00 6666 (This helpline might be able to answer general enquiries related to property tax)

- Email:

Properties Exempted from Paying the PCMC Property Tax

Considering the value, they provide to the community, specific properties are exempted from paying the PCMC property tax.

- Temples, Mosques, Churches, Gurudwaras, or any other sacred property used for worship.

- Properties are used as a burial ground or for cremation.

- Heritage land

- Any property that is utilised for charitable, agricultural, or educational reasons.

- Also, PCMC house tax-exempts any residential constructions less than 500 square feet from property tax. This has benefited over 1.5 Lakh households.

Legal Services Offered by NoBroker

NoBroker offers legal assistance specifically geared towards property transactions. Here's a breakdown of our services:

- Document Scrutiny: Our legal team examines crucial documents like title deeds and sale agreements to identify potential problems before finalising the property deal.

- Protection Measures: We help safeguard you from fraudulent practices by checking for any existing legal disputes on the property and verifying ownership.

- Packages: NoBroker offers various legal service packages. These can include:

- Buyer Assistance: We provide guidance and support throughout the buying process.

- Registration: We handle property registration, saving you time and hassle.

- On-Demand Services: If you don't need a full package, we offer specific services like property title checks, guidance on market value, assistance with missing documents, and verification of occupancy certificates.

- Free Consultation: NoBroker offers a free consultation to discuss your needs and get initial legal advice related to property.

- NoBroker Pay: By using NoBroker Pay, you can ensure a secure and convenient way to make your KMC property tax payments. Additionally, you can track all your payments conveniently in one place.

How to Book NoBroker Legal Services

Follow these simple steps to secure our services for a smooth and hassle-free experience:

- Begin by downloading the NoBroker app or visiting our website.

- Navigate to the NoBroker Legal Services section.

- Browse through the various service packages we offer, including drafting agreements, property verification, and legal consultations.

- Once you choose a service, fill in the necessary details and complete the form.

- After submitting your form, our NoBroker experts will reach out to you for further details, either through a phone call or a chat window. You can also book a free consultation call for additional enquiries.

- Our legal services page also features online rental agreements that can be directly purchased and customised on the NoBroker website.

Why Choose NoBroker Legal Services

Here are some of the key reasons to choose NoBroker legal services:

- Convenience: NoBroker emphasises the ease of their service. You can complete legal tasks from the comfort of your home without needing to visit a lawyer's office.

- Affordability: We offer competitive pricing on our legal services compared to traditional lawyers, ensuring value for money.

- Experienced Lawyers: NoBroker collaborates with seasoned lawyers (minimum 15 years of practice) who are qualified by the Bar Council.

- Streamlined Process: We simplify the legal process by providing pre-defined packages and managing communication with the lawyer on your behalf.

- Technology-Driven: NoBroker utilises technology for tasks like document management to enhance efficiency and improve service delivery.

Explore Property Tax Payment Options City-Wise in India

Seamless Legal Assistance for Your Property Needs with NoBroker

Every person who owns any land or real estate must pay its due tax to the municipal corporation functional in that region. For Pimpri-Chinchwad in Pune, property tax is collected by the PCMC (Pimpri-Chinchwad Municipal Corporation) on a yearly or half-yearly basis. It is considered one of the wealthiest civic bodies of our nation and is one of the few corporations to begin the process of PCMC property tax online payment. In addition, PCMC provides rebates and exemptions from the property tax under particular circumstances.

If you own land in Pimpri-Chinchwad and are looking to manage the property tax or need help with PCMC property tax online payment login or document submissions, contact professionals of the legal department at NoBroker at a very affordable cost. Opt for NoBroker Pay. With this service, you can securely and conveniently handle your VVMC property tax payments. Additionally, you can track all your payments in one place. Our secure platform also streamlines the stamp duty process. Download the app today!

Frequently Asked Questions

Ans: Yes, property tax is collected for empty land unless used for agricultural, educational, or charitable purposes.

Ans: Women property owners were granted a special tax rebate on 8th March 2011.

Ans: PCMC stands for Pimpri-Chinchwad Municipal Corporation.

Ans: In cases of property ownership transfer, you must submit the documents to the Commissioner of Revenue in the PCMC office.

Ans: No, any property under 500 square feet is exempted from paying the PCMC property tax.

Ans: Unfortunately, changing your name on PCMC property tax records cannot be done online. It's an offline process that requires submitting a filled application form along with supporting documents at the nearest zonal office. A duly filled name change application form should be submitted to the revenue commissioner at the PCMC office.

Ans: Yes, PCMC has a mobile app available at the Google Play or Apple App Store. Using the app, you can log in or register and pay the property tax bill online. You can also check the status of any due payment and download the payment receipt.

Ans: SUC stand for Service User Charge, and it is an additional fee that the Municipal Authority ask to pay. It covers water supply, waste management and sewage treatment.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

61959+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2026-27

March 25, 2025

50439+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

44546+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

39976+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

34324+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116860+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

200707+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

145375+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135810+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!