Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

KMC Property Tax Kolkata: Online and Offline Payment, Tax Rebates, Rates and Calculations for 2025

Table of Contents

Kolkata homeowners who own property are responsible for paying Kolkata Municipal Corporation (KMC) property tax. Property tax is the yearly tax imposed by the government on real properties. Respective local governments raise these monies to offer public facilities and other services. Similar to this, Kolkata homeowners must annually pay taxes to the KMC (Kolkata Municipal Corporation). To simplify the procedure, we have assembled some crucial information about Kolkata Municipal Corporation property tax and created a detailed guide.

On December 15, 2016, the Kolkata Municipal Corporation Bill was approved to streamline the tax collection procedure. This gave the Kolkata Municipal Corporation, or KMC, the authority to accurately assess a person’s property tax and manage any rate increases or decreases.

KMC Property Tax - Quick Information for 2025

| Tax Authority | Kolkata Municipal Corporation (KMC) |

| Official Website | https://www.kmcgov.in/KMCPortal/jsp/KMCPortalHome1.jsp |

| Last due date | July 2024 |

| Types of Properties | Residential, Commercial, Industrial, Institutional, Vacant Land, Mixed-Use, Government, etc. |

| Payment Modes | Online: KMC's official website, mobile app, e-wallets like NoBroker Pay. Offline: KMC offices, authorised banks, CSCs (Common Service Centers). |

| Exemptions & Rebates | Available for certain categories (e.g., senior citizens, physically challenged individuals) |

KMC Property Tax: What is the Assessee Number?

The KMC Assessee Number is a unique identifier assigned to each property registered with the Kolkata Municipal Corporation (KMC) for property tax purposes. It acts like an account number for your property tax dues.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

How to Find the Assessee Number to Pay Kolkata Municipal Corporation Property Tax?

- Visit the Kolkata Municipal Corporation's Assessee Information Search page - https://www.kmcgov.in/KMCPortal/jsp/AssesseeInformationSearch.jsp

- Enter your Ward No., Street Name, and Premise No. in the designated fields.

- Once you submit the information, your Assessee Number will be displayed on the screen, if available.

How to locate a property’s assessed number on the KMC website

Property owners can search for the assessee number on the KMC website.

Step 1: Go to the Kolkata Municipal Corporation’s official website at https://www.kmcgov.in/KMCPortal/HomeAction.do

Step 2: Select “Assessment-Collection” under “Online Services” in the left menu.

Step 3: You will be directed to the page with the “Assessee Information Search” option available.

Step 4: Choose the ward number, premises number, assessee number, and street. Your name and the assessee number will be displayed.

Property Tax Exemption Program Run by KMC

The KMC initiated a tax waiver programme in October 2020 to compensate for the property taxes’ lost revenue. But only those are protected by this if they receive their KMC property tax bill payment for the 2019–20 fiscal year by March 31, 2020. Taxpayers were eligible to waive all interest and penalties if they paid off their bills by February 28, 2021. If someone paid between March and May 2021, 60% and 100% of the penalty were correspondingly waived and returned. Applications for this programme must be submitted by January 31, 2020, to be evaluated. The corporate offices and tax collection facilities of KMC accepted applications online.

A Guide to Paying Kolkata Property Taxes Online: Pay KMC Property Tax Bill for 2025

Homeowners are required to pay KMC property tax every year. The amount of tax, however, varies depending on where you are. This is a guide to online property tax payments. Property tax is due each year to the Kolkata Municipal Corporation (KMC) from owners of residential properties in Kolkata. The municipality provides significant public facilities and services using the money obtained from property taxes. To calculate and pay KMC property tax online, follow these steps:

How to Pay KMC Property Tax Online Payment 2025

The Kolkata Municipal Corporation makes it simple for residents to pay property taxes online and check the amount of tax that remains unpaid.

To use this service, however, taxpayers must be aware of their assessee and mobile numbers on file with them. Using your street name and ward number, go to KMC Portal formation Search.jsp to find your assessee number. You can check your KMC assessment status online to see if there are any updates on your property tax bill. We have outlined the steps for paying property taxes online with the Kolkata Municipal Corporation:

Step 1: Visit the Kolkata Municipal Corporation’s official website.

Step 2: Locate the “Online Payment” option on the right side. You will get a drop-down menu with the following options when you choose “Property Tax” from the menu:

- Present PD

- newly added supplements

- Outstanding LOI

- UAA online submission and tension.

Step 3: Select the appropriate choice. Your phone number, assessee number, and email address must be entered. Then click “Pay.”

Step 4: Enter the payment amount on the following screen. Pay the applicable year’s property tax bill from KMC. Users will get an electronic receipt.

How to Download/Print KMC Property Tax Receipt?

Here are the steps on how to download the KMC property tax receipt online:

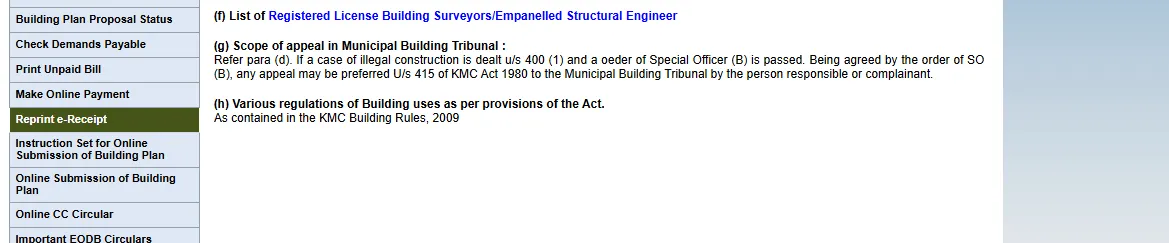

- Go to the Kolkata Municipal Corporation website

- On the left-hand panel, select “Assessment Collection” under the “Online Services” tab.

- On the redirected window, click on the “Reprint E-receipt” option.

- Enter the following details:

- Assessee number

- Receipt date from (optional)

- Receipt date to (optional)

- Click on the “Search” button.

- The list of e-receipts will be displayed.

- Click on the “Download” button next to the e-receipt you want to download.

- The e-receipt will be downloaded to your computer.

How to Check KMC Property Tax Payment Status 2025?

To find out the status of the Kolkata Municipal Corporation’s online property tax payment, go to the official website. You can determine whether or not you have paid your KMC property taxes by providing the property details on the official website.

How to Check Unpaid KMC Property Tax Bill Online 2025?

The Kolkata Municipal Corporation (KMC) website doesn't offer a programmatic way to access information on unpaid bills for the current year (2025-26).

However, you can leverage their online services to check your unpaid KMC property tax bill:

- Visit the KMC website.

- Navigate to the "Assessment Collection" section under "Online Services".

- Look for options like "Print Unpaid Bill" or "Check Demands Payable" (terminology might change). These options typically require your Assessee number to retrieve outstanding bills.

How to Print the KMC Property Tax Bill?

Here's how to print your KMC Property Tax bill, assuming it's an unpaid bill for the current financial year (2025-26):

1. Visit the KMC website: Head over to the official website of the Kolkata Municipal Corporation (https://www.kmcgov.in/KMCPortal/jsp/KMCPortalHome1.jsp).

2. Go to "Assessment Collection": Under the "Online Services" section, navigate to the "Assessment Collection" option.

3. Find "Print Unpaid Bill": The specific terminology might differ, but look for options like "Print Unpaid Bill", "Check Demands Payable", or "Download Unpaid Demand Notice".

4. Enter your Assessee Number: This unique identifier is crucial for accessing your property tax information. Enter your Assessee number in the designated field.

5. Print the Bill: Once you retrieve your unpaid bill details, you should be able to print it directly through your browser's print function.

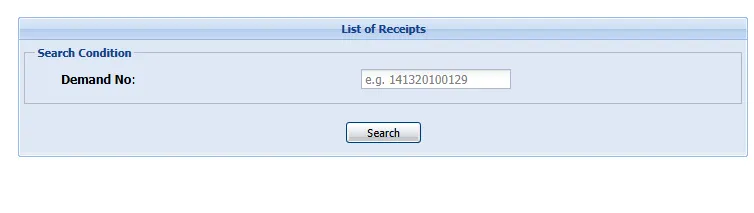

How to Reprint KMC Property Tax Receipt?

Here is how to reprint the KMC property tax receipt:

1. Visit the official website of KMC property tax - https://www.kmcgov.in

2. Select the reprint e-receipt option.

3. Enter your demand number and click on the search option.

4. Then, reprint the property tax receipt.

KMC’s 2025-26 Property Tax Statement: Online KMC Property Tax Payment Procedures

Depositing the Kolkata Municipal Corporation property tax is simple and easy with the online payment option. Follow these procedures to pay your KMC property tax online through KMC online payment of property tax:

Step 1: To make a KMC property tax online payment, go to the official website of kolkata municipal corporation.

Step 2: In the right-hand menu’s fast links, select “Make Online Payment for Kolkata Municipal Corporation“ from the list.

Step 3: Select the Property tax option under this.

Step 4: Under this, select the “All Bill” option

Step 5: The window for overdue property taxes will be opened in step five.

Step 6: Type the assessee’s number, phone number, and email address, then press the Search button.

Step 7: A screen will show the outstanding real estate tax.

Step 8: You can view and pay your property tax on the KMC portal property tax section using your debit card, credit card, UPI, wallet, NEFT, RTGS, internet banking, etc. You will receive the ‘tax paid’ receipt following a successful transaction. This receipt has to be kept nearby for future use.

How to Pay KMC Property Tax Offline 2025?

To make an offline payment, you can visit the nearest tax collection centres or a designated bank branch between 11:00 AM and 03:00 PM on a working day. For online payments, they can visit the KMC Property tax portal anytime.

Important Aspects of the Unit Area Assessment

According to the UAA model, the city has been divided into 293 blocks and seven categories, ranging from A to G. The division is based on the market value of assets, including infrastructure, facilities, and properties.

Each category has been assigned a base Unit Area Value (BUAV), also known as a yearly value per square foot. Category A has the greatest BUAV, and Category G has the lowest.

To lessen the tax burden on the economically underprivileged, all slum areas in the city, regardless of location, are classified as “G” zones. Similarly, all Refugee Rehabilitation camps and government programmes for the economically underprivileged are categorised as “E.”

In Kolkata, the system serves about 6 lakh property taxpayers. The UAA calculation approach is anticipated to bring about tax system parity, resulting in consistent taxation of all properties within the block.

How Can One Produce a Tax Receipt?

Tax receipts or challans must always be collected while paying Kolkata corporation property taxes, regardless of the method. If you print your challan online, you can retrieve it from the official website and do it again if necessary. After making the payment offline, you can pick up the receipt at the appropriate centres. You can access your KMC property tax online payment receipt by visiting the Kolkata Municipal Corporation portal.

What does the PD Bill Mean to the KMC Property Tax Bill?

Based on the most recently determined property valuation, periodic demand bills are sent yearly. If you choose “current PD” after selecting the property tax button on the homepage, you will be directed to https://www.kmcgov.in/KMCPortal/KMCPortalPDPaymentAction.do. It is necessary to enter the assessee’s number and contact information. Search for the list of outstanding current PD bills using the email address you entered, and then click Pay to proceed with the payment for e payment of KMC property tax. Remember that you may only take advantage of the additional 5% rebate on the previous three quarters if you pay for all four quarters simultaneously and within the first quarter’s rebate period.

F/S Bill in the KMC Property Tax Bill: What Does it Mean?

New or supplemental bills are released following a hearing to reflect changes made to previously published bills. After a property’s initial evaluation, new bills are also generated. If you choose “fresh supplementary” after selecting the property tax button on the homepage, you will be directed to https://www.kmcgov.in/KMCPortal/KMCPortalFSPaymentAction. proceed to pay by entering the assessee No., Contact No., and email if applicable.

What does LOI Mean on the KMC Property Tax Bill?

The following tax bills may be included in the letter of notification, which is delivered concerning unpaid tax bills:

- All unpaid new and additional bills are subject to penalties.

- Periodic demand invoices that were not paid were issued before the current fiscal year.

- If you choose “outstanding (LOI)” after selecting the property tax button on the homepage, you will be directed to https://www.kmcgov.in/KMCPortal/jsp/KMCAssessmentLoiPayment.jsp. Enter the assessee number to search for all outstanding bills and overdue property taxes (LOI).

- You must log in with your login information to access the suspense and UAA online submissions. If you don’t already have one, sign up before visiting the KMC website to learn more.

KMC Property Tax Waiver Scheme Programme

After a protracted Coronavirus lockdown, the KMC finally announced a tax waiver programme in October 2020 to compensate for the lost property tax revenue. Only taxpayers who received their KMC property tax bill for the 2019–20 fiscal year by March 31, 2020, are eligible for the tax relief programme. The plan states that if taxpayers pay their debts in full by February 28, 2021, interest and penalties that would otherwise be applied to the debt will be 100% waived. A taxpayer will receive a 60% interest and 99% penalty remission if they fully settle their debt between March and May 2021. To be eligible for the programme, the applicant must submit their application before January 31, 2020. Applications will be accepted online, at the KMC’s headquarters, and at all its tax collection locations. A taxpayer will receive the updated bill as soon as they submit their application.

KMC Property Tax Rate 2025

The Annual tax on property varies with the Annual valuation of the same. The following table shows the calculation of Annual Tax calculation according to the Annual Valuation of property.

| SI NO. | Annual Valuation (Rs) (AV) | Annual Tax | Rebate if Tax is deposited on Time |

| AV less than 600 | 0.11*AV | 0.05*Quarterly Tax | |

| AV greater than 600 but less than 18000 | (AV/600 + 10)*1/100 *AV | 0.05*Quarterly Tax | |

| AV greater than 18,000 | 0.4*AV | 0.05*Quarterly Tax |

Note: Commercial Surcharge not exceeding 50% of tax is levied for non-residential property.

- If the Annual Valuation, as fixed above, does not exceed ₹600/-, then the tax rate is 11% of the Annual Value. If A.V. is ₹500/-, then the property tax per year is ₹55/- plus Howrah bridge tax @ 0.5% of the quarterly tax is allowed if deposited in time. The quarterly gross amount of tax should be divided by 4 and rounded off to the nearest rupee. Net tax after rebate will also be rounded off to the nearest rupee.

- If the Annual Valuation, as fixed above, exceeds ₹600/- but does not exceed ₹18000/-, then the tax rate is the percentage of the A.V. worked out by dividing the A.V. of the premises by 600 and adding 10 to the quotient, the sum thus worked out being rounded off to the nearest first place of decimal. If the A.V. of premises is ₹1300/-; then the rate will be 1300/600=2.16%. Hence, the property tax percentage is 2.16+10=12.2% (rounded off). So, the gross tax of such property per year will be ₹158.60/- plus the Howrah bridge tax @ 0.5%. Of AV. The quarterly gross amount of tax should be divided by 4 and rounded off to the nearest rupee. A further rebate of 5% of the quarterly tax is allowed if deposited in time. Net tax after rebate will also be rounded off to the nearest rupee.

- If the Annual Valuation as fixed above exceeds ₹18000/-, the tax rate is 40% of the Annual Value. That is, if A.V. is ₹20000/- then the property tax per year is ₹8000/- plus Howrah Bridge tax @ 0.5% of A.V. and a further rebate of 5% of the quarterly tax is allowed if deposited in time.

- In the case of general flats/ appropriate units, the tax rate percentage should be calculated based on the cumulative Annual Value of all the flats within that premises. It should then be applied to the individual Annual Value of the respective flats to get the amount of gross property tax.

- The tax rate for Bustee and some statutory organisations is different. For Bustee, the maximum tax rate is 18%, and the minimum tax rate is 15% on Annual Value.

- For commercial/non-residential property, normally, a surcharge at not exceeding 50% of tax applies to such property or a portion of such property under non-residential use and is levied additionally.

- No tax is payable if AV does not exceed ₹300 (three hundred).

Program for KMC Property Tax Exemption

The KMC Property Tax Exemption Program 2025 offers significant relief to taxpayers with pending dues. Taxpayers with defaults of less than 2 years are eligible for a 99% waiver on penalties and a 50% reduction on interest. For taxpayers with defaults between 2 to 5 years, the program provides a 75% waiver on penalties and a 45% reduction on interest. This initiative aims to encourage timely payments and reduce the burden on defaulters while improving tax compliance.

How to Calculate KMC Property Tax?

The Unit Area Assessment technique is used to determine the KMC property tax in a scientifically sound manner. The KMC property tax calculation follows a predetermined formula. The equation reads as follows:

Base Value X Age Factor X Built-up Area X Building Type X Floor Factor X Category of Use = KMC Property Tax.

The following table is used to determine the base unit area for the KMC property tax.

| Block category | Base unit area value |

| A | 74 |

| B | 56 |

| C | 42 |

| D | 32 |

| E | 24 |

| F | 18 |

| G | 13 |

KMC Helpline Contact Details and Addresses

The KMC can be reached at The Municipal Corporation of Kolkata.

S. N. Banerjee Road 5, India, Kolkata 700 013

Ph: +91 33 2286-1000

Telephone Free: 18003453375

On working days, between 10 AM and 6 PM, and on Saturdays, between 10 AM and 5 PM, the following contact number may be used to lodge complaints and inquiries: 033-2286 1305.

How to Download an NOC from the KMC website

An NOC (No Objection Certificate) from KMC (Kolkata Municipal Corporation) is required for various purposes. When selling a property, an NOC demonstrates that you have paid all property taxes and have no outstanding dues.

Lenders may request an NOC to verify your financial standing and ensure no debts to the KMC. Government job applications may require an NOC to indicate a clean property tax record. Additionally, passport and visa applications may necessitate an NOC to prove compliance with property tax payments. Obtaining an NOC involves a simple application process, providing necessary personal and property information, along with a small fee. The issued NOC remains valid for one year.

- Go to the Kolkata Municipal Corporation website: https://www.kmcgov.in/

- On the left-hand panel, select “Assessment Collection” under the “Online Services” tab.

- On the redirected window, click on the “No Outstanding Certificate (NOC)” option.

- Enter the following details:

- Assessee number

- Property address

- Contact details

- Click on the “Submit” button.

- A NOC will be generated and displayed on the screen.

- You can download the NOC by clicking on the “Download” button.

Here are some additional tips:

- You can also write the NOC manually. The format of the NOC is as follows:

- No Objection Certificate

- This is to certify that there are no outstanding dues on the property bearing assessee number [assessee number] and located at [property address].

- This certificate is issued on [date] by [name of officer] of the Kolkata Municipal Corporation.

- [Signature of officer] [Designation of officer]

- You can submit the NOC to the KMC office along with other required documents.

- The NOC is valid for one year.

Property Tax in KMC: The Latest Updates

The Kolkata Municipal Corporation (KMC) has collected over ₹944 crore in property tax till December 8, 2024, nearing its previous fiscal total of ₹1,210 crore. KMC is also awaiting state approval to implement the Unit Area Assessment (UAA) tax method in three added-area wards.

To prevent property tax dues from being shifted to new owners, KMC requires developers to submit undertakings to clear all pending taxes during a building’s construction. If taxes remain unpaid for four quarters, KMC may issue a stop-work notice. Approved building plans will include a clause transferring pending tax liability to new owners, urging buyers to verify dues before purchasing.

Buyers can check tax liabilities at KMC’s assessment department or online using the property’s assessee number. For multi-owner buildings, unpaid taxes will be divided equally among all owners.

Source: The Telegraph India

Legal Services Offered by NoBroker

NoBroker provides comprehensive legal assistance tailored to property transactions. Here's an overview of our services:

- Document Scrutiny: Our legal team examines essential documents like title deeds and sale agreements to identify potential issues before finalising the property deal.

- Protection Measures: We help safeguard you from fraudulent practices by checking for any existing legal disputes on the property and verifying ownership.

- Packages: NoBroker offers various legal service packages. These can include:

- Buyer Assistance: We provide guidance and support throughout the buying process.

- Registration: We handle property registration, saving you time and hassle.

- On-Demand Services: If you don't need a complete package, we offer specific services like property title checks, guidance on market value, assistance with missing documents, and verification of occupancy certificates.

- Free Consultation: NoBroker offers a free consultation to discuss your needs and provide initial legal advice related to property.

- NoBroker Pay: By using NoBroker Pay, you can ensure a secure and convenient way to make your KMC property tax payments. Additionally, you can track all your payments conveniently in one place.

How to Book NoBroker Legal Services

Here are the simple steps to secure our services for a smooth and hassle-free service:

- Download/ Visit the NoBroker app.

- Visit the NoBroker Legal Services page.

- Explore the different service packages offered. We cover tasks like drafting agreements, property verification, and legal consultations.

- Once you decide on a service, fill in the necessary details and complete the form.

- Then, our NoBroker experts will contact you for further details. This contact might be through a phone number or a chat window. You can also book a free consultation call for further enquiries.

- NoBroker's legal services page also highlights its online rental agreements, which can be purchased and customised directly on the NoBroker website.

Why Choose NoBroker Legal Services

Here are some of the key reasons why you should choose NoBroker legal services:

- Convenience: NoBroker emphasises the ease of its service. You can complete legal tasks from the comfort of your home without physically visiting a lawyer's office.

- Affordability: We claim to offer competitive pricing on their legal services compared to traditional lawyers.

- Experienced Lawyers: NoBroker has experienced lawyers (minimum 15 years of practice) qualified by the Bar Council.

- Streamlined Process: We aim to simplify the legal process by offering pre-defined packages and handling communication with the lawyer on your behalf.

- Technology-Driven: NoBroker leverages technology for tasks like document management, to improve efficiency.

Explore Property Tax Payment Options City-Wise in India

Simplify Your Property Legalities with NoBroker's Expert Assistance

With their expertise in property tax management, NoBroker provides a streamlined and hassle-free experience. For professional assistance with all your property tax needs, visit NoBroker Legal Services today and ensure a smooth tax payment process. Still need help with KMC property tax? Choose NoBroker Pay. Using this, you can be assured of a secure and convenient way to pay your KMC property tax. Also, track all your payments conveniently in one place. Our safe and convenient platform simplifies the stamp duty process. Download the app today!

Frequently Asked Questions

Ans: Unfortunately, KMC does not currently have a system for self-assessment of property tax. The annual value of your property, which determines your tax amount, is assessed by KMC itself.

Ans: Yes, you may do that at https://www.kmcgov.in/kmc-property-tax.

Ans: After entering your User ID on the KMC website, you can examine the outstanding property tax.

Ans: Failure to pay taxes on time will result in penalties for property taxpayers. A one-time correction of up to 15% of the tax amount will be assessed along with additional repercussions.

Ans: The unit area assessment (UAA) system calculates property taxes. It tries to standardise the system based on location, area, use, property age, type of occupancy, and structure.

Ans: After entering your User ID on the KMC website, you can examine the pending property tax there.

Ans: Regardless of the method used to pay the Kolkata corporate property tax, challans or tax receipts are required. The challan is available for download and reprints on the official website. After paying the fees, you can get a tax receipt at the appropriate place.

Ans: A KMC property tax supplementary bill is an additional property tax bill issued when a property’s status changes that impact its tax liability. The changes include property ownership, reassessment, and corrections to the original tax calculation.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

61961+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2026-27

March 25, 2025

50445+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

44548+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

39976+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

34326+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116862+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

200720+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

145387+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135819+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!