Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Panchkula Property Tax Online and Offline Payment: Receipt Download and Check Status 2025

Table of Contents

Panchkula Property Tax, mandated by the Municipal Corporation of Panchkula (MCP), is an annual obligation for all properties within this Haryana city’s limits. It is a pivotal revenue source, driving the city's development and maintenance. Property tax is compulsory for residential, commercial, industrial, and vacant land owners.

Panchkula property tax for commercial properties is ₹12 per square foot, and for residential properties is ₹7 per square yard. The funds collected are vital in financing numerous civic amenities and infrastructure ventures, including road upkeep, sanitation, parks, and public buildings.

Panchkula Property Tax: A Quick Info 2025

Panchkula Property Tax, introduced in 2001, is a municipal tax levied on residential, commercial, and institutional properties within Panchkula. Here is a quick info Panchkula house tax:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

| Information | Details |

| Authority | Panchkula Municipal Corporation, Haryana |

| Address | Municipal Corporation, Sector 14, Haryana - 134112 |

| Official website | https://mcpanchkula.in/ |

| Last due date | Mar 31, 2025 |

| Helpline number | 9696494949 |

| Email ID | mcpanchkula@gmail.com |

How to Pay Panchkula Property Tax Online?

To initiate payment on the ULB Haryana website, follow these steps:

1. Visit the official website of PCMC:https://property.ulbharyana.gov.in/

2. Log in to the portal using your credentials.

3. select the "Make Payment/Generate NDC" option if you have your property ID.

4. Enter your property ID (PID) and click on "Search". If you don't know your PID, click on "PID not known, Click Here" to search for your property.

5. The system will present three payment options: Pay Property Tax, Pay Garbage Collection Charges, or Pay all Dues and Generate NDC.

6. Choose the desired payment option and proceed.

7. The payment details will be displayed, and you can click on the "Pay Online" button to proceed to the payment gateway to complete the transaction.

How to Check Panchkula Property Tax Bill Payment Application Status ?

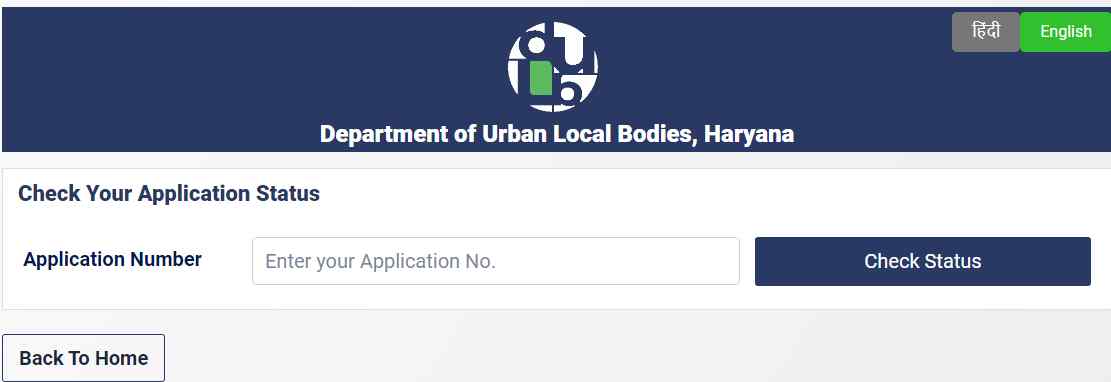

To check the status of your application on the ULB Haryana website, follow these simple steps:

1. Visit the official website of Panchkula Municipal Corporation: https://mcpanchkula.in/

2. Click on "Check Application Status".

3. You will be directed to the following page.

4. Enter your Panchkula property details like application number assigned to your application and click the "check status" button.

5. The status of your application will then be displayed.

How to Download Panchkula Property Tax Bill/Receipt Online?

To download your Panchkula Property Tax Bill, follow these steps:

1. Visit the link: Tax/Bill/Payment detail (https://ulbharyana.gov.in/Beri/2512?DynamicTypeIdView=5904)

2. Tap on "click here for external link".

3. You will then be redirected to a new site.

4. Search for your property by entering your property ID.

5. Your payment receipt/bill will appear on the screen.

6. Download the bill for any year. Then, save it for your device.

What are the benefits of paying Panchkula property tax online?

Here are some benefits of paying your Panchkula Property Tax online:

Convenience:

- 24/7 Accessibility: You can access the online payment portal anytime, anywhere. You are not restricted by office hours or long queues, allowing you to pay at your convenience, day or night.

- Quick and Easy Process: Avoid manual form filling or visiting the Municipal Corporation office.

- Multiple Payment Options: You can use various payment methods, such as UPI, debit cards, credit cards, net banking, or e-wallets.

Security:

- Secure Transactions: Reputable online payment gateways ensure secure transactions with encryption and fraud protection, minimising the risk of theft or misuse of your financial information.

- Payment Confirmation: You will receive immediate confirmation via email or SMS, providing a record for your reference.

Efficiency:

- Faster Processing: Online payments are processed instantly and reflect quickly in your property tax records. There is no need to wait days or weeks for the payment to be acknowledged.

- Reduced Paperwork: You no longer need paper bills or receipts. Download or print a digital copy of your payment confirmation for your records.

How to Pay Panchkula Property Tax Offline?

Here are the methods for offline payment of Panchkula Property Tax:

1. Municipal Corporation Office:

- Visit the Office: Go to the Municipal Corporation of Panchkula (MCP) office during working hours.

- Locate the Counter: Find the department or counter responsible for property tax payments.

- Carry Necessary Documents: Bring your property tax bill if you have it, or provide your Property ID.

- Make the Payment: For smaller amounts, you can pay in cash. For larger amounts, use a Demand Draft (DD) made payable to "Municipal Corporation, Panchkula."

2. Ward Office:

- Find Your Ward Office: Each ward in Panchkula might have a dedicated office. Inquire with the MCP or search online for contact details.

- Visit the Ward Office: Go to your ward office during working hours.

- Provide Identification: Use your property tax bill or Property ID for identification.

- Payment Options: Cash payments might be accepted for smaller amounts. For larger amounts, a Demand Draft might be preferred.

How to Calculate Panchkula Property Tax Online?

Here is the guide to using the property tax calculator for Panchkula:

Step 1: Access the Official Website

Go to the official website of MC Panchkula at [ulbharyana.gov.in/Panchkula](https://ulbharyana.gov.in/Panchkula).

Step 2: Find the Property Tax Calculator

On the homepage, locate and click on the 'Property Tax Calculator' option to proceed.

Step 3: Navigate to the Tool

Follow the prompts to access the 'Panchkula Property Tax Calculator' tool.

Step 4: Enter Required Details

Please provide the necessary details, such as session, year, property category, type, floor number, covered area, usage, and total rebate.

Step 5: Verify Your Information

Double-check the entered information to ensure accuracy, then click on the 'Calculate' button.

Step 6: Review the Calculated Tax

Review the calculated property tax displayed on the screen. Once done, you can exit the homepage.

What is the Panchkula Property Tax Rebate?

The MC Panchkula has announced that citizens who pay their property tax in advance will receive a 15 percent rebate on the total amount and a 100 percent rebate on the interest accrued. This initiative encourages early payments, providing financial benefits to proactive taxpayers.

What is the Panchkula property tax rate?

The property tax slabs in Haryana for residential properties, commercial properties, and vacant land are shown in the images below:

What is the process for online changing the name on Panchkula property tax records?

Changing the name in the property tax records for Panchkula is straightforward. Follow these steps:

- Step 1: Visit the official ULB Haryana website at (https://ulbhryndc.org).

- Step 2: Sign in to the portal using your mobile number and input the OTP you've received.

- Step 3: Access your property details and click on the "Update Details" option to change the name on the portal.

- Step 4: Save the changes to the property details on the dashboard and proceed to the next page.

- Step 5: Review the changes on the "View Details" page and then log out of the dashboard.

What is the Panchkula Property Tax's Last Due Date?

March 31, 2025, was the deadline for paying Panchkula property tax with a 15 per cent rebate and a 100 per cent interest waiver on previous dues. After this date, penalties for late payments might apply.

Panchkula Property Tax Helpline Number

Located at CO No. 15-16, Sector-14, Near Rally Chowk, Panchkula, Haryana 134112, our office is a convenient point of contact for all your queries and concerns. Please contact via toll-free helpline at 18001802013 or 0172-2583094, if you have any enquiries. Alternatively, you can email us at mcpanchkula@gmail.com for prompt support.

Paying Your Panchkula Property Tax Bill Using NoBroker Pay

Paying your Panchkula property tax bill is simple and secure with NoBroker Pay. Here's a straightforward guide to help you through the process:

- Download the NoBroker Pay App: Begin by downloading the app from the app store on your device.

- Set Up Your Account: If you're new to the app, enter your bank details and complete the account setup process.

- Select Property Tax: Choose the type of property tax you must pay from the available options.

- Input Your Property Tax Details: Enter all the required information accurately.

- Review the Bill Information: Take a moment to review the bill details to ensure accuracy carefully.

- Choose Your Payment Method: Select your preferred mode of payment to complete the transaction.

- Confirm Payment: Double-check all the details and then confirm the property tax payment to proceed.

- Download Receipt: Finally, download the receipt for your records to have proof of your payment.

Legal Services Offered by NoBroker

Legal services offered by NoBroker are tailored to Panchkula property tax transactions. Here's what we provide:

- Document Scrutiny: Our legal team examines critical documents such as title deeds and sale agreements to uncover potential issues.

- Protection Measures: We conduct checks for legal disputes related to the property and verify ownership details to prevent fraud.

- Service Packages: NoBroker offers various service packages, including buyer assistance and registration support.

- NoBroker Pay: Use NoBroker Pay for secure and convenient property tax payments, with all transactions easily tracked.

How to Book NoBroker Legal Services

To book NoBroker legal services:

- Access the NoBroker Platform: Download the app or visit the website.

- Navigate to Legal Services: Find the app or website interface section.

- Browse the Services Offered: Explore the range of services available.

- Select Your Service: Choose the needed service and fill in your details to start the process.

- Consultation and Assistance: A NoBroker expert will reach out to gather further information or book a free consultation call.

Latest News on Panchkula Property Tax 2025

The Haryana Government’s recent decision to waive interest on pending property tax for owners clearing dues by March 31 has raised hopes for the Municipal Corporation (MC) to recover nearly ₹100 crore in arrears. So far, ₹30 lakh has been collected in the past month.

Mayor Kulbhushan Goyal expressed optimism about meeting the recovery target, cautioning that the properties of defaulters may be sealed after the deadline. Major tax defaulters include hotels, banks, schools, government institutions, and petrol pumps.

Civic officials highlighted property tax as the MC's key revenue source, noting financial challenges due to unpaid fees from telecom firms for installing over 290 towers and laying phone lines. The MC has also passed resolutions to take stricter action against defaulters to improve its financial health.

Explore Property Tax Payment Options City-Wise in India

NoBroker: Simplifying Property Transactions Through Advanced Legal Solutions

Understanding and managing your Panchkula Property Tax is crucial for fulfilling your civic duties and supporting the city's development. Staying informed and utilising resources like NoBroker Pay can ensure timely and hassle-free payments.

Consider NoBroker legal services for convenience, affordability, experienced lawyers, streamlined processes, and technology-driven solutions. NoBroker revolutionises legal processes for property transactions, ensuring efficiency and aiding community development. Stay informed and utilise NoBroker for reliable aid in managing Panchkula property tax. Download the app now!

Frequently Asked Questions

Ans: Visit the MCP website: https://mcpanchkula.in/. Look for sections related to "Property Tax" or "Tax/Bill Payment." You might find options for online payment. These could involve entering your Property ID and selecting a secure payment method like debit card, credit card, or net banking.

Ans: To pay your Panchkula house tax online, you'll typically need property ID, debit card, credit card, or net banking login credentials ready for secure online payment.

Ans: You can make payments 24/7 from anywhere with an internet connection, eliminating the need to visit offices during working hours. Online payments are processed instantly, reflecting in your property tax records quickly. Reputable payment gateways ensure secure transactions with encryption and fraud protection measures.

Ans: All property owners in Panchkula, including those with residential, commercial, industrial properties, and vacant land, are required to pay property tax.

Ans: Paying your property tax on time ensures you contribute to the city's development and upkeep. Additionally, the Municipal Corporation of Panchkula (MCP) might offer early payment discounts for those who settle their dues before the deadline.

Ans: Property prices in Panchkula vary based on location, type, and amenities. On average, residential apartments range from ₹4,500 to ₹7,500 per sq. ft., while independent houses in prime sectors like Sector 6, 9, and 20 command higher rates.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

61960+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2026-27

March 25, 2025

50445+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

44546+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

39976+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

34326+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116861+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

200715+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

145382+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135814+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!