Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Tenant Super Relax Plan

Enjoy Hassle-Free Renting

Full RM + FRM support

Full RM + FRM support Instant alerts & premium filters

Instant alerts & premium filters Rent negotiation & relocation help

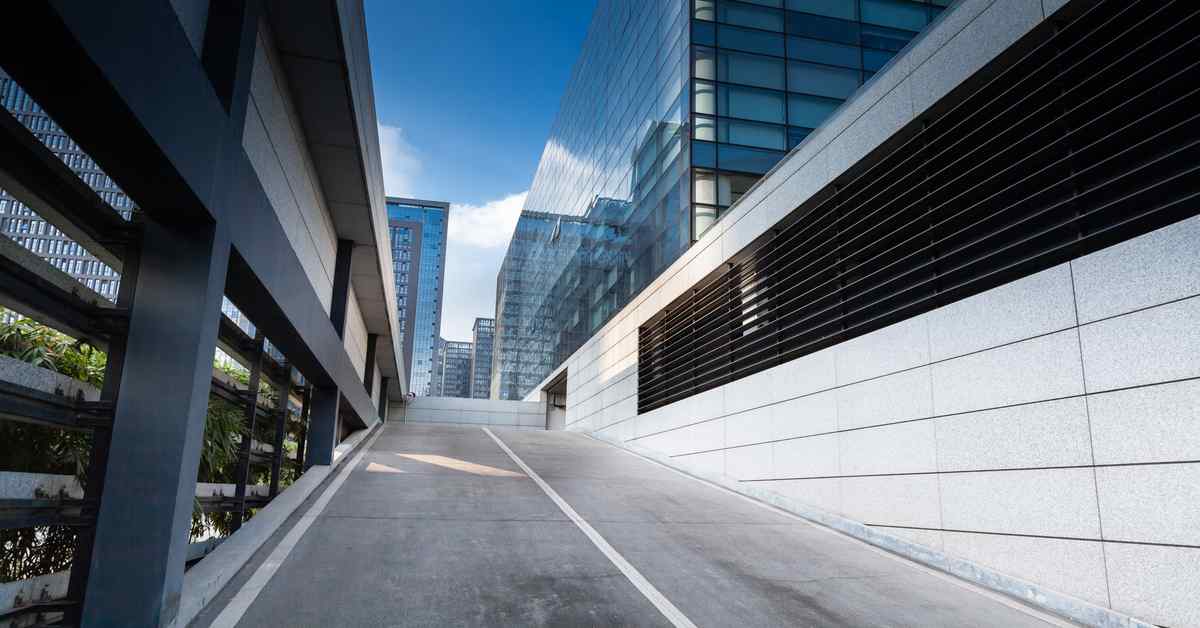

Rent negotiation & relocation helpOffice on the Rise: Indian REITs Expand as Demand Soars

Table of Contents

Mumbai, May 20, 2024: Good news for India's commercial real estate market! Indian Real Estate Investment Trusts (REITs) are experiencing a period of rapid expansion, fuelled by a surging demand for office space across major cities.

A Booming Market:

Gone are the days of deserted office buildings. With the Indian economy on a positive trajectory and businesses reopening after the pandemic, office space is in high demand. This surge in demand is directly impacting Indian REITs, which primarily invest in income-generating commercial properties.

Metrics on the Move:

- Spiking Spreads: All indicators point towards a thriving market. Vacancy rates are declining, while rental agreements are being signed at higher rates, leading to increased rental spreads (the difference between a REIT's income from rent and its expenses).

- Expansion Ambitions: Embassy Office Parks REIT, a major player, has grown its portfolio significantly since its launch in 2019, expanding from 24 million square feet to a much larger holding. This trend of portfolio expansion is expected to continue across other REITs as well.

Analysts Speak:

Market analysts are bullish on the future of Indian REITs. "[This is] a golden period for Indian REITs," says [Analyst Name], a leading industry expert (or relevant position) at [Analyst Firm Name]. "The combination of rising demand and a limited supply of quality office space creates a perfect scenario for REITs to generate strong returns for investors."

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Benefits Beyond Bricks:

The growth of Indian REITs goes beyond just benefiting the companies themselves. Here's how it positively impacts the market:

- Increased Liquidity: REITs provide an attractive avenue for investors to participate in the commercial real estate market, offering liquidity and diversification opportunities.

- Transparency and Governance: REITs are subject to stricter regulations and reporting requirements, leading to greater transparency and improved corporate governance practices in the real estate sector.

The Road Ahead:

The Indian office market's upswing presents a promising future for Indian REITs. While factors like global economic conditions and interest rate fluctuations can influence the market, the current scenario suggests that Indian REITs are well-positioned to capitalise on the growing demand for premium office space and deliver strong returns to investors

Loved what you read? Share it with others!

Most Viewed Articles

Building Setback: Meaning, Significance and Rules

January 31, 2025

62294+ views

House Price Graph Last 20 Years India: Trends, Factors, and Future Predictions

January 31, 2025

24788+ views

ERP Solutions for Society: A Game-changer For Society Living

January 31, 2025

6351+ views

Scorching Heat & Dwindling Supplies: Delhi's Water Crisis Heats Up with ₹2,000 Fines for Wastage!

January 31, 2025

4745+ views

'रिअल इस्टेट'ने लॉकडाऊन विस्ताराचे स्वागत करत, तरलतेच्या संकटासाठी नुकसान नियंत्रण उपाययोजना मागितली

January 31, 2025

4730+ views

Recent blogs in

BBMP Collects ₹4,930 Cr in Property Tax, Offers 5% Rebate for Early Payments

April 24, 2025 by Simon Ghosh

क्या है टाइनी हाउस मूवमेंट? छोटे घरों में रहने का बढ़ता ट्रेंड

January 31, 2025 by NoBroker.com

क्या आपने प्रॉपर्टी मैनेजमेंट कंपनियों के बारे में सुना है? उनसे जुड़ी सभी ज़रूरी जानकारी

January 31, 2025 by NoBroker.com

Join the conversation!