Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

How to get Non-Encumbrance Certificate Online and Offline: Download and Check Status 2025

Table of Contents

If you are in the real estate sector, then the term non-encumbrance certificate should not be unfamiliar. If you are looking to invest in property or wish to avail of a home loan, you will need to furnish your lending institution with this certificate. The non-encumbrance certificate lists all the legal and financial transactions associated with the property for the last 12 years. This is done to ensure that whatever property you are interested in does not have any financial liabilities. The non-EC certificate is a mandatory requirement before applying for home loans. Read on to learn more about how this certificate works and why you need it.

Non- Encumbrance Certificate - Quick Info

A Non-Encumbrance Certificate (NEC) verifies that a property is free from legal and financial liabilities, ensuring smooth transactions. It's essential for buying, selling, and applying for loans. Below is a table about the non-encumbrance certificate:

| Criteria | Details |

| Validity of EC | Typically up to 30 years or as per state regulations |

| Modes of Application | Online and Offline |

| Mandatory Fields | Property details, Owner's details, Period of EC |

| Exemptions | None, mandatory for property transactions |

| Application Status | Check online or at the sub-registrar's office |

| Offline Availability | Available at sub-registrar's office |

| Required Documents | Ownership proof, ID proof, Address proof, Tax receipts |

| Application Fees | Varies by state and property size |

| Processing Time | 7-15 days |

| Legal Implications | Ensures property is free from encumbrances |

| Contact for Help | State registration department or sub-registrar office |

| Additional Points | Required for property transactions, loan applications |

What is a Non-Encumbrance Certificate?

To truly understand the concept of a non-encumbrance certificate, you need to know the meaning of encumbrance. In real estate, non-encumbrance means any charge levied on an asset in the form of security. To explain it further, suppose you have taken out a loan to buy a house. Until you do not repay the loan, the lender will levy some charges(interest) against the loan. This goes on for the duration of the loan. During this time, the property also remains mortgaged to the lender.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

This certificate is necessary whenever you take an advance for a home loan to ensure that the property in question does not have financial and legal obligations. A non-encumbrance certificate lists all previous transactions associated with the property within a specified period.

Why do you need a Non-Encumbrance Certificate?

When purchasing a house and seeking a mortgage, you must obtain a Non-Encumbrance Certificate (NEC). All financial institutions and government authorities mandate an NEC spanning 13 to 30 years. Without this certificate, no financial institution will provide the loan you require.

What are the types of Non-Encumbrance Certificates issued?

There are primarily two types of non-EC certificates issued against your property.

- #1 Form 15: This is issued if the property has pending encumbrances from its earlier transactions for when the applicant requests the EC.

- #2 Form 16 or Nil Encumbrance Certificate: This is issued when the property has no monetary or legal liabilities. During the non-EC certificate, no charges will be placed on the property, and the homeowner will have a free title. One can quickly obtain a home loan for these properties in any part of the country.

What details are included in a Non-Encumbrance Certificate?

A Non-encumbrance certificate should have the following property details:

- All details of the previous and current property owners

- All-important property-related information (location, size of the property, age of the property etc.)

- A detailed history of all previous transactions associated with the property

- Mortgage details (if any)

- Details of the property received as a gift

- All further information about the release deed

How much is Non-Encumbrance Certificate Fees?

To obtain a Non-Encumbrance Certificate (NEC), there are specific fees associated with different services. The costs vary depending on the state and the type of service required. Here’s a detailed table of fees for various states:

| Service | Fee |

| Inspection of the search of the index for the first year | Rs. 5 |

| Review of the pursuit of index every additional year | Rs. 3 |

| Examination of a copy of each document in the register boo, including files of copy memorandum and sale certificate | Rs. 5 |

| A search of inspection of any other register for any particular year | Rs. 5 |

| When the document needs to be furnished within three days from the date of application | Rs. 20 |

Why is a Non-Encumbrance Certificate important?

When you wish to take a loan, it is essential to ensure that the property does not have any monetary complications. For example, if a loan against the same property was sanctioned before or mortgaged to a lender, these have to be cleared, and the property should have a free title. Only then you can apply for a housing loan. This is a mandatory requirement, and the ownership and completion certificate must be presented to banks and financial institutions while applying for a loan. The lender will automatically ask for this certificate to ensure that you have a clear title to the property in question.

If there are any existing monetary liabilities and a transaction is done without the non-EC certificate, then the buyer is responsible for handling the legal and financial obligations.

How to apply for a Non Encumbrance Certificate?

If you are wondering how to get a non-encumbrance certificate, you can get your handwritten physical copy from your local Tehsildar or sub-registrar’s office. There are also provisions for online non-EC Certificates in a few select states like Telangana, Andhra Pradesh, Orissa, Puducherry, Tamilnadu and Kerala.

Steps to Get a Non-Encumbrance Certificate Online:

Just follow these few steps to obtain the certificate online smoothly:

- Step 1: Visit the official state government portal and click on the Government Forms section.

- Step 2: Click on Stamps and Registration> Application form (Encumbrance Certificate)

- Step 3: Now you can get a non encumbrance certificate downloaded by filling out form 22 with all the required details. Remember to directly affix a Rs 2 non-judicial stamp on it.

- Step 4: Attach all the required documents along with the filled-up form.

- Step 5: Now visit your nearest sub-registrar or Tehlsildar’s office and submit this application form. You will receive an acknowledgement slip.

- Step 6: The sub-registrar’s office will conduct a thorough inspection and check for previous transactions and deeds.

- Step 7: Once cleared, they are usually processed within 2-3 working days. You will receive the EC from the sub-registrar’s office within 30 days max.

What documents required for a Non-Encumbrance Certificate?

To apply for a Non-Encumbrance Certificate, you need to submit essential documents that validate your identity and legal ownership of the property. Below is a detailed list of documents required for a non-encumbrance certificate:

Proof of Property Ownership

- Sale Deed: The primary document establishing ownership of the property.

- Previous Title Deeds: Historical ownership records, if applicable.

- Encumbrance-Free Property Records: In some states, prior encumbrance reports are needed to confirm the property is free from financial liabilities.

Identification Documents

- Aadhaar Card: A universally accepted ID proof.

- PAN Card: Required for financial validation.

- Passport or Other Government-Issued IDs: Valid alternatives for identity verification.

How to get a Non-Encumbrance Certificate Offline?

Obtaining a Non-Encumbrance Certificate is simpler than it seems. Follow these steps for a hassle-free process:

- Step 1: Gather Necessary Documents: Start by collecting all required documents, including proof of property ownership, personal identification, and, if needed, previous title deeds.

- Step 2: Submit Your Application: Visit the local sub-registrar's office or use the government's property portal to apply online. Fill out the application form accurately, providing all the necessary details.

- Step 3: Pay the Applicable Fees: Pay the required fee, which varies depending on your state or locality. Keep the payment receipt for your records.

- Step 4: Wait for the Process: The certificate is typically issued within a few days to a couple of weeks, depending on your location. Many states now offer faster processing times thanks to e-governance systems.

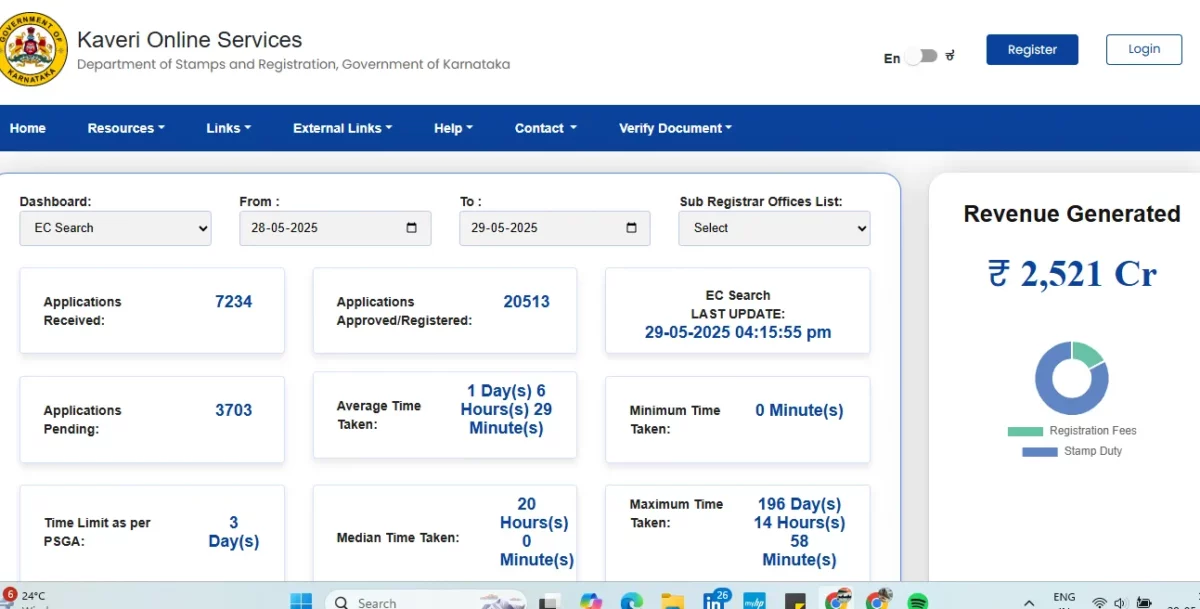

How to Check the Status of Non-Encumbrance Certificate Online?

Checking the status of the application for a non-encumbrance certificate online is now simple and convenient through portals. Follow these step-by-step instructions:

- Step 1: Visit the Official Registration Portal: Access your state’s official registration department website. Ensure it’s the authorised platform to avoid confusion or errors.

- Step 2: Log in or Register: Log in using your credentials. If you’re new, create an account by providing basic personal details like name, email ID, and phone number.

- Step 3: Go to the ‘E-Services’ Section: Locate the section for property-related services, often labelled as ‘E-Services.’ Select the option for 'Non-Encumbrance Certificate' from the list.

- Step 4: Enter Property Details: Fill in the required information, such as property location, registration details, and survey number. Verify the details for accuracy before proceeding.

- Step 5: Search and Download the NEC: After submitting the details, the system will process your request. View the certificate and download it for future reference.

How to Download Non-Encumbrance Certificate Online?

To download a Non-Encumbrance Certificate online, follow these steps:

- Step 1: Visit the Registration Portal: Access your state’s official registration department website. Ensure it is the authorised portal to avoid misinformation or errors.

- Step 2: Go to Services: Look for the section dedicated to property-related services, often labelled as ‘E-Services’ or similar. This section usually provides options for Non-Encumbrance Certificates.

- Step 3: Enter Property Details: Input accurate property information, such as location, survey number, or registration details. Double-check the information to ensure precise results.

- Step 4: Pay the Fee: Make the required payment online using the available gateway. Keep the payment confirmation receipt for tracking or future reference.

- Step 5: Download the Certificate: Once the details are verified, you will be able to download the Non-Encumbrance Certificate in PDF format. Save it securely for official use.

How to View a Non-Encumbrance Certificate?

To view a Non-Encumbrance Certificate online, follow these steps:

- Step 1: Visit Your State's Registration Department Website: Go to the official website of your state's registration department.

- Step 2: Go to the Property-Related Services Section: Look for the section related to property services on the website.

- Step 3: Enter the Required Property Details: Provide the necessary details regarding the property you need the certificate for.

- Step 4: Submit the Information and Verify Your Identity: Submit the entered details and verify your identity as per the website's instructions.

- Step 5: View or Download the Non-Encumbrance Certificate: Once your request is processed, you can view or download the Non-Encumbrance Certificate.

What is the format of a Non-Encumbrance Certificate?

A Non-Encumbrance Certificate (NEC) is a crucial legal document that certifies a property is free from any financial or legal liabilities, such as loans, mortgages, or disputes. It is often required for property transactions, applying for loans, or ensuring clear property ownership. Here is a non-encumbrance certificate format to follow:

| Non-Encumbrance Certificate Registrar Office: [Name of Registrar Office][Office Address] Certificate No: [Certificate Number] Property Details: Property Description: [Complete description of the property, including address, boundaries, and area] Property Identification Number (if applicable): [Property ID or other relevant identifier] Land or Plot Number (if applicable): [Land or plot number associated with the property] Area (sq.ft./sq.m.): [Area of the property] Period of the Certificate: From Date: [Start Date] To Date: [End Date] Transactions: [Details of Transactions, if any, such as sales, transfers, mortgages, or any other encumbrances] Example: [Transaction 1 - Date, Details, Parties Involved] Example: [Transaction 2 - Date, Details, Parties Involved] [Additional transactions, if applicable] Encumbrance Status: This is to certify that the property described above is free from any encumbrances (including mortgages, liens, or claims) during the specified period, and there have been no encumbrances created on the property for the mentioned duration. Issued For: [Purpose for which the certificate is being issued, e.g., loan application, sale of property, etc.] Date of Issue: [Date] Registrar: [Registrar's Name][Designation][Registrar Office Name] Signature: [Registrar's Signature] |

What is the Non-Encumbrance Certificate Validity?

A Non-Encumbrance Certificate is typically valid for up to 30 years, but the exact validity depends on state regulations. It certifies that the property is free from legal or financial liabilities during the specified period. This certificate ensures that the property has a clear title and is essential for property transactions and loan applications.

Why is a Non-Encumbrance Certificate crucial for property transactions?

A Non-Encumbrance Certificate is crucial in property transactions, ensuring the property is free from legal or financial liabilities and providing peace of mind to buyers, sellers, and lenders. Below are the key points:

- Mandatory for Property Loans: Financial institutions require an NEC to verify that the property has no debts or claims before approving loans.

- Ownership Verification: The NEC acts as proof of a clear ownership title necessary for transferring property rights.

- Essential for Tax Updates: An NEC is required to update property or land tax records if taxes have been unpaid for over three years.

- PF Withdrawal for Construction: Provident Fund withdrawals for property purchase or house construction necessitate submitting an NEC to ensure the property is free from encumbrances.

- Avoiding Legal Conflicts: It safeguards buyers from future disputes by confirming the absence of legal liabilities on the property.

- Crucial for Resale: An NEC is indispensable for reselling the property, providing buyers with the assurance of a clear and dispute-free history.

What is the difference between an Encumbrance Certificate and a Non-Encumbrance Certificate?

An Encumbrance Certificate (EC) and a Non-Encumbrance Certificate (NEC) both serve as important documents in property transactions. However, they have distinct differences in terms of their purpose and content.

| Criteria | Encumbrance Certificate (EC) | Non-Encumbrance Certificate (NEC) |

| Purpose | Shows history of financial/legal transactions on property | Certifies property is free from encumbrances |

| Content | Includes mortgages, loans, sales, transfers | No mortgages, loans, or encumbrances |

| Usage | Required for property transactions, loan applications | Essential for property transactions, clear title verification |

| Issuing Authority | Sub-Registrar's Office | Sub-Registrar's Office |

| Validity Period | Up to 30 years or as per state regulations | Up to 30 years or as per state regulations |

| Application Process | Online and Offline | Online and Offline |

| Application Fee | Varies by state and property size | Varies by state and property size |

| Processing Time | 7-15 days | 7-15 days |

| Legal Implications | Indicates financial obligations | Confirms clear title, free from liabilities |

| Commonly Used For | Verifying encumbrances for property transactions | Confirming no encumbrances before property transactions |

What is the process to obtain a Non-Encumbrance Certificate for inherited property?

To obtain a Non-Encumbrance Certificate for inherited property and ensure it is free from legal or financial liabilities, follow these steps:

- Step 1: Go to the Sub-Registrar's Office: Visit the local sub-registrar's office for property-related services.

- Step 2: Collect All Necessary Documents: Gather all required documents such as proof of inheritance, identification, and property details.

- Step 3: Complete the Application Form (Form 22): Fill out the necessary application form (Form 22) for the Non-Encumbrance Certificate.

- Step 4: Submit the Filled-Out Form and Required Documents: Submit the completed form, along with the required documents and application fee.

- Step 5: Wait for the Verification Process: Once submitted, wait for the verification process to be completed and receive the Non-Encumbrance Certificate.

What common mistakes should be avoided when applying for a Non-Encumbrance Certificate?

When applying for a Non-Encumbrance Certificate, it's essential to avoid common mistakes to ensure a smooth process. Here are key points to consider:

- Incomplete Application: Ensure all required fields are filled, and documents are attached to avoid delays. Double-check the application form and supporting documents before submission.

- Incorrect Property Details: Double-check property information to prevent errors that could lead to rejection. Incorrect details can cause significant delays and may require reapplication.

- Missing Proof of Ownership: Include all necessary ownership documents to validate your application. Ensure that deeds, tax receipts, and other relevant documents are complete and up-to-date.

- Not Paying Fees: Pay the application fee promptly to avoid processing delays. Keep the fee receipt as proof of payment, as it may be needed later.

- Ignoring Verification Steps: Follow up with the sub-registrar's office to ensure all verification steps are completed. Regularly check the application status to address any issues promptly.

- Ignoring State-Specific Requirements: Each state may have unique requirements, so ensure you comply with your state's guidelines. Familiarise yourself with the local regulations to avoid unnecessary complications.

What are the charges for Non-Encumbrance Certificate?

Charges for obtaining a Non-Encumbrance Certificate vary by state and depend on factors like property size and duration of the certificate. Typically, applicants must pay an application fee and a service fee, ranging from ₹1 to ₹200. Below is a table with approximate charges for different states:

| State | Application Fee (₹) | Service Fee (₹) |

| Telangana | 10 | 50 |

| Andhra Pradesh | 15 | 60 |

| Tamil Nadu | 20 | 70 |

| Kerala | 25 | 80 |

| Odisha | 30 | 90 |

| Puducherry | 35 | 100 |

Who issues Non-Encumbrance Certificates?

As a property buyer, you want to make sure that the property you're investing in is free from any financial or legal liabilities. This is where a Non-Encumbrance Certificate (NEC) comes into play.

To put it simply, an NEC is a document that certifies that a property is free from any outstanding debts, mortgages, or legal disputes. It's like a clean chit for the property you plan to buy. This certificate is an essential document for any property transaction and is often required by banks for home loans. But who exactly issues this certificate of non encumbrance? Let's dive in to find out!

Government bodies to the rescue: The issuing authority of a Non-Encumbrance Certificate varies from state to state in India. In most states, the Sub-Registrar's office is responsible for issuing the NEC. The Sub-Registrar is a government official who is responsible for registering property transactions in a particular jurisdiction.

Your bank can help for obtaining NEC: If you're applying for a home loan, the bank that you're taking the loan from can also issue a NEC on your behalf. Banks have a tie-up with the Sub-Registrar's office, and they can obtain the certificate for you after conducting a thorough background check on the property. This process usually takes around 7-10 working days.

Note that while obtaining a NEC, it's crucial to keep the following in mind:

- Ensure that the NEC is obtained from a credible source like the Sub-Registrar's office or a reputed bank.

- Check the validity of the NEC, as it's only valid for a specific period.

- Keep in mind that the NEC is only a reflection of the information available at the time of issue, and it may not reflect any subsequent changes.

How can NoBroker assist with Non-Encumbrance Certificates?

To sum it up, a Non-Encumbrance Certificate is a crucial document for any property transaction, and it certifies that the property is free from any financial or legal liabilities. The issuing authority of the NEC varies from state to state, with most states having the Sub-Registrar's office as the responsible party. Banks can also issue the NEC on behalf of the property buyer. So, now that you know who issues a Non-Encumbrance Certificate, you can take the necessary steps to ensure a smooth and hassle-free property transaction. And don't forget, NoBroker is here to help with all your real estate and home loan needs!

Frequently Asked Questions

Ans: The non-EC certificate is also known as the “Gyar Bhar PramanPatra (non encumbrance certificate meaning in Hindi stand as गैर भार प्रमाणपत्र).

Ans: Sure. You can get your hands on the non-Ec certificate online in selected states like Orissa, Tamil Nadu, Andhra Pradesh, Telangana and Pondicherry.

Ans: You can visit your local sub-registrar or Tehsildar’s office and collect the non-encumbrance certificate application form 22 by providing the required documents. You have to submit the filled-up application form, and then on successful completion of the inspection, you can collect your EC certificate within 30 days.

Ans: This certificate is necessary whenever you take an advance for a home loan to ensure that the property in question does not have financial and legal obligations. A non-encumbrance certificate lists all previous transactions associated with the property within a specified period.

Ans: There are no standardized rates for non-EC certificates. It largely varies depending on the state the property is in. Also, they are calculated based on the size of the property and the duration for which the certificate is applicable.

Ans: The Sub-Registrar's office or the Tehsildar of the area where the property is located issues a Non-Encumbrance Certificate (NEC), which is essentially the local land revenue office in charge of preserving property records.

Ans: A non-encumbrance certificate (NEC) is normally valid for up to 30 years, but the actual validity period is determined by state rules. The certificate's validity is determined by the period during which it was granted.

Ans: A Non-Encumbrance Certificate (NEC) normally takes roughly 20-30 days to get, depending on the location and form of application; internet applications are often faster than offline submissions.

Ans: Yes, many states allow you to apply for a Non-Encumbrance Certificate online through their official portals for ease of access.

Ans: To obtain a Non-Encumbrance Certificate (NEC), the following documents are typically required: the Sale Deed (proof of ownership), identification proof, address proof, and property details. You should also submit any previous Encumbrance Certificates, if applicable; essentially demonstrating clear ownership of the property with no outstanding legal claims.

Ans: NEC is typically required for property transactions involving loans, sales, or transfer of property, to ensure the property is free from legal liabilities.

Recommended Reading

Doctrine of Adverse Possession: What It Means and How to Claim Property Rights in 2026

May 28, 2025

93135+ views

EC Online Bangalore: Importance, Online Application and Status Check in 2026

June 1, 2025

70017+ views

Encumbrance Certificate Karnataka - Online and Offline Application Process in 2025

January 2, 2025

45430+ views

How to Apply Encumbrance Certificate in Tamilnadu Online and Offline 2025

May 1, 2025

44992+ views

Everything You Need to Know About NOCs for Property Transfer in India

January 31, 2025

37272+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116858+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

200674+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

145334+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135790+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!