Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Tenant Super Relax Plan

Enjoy Hassle-Free Renting

Full RM + FRM support

Full RM + FRM support Instant alerts & premium filters

Instant alerts & premium filters Rent negotiation & relocation help

Rent negotiation & relocation helpRent Receipt Format: The Key to a Smooth Landlord-Tenant Relationship

Table of Contents

In the world of renting, a crucial document emerges the rent receipt. This seemingly simple piece of paper holds significant weight, acting as proof of your rent payment and potentially unlocking tax benefits. But what exactly goes into a proper rent receipt format? This guide will break down everything you need to know to ensure your rent receipt is clear, accurate, and serves its purpose.

What is Rent Receipt?

A rent receipt is a formal document issued by a landlord to a tenant acknowledging that rent has been paid. It acts as a record and official proof of the transaction, specifying details like the amount paid, the date of payment, and the rental period covered. For easy record-keeping, consider using a rent receipt template to ensure all the necessary details are included in your rent receipts.

Rent receipts are important for both tenants and landlords, serving various purposes such as:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

- Maintaining Financial Records: They provide a clear record of rental income for landlords and rental expenses for tenants.

- Claiming Tax Benefits: Tenants can use rent receipts to claim tax deductions or allowances, such as House Rent Allowance (HRA) in some countries.

- Dispute Resolution: In case of disagreements regarding rent payment, a valid receipt serves as evidence for both parties.

Importance of Rent Receipt Format

The format of a rent receipt might seem like a minor detail, but it actually plays a crucial role in ensuring the document serves its purpose effectively. Here's why a proper house rent receipt format is important:

- Validity and Clarity: A well-structured format ensures all essential information is included and presented. This minimises confusion and strengthens the receipt's validity as proof of payment.

- Tax Benefits: For claiming tax deductions or allowances, some tax authorities might have specific requirements for the rent receipt format. A proper format ensures your receipt meets these criteria and helps you claim your rightful benefits.

- Dispute Resolution: In case of a disagreement about rent payment, a clear and accurate format strengthens the receipt's credibility as evidence in resolving the issue.

- Record Keeping: A consistent format makes it easier for both landlords and tenants to organise and maintain their rent payment records for future reference. You can easily keep track of rent payments by using a standardised rent slip format.

How Can You Generate Rent Receipt Format Online?

In today's digital world, generating a simple rent receipt format online is a convenient and efficient option. Here's how you can do it:

- Find a Rent Receipt Generator: Several websites and online tools offer free rent receipt generators. These platforms guide you through a user-friendly interface to enter the necessary details. While you can find many resources online, house rent receipt format PDFs are a good starting point, but remember to customise them with your specific details.

- Enter Required Information: Typically, you'll need to enter details like your name and contact information, your landlord's information (including PAN number in some regions), the rental property address, the rent amount, and the specific period covered by the payment.

- Select Payment Method: Some generators might allow you to specify the payment method (cash, cheque, online transfer) for record-keeping purposes.

- Generate and Download: Once you've entered all the information, the platform will generate a rent receipt format in a downloadable format like PDF.

- Print and Obtain Signatures: Print the generated rent receipt. While the online format serves as a record, it's important to get it signed by both you (the tenant) and your landlord for added validity.

Details Required For Rent Receipt Format

You need to enter the following details in your rent receipt Format–

- Tenant name. You have to fill in your name if you are the tenant

- Name of your landlord

- Payment amount

- Rental term

- Address of your house

- Signature of your landlord or manager

Rent Receipt Format

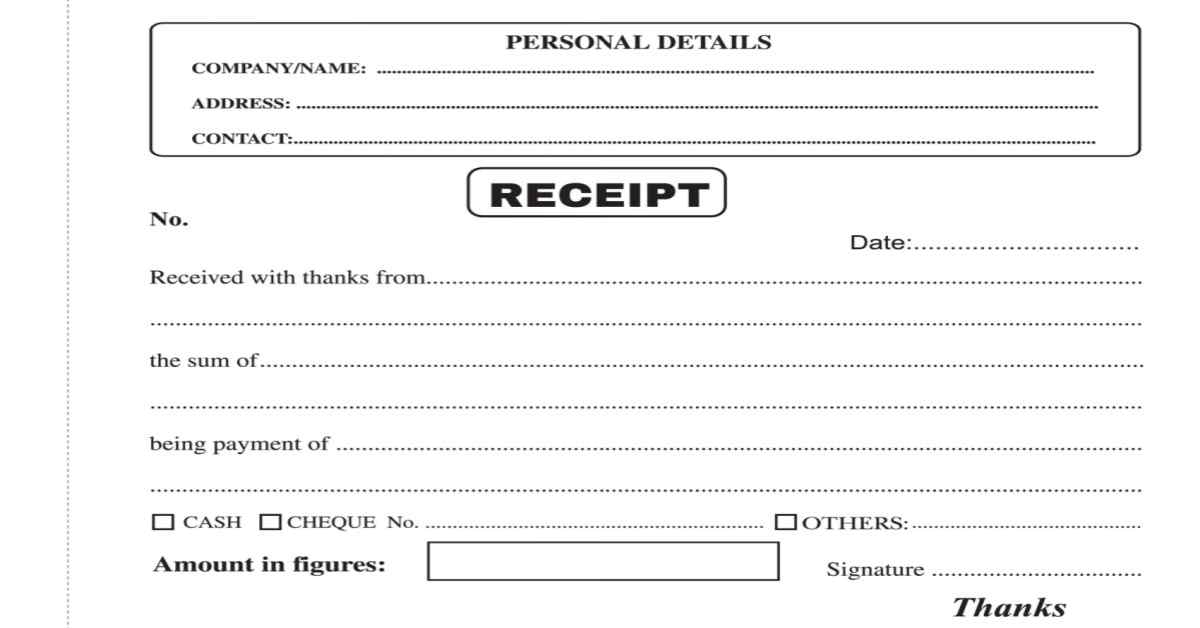

A rent receipt format in India typically includes the following information:

Date: The day on which the entire rent was paid.

Receipt Number: A unique receipt number for easy identification and record keeping.

Landlord’s Name and Address: The name and address of the landlord or the person receiving the rent payment.

Tenant’s Name and Address: The name and address of the tenant or the person making the rent payment.

Property Address: The address of the property for which the rent is being paid.

Rent Amount: The amount of rent being paid, including any additional charges such as utilities or maintenance fees.

Payment Mode: The method of payment, such as cash, check, or online transfer.

Signature: The landlord's or authorised representative's signature, confirming receipt of the rent payment. In India, a revenue stamp on a rent receipt might be required only if the cash payment exceeds Rs. 5,000; otherwise, the standard rent receipt format will suffice.

Types of Rent Receipt Formats

There are three main types of rent receipt formats to consider:

A. Traditional Paper Receipts:

This is the classic format, a physical receipt printed on paper. Landlords may handwrite the details or use pre-printed templates.

- Pros: Tangible and readily available, some tenants might prefer a physical copy for their records.

- Cons: Prone to loss or damage, less eco-friendly, requires additional storage space.

B. Digital or Electronic Receipts:

Generates electronically using online tools or software. These can be sent via email or downloaded in formats like PDF.

- Pros: Convenient, easy to store and share electronically, environmentally friendly.

- Cons: Requires access to a computer or device to access and print if needed, some tenants might prefer a physical copy.

C. Customised Templates:

Landlords or property management companies might have pre-designed templates that include their branding and specific information fields.

- Pros: Provides a professional look, and can include additional relevant details specific to the property or rental agreement.

- Cons: Reliance on pre-designed templates might limit flexibility, tenants might need to adjust the format if their landlord needs to provide one.

Tips for Creating and Using Rent Receipts

Having a proper rent receipt is essential for both tenants and landlords. Here are some key tips to ensure your rent receipts are accurate, secure, and serve their purpose effectively:

A. Use a Reliable Template:

- Pre-designed templates: If your landlord provides a template, use it to ensure consistency and avoid missing any crucial information.

- Online generators: Utilise reputable online rent receipt generators that offer clear and well-structured formats.

- Local regulations: Check if your region has specific legal requirements for rent receipt format.

B. Ensure Accuracy of Information:

- Double-check details: Carefully review all information entered on the receipt, including names, addresses, dates, rent amount, and the rental period covered.

- Clarity is key: Ensure all details are clear, concise, and easy to understand.

C. Keep Copies for Both Landlord and Tenant:

- Maintain records: Both tenants and landlords should keep a copy of each rent receipt for their records. This helps track payments and serves as proof if needed.

- Physical vs. digital: Decide whether you prefer physical copies or digital formats (or both) for record-keeping.

D. Secure Storage of Receipts:

- Physical copies: Store physical receipts in a secure and organised manner, such as a designated file or folder.

- Digital copies: Save digital receipts in a secure location on your device or cloud storage, ensuring proper backup procedures.

Get the Correct Rent Receipt Format with NoBroker

The rent receipt format serves as a crucial document for both tenants and landlords. By following this format and ensuring all necessary details are included, you can create a clear and professional record of your rent payment. This can be beneficial for tax purposes, resolving payment disputes, and maintaining a positive landlord-tenant relationship.

To make this task easier and error-free, consider using services like NoBroker. NoBroker offers a straightforward way to generate rent receipts that comply with legal standards. This ensures that you capture all necessary details such as the amount paid, the date of payment, tenant and landlord names, and the property address.

Still, confused about rent payments? With NoBroker Pay you can simplify the payment process. Pay your rent using credit cards through NoBroker and earn reward points. Visit NoBroker Pay today to experience a hassle-free way to manage your bill payments. Download the app today!

Frequently Asked Questions

Ans: There's no specific government-mandated format for rent receipts in India. However, it should include essential details for tax purposes. These typically include tenant name, landlord name, rent paid (in figures and words), rental period, property address, payment mode (cash, cheque, etc.), date of payment, and landlord's signature.

Ans: Yes, several websites offer downloadable rent receipt templates in PDF format. These can be a good starting point, but ensure they include all the necessary details mentioned above. You can search for "printable rent receipt format India" to find these.

Ans: While it's not advisable to directly use a filled example, you can find sample rent receipts online. These can help you understand how to fill in the details correctly in your receipt. Search for "filled rent receipt format India" for reference examples.

Ans: As mentioned earlier, there's no specific format mandated by the government. The key is to ensure all the crucial details for claiming a House Rent Allowance (HRA) exemption are present. Refer to question 1 for the essential details.

Ans: The rent receipt is a key document, but you might need additional documents depending on your situation. Generally, you'll also need a copy of the rent agreement and proof of your PAN card details. It's always best to consult a tax advisor for specific requirements.

Loved what you read? Share it with others!

Most Viewed Articles

10 Best App for House Rent in India 2025: Subscriptions, Pros and Cons

May 28, 2025

42279+ views

Magenta Line Delhi Metro: Route, Timing, Ticket Fare , Fact & Stations 2025

May 16, 2025

38155+ views

NoBroker Paid Services Reviews

January 31, 2025

16163+ views

Exploring Rental Yield in Mumbai's Property Market

January 31, 2025

16049+ views

10 Best Apps to Rent a House in Hyderabad in 2025

January 31, 2025

13987+ views

Recent blogs in

Magenta Line Delhi Metro: Route, Timing, Ticket Fare , Fact & Stations 2025

May 16, 2025 by Priyanka Saha

NoBroker Super Relax Plan Review: The Go-to Solution For All Your House-hunting Problems

April 17, 2025 by Siri Hegde K

5 तरीक़े जिनसे घर किराए पर लेते समय NoBroker आपके पैसे बचा सकता है

January 31, 2025 by NoBroker.com

Join the conversation!