Table of Contents

Get End-to-end Assistance in Buying a Property

Buyer Benefits Worth Rs.2 Lakh

Complete Property Legal Assistance

Get up to 90% of Property Funding

Up to 25% Off on Home Interior

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Tenant Super Relax Plan

Enjoy Hassle-Free Renting

Full RM + FRM support

Full RM + FRM support Instant alerts & premium filters

Instant alerts & premium filters Rent negotiation & relocation help

Rent negotiation & relocation helpKhata Certificate in Bangalore: The Essential Document for Real Estate Transactions

Table of Contents

So, you’ve zeroed down on a property in Bangalore, but are unclear about the documents that you need to complete the deal? Do not worry. Some terms usually sound intimidating but aren’t necessarily so. We have broken it down for you in simple terms so that you are able to close the transaction and other relevant procedures seamlessly.

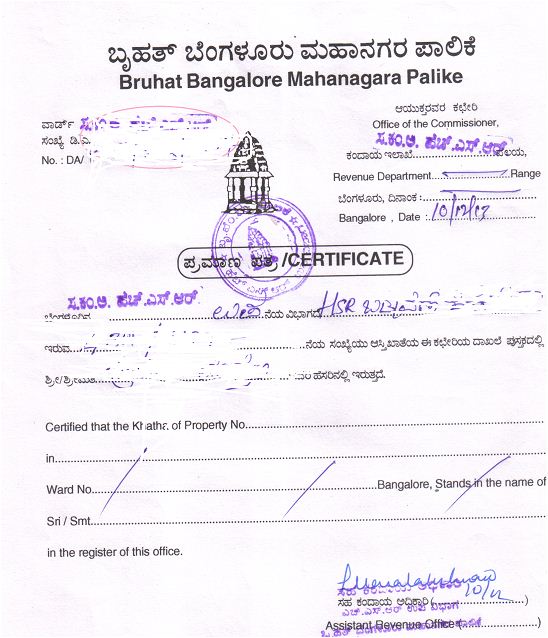

What is the Khata Certificate in Bangalore?

Khata document is important when buying a property in Bangalore. The word when translated means ‘account’. Wondering what is a municipal Khata copy? Khata is basically a document that proves that the person buying a property has an account with the Municipality for taxation purposes. It identifies whether the person is liable for paying tax. Yes, welcome to India! An owner’s Khata includes details such as the size of the property, location of the property, built-up area, etc. that would estimate the tax liability of the owner.

A Khata: Who can Apply?

If the property is within the jurisdiction of the BBMP A Khata, the titleholder can apply for A khata in the required form, along with relevant papers, to the assistant revenue officer (ARO). The A Khata application can be received from any citizen service centre or ARO office. Fill up the A Khata application and return it to the office. Following that, you will receive an acknowledgement.

Get End-to-end Assistance in Buying a Property

Buyer Benefits Worth Rs.2 Lakh

Complete Property Legal Assistance

Get up to 90% of Property Funding

Up to 25% Off on Home Interior

Recommended Reading

Plinth Area: Meaning, Calculation & Difference from Built-Up, Carpet, Covered and Floor Area

January 31, 2025

72671+ views

How To Check the Market Value in Andhra Pradesh?

February 12, 2025

69437+ views

Construction Cost in Bangalore: Detailed Guide to Per Sq. Ft. Rates (2025)

January 31, 2025

67737+ views

Property Rates in Mumbai: Price per Sq. Ft. and Rental Trends in Top Areas 2025

February 12, 2025

60256+ views

10 Best Real Estate Companies in India for Investment & Property Development (2025)

May 2, 2025

58846+ views

Why does one Need a Khata?

As per the A katha meaning, apart from calculating and fulfilling tax liability, Khata is also required to apply for bank loans. While applying for water and electricity connections also, one would need a Khata.

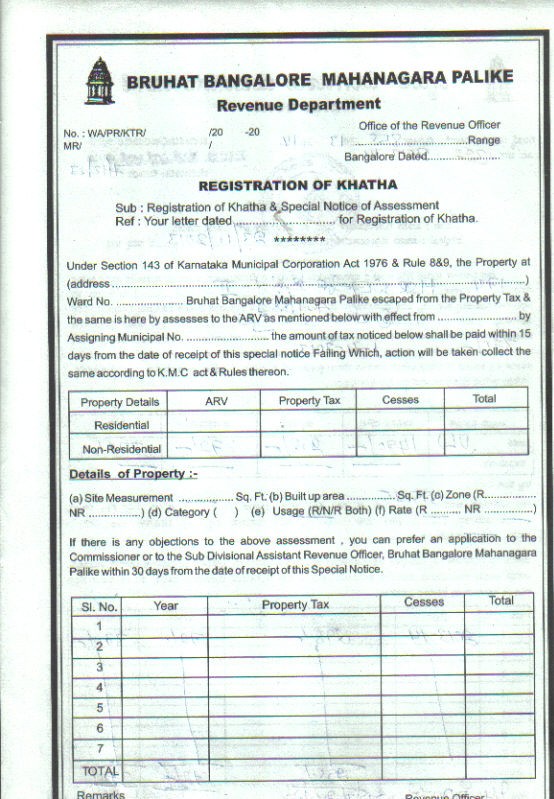

How to Apply for Khata?

Complicated as it might sound, it is very simple to apply for a Khata. All one needs to do is buy an application form from BBMP, fill in and submit the necessary details pertaining to your property along with the latest tax receipts. This has to be submitted to the Assistant Revenue Officer of the area where your property is located. It would take approximately a month to get a Khata account.

A Khata and B Khata Bangalore

Now that we’ve explained in simple terms what Khata is, and how to get a Khata account, let’s decode A Khata from B Khata. Properties that fall under BBMP jurisdiction would fall under A Khata whereas B Khata means that properties fall under local jurisdiction. One can get a property listed under B Khata transferred under A Khata listing by paying a small fee that is known as Betterment Charges for B Khata. There are multiple advantages of listing a property under A Khata and it is therefore advisable. For one, the owner of the A Khata property can apply for bank loans much easier.

A Khata Certificate and A Khata Extract: Charges in Bangalore

You must pay a cost of Rs 25 (per copy) for an A khata certification and Rs 100 (per copy) for an A khata extract. A copy of A Khata certificate or A Khata extract can be obtained from the appropriate office of the assistant revenue officer or any one of the citizen service centres.

B Khata to A Khata Conversions in Bangalore: List of Documents Required

Here are the documents required for the B khata to A khata conversion certificate:

- Copies of previously paid property tax receipts

- Sale deed

- Title deed

- Occupancy certificate

- Khata extract

- Order of conversion of the land from agricultural to non-agricultural use

- Blueprint showing property’s location

- Blueprint showing property’s dimensions and other specifications

- Proof of any improvement charges paid

- Any other document requested by the authorities.

B Khata to A Khata conversion: Step-by-step process of Khata Conversion

(Offline)

Here is the step-by-step process:

Step 1: File an application with the District Commissioner (DC) to change the land from agricultural to non-agricultural purposes.

Step 2: Ensure that you have paid all outstanding property taxes.

Step 3: Obtain the A khata form from the BBMP office and fill it out as instructed.

Step 4: A Katha application form includes a list of all the documentation that must be supplied with the form. Keep them on hand.

Step 5: B khata Betterment charges are levied by the BBMP on khata conversion costs. Submit the completed A khata form, including the tax receipts and other relevant documentation, to the area's assistant revenue officer.

After submitting the form, the khata certificate will be issued within four to six weeks.

(Online)

Step 1: Go to www.sakala.kar.nic.in/online/bbmp.

Step 2: Select khata transfer as an option.

Step 3: Enter the necessary information.

Step 4: You will need to upload the required documents.

Step 5: You will be assigned a Sakala number, which you may use to monitor the state of your request. You will be notified of each stage through SMS. When prompted, download the khata extract online from BangaloreOne or an online website.

Can I get a loan against B Khata Properties?

Nationalised banks will not lend against a B khata property because it is not a legal or official document establishing ownership. Individuals can obtain loans from private banks, although the interest rates on loans secured by B khata properties are greater than those on loans secured by A khata properties.

Misconceptions of a Khata

A common misconception is that a Khata and Title Deed is the same thing. A Title Deed is nothing but a written contract between the buyer and the seller during the transfer of property. Title Deed is to prove ownership of the property whereas Khata is used to assess the property for the purpose of paying taxes and maintaining records.

Need more help understanding the real estate world? Follow our blog or just leave us a comment with what you would like to know. Our NoBroker experts are always here to help.

FAQ’s

Ans. The A Khata is a document that proves that the property owner has paid all applicable property taxes to the BBMP and is the lawful owner of a legal property. Property owners with an A Khata can apply for trade licences, building permits, and loans on their property.

Ans. A khata conversion can be applied for buildings that have minor deviations from the standard and acceptable building regulations.

Ans. There are no unique safety concerns associated with owning a B khata property. You can also sell your property with a B khata. However, if you wish to build or remodel your property, you may run into problems because a B khata does not grant building rights.

Ans. Until 2014, B khata property owners had some privileges in terms of property ownership in Bangalore. However, in December 2014, a Karnataka High Court decision annulled all legal rights. B khata properties must now be transformed into A khata to avoid problems when selling, purchasing, or transferring.

Ans. A Khata is a legal document used in Karnataka to calculate and file property tax. It includes all property information, including the owner's information, property size, built-up area, location, carpet area, tax assessment, and property identification number.

Loved what you read? Share it with others!

Most Viewed Articles

Top 26 Cleanest City of India: List of the Best Cities Ranking Wise in 2025

March 17, 2025

165504+ views

Auspicious Dates and Good Nakshatra for Property Registration in 2025

May 21, 2025

131556+ views

How Mivan Construction Technology Is Transforming the Art of Building!

January 31, 2025

114347+ views

CIDCO Lottery 2025 - CIDCO Starts Registration for 5730 Homes in Navi Mumbai

April 30, 2025

86712+ views

Breaking Down House Construction Costs in India: Easy Tips for Your Budget" in better way

January 31, 2025

74500+ views

Recent blogs in

Top 10 Largest Houses in the World: Location, Owner, No. of Rooms and Floors in 2025

June 30, 2025 by Jessica Solomon

June 22, 2025 by Vivek Mishra

10 Best Places to Live in Chennai: Budget-Friendly Neighborhoods to Buy or Rent a Home in 2025

May 30, 2025 by Ananth

May 30, 2025 by Suju

Join the conversation!