Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Nashik Property Tax: Online and Offline Bill Payment, Receipt Download and Calculator 2025

Table of Contents

Nashik Property Tax is a key source of revenue for the Nashik Municipal Corporation (NMC). It helps fund civic services such as road maintenance, water supply, waste management, and public infrastructure. NMC recorded a substantial 33% increase in property tax collection during the current financial year, reaching ₹234 crore by the end of February 2025.

In a recent update, NMC announced a hike in property tax for new industrial properties. Effective April 1, 2025, the tax rate will increase from ₹13.2 per square meter to ₹19.8 per square meter. Please keep reading to learn more about the property tax in Nashik Municipal Corporation, including how to pay it and the latest recent information on refunds.

Nashik Property Tax: A Quick Information in 2025

Nashik Municipal Corporation handles property tax in Nashik. Here is some quick info on Nashik property tax:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

| Information | Details |

| Authority | Nashik Municipal Corporation |

| Official website | https://nmc.gov.in/ |

| Last due date | June 30, 2025 |

| Helpline number | 7030300300 |

| Email ID | commissioner@nmc.gov.in |

Latest News on Nashik Property Tax 2025

Under the latest Nashik property tax update, tax on new residential and commercial properties will increase by 2% starting from April 1, 2025, which is expected to generate an additional ₹10 crore in revenue. Property tax in the industrial areas has also been hiked, rising from ₹13.2 per square meter to ₹19.8 per square meter.

The Nashik Rental Tax Reform has also revised the taxation system to relieve property owners. Previously, residential rental properties were taxed at double the standard rate, while commercial rental properties faced a fourfold increase. The new system will levy a 30% additional tax on rented residential and commercial properties. However, property owners must inform the Nashik Municipal Corporation (NMC) about their tenants to avail of this benefit.

The Nashik Municipal Corporation recorded a 33% increase in property tax collection, reaching ₹234 crore by the end of February 2024 (for the financial year April 2024 – March 2025).

Nashik Property Tax Bill Payment 2025

In 2025, property owners in Nashik can pay their property taxes online or offline. This system will facilitate effective and timely tax payments, guaranteeing accessibility and convenience for all.

NMC streamlines the procedure by accommodating all preferences, whether you prefer the traditional manner at a designated payment location or the speedy digital technique via NMC's online portal.

Nashik Property Tax Online Payment 2025

The process of Nashik Property Tax Online Payment is very easy and simple. An online system provided by the Nashik Municipal Corporation makes the online payment of tax for property owners hassle-free. To complete the payment process, follow these steps:

Step 1: Go to the NMC Website: Visit Nashik Municipal Corporation's official website (nmc.gov.in) first.

Step 2: Find the “E-Services” Section: Click on the "Property Tax" option under the "E-Services" section.

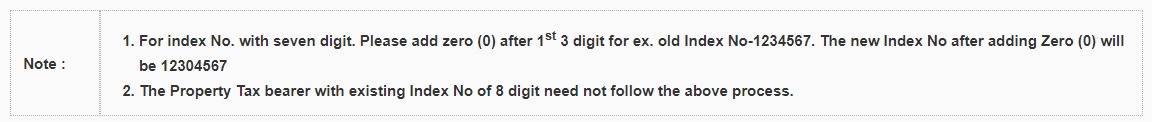

Step 3: Enter Your Index Number: Input your Index number and click "Submit" to retrieve your tax details. This unique PIN is personal to your property and can be on old property tax receipts or paperwork.

Step 4: Review The Tax Bill: Check the bill details and click "Pay Now” after accepting the terms and conditions.

Step 5: Complete Your Payment Process: You will be directed to the payment gateway. After selecting the payment method, complete the process.

Besides using the official website to pay the property taxes, you can also use the NoBroker app to pay the Nashik Property Taxes. The steps are as follows:

NMC Property Tax Offline Payment 2025

Paying the Nashik Mahanagar Palika property tax offline is very easy. You need to visit an authorised NMC payment centre or the main office. Make sure you bring the bill for the property tax, the Adhaar card, and other property details. You can pay by cash, UPI, credit card, debit card, or cheque.

- Benefits of Online Payment: For both local governments and property owners, online property tax payment provides a number of advantages:

- Convenience: Property owners can conveniently pay their taxes using a computer or mobile device with internet access at any time and from any location.

- Time-saving: Online payments reduce the effort needed to prepare and mail cheques or visit payment centres.

- Accuracy: Online systems significantly decrease the chance of errors by automatically calculating taxes based on property assessments and local tax rates.

- 24/7 Accessibility: Because payment services are available around the clock, property owners can fulfil deadlines without being limited by office hours or vacations.

Nashik Property Tax Bill/Receipt download 2025

To download your Nashik Municipal Corporation property tax receipt for 2025, you can follow these steps:

Step 1: Access the NMC Website: Go to the official website of Nashik Municipal Corporation:: Nashik Municipal Corporation (nmc.gov.in)

Step 2: Look for the “Property Tax” Section: Find the “Property Tax” tab.

Step 3: Enter Your Account Login Details: Log in with your username and password.

Step 4: View the Details of your Property: The property details will be shown to you once you log in.

Step 5: Download the Bill/Receipt: Click on “View Bill” or “Download Bill” as per your choice.

Step 6: Save or Print the Bill/Receipt: You can save the bill or print it for future reference.

Nashik Property Tax Last Due Date 2025

The last Nashik Municipal Corporation Property Tax date is June 30, 2025. Property holders should pay the taxes on time to avoid any late fees or fines. They can pay the taxes either online or offline at their convenience. By maintaining the deadline, they ensure smooth municipal service administration and adherence to local legislation.

Nashik Property Tax Rebate 2025

According to the Times of India, the Nashik Government offers a rebate for early payments. There is an 8% rebate if the tax is paid in April, followed by a 6% rebate if it is paid in May and a 3% rebate if it is paid in June. It is always advisable to pay the property tax before the last date to enjoy the discounts provided by the Nashik Municipal Corporation.

Nashik Property Tax Transfer Charges 2025

The Nashik Property Transfer charges mainly comprise the Stamp Duty Charges and the registration fees. The current stamp Duty Charge is 4% of the property price. The registration fee is 1%. It is always essential to remember these charges. You should always refer to the official website for the exact charge, as it varies.

Nashik Property Tax Helpline Number 2025

If you need any assistance with your property tax, the Nashik Municipal Corporation is always available.

- Contact Details: You can visit their main office, which is located in Nashik Mahanagar Palika, Rajiv Gandhi Bhawan, Sharanpur Road, Nashik. They will assist you with any issues that you might face.

- Helpline Number: For immediate assistance, contact them at their helpline number 0253 - 2575631 / 2 / 3 / 4.

Nashik Property Tax App 2025

The Nashik Municipal Corporation has launched an online payment source for better convenience. NMC e-Connect is a one-stop solution for all things NMC. This app helps inform senior officials about the operations of various NMC departments through the complaints section and provides instant access to smart information on how these departments operate. It is available for both Android and iOS users.

Nashik Property Tax Payment through NoBroker Pay:

- Step 1: Log In to NoBroker Pay: You can access your NoBroker account through their website or app. If you're new, create an account first.

- Step 2: Locate the Payments Section: After logging in, select 'Pay Rent & More' and click on 'Pay Property Tax'.

- Step 3: Choose NMC as the Corporation: Select 'Nashik Municipal Corporation (NMC) from the list of municipal corporations.

- Step 4: Input your Property Details: Provide all the details of the property like the holding number and other required information from your property tax bill.

- Step 5: Select the method of payment: Choose payment options like UPI, net banking, credit card or debit card.

- Step 6: Confirm your transaction: Check and confirm the payment details to complete the transaction. A confirmation of the payment will be received from NoBroker.

- Step 7: Download the NMC Property Tax Bill: Save a copy of the payment receipt for future reference.

Explore Property Tax Payment Options City-Wise in India

Streamlining Nashik Property Taxes with NoBroker

Understanding and managing property taxes in Nashik can be complex, but NoBroker simplifies the process with clarity and efficiency. NoBroker offers valuable insights and tools to help property owners and investors navigate Nashik’s property tax requirements effortlessly. From accurate tax calculations to convenient online payment options, NoBroker ensures a streamlined experience. Trust NoBroker to provide transparent guidance and reliable support, empowering you to manage your Nashik Property taxes easily and competently.

FAQs About Nashik Property Tax

Ans: Property tax in Nashik is calculated based on the property's location, size, type, usage, and applicable rates set by the municipal corporation.

Ans: You can check your property tax balance online through the Nashik Municipal Corporation's website by entering your property details.

Ans: To pay your Nashik property tax, you must provide your property tax bill or assessment number, identification proof, and payment details.

Ans: The property tax rate in Nashik varies depending on the type and location of the property, and the Nashik Municipal Corporation sets it.

Ans: The Nashik Municipal Corporation usually updates the property tax rate annually based on various factors.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

61680+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

50188+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

44379+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

39842+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

34137+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116765+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

199762+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

144467+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135226+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Mobile Home Lease Agreement: Types, Rights, Rules & Legal Requirements in 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!