Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Mira Bhayander Property Tax: How to Pay, Calculate, Download and View Status in 2025

Table of Contents

If you own a property in Maharashtra, you need to know about the Mira Bhayandar Property Tax payment. This tax is a mandatory payment made by property owners to Mira Bhayandar Municipal Corporation (MBMC). An important tax maintains the smooth running of public services like roads, street lights, sanitation, hospitals, and others. The MBMC property tax payment is made online using the official website or offline by visiting the designated centres.

The Mira Bhayandar Property Tax is calculated based on the property type, size and location. All eligible taxpayers can visit the MBMC portal to pay the tax and check the dues if they have any. MBMC helpline and local ward bodies are there to help. Taxpayers should always verify their tax details regularly and see if there are any updates or pending dues. This blog provides relevant information about payment methods and a step-by-step process for the Mira Bhanyandar property tax bill download.

Mira Bhayandar Property Tax Quick Info 2025

| Information | Details |

| Official Website Link | https://www.mbmc.gov.in/en/ |

| Tax Payment due date | April 1, 2025 (first instalment), October 1, 2025 (second instalment) |

| Rebate | 1-2% |

| Penalty for late payment | 2% |

| Method for Tax Calculation | Capital Value System (CAS) |

| Tax Rates | The tax rate is based on the location and area |

| Payment method | Online via KBMC's official website, credit/debit cards, net banking, e-wallets, & UPI |

| Properties for tax payments | Residential, Industrial and commercial lands |

| How to check Status | Visit the KBMC Property Tax website and check using the property number & owner name |

| Contact Details | Address: Mira Bhayandar Municipal Corporation, Indira Gandhi Bhavan, Chhatrapati Shivaji Maharaj Road, Bhayandar(w.) Mira Bhayandar, Thane, Maharashtra 401101Contact: 022-2819 2828 / 28193028Toll-Free Number: 1800 224 849 |

How do you Calculate Property Tax Mira Bhayandar Online?

Property owners across India must pay the property tax in their respective jurisdictions. Many rules and laws enforce tax collection and help payers do it fairly and transparently. That is why, it is important to understand how to calculate the tax to plan and pay on time. There are a few components and factors to keep in mind before calculating:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

What are the Components of Property Tax?

- Capital Value System (CAS): The property tax in Mira Bhayandar is based on the capital value system, which considers the property's market value.

- Tax Rate: The Mira Bhayandar Municipal Corporation fixes the tax rate, but it varies depending on the property type and category.

- Build-up area: The garage and the balconies are also added to the build-up-area when calculating the property booked for the tourist

- Usage of property: The tax varies depending on the type of property used, such as commercial, residential, or industrial.

Factors Affecting the Property Tax

- Location of the property: The property's location is calculated depending on its zone, such as residential or commercial. If the property is commercial, the tax is higher than for residential.

- Age of the property: Tax paying is also based on this factor. If the property is old, then the tax payable is less.

What is the formula for calculating Property Tax?

Below is the formula to calculate Property Tax:

Capital Value of the Property x Rate of Tax x Usage Factor

Why Pay Property Tax in Mira Bhayander?

Mira Bhayander is a city in the Thane district of Maharashtra, India. Property tax, also known as property rate, is a tax levied on properties such as houses, lands, and buildings by the local government. The property tax payment for Mira Bhayander is usually made annually, based on the value of the property.

To make the property tax payment in Mira Bhayander, you may visit the official website of the Mira Bhayandar Municipal Corporation Property Tax and look for the option to pay property tax online. You may also be able to pay property tax in person at the MBMC office or authorized banks by submitting the necessary forms and documents.

It is important to note that the procedure and amount of property tax payment may vary depending on the specific location within Mira Bhayander and your property type.

In Mira Bhayander, the MBMC levies property tax, which is an important source of revenue for the corporation. By paying your property tax, you contribute to the city's development and maintenance and ensure that essential public services are maintained.

How to Pay Your Mira Bhayander Property Tax Online

The MBMC offers several options for paying your property tax, including online payment through the official website, payment at designated banks, and payment through the MBMC's mobile app.

To pay property tax in Mira Bhayander, you can follow these steps:

- Visit the official website of the Mira Bhayander Municipal Corporation (MBMC) and look for the option to pay property tax online.

- Register for an account on the website if you do not already have one.

- Log into your account and enter your property details, such as the property address, tax assessment number, and the financial year for which you want to pay the tax.

- Calculate the property tax due using the online calculator provided on the website.

- Review the tax amount and confirm the payment.

- Choose a payment method, such as credit card, debit card, net banking, or UPI, and follow the prompts to complete the payment.

- Print or save the Mira Bhayander Property Tax receipt downloaded for your records.

Property tax can also be paid in person at the MBMC office or at authorized banks. In this case, you may need to complete a physical form and submit it along with the payment.

Checking and Downloading Your Property Tax Bill in 2025

Now that we have a basic understanding of property tax in Mira Bhayander, let's look at how you can view and download your property tax bill.

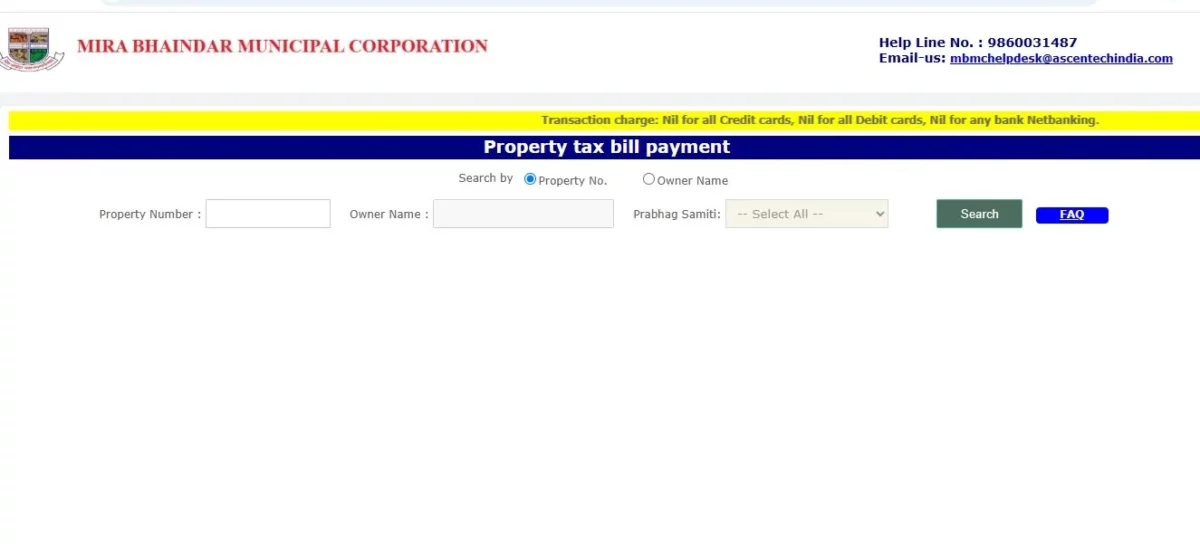

How to Check Your Property Tax Bill Online?

The MBMC has made it easy to view your property tax bill online. Simply visit the MBMC's official website, and navigate the Property Tax section. You can enter your property's assessment number and view your bill from there.

Here are the steps for checking and downloading your property tax bill in Mira Bhayander:

- Visit the official website of the Mira Bhayander Municipal Corporation (MBMC).

- Look for the option to view your property tax bill and payment history.

- Enter the necessary information, such as your property address or tax assessment number, to search for your tax bill.

- Review the details of your property tax bill, including the amount due, the due date, and any payment history.

- Download or print a copy of your property tax bill for your records.

How to Download Your Property Tax Bill?

Once you have viewed your property tax bill, you can download a copy for your records. To do this, simply click the Download button on the bill screen and save a copy to your computer.

Note that the process for checking and downloading your property tax bill in Mira Bhayander may vary depending on the specific procedures and technology used by the MBMC. If you have any difficulties accessing your property tax bill, you may contact the MBMC for assistance.

Verifying Your Mira Bhayander Property Tax Payment Status

Verifying the payment status of your Mira Bhayander Property Tax is a pivotal task to prevent legal complications and maintain compliance. To perform this verification, carefully follow the step-by-step process outlined below:

- Visit the Official MBMC Website: To initiate the procedure, navigate to the official Mira Bhayander Municipal Corporation (MBMC) website: www.mbmc.gov.in.

- Access the Property Tax Payment Section: In the menu bar, locate and select the 'PROPERTY TAX PAYMENT' option within the website's interface.

- Explore the Tax Bill Section: Inside the 'PROPERTY TAX PAYMENT' category, you will find the 'VIEW YOUR TAX BILL' option. Click on it to proceed.

- Provide Property Details: Enter precise details about the property, including the owner's name, location, and type. Once the information is filled in accurately, initiate the search by clicking the 'SEARCH' button.

- Unveil Your Payment Status: After completing the above steps, the system will display your property tax's current payment status. This status update will explicitly indicate whether the payment has been successfully processed, is pending, or involves any outstanding dues.

By adhering to these clear-cut instructions, you can effectively uncover the precise status of your Mira Bhayander Property Tax payment. This proactive approach empowers you to promptly address discrepancies and ensures your unwavering commitment to property tax regulations.

Changing Your Property Tax Details Online in Mira Bhayander Municipal Corporation

When alterations are needed for your property tax information, such as a name or address change, Mira Bhayander Municipal Corporation (MBMC) offers a user-friendly online portal. This lets you easily refine your details, ensuring accurate property tax billing.

How to Update Your Details on Mira Bhayandar Municipal Corporation?

To modify property tax information through MBMC's online platform:

- Visit MBMC's official website.

- Find the property tax detail update option.

- Access your account or create one.

- Enter revised details (address, contact, or bank info).

- Verify accuracy; await MBMC validation.

- Confirm changes and retain a copy.

Note that process variations may exist. For assistance, contact MBMC directly.

Smooth Transition with MBMC

MBMC provides direct support for any issues during online property tax detail updates. Seek guidance to ensure a seamless property tax process.

MBMC Property Tax Bill Helpline: Effortless Assistance at Your Fingertips

The MBMC Property Tax Bill Helpline is your dedicated support channel for all matters related to property tax bills. If you have questions or require clarification about your property tax bill, please contact us. Feel free to email your queries to propertytax@mbmc.gov.in using the subject line "MBMCPROPERTYOL" along with your Property Number and/or Transaction ID for swift resolution. Alternatively, you can reach out directly by calling 28192828-ext 333. Our experts are here to provide accurate information and guidance, ensuring a seamless property tax experience in Mira Bhayander.

Explore Property Tax Payment Options City-Wise in India

NoBroker Can Help with Your Property Tax Needs

Paying property tax in Mira Bhayander is an important responsibility for property owners. By checking your property tax bill, downloading a copy, and making a payment, you can ensure that your property tax obligations are met and that you contribute to the city's development and maintenance. If you’re struggling to understand the property tax payment process in Mira Bhayander or need help with your property tax bill, NoBroker can help. Our team of experts can assist with all your property tax needs, including bill payment and Mira Bhayander Municipal Corporation Property Tax receipt generation.

Frequently Asked Questions

Ans: To acquire a Mira Bhayander Property Tax duplicate bill, visit the official website of MBMC and navigate to the 'Property Tax Payment' section. Select 'View Your Tax Bill' and input your property details to generate the duplicate bill.

Ans: Yes, you can pay your property tax online in Mira Bhayander by visiting the MBMC's official website and following the instructions to make an online payment.

Ans: If you don't pay your property tax in Mira Bhayander, you may be subject to penalties, interest charges, and legal action, including the seizure of your property.

Ans: Depending on your circumstances, you may be eligible for a property tax rebate in Mira Bhayander. Check with the MBMC for information on rebates and other concessions.

Ans: You can check your property tax status in Mira Bhayander by visiting the MBMC's official website and looking for the option to view your tax bill and payment history. Alternatively, you can contact the MBMC for your property tax status information.

Ans: To download the Mira Bhayander receipt:

Visit the official website of MBMC

Under the services column, click on Payment of Water Supply Tax online

Click on view payment

Now click on Download and the type of format you want to download in

Ans: If you want to pay the property bill using the app, then you can check the below steps:

Download the My MBMC Mobile app via Google Playstore or App Store

Register or Login using a valid email ID

Here, you can make payments using various payment options

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

61762+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

50241+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

44419+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

39877+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

34185+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116785+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

200044+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

144749+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135383+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Mobile Home Lease Agreement: Types, Rights, Rules & Legal Requirements in 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!