Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

GMC Property Tax Guwahati: Pay Tax Online, and Offline, Receipt Download and Check Status in 2025

Table of Contents

Are you a property owner within the jurisdiction of Guwahati Municipal Corporation limits? Then you for sure should know about the GMC property tax. It is a mandatory levy imposed by the city on property owners. This tax is crucial for funding various municipal services and maintaining infrastructure. All property owners in Guwahati must pay this tax annually to contribute to the city's development and upkeep.

Paying your property tax in Guwahati on time ensures that essential services such as road maintenance, waste management, and public amenities are well-funded and functional. It is a straightforward process that can be done online and offline, providing flexibility and convenience to all taxpayers.

GMC Property Tax: A Quick Info 2025

Here is the quick info for GMC property tax 2025:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

| Information | Details |

| Authority | Guwahati Municipal Corporation |

| Official website | https://gmcpropertytax.com/ |

| Property tax rate | 5%-20% |

| Last date for payment | March 31 |

| Helpline Number | 88110-07000 |

GMC Property Tax Bill Payment 2025

In 2025, Guwahati property owners can pay their property taxes online or offline, thanks to the Guwahati Municipal Corporation (GMC). This system ensures convenience and accessibility for all, allowing for efficient and timely tax payments.

Whether you prefer the quick digital method via GMC’s online portal or the traditional approach at a designated payment centre, GMC accommodates all preferences to keep the process straightforward. This variety of payment options helps ensure that all property owners can easily meet their tax obligations.

How to Pay GMC Property Tax Online (2025)

Paying your property tax online to the Guwahati Municipal Corporation (GMC) is straightforward and quick. In 2025, GMC will continue to offer an efficient online system that simplifies the process for all property owners in Guwahati. Here’s how you can complete your payment with ease:

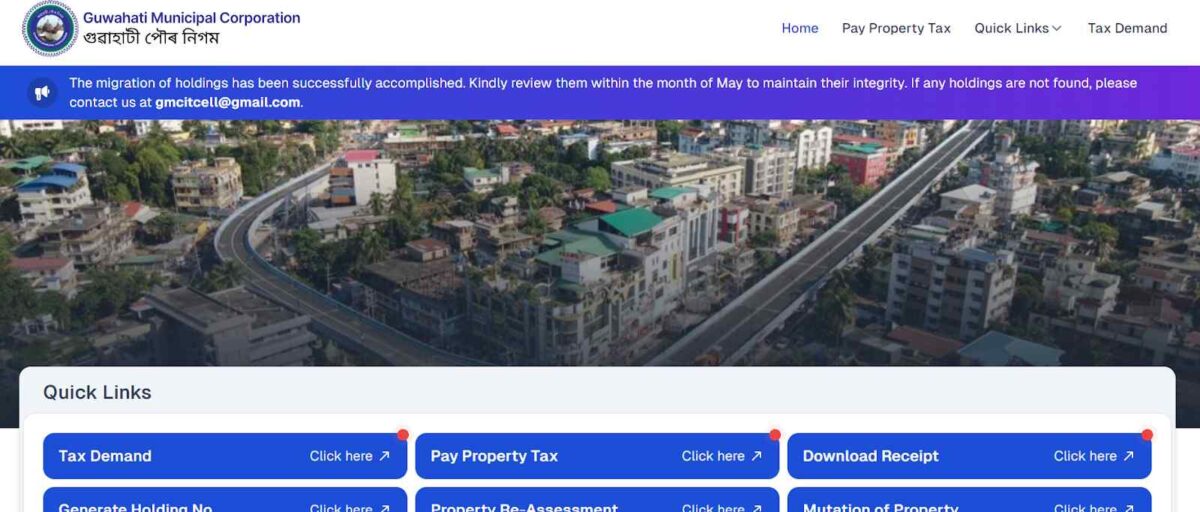

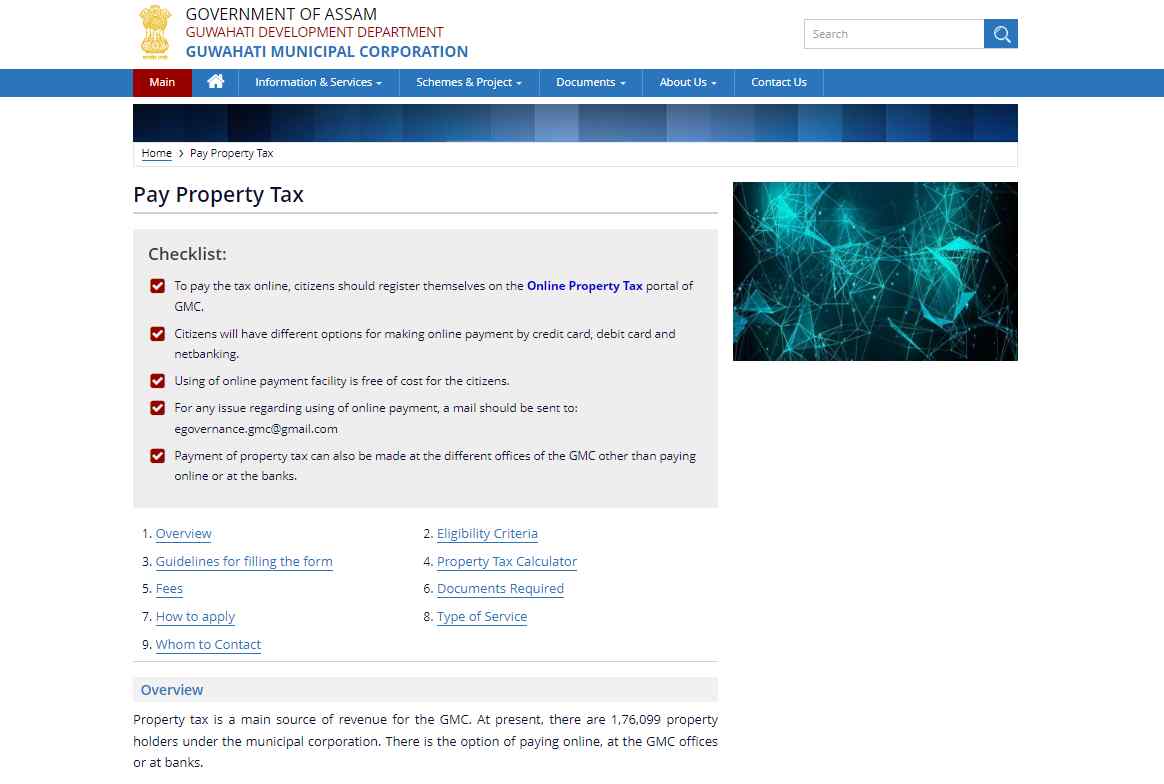

Step 1: Access the GMC Website: First, visit the Guwahati Municipal Corporation's official website at gmc.assam.gov.in.

Step 2: Locate the Tax Payment Section: Click on the "Pay Property Tax" option on the homepage to proceed.

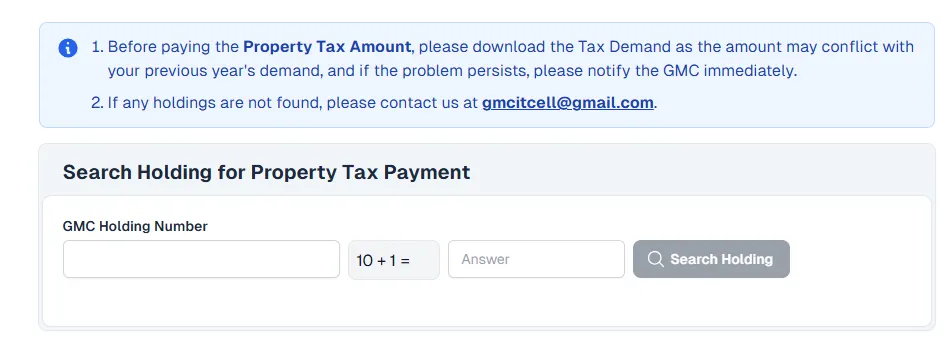

Step 3: Enter Your Holding Number: Input your holding number and click "Go" to fetch your tax details.

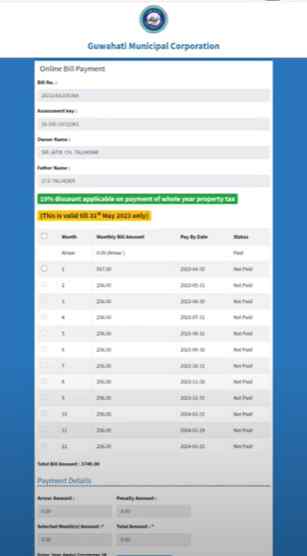

Step 4: Confirm Your Tax Bill: Review the bill details. Select the checkboxes for the quarters you want to pay and press "Pay Now."

Step 5: Complete the Payment Process: Once you verify the details, you'll be directed to the payment gateway. Select your preferred payment method and complete the required information.

Step 6: Secure Your Receipt: A receipt will be generated once the payment is successful. Please download and keep this for future reference.

Apart from paying through their official site, you can also pay your GMC taxes hassle-free through NoBroker Pay. Here are the steps for it:

Payment through NoBroker Pay:

- Step 1: Sign In to NoBroker Pay: You can log in to your NoBroker account through their website or app. You'll have to create one if you don't have an account.

- Step 2: Go to the Payments Section: Once logged in, go to the 'Pay Rent & More' section and select 'Pay Property Tax'.

- Step 3: Select GMC as the Corporation: Choose 'Guwahati Municipal Corporation (GMC)' from the list of available municipal corporations.

- Step 4: Enter Property Details: Enter your property details, including the holding number and any other information required for your property tax bill.

- Step 5: Choose Your Payment Method: Select your preferred payment method. NoBroker Pay offers options like credit cards, debit cards, net banking, and UPI.

- Step 6: Complete Your Transaction: Confirm the payment details and complete the transaction. You will receive confirmation of your payment directly through NoBroker.

- Step 7: GMC Property Tax Bill Download: Download and save your Guwahati Municipality tax payment receipt for future reference.

How to Pay GMC Property Tax Offline 2025

For those who prefer to pay their property tax in person, the Guwahati Municipal Corporation offers a straightforward offline payment method for 2025. This option caters to residents who are more comfortable handling transactions face-to-face or cannot access online services.

To pay, visit any authorised GMC payment centre or the main office. Ensure you bring your property tax bill and a valid form of identification to facilitate the payment process. Depending on what the centre accepts, payments can be made via cash, check, or debit card.

Benefits of Online Payment

Paying your GMC property tax online in 2025 offers several advantages that make the process easier and more efficient.

- Convenience: You can settle your property tax conveniently from your residence. Visiting the GMC office or standing in long queues is unnecessary.

- Time-Saving: Online payment is quick and straightforward. It takes just a few minutes to complete the transaction.

- Secure Transactions: The GMC online portal uses secure payment gateways, ensuring your payment information remains safe.

- Instant Confirmation: After making the payment, you receive an instant confirmation and a digital receipt for your records.

- Accessibility: The online system is available 24/7, allowing you to make payments at any time that is convenient for you.

How to Download GMC Property Tax Receipt

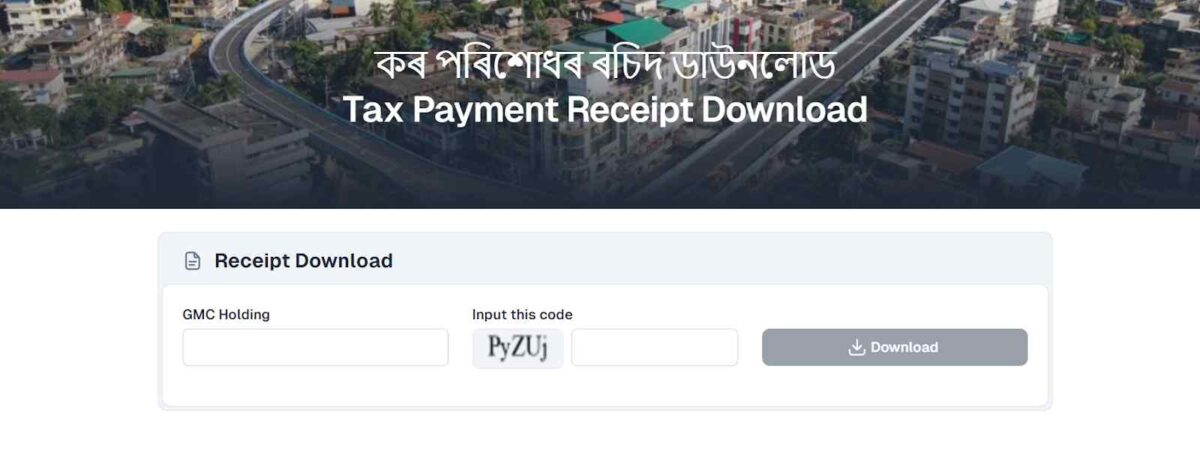

The process is quick and straightforward if you need a copy of your Guwahati Municipal Corporation (GMC) property tax receipt. You can download it directly from the GMC website dedicated to property tax management.

Step 1: Visit the Direct Link

Go to https://gmcpropertytax.com/.

Step 2: Download Your Receipt

Click on the 'Download Receipt' option. Enter your GMC Holding Number and input the code provided on the page.

Step 3: Generate Your Receipt

Click 'Continue' to generate your receipt. Once the receipt appears, you can download and save it to your device for future reference.

Step-by-Step Guide to GMC Property Tax Calculator 2025

Calculating your property tax for the Guwahati Municipal Corporation (GMC) in 2025 is straightforward with the online tax calculator. This tool helps you understand exactly what you owe without any hassle.

Step 1: Start with a Search

Enter 'Guwahati Municipal Corporation property tax calculator' into your preferred search engine to begin.

Step 2: Go to the Official Page

Click on the 'Pay Property Tax, Government of Assam' result to proceed to the official site.

Step 3: Access the Calculator

Once on the site, locate and select the 'Property Tax Calculator' section to open the calculator.

Step 4: Input Your Details

Fill in the required fields with your property information to calculate your GMC property tax.

GMC Property Tax Rate 2025: What You Need to Know?

The Guwahati Municipal Corporation (GMC) has structured its property tax rates to accommodate various property types, ensuring fairness and responsibility in tax contributions towards city development.

- Residential Properties: In 2025, homeowners in Guwahati will be subject to a 15% property tax rate. This applies to all residential units under GMC's jurisdiction.

- Commercial Properties: Commercial property owners will incur a tax rate of 7.5%. This includes establishments like stores, offices, and other business venues.

- Vacant Lands: Vacant lands attract a 5% property tax rate, reflecting their non-productive status but acknowledging their potential for development.

GMC Property Tax Rebate 2025

Property taxes are a significant part of your yearly financial planning. For 2025, the Guwahati Municipal Corporation (GMC) is offering a 10% rebate on property taxes for early payments, providing an excellent opportunity for savings.

- Step 1: Understand the Rebate Offer: Guwahati Municipal Corporation (GMC) offers a 10% rebate for early property tax payments. This initiative is part of GMC's effort to encourage timely tax payments.

- Step 2: Confirm Eligibility: The rebate is available to all Guwahati property owners who pay their property tax early. To qualify, your property must fall within the GMC jurisdiction.

- Step 3: Time Your Payment: To avail of the 10% discount, you must pay your property tax between April 1 and May 31, 2025. Payments made within this period will automatically receive the rebate.

- Step 4: Make Your Payment: To make the payment, visit the official GMC website or use their mobile app. If available, you can also pay through other authorised channels.

- Step 5: Verify the Discount: After completing the payment, check the payment receipt or your account summary to ensure the discount has been applied. This proves that you have taken advantage of the early payment rebate.

- Step 6: Keep Records: Keep a copy of the receipt for your personal records. It’s important to have documentation verifying that you met the early payment criteria.

GMC Property Tax Transfer Online 2025

Transferring property tax responsibilities is an important step in the ownership change process. Guwahati Municipal Corporation (GMC) will offer an online system in 2024 to simplify this transfer, ensuring new owners can easily assume their tax duties.

- Step 1: Visit the GMC Website: You can start by going to the Guwahati Municipal Corporation’s official website. This portal provides access to all property-related services.

- Step 2: GMC Property Tax Login or Register: Log in using your existing credentials. If you’re new to the system, follow the registration process to create an account.

- Step 3: Select Property Tax Services: Once logged in, go to the 'Property Tax' section. Look for the 'Transfer of Ownership' option and select it.

- Step 4: Input Property Information: Enter the necessary details about the property, such as the holding number or address. Ensure all the information is accurate to avoid issues with the transfer.

- Step 5: Fill Out the Transfer Details: Complete the required fields regarding the transfer, including information about the previous and new owner.

- Step 6: Submit the Required Documents: Attach any required documents that support the transfer, such as sale deeds or legal affidavits.

- Step 7: Submit and Confirm: Review the details before submitting the form. You will receive an online confirmation or transaction number; keep this for your records.

- Step 8: Monitor the Status: After submission, monitor the status of your transfer request through your GMC account. If it is not updated within a few days, contact GMC customer service.

Guide to GMC Property Tax App 2025

The Guwahati Municipal Corporation has launched an updated app for 2025, making property tax management easier than ever. This app allows residents to efficiently handle their property tax payments from their smartphones.

- How to Download: You can download the GMC Property Tax App from the Google Play Store or Apple App Store. Search for "GMC Property Tax App" and select the official version.

- Features of the App: The app provides features to view your property tax due, make payments securely, and check previous transactions. You can also update personal details linked to your property tax account.

- Making a Payment: To pay your property tax, simply log in, login on 'Pay Now,' and enter the amount. You can make payments using a credit card, debit card, or net banking. After the transaction, you will receive a confirmation directly on your phone.

- Accessing Tax Records: The app lets you view and download your property tax bills and receipts. To do so, go to the 'Documents' section, select the year you need, and download the required documents.

- Support and Assistance: If you encounter any issues while using the app, the 'Help' section offers troubleshooting advice and contact information for GMC support staff.

GMC Property Tax Last Due Date 2025

All property taxes are due by March 31st each year to avoid penalties. Property owners can pay their taxes online via the official GMC website, providing a convenient and secure method to fulfil their fiscal duties.

- Consequences of Late Payment: If you miss the March 31st deadline, you may face late fees. Continued non-payment could lead to more severe penalties, including legal action or a lien on your property.

- Stay Informed: Regularly check the GMC's official communications for any updates or changes to the due date. This will help prevent unexpected surprises at the last minute.

- Prepare Early: Consider preparing your payment a few weeks in advance to avoid a rush. This gives you time to resolve any issues arising during the payment process.

GMC Property Tax Helpline Number 2025

If you have any questions or need assistance with your 2025 property tax, the Guwahati Municipal Corporation is ready to help.

- Contact Details: GMC's main office is in Dispur, Guwahati, Assam—781006. They offer support for any property tax inquiries or issues you might encounter.

- Email Support: For non-urgent queries or if you prefer digital communication, email the support team at gmcitcell@gmail.com. They strive to respond quickly to all inquiries.

- Helpline Number: Call the helpline at 88110-07000 for immediate assistance. This number is available for all property tax-related questions and support needs.

Latest News/Developments of GMC Property Tax 2025

The Guwahati Municipal Corporation (GMC) has instructed property tax defaulters to clear their dues by March, warning of strict action against non-compliance. GMC Mayor Mrigen Sarania announced that taxes have been collected from ₹1.10 lakh households out of ₹1.16 lakh, totalling ₹80-85 crore against a target of ₹130 crore. Shops have contributed ₹27 crore, though 25,000 traders are yet to obtain trade licenses.

For FY 2025-26, taxpayers paying by April will get a 10% discount, while later payments will get 5%. Defaulters will face penalties of up to 20%. Legal action, including sealing shops, will begin in June against those without valid trade licenses.

Source: India Today NE

Explore Property Tax Payment Options City-Wise in India

Simplifying GMC Property Tax Payments with NoBroker Pay!

Paying your GMC property tax on time is crucial to avoid penalties and ensure the smooth provision of municipal services. NoBroker Pay offers a seamless and efficient way to manage your tax payments hassle-free.

NoBroker Pay provides a user-friendly platform to pay your GMC property tax online. This service ensures that your payment is processed quickly and securely. You can complete the transaction from the comfort of your home, avoiding long queues and paperwork. Visit NoBroker Pay today to manage your GMC property tax payments effortlessly and keep your finances in order.

Frequently Asked Questions

Ans: GMC property tax is a levy the Guwahati Municipal Corporation imposes on property owners to fund municipal services and infrastructure maintenance.

Ans: You can view your GMC tax paid details by logging into the GMC official website and accessing your payment history.

Ans: To download your GMC property tax payment receipt, visit the GMC website, log in, and click on 'Download Receipt' after your payment.

Ans: You typically need your property identification details, such as the holding number and valid identification documents.

Ans: Yes, GMC offers a 10% discount for early payments made between April 1st and May 31st.

Ans: The GMC generally sets deadlines for paying to hold tax within each financial year. Property owners are advised to pay the tax on time to avoid penalties.

Ans: The GMC house tax rate in 2025 is from 5% to 20%, and the due date is March 31st.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

61608+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

50153+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

44361+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

39812+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

34107+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116747+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

199631+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

144337+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135136+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Mobile Home Lease Agreement: Types, Rights, Rules & Legal Requirements in 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!