Table of Contents

Loved what you read? Share it with others!

Aurangabad Property Tax: Online Payment, Receipt Download, Status, Rates 2025

Table of Contents

Did you know a slight Aurangabad property tax calculation change could significantly affect your annual expenses? The Aurangabad property tax is a fee charged by the Chhatrapati Sambhajinagar Municipal Corporation (CSMC) on properties within Aurangabad, Maharashtra, India. Aurangabad property tax rate for residential properties is ₹1.25 per sqm. Funds collected through the Municipal Corporation Aurangabad property tax are used for city development projects, sanitation, drainage, and public welfare programs.

Aurangabad Property Tax: A Quick Info

Here is the quick info for Aurangabad property tax:

| Information | Details |

| Authority | Chhatrapati Sambhajinagar Municipal Corporation (CSMC) |

| Official website | https://aurangabadmahapalika.org/TaxCollection/pg/property/getPropertyPgWebApi |

| Property rate | ₹1.25 per sq m |

| Last due date | 31st December |

| Helpline number | 0242333537 |

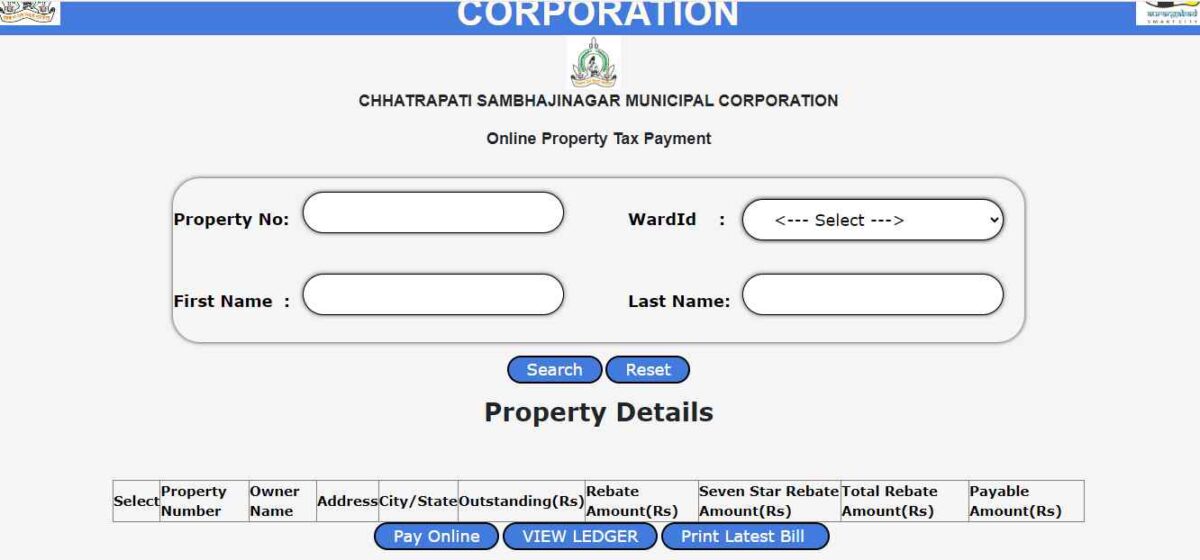

Aurangabad Property Tax Online Payment 2025

Here's how to pay your Aurangabad Municipal Corporation Property Tax Online for 2025:

1. Begin by visiting the "Pay Property Tax Online" page https://aurangabadmahapalika.org/TaxCollection/pg/property/getPropertyPgWebApi

2. You'll then likely land on a page where you can enter your property details to view your bill and make the payment. This may include fields for:

- Property Number

- Ward ID

- Last Name

3. Once you've entered your details, click "Search" or a similar button to locate your property tax information.

4. The website will display your property details, including the outstanding tax amount for 2025.

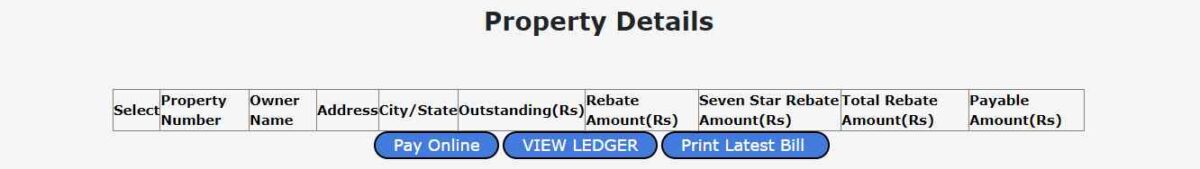

property-details-page-in-Aurangabad-property-tax-website

5. Look for an option "Pay Online" or "Make Payment".

6. You'll be directed to a secure payment gateway where you can select your preferred payment method. Common options include:

- Net Banking

- Credit Card

- Debit Card

- Online Wallets

7. Follow the onscreen instructions to complete your payment.

8. After your payment is successful, you should be able to download a receipt for your records.

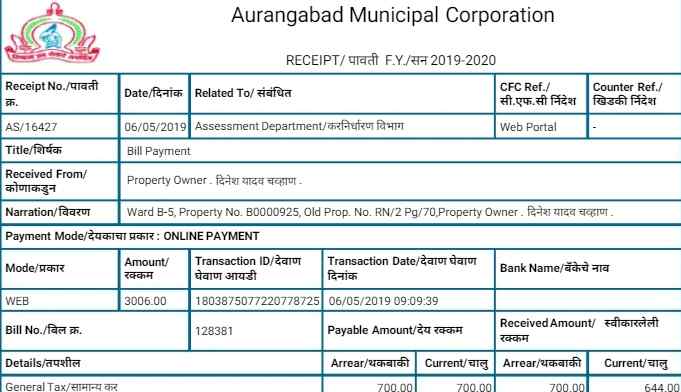

Aurangabad Property Tax Bill/Receipt Download 2025

Here's how to download your Aurangabad Property Tax Bill/Receipt for 2025 from the Chhatrapati Sambhajinagar Municipal Corporation (CSMC) website:

1. Start by visiting the CSMC payment website: https://aurangabadmahapalika.org/TaxCollection/pg/property/getPropertyPgWebApi

2. You'll then likely land on a page where you can enter your property details. This may include fields for:

- Property Number

- Ward ID

- Last Name

3. Once you've filled in your details, click "Search" or a similar button to locate your property tax information.

4. The website should display your property details and the outstanding tax amount for 2025.

5. Look for a button labelled "Print Latest Bill" or "Download Bill". This option might be visible alongside your property information or on the payment page.

6. Clicking the button should allow you to download your property tax bill in PDF format.

Benefits of Aurangabad Property Tax Online Payment

There are numerous advantages to paying your Aurangabad Mahanagarapalika Property Tax online in 2025:

Convenience:

- Saves Time and Effort: By opting for online payment, you can bypass the queues and long waits at the physical tax office. Instead, you can conveniently pay from anywhere, anytime with an internet connection.

- 24/7 Accessibility: The online portal is accessible 24 hours a day, 7 days a week, so you can pay at your convenience without being restricted by office hours.

Efficiency:

- Faster Processing: Online payments are processed immediately, ensuring that your payment reflects in your account much quicker compared to traditional methods.

- Reduced Risk of Errors: Manual data entry can often result in errors. However, online payments minimise this risk by automatically populating your information based on your property ID.

Security:

- Secure Transactions: Reputable online payment gateways employ secure encryption protocols to safeguard your financial information during transactions, providing peace of mind.

- Record Keeping: Reputable online payment gateways employ secure encryption protocols to safeguard your data during transactions.

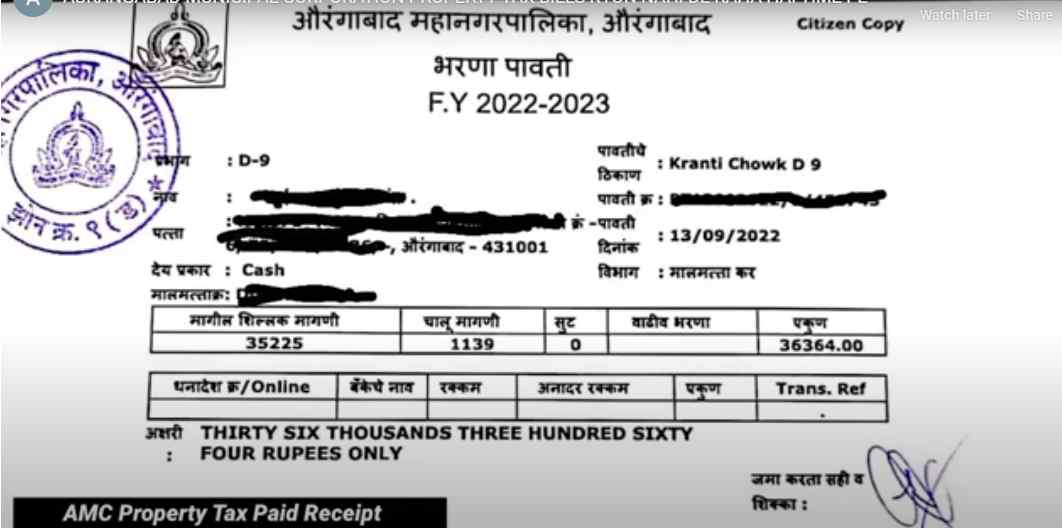

Aurangabad Property Tax Offline Payment 2025

Here's the step-by-step process for making an Aurangabad Property Tax Offline Payment for 2025:

- Gather Required Documents:

- Property Identification Details

- Proof of Correspondence Address

- Owner Identity Proof

- Visit the Municipal Corporation Office: Go to the Aurangabad Municipal Corporation office in person.

- Locate the Tax Payment Counter: Identify designated counters or departments specifically handling property tax payments.

- Present Documents and Request Bill: Inform the official of your intention to pay property tax for 2025 and provide your property identification details. They may generate a bill for you if one hasn't been received.

- Verify and Calculate Payment Amount: Thoroughly review the bill for accuracy, ensuring it correctly reflects the property and tax amount for 2025.

- Make the Payment: While smaller amounts may be payable in cash, for larger payments, the office may prefer a Demand Draft (DD) made payable to the "Chhatrapati Sambhajinagar Municipal Corporation".

- Obtain Receipt: Collect a receipt for your records upon processing the payment. Please keep this receipt as evidence of payment and store it for future reference.

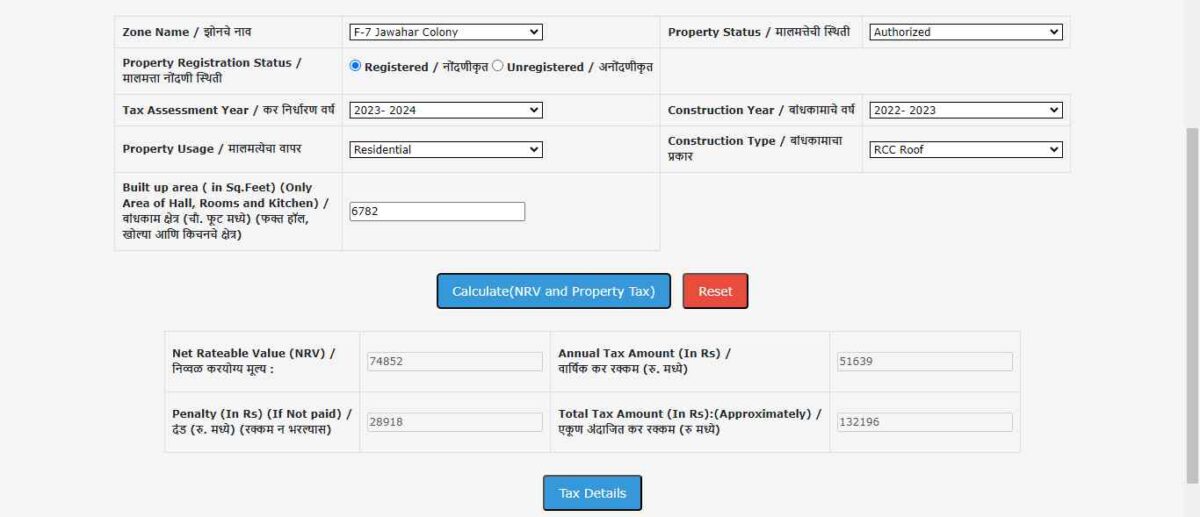

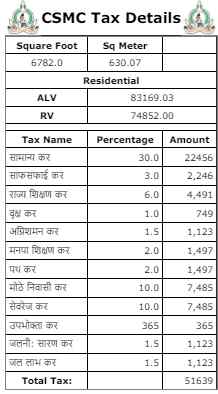

Aurangabad Municipal Corporation Property Tax Calculator 2025

The Chhatrapati Sambhajinagar Municipal Corporation (CSMC) website provides a property tax calculator for estimating your Aurangabad Property Tax for 2025. Here's how to access it:

1. Begin by visiting the CSMC website: [https://aurangabadmahapalika.org/TaxCollection/pg/property/getPropertyPgWebApi]

2. Look for the "Tax Collection" section or a link labelled "Property Tax Calculator".

3. You'll likely be directed to a page where you can input various property details to estimate your tax liability. These details may include:

- Zone Name: Choose your property's zone from a dropdown menu (e.g., A1 Town Hall, B5 Ward B 5).

- Property Status: Select from options like authorised, unauthorised, partially authorised, etc.

- Property Registration Status: Choose between Registered or Unregistered.

- Tax Assessment Year: Since you're calculating for 2025, select "20252026".

- Construction Year: Enter the year your property was constructed (optional).

- Property Usage: Pick the category that best describes your property's usage (e.g., Residential, Commercial, Open Plot).

- Construction Type: Select the type of construction (e.g., Open Land, RCC Roof).

- Builtup Area (Sq. Ft.): Input the builtup area of your property, encompassing only the area of halls, rooms, and kitchens (in square feet).

4. Once you've filled in all the details, click the "Calculate" button.

Aurangabad Property Tax Rebate 2025

Property tax rebate serves as a concession on the total tax, benefiting citizens who settle their dues before the deadline. For Aurangabad Property tax, taxpayers expect a 1 per cent rebate if payment is made within 15 days of receipt.

Property investors and homeowners must grasp the nuances of Aurangabad Property tax. Familiarising oneself with factors like the tax rate, rebates, discounts, and other aspects ensures prompt payment.

Notably, Property tax stands as a significant revenue source for local authorities, aiding in the infrastructure development of Aurangabad, Maharashtra.

Aurangabad Property Tax Rate 2025

The Aurangabad Municipal Corporation has put forward plans to raise property tax rates across the city, aiming to increase revenue generation.

For Residential Properties, the proposed adjustment entails an increase from ₹1 per sq m to ₹1.25 per sq m, indicating a hike of ₹0.25 per sq m.

Similarly, for Commercial Properties, the proposal suggests elevating the rate from ₹28 per sq m to ₹35 per sq m, resulting in a significant hike of ₹7 per sq m.

Aurangabad Property Tax Last Due Date 2025

The deadline for Aurangabad Property tax payment falls on the last day of the financial year, which is 31 December.

Aurangabad Property Tax App 2025

The Aurangabad Municipal Corporation (AMC) provides the Smart Nagrik Aurangabad (AMC) app. This multifunctional app caters to various civic services, including property tax-related functionalities such as bill viewing and online payments.

With the Smart Nagrik Aurangabad (AMC) app, users can conveniently:

- View Property Tax Due: Access property tax bills and review outstanding amounts for 2025.

- Online Payment: Facilitate secure online payments for property tax through debit cards, credit cards, or internet banking options directly within the app.

To utilise this app for property tax purposes, follow these steps:

- Download the App: Search for "Smart Nagrik Aurangabad (AMC)" on the Google Play Store or visit the AMC website for download links.

- Know Your Tax: Upon opening the app, locate a section or button labelled "Know Your Tax" or "Property Tax."

- Enter Details: Provide your property ID or other required information to access personalised details.

- View and Pay: The app will display your property tax particulars for 2025, including the due amount. Look for a "Pay Online" button or similar to initiate the online payment process.

Aurangabad Property Tax Helpline number 2024

For individuals seeking assistance with Aurangabad Property Tax matters, the Chhatrapati Sambhajinagar Municipal Corporation provides accessible channels for communication. These contact details enable residents to connect with municipal authorities for enquiries, assistance, and guidance regarding property tax concerns. Here's an overview of the available helpline resources:

- Telephone No.: 02402333536

- Mobile No.: 0242333537

- Email ID: contact@aurangabadmahapalika.org/ contact@chhsambhajinagarmc.org.

- Address: Located at the Main Building, Town Hall, behind the Post Office, Chhatrapati Sambhajinagar, Maharashtra 431001.

Paying Your Aurangabad Property Tax Bill Using NoBroker Pay

NoBroker Pay offers a secure and transparent way to pay your property tax bills in Aurangabad. Here's a simple guide to completing your payment:

- Download the NoBroker Pay App: Get started by downloading the app from your device's app store.

- Set Up Your Account: If you're a first-time user, fill in your bank details and complete the account setup process.

- Select Property Tax: Choose the type of property tax you need to pay from the available options.

- Input Your Property Tax Details: Enter all the necessary property tax information accurately.

- Review the Bill Information: Review the bill details to ensure everything is correct carefully.

- Choose Your Payment Method: Select your preferred mode of payment to complete the transaction.

- Confirm Payment: Double-check all the details and then confirm the property tax payment to proceed.

- Download Receipt: Finally, download the receipt for your records for future reference.

Legal Services Offered by NoBroker

NoBroker provides various legal services tailored specifically to Aurangabad property tax transactions. Here's what we offer:

- Document Scrutiny: Our legal team meticulously examines critical documents such as title deeds, property documents, and sale agreements to uncover any potential issues before finalising property deals.

- Protection Measures: We conduct thorough checks for existing legal disputes related to the property and verify ownership details to safeguard you from potential fraud.

- Service Packages: NoBroker has various legal service packages designed to meet your specific needs, including buyer assistance, registration assistance, and on-demand services like property title checks and verification of occupancy certificates.

- NoBroker Pay: Use NoBroker Pay as a secure and convenient method to make your Aurangabad property tax payments. Plus, easily track all your payments within a single platform.

How to Book NoBroker Legal Services

Follow these steps to book NoBroker Legal Services seamlessly and securely:

- Access the NoBroker Platform: Download the NoBroker app or visit the NoBroker website.

- Navigate to the Legal Services Section: Locate and click on the NoBroker Legal Services section within the app or website interface.

- Browse the Services Offered: Explore the services available, including drafting agreements, property verification, and legal consultations.

- Select the Desired Service: Choose the specific service you require and fill in your details to initiate the process.

- Consultation and Assistance: A NoBroker expert will promptly contact you via phone or chat to gather further information. Alternatively, you can book a free consultation call for any enquiries.

- Online Rental Agreements: Additionally, on the legal services page, you'll find options for online rental agreements that you can purchase and customise directly on the NoBroker website.

Why Choose NoBroker Legal Services

Consider these reasons for choosing NoBroker legal services:

- Convenience: Handle legal tasks from the comfort of your home without time-consuming visits to a lawyer's office.

- Affordability: Benefit from remarkably affordable legal services that offer cost-effective solutions compared to traditional lawyers' fees.

- Experienced Lawyers: Collaborate with seasoned lawyers boasting a minimum of 15 years of experience and holding qualifications from the Bar Council.

- Streamlined Process: NoBroker streamlines the legal process with pre-defined service packages, simplifying decision-making and managing all communication with the lawyer on your behalf.

- Technology-Driven: Using advanced technology to enhance efficiency and service delivery, ensuring an easy experience for our clients.

Explore Property Tax Payment Options City-Wise in India

NoBroker: Revolutionising Legal Processes for Property Transactions to Enhance Efficiency

Homeowners must grasp Aurangabad property tax regulations to fulfil civic responsibilities and aid community development. Stay informed and leverage available resources to navigate property tax matters effortlessly.

For dependable aid in managing Aurangabad property tax and accessing expert legal advice, book a free consultation with NoBroker's skilled professionals. Utilise NoBroker Pay for secure and hassle-free Aurangabad property tax payments, all conveniently tracked in one place. Download the app now!

Frequently Asked Questions

Ans: Aurangabad Mahanagar Palika Property Tax refers to the tax imposed by the Chhatrapati Sambhajinagar Municipal Corporation (CSMC) on properties situated within the boundaries of Aurangabad City, Maharashtra, India. The funds collected aid in financing various civic services and infrastructure development initiatives within the city.

Ans: Unfortunately, the Aurangabad Municipal Corporation (AMC) doesn't currently allow searching for property tax bills by name. Property tax bills are typically linked to a specific property identification or assessment number.

Ans: The Aurangabad Municipal Corporation (AMC) website likely offers a property tax calculator. You can access it and enter details like property zone, type, area, and year (2025) to get an estimated amount for your property tax dues.

Ans: The availability of property tax rebates can change yearly. You can check the AMC website or contact the CSMC to see if any rebates are applicable for 2025. These might include early payment discounts, senior citizen rebates, or rebates for specific property types.

Ans: Aurangabad property tax rates can vary depending on property type, location, and size. There might be different rates for residential, commercial, and vacant land properties. It's difficult to provide a single rate.

Ans: You can pay your Aurangabad Corporation Tax online by visiting the official Aurangabad Municipal Corporation (AMC) website. Enter your property details, generate the tax bill, and make the payment using internet banking, UPI, or other available options.

Ans: To check your Municipal Corporation Aurangabad Property Tax dues, visit the AMC’s official portal, enter your property details (Property ID or assessment number), and view outstanding tax amounts.

Ans: The water tax in Aurangabad Mahanagarpalika is ₹2,025.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

62045+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2026-27

March 25, 2025

50707+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

44584+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

40011+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

34412+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116883+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

200910+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

145550+ views

Rectification Deed Format and Process in India 2026

June 1, 2025

135945+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!