Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Nizampet Property Tax: Online Payment and Receipt Download 2025

Table of Contents

Are you a homeowner in Nizampet planning to pay your property tax? Do you know the current Nizampet property tax rates and payment deadlines for properties? Owning property in Nizampet has numerous advantages, alongside the responsibility of annual property tax payments. This essential contribution supports crucial services within your community. Yet, navigating this fiscal landscape becomes more manageable with the proper knowledge and resources.

Nizampet Property Tax: A Quick Info

Here is the quick info for Nizampet Municipal Corporation property tax:

| Information | Details |

| Authority | Nizampet Municipal Corporation |

| Official website | https://nizampetcorporation.telangana.gov.in/ |

| Payment last date | 31 July |

| Address | Nizampet Municipal Corporation Office, old Gram Panchayat Office, Pragathi Nagar - 500090 |

| Email ID | mc.nizampetulb@gmail.com |

| Helpline number | 7729003999 |

What is Nizampet Property Tax?

Nizampet property tax is an annual obligation mandated by the Nizampet Municipal Corporation for all property owners within its jurisdiction.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

These include road maintenance, sanitation, street lighting, and public amenities. Essentially, it represents your contribution towards fostering a well-sustained and flourishing Nizampet. And the Nizampet property tax rate in 2025 is 2%.

How to Pay Nizampet Property Tax Online in 2025

Paying your Nizampet property tax online is a quick and convenient way to fulfil your civic duty. Here's a detailed guide to ensure a smooth process:

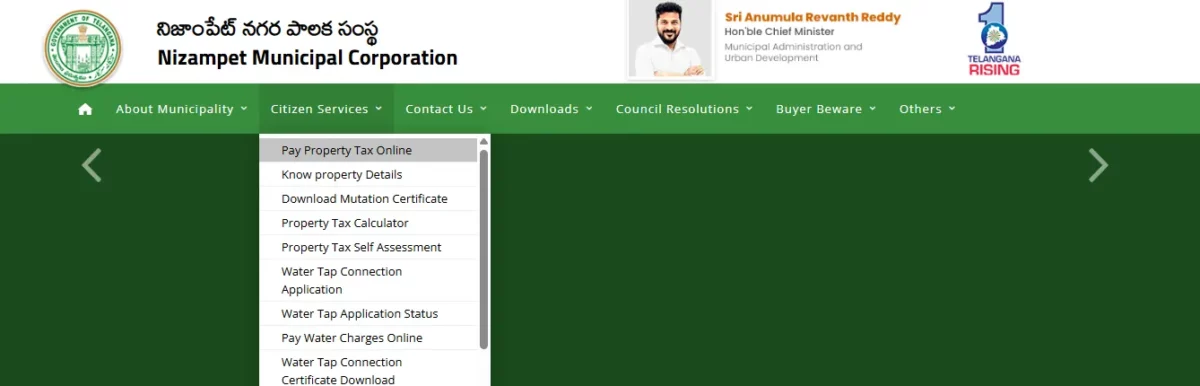

1. Visit the CDMA Telangana website - https://cdma.cgg.gov.in/. Access the "citizen services" section and select "pay property tax online".

2. Then, click on the property tax payment option. Input your PTIN number, click "know property tax dues," and begin the search. This action prompts you to display your current tax amount, outstanding dues, and relevant late fees.

3. Upon confirming the amount due, transit to a secure payment gateway. Complete your preferred payment mode via UPI, credit card, debit card, net banking, or any other options here.

- Follow the instructions on the screen to finalise your payment securely. Upon successful completion, you’ll be notified via SMS and can download a receipt for your records.

Nizampet Property Tax Bill/Receipt Download 2025

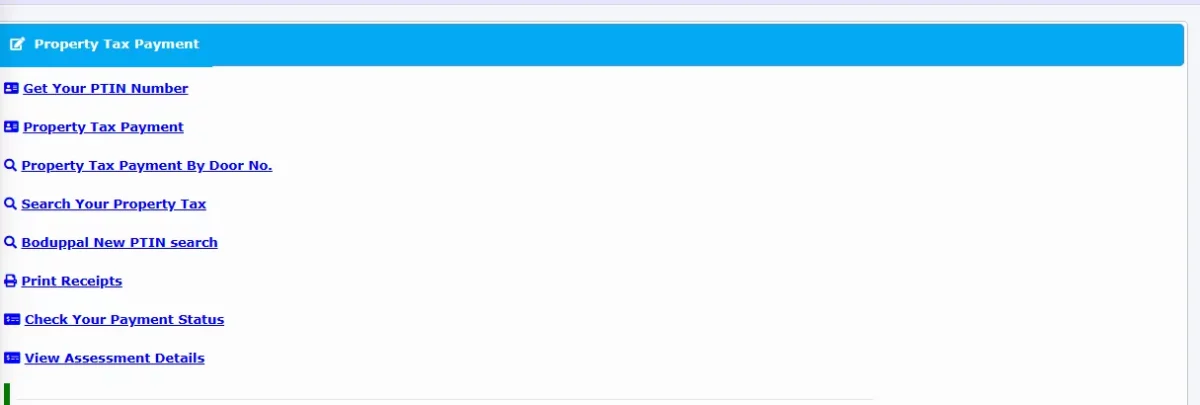

The Nizampet Municipality property tax website lets you view and download your property tax bill/receipt. Here's how:

1.Visit the NMC Online Payments website: https://onlinepayments.ghmc.gov.in/

2. Click "property tax" and then "search your property tax".

3. Enter your PTIN number and the mobile number.

4. Once you see the bill details, you can download a printable copy of the receipt.

Benefits of Nizampet Property Tax Online Payment

Paying your Nizampet property tax online presents numerous advantages when compared to traditional offline methods:

- Convenience: You can make payments from anywhere, at any time. You don't need to adhere to specific municipal office hours or endure lengthy queues.

- Time-saving: Opting for online payments streamlines the process, allowing you to complete transactions within minutes, sparing you the time spent on travel and waiting.

- 24/7 Accessibility: Online portals remain accessible 24/7. You can settle your taxes at your convenience, regardless of the hour.

- Reduced Risk of Errors: Online forms typically incorporate validation checks, minimising the likelihood of errors compared to manual entries at counters.

- Secure Transactions: Reputable online payment gateways employ secure protocols, ensuring the protection of your financial data throughout transactions.

- Payment Records: Online transactions provide a digital trail of your payment history, readily available for future reference.

Nizampet Property Tax Offline Payment 2025

Here's what you need to know about making an offline payment for your Nizampet property tax in 2025:

- Visit the Nizampet Municipal Corporation office. You can find their contact information on their website: https://nizampetcorporation.telangana.gov.in/

- Locate the designated counter for property tax payments. Look for signage or ask a staff member for guidance.

- Present your PTIN and any relevant enquiries to the official at the counter.

- Confirm the amount due. The official will verify your information and provide the exact amount payable.

- Make your payment using cash, check, or demand draft.

Nizampet Property Tax Calculator 2024

The Nizampet Municipal Corporation website brings forth an exciting development for 2025 by introducing a property tax calculator tool! Here's how you can access and utilise it:

1. Visit the Nizampet Municipal Corporation Website:

Direct your browser to the official Nizampet Municipal Corporation website at [https://nizampetcorporation.telangana.gov.in/]

2. Access the Property Tax Calculator:

Look for citizen services. Then click on property tax calculation services. You’ll be directed to another window.

Utilising the Calculator:

While the specifics may vary, here's a general outline of the information typically required:

- Registered Title Deed/Court Decree/Patta Available: Choose the document type affirming your property ownership.

- Building Permission: Indicate whether you possess building permission for your property.

- District: Opt for "Medchal-Malkajgiri" since Nizampet falls within this district.

- ULB (Urban Local Body): Select "Nizampet Municipal Corporation".

- Locality Name/Grama Panchayat: Input the specific locality name where your property is situated.

- Street Name: Provide the street name where your property is positioned.

- Total Plot Area (In Sq. Yards): Enter the total plot area in square yards.

Upon entering this data, the calculator promptly estimates your property tax for the year 2025.

Nizampet Property Tax Exemptions 2025

In Nizampet, Telangana, several property tax exemptions are available to different categories of property owners:

- Properties with Low Monthly Rent: No tax is imposed on properties with a monthly rental value of up to ₹50. Furthermore, 2% rates apply to properties with rent ranging between ₹51 and ₹100.

- Defence and Social Welfare Properties: Properties owned by ex-military personnel, charitable trusts, and religious institutions are completely exempt from property tax.

- Educational Institutions: Recognised educational institutions are exempt from paying property tax, acknowledging their contribution to the community.

- Vacant Properties: A significant benefit is available for vacant properties, which receive a 50% reduction in property tax. However, this is contingent on verification by a tax inspector.

Nizampet Property Tax Rate Penalties 2025

If you fail to pay your Nizampet property tax on time, a penalty interest rate of 2% per month applies to the outstanding amount. This means the longer the delay, the higher the interest you'll owe.

Nizampet Property Tax App 2025

Although there isn't a dedicated Nizampet Municipal Corporation app specifically for property tax purposes, you can utilise the Citizen Buddy Telangana app for various citizen services, including property tax management in Nizampet.

Here's what you can do with the Citizen Buddy Telangana app:

- View Property Tax Details: Access your property tax information, including outstanding amounts and due dates.

- Pay Property Tax Online: Conveniently pay your property tax electronically using various payment methods offered within the app.

Details About the Citizen Buddy Telangana App:

- Download: The app is likely available on both the Google Play Store and Apple App Store. Simply search for "Citizen Buddy Telangana" in your device's app store.

- Developed By: This app is likely developed by the Government of Telangana under the guidance of CDMA (Commissionerate of Municipal Administration).

Nizampet Property Tax Last Due Date 2025

The due dates for Nizampet property tax payments, which are made on a half-yearly basis, are 31 July and 15 October.

Nizampet Property Tax Helpline number 2025

The Nizampet Municipal Corporation website offers several contact options, although it does not specify a helpline dedicated exclusively to property tax enquiries. For the best chance of reaching someone who can assist you, it is advisable to call during their office hours. Here are the contact details you can use for property tax-related questions in Nizampet for 2025:

- Toll-free Number: 18005997873

- Helpline Number: 14420

- Office Landline Numbers:

- 040-29569700

- 040-29569600

How to Pay Your Nizampet Property Tax Bill Using NoBroker Pay

NoBroker Pay offers a secure and transparent method for paying your property tax bills. Follow these straightforward steps to complete your payment:

- Download the NoBroker Pay App: Download the app from your device's store.

- Set Up Your Account: If you are a first-time user, fill in your bank details and complete the account setup process.

- Select Property Tax: Choose the type of property tax you must pay from the available options.

- Input Your Property Tax Details: Enter the required property tax information accurately.

- Review the Bill Information: Carefully review the bill details to ensure everything is correct.

- Choose Your Payment Method: Select your preferred mode of payment to complete the transaction.

- Confirm Payment: Confirm the property tax payment and complete the transaction.

- Download Receipt: Finally, download the receipt for your records to ensure you have a payment record.

Legal Services Offered by NoBroker

NoBroker provides a comprehensive range of legal services specifically tailored to Nizampet property tax transactions. Here's the services we offer:

- Document Scrutiny: Our legal team meticulously examines critical documents, including title deeds, property documents, and sale agreements. This thorough scrutiny helps uncover potential issues before finalising property deals, ensuring a smooth transaction process.

- Protection Measures: To safeguard you from potential fraud, we conduct exhaustive checks for any existing legal disputes related to the property and verify ownership details. These measures provide peace of mind by ensuring the legitimacy of your transaction.

- Service Packages:

- NoBroker offers various legal service packages designed to cater to your specific needs:

- Buyer Assistance: Receive guidance and support throughout the buying process, making it stress-free.

- Registration Assistance: We can handle the property registration process, saving you time.

- On-Demand Services: For those requiring specific assistance, services such as property title checks, market value guidance, assistance with missing documents, and verification of occupancy certificates are available.

- NoBroker offers various legal service packages designed to cater to your specific needs:

- NoBroker Pay: Utilising NoBroker Pay ensures a secure and convenient method for making your Nizampet property tax payments. Additionally, you can easily track all your payments within a single platform, simplifying your financial management.

How to Book NoBroker Legal Services

Here's a step-by-step guide to booking NoBroker legal services securely:

- Access the NoBroker Platform: Start by downloading the NoBroker app on your smartphone or visiting the NoBroker website.

- Navigate to the Legal Services Section: Locate and click on the NoBroker Legal Services section within the app or website interface.

- Browse the Services Offered: Explore the extensive services available, including drafting agreements, property verification, and legal consultations.

- Select the Desired Service: Choose the specific service you require. Fill in your details and complete the provided form to initiate the process.

- Consultation and Assistance: A NoBroker expert will contact you via phone or chat to gather further information. Alternatively, you can book a free consultation call for any enquiries.

- Online Rental Agreements: Additionally, on the legal services page, you'll find options for online rental agreements that you can purchase and customise directly on the NoBroker website.

Why Choose NoBroker Legal Services

Here are several compelling reasons why you should consider NoBroker legal services:

- Convenience: Experience unparalleled convenience with NoBroker, enabling you to handle legal tasks from home. Say goodbye to time-consuming visits to a lawyer's office.

- Affordability: Benefit from remarkably affordable legal services that offer cost-effective solutions, standing out compared to traditional lawyers' fees.

- Experienced Lawyers: Collaborate with seasoned lawyers with at least 15 years of experience and qualifications from the Bar Council.

- Streamlined Process: NoBroker streamlines the legal process with pre-defined service packages, simplifying decision-making. Moreover, we manage all communication with the lawyer on your behalf, saving you time and effort.

- Technology-Driven: Leverage advanced technology with NoBroker, enhancing efficiency and service delivery. From document management to communication, our technology-driven approach ensures a seamless experience for our clients.

Explore Property Tax Payment Options City-Wise in India

NoBroker: Innovating Property Transaction Legal Processes for Efficiency

Understanding the intricacies of the Nizampet property tax is essential for homeowners to fulfil their civic obligations and contribute to the development of their community.

For reliable assistance in managing Nizampet property tax and obtaining expert legal guidance, schedule a complimentary consultation with NoBroker's proficient professionals. Take advantage of NoBroker Pay for a secure and seamless method to settle your Nizampet property tax payments, all conveniently tracked in one location. Download the app today!

Frequently Asked Questions

Ans: To pay your Nizampet property tax online, visit the CDMA Telangana website. Begin by navigating to the CDMA Telangana website: https://emunicipal.telangana.gov.in/. Scroll down to the "Online Services" section. Proceed to "Pay your Tax Online". Input your 10-digit Property Tax Identification Number (PTIN) and click "Know Property Tax Dues". Review the displayed details, including your property tax amount, pending dues, and interest in late payment. Upon verification, select your preferred online payment method. A receipt for your property tax payment will be generated upon successful payment.

Ans: Ideally, you'll have your PTIN for the most accurate search. However, you can also try searching by door number (if known) or by selecting your district and ULB.

Ans: Your PTIN can be found on your property tax bill or any document containing your holding number.

Ans: Accepted payment methods may vary but typically include credit cards, debit cards, net banking, and UPI.

Ans: Depending on the chosen payment method, minimal transaction fees may apply. Any applicable fees should be displayed on the website before finalising the payment.

Ans: To find your property tax details, visit the official Nizampet Municipal Corporation website. Navigate to the "property tax" section and enter key information, such as your PTIN number or assessment number, to retrieve your tax records.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

61956+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2026-27

March 25, 2025

50429+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

44543+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

39971+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

34318+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116860+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

200684+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

145349+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135800+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!