Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Property Tax Gurgaon Online: Online and Offline Payments, Due Dates, and Penalty in 2025

Table of Contents

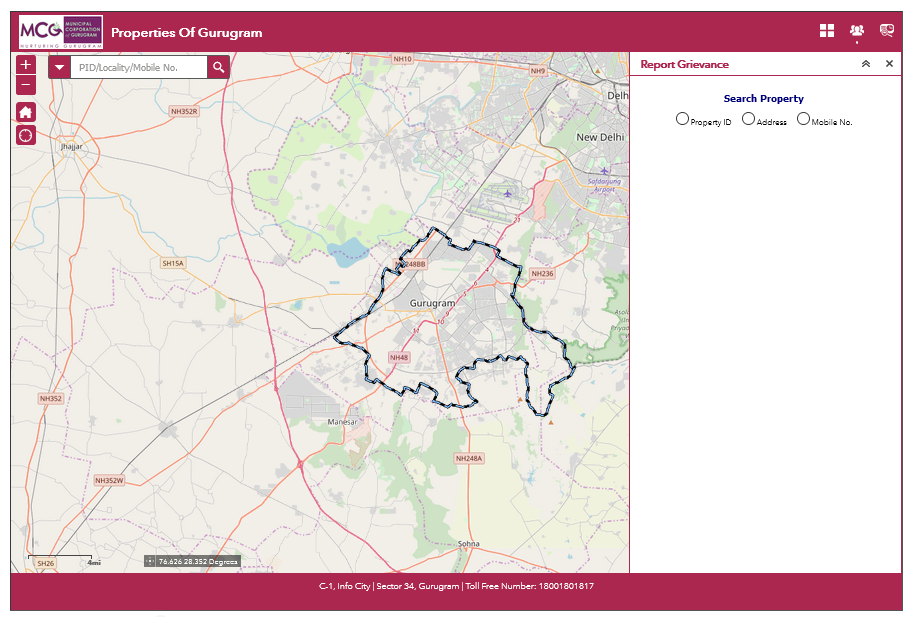

Property Tax Gurgaon online is a mandatory tax property owners pay to the Municipal Corporation of Gurugram (MCG). This tax is required to maintain street lights, roads, sewage, public schools, hospitals, and other public services. The Property tax in Gurugram applies to residential, industrial, and commercial properties.

To make the MCG property tax online payment, visit the official website and select one of the available payment modes. The tax amount is based on the location, property type, and usage. Property owners must pay the taxes on time to avoid penalties and legal actions. In this blog, you will learn about online payment methods, house tax rates on different property types and how it is calculated, rebates and more information.

Gurugram Property Tax Quick Info 2025

| Information | Details |

| Official Website Link | https://property.ulbharyana.gov.in/ |

| Tax Payment due date | July 31, 2025 |

| Rebate | 10% rebate |

| Penalty for late payment | 1.5% per month of due amount |

| Method for Tax Calculation | Unit Area System(UAS) |

| Tax Rates | The tax rate is based on the location, property type, and usage. |

| Payment method | Payment methods include online payment via MCG’s official website, credit/debit cards, net banking, UPI and more. |

| Properties for tax payments | Residential, Industrial and commercial & vacant lands |

| How to check Status | Visit the MCG Property Tax website and check using the property ID |

| Contact Details | Address: Municipal Corporation Gurugram, C-1, Info City, Sector 34, Gurugram, 122001 Contact Number: 8860203261Toll-free number: 18001801817Email: cghelp@mcg.com |

How to pay Gurgaon Property Tax Online?

Property owners can easily pay their taxes in the comfort of their homes using the online portal. Simply follow the steps below to understand it in a better way:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

- Visit the official website of Municipal Corporation Gurgaon- https://property.ulbharyana.gov.in/

- Login using the mobile number or email ID or Property ID

- Enter the required details like property ID, owner name and full property address

- Once all the details are filled in, the information about the property will appear with the tax amount to be paid and the outstanding amount if any.

- Now choose the mode of payment from credit/debit card, net banking, and UPI.

- Once the payment is done a receipt will be available. Download the receipt for further use.

How to Calculate the Property Tax Rate in Gurgaon and What are Taxes for Different Properties?

The MCG has made property tax payment a bit easy and the property owners can calculate their taxes based on rates applied to specific property types. Below is the table that simplifies the gurgaon house tax on residential property and how it is different from commercial and industrial ones:

House Tax on Residential Property

| Residential Area per Square Yard | Property Tax per square yard |

| Up to 300 square yards | ₹1 |

| 301 to 500 square yards | ₹4 |

| 501 to 1000 square yard | ₹6 |

| 1001 square yards to 2 acres | ₹7 |

| More than 2 acres | ₹10 |

House Tax Rates on Vacant Plots

| Vacant Land per Square Yard | Property Tax per Square Yard |

| Up to 100 square yards | Nil |

| 101 to 500 square yards | ₹0.5 |

| More than 500 square yards | ₹1 |

Property Tax on Commercial Land

| Commercial Spaces per Square Yard | Property Tax per Square Yard |

| Up to 1000 square feet | ₹12 |

| More than 1000 square feet | ₹15 |

Property Tax on Industrial Land

| Industrial Spaces per Square Yard | Property Tax per Square Yard |

| Up to 2500 square yards | ₹5 |

| From 2501 square yards to 2 acres | ₹6 |

| From 2 acres to 50 acres | ₹6 till it is 2 acres after that it is +2 per square yard |

| More than 50 acres | ₹6 till it is 2 acres after that it is +2 per square yard +1 square yard for an area above 50 acres |

Property Tax on Commercial Ground floor Shops

| Area Covered | Property Tax per Square Yard |

| Up to 50 square Yard | ₹24 |

| From 51 to 100 square yards | ₹36 |

| From 101 to 500 square yards | ₹48 |

| From 505 to 1000 square yards | ₹60 |

What is the penalty for Late Payment?

It is advisable for property owners to pay their taxes on time to avoid penalties. If they fail to pay the property tax before the due date, 1.5 % interest per month on the outstanding amount is charged.

Explore Property Tax Payment Options City-Wise in India

How to Pay Gurgaon Property Tax using NoBroker Pay?

Paying Property Tax in Gurgaon using NoBroker Pay is easy and convenient. It allows property owners to pay their taxes securely and conform to their homes. NoBroker also has a multiple modes of payment as well like credit/debit cards, net banking and UPI. Follow the below steps to pay the tax bill using the NoBroker App:

- Now the NoBroker app from Playstore or Apple store

- New users can fill in the bank details to create an account

- Select the type of property tax

- Add the property tax details

- Check the bill information

- Choose the mode of payment you want to pay

- Once the payment is done, download the receipt

Frequently Asked Questions

Ans: Yes property owners can pay the taxes offline by visiting the Municipal Corporation Gurgaon office or the designated centres for property tax.

Ans: The Municipal Corporation of Gurgaon has decided that the basements and parking lots in residential areas will not come under property tax and are exempted.

Ans: If the tax is not paid on time, 1.5% interest per month is charged on the outstanding amount. It is advisable to pay property tax on time to avoid penalties and legal action.

Ans: If the apartment or housing society has an area of less than 2000 square feet, it is exempt from the property tax.

Ans: Yes, you can pay the property tax using an e-wallet. Open the Paytm app and click on the Property Tax option for Gurgaon. Now add all the information and make the payment.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

61785+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

50262+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

44420+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

39888+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

34202+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116791+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

200109+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

144802+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135427+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Mobile Home Lease Agreement: Types, Rights, Rules & Legal Requirements in 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!