Explore all blogs

Agra Nagar Nigam House Tax Payment: Online, Offline, Calculation and Receipt Download

Agra Nagar Nigam House Tax is a mandatory annual property tax collected by the Agra Municipal Corporation from property owners within city limits. This comprehensive guide covers everything from tax calculation and payment methods to rebates and recent digital initiatives. Whether you're

Written by Ananth

Published on

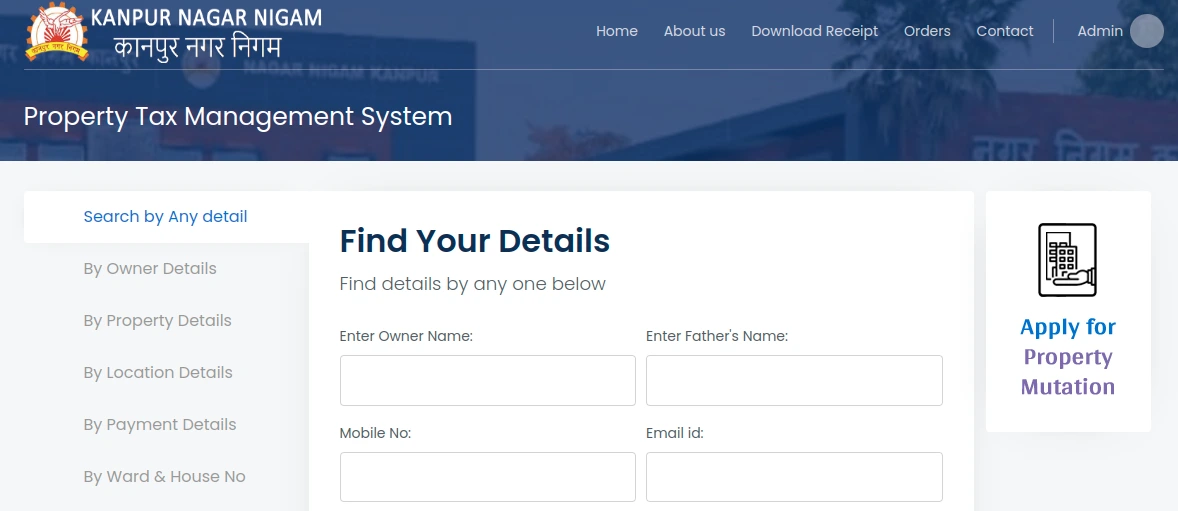

Kanpur Nagar Nigam House Tax Online, Offline Payment, Calculation and Tax Charges for 2025

Kanpur Nagar Nigam house tax is a mandatory annual assessment levied on property owners within the municipal jurisdiction, serving as a crucial revenue source for the city's development and maintenance. This comprehensive guide demystifies the various aspects of property tax, from calcula

Written by Krishnanunni H M

Published on

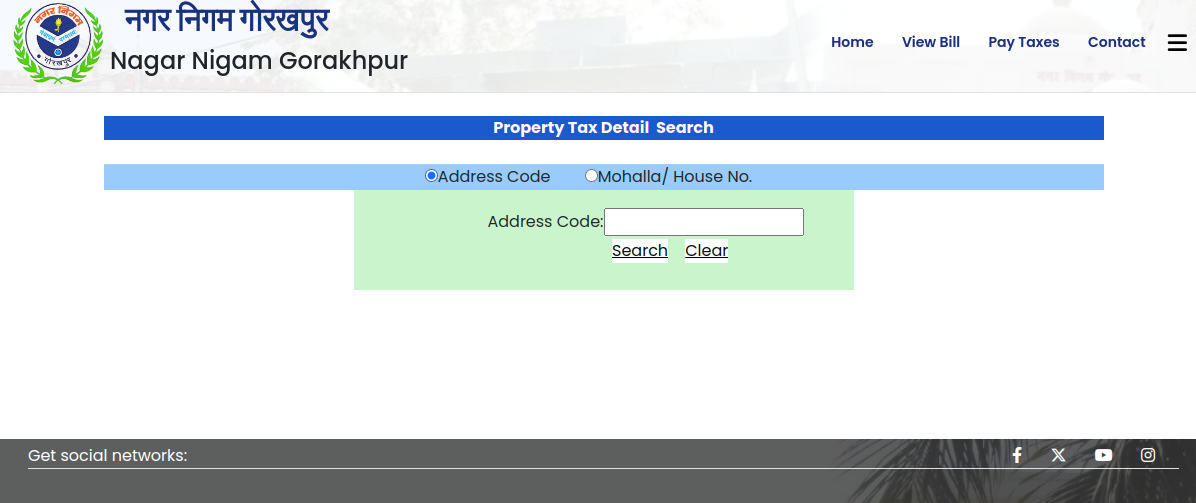

Nagar Nigam Gorakhpur House Tax Online and Offline Payment: Calculation and Receipt Download

The Nagar Nigam Gorakhpur house tax system is an important revenue source for the city's development and maintenance of civic amenities. Gorakhpur property owners must pay this annual tax, which is calculated based on factors like property size, location, and usage type. The municipal cor

Written by Krishnanunni H M

Published on

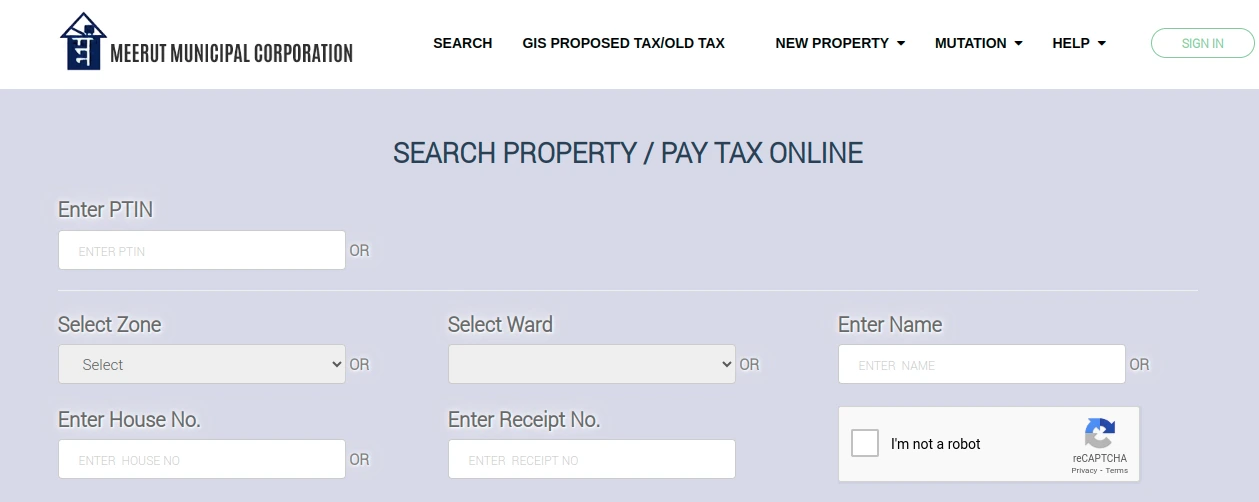

Meerut Nagar Nigam House Tax: A Complete Guide to Calculation, Payment & Rebates 2025

The Meerut Nagar Nigam house tax is a crucial annual property levy administered by the Municipal Corporation of Meerut to sustain and enhance civic infrastructure and services. Calculated based on factors like property size, location, and usage type, this tax forms the backbone of municip

Written by Suju

Published on

Lucknow Nagar Nigam House Tax Payment Online and Offline: Calculation, Charges and Tax Receipt Download in 2025

Lucknow Nagar Nigam house tax is a mandatory annual contribution property owners must pay to support municipal services and urban development. This comprehensive guide covers everything from calculation methods and payment procedures to rebates and recent digital initiatives. Understandin

Written by Nivriti Saha

Published on

Capital Gains Tax on Inherited Property: Rules, Rates & Exemptions in 2025

Capital gains tax on inherited property is a crucial financial consideration that impacts how beneficiaries manage and sell inherited assets in India. When you inherit property, while there's no immediate tax liability, selling the property triggers capital gains tax based on the apprecia

Written by Kruthi

Published on

Everything You Need to Know about Ghaziabad Nagar Nigam House Tax

Nagar Nigam Ghaziabad plays a vital role in funding its operations through property tax, which is an annual payment made by landowners to the local government. This tax applies to various types of properties, including residential and commercial buildings, as well as rented properties. Th

Written by Vivek Mishra

Published on

Sanchaya in Kerala – Registration Process, Tax Payment & Contact Details

The days of waiting in line for hours at a time and devoting an entire day to paying the property tax have long since passed. In this context, it is worthy of admiration that several state governments are working toward digitising their respective systems. The Sanchaya Tax Payment system

Written by Vivek Mishra

Published on