Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Real Estate Investment in Mumbai: Best Areas Returns and Price Trends in 2026

Table of Contents

Mumbai continues to command strong real estate demand due to limited land supply and consistent employment generation. Continuous infrastructure upgrades and metro expansion have supported property appreciation of around 8–12% annually in well-connected zones. With strong regulatory oversight and sustained rental demand, real estate investment in Mumbai remains a preferred choice for long-term wealth creation. This guide highlights the best locations, strategies, and market drivers shaping Mumbai’s property investment landscape in 2026.

Why Should You Invest in Mumbai? The Market Drivers

Strong economic fundamentals and ongoing infrastructure development drive property investment in Mumbai. As India’s financial capital, Mumbai benefits from sustained employment, premium land scarcity, and infrastructure-led redevelopment, all of which consistently support long-term value appreciation.

1. The IT & Tech Boom

Mumbai has evolved into a major IT, startup, and BFSI centre. Global corporations and technology firms have created jobs, attracted high-income professionals, and created a steady demand for real estate, especially in Powai, Andheri East, and Navi Mumbai, keeping residential occupancy levels consistently high.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

2. Infrastructure & Connectivity

Metro Lines 2A, 7, and Aqua Line 3 are improving east–west and north–south connectivity. The Mumbai Trans Harbour Link (MTHL) and the Coastal Road project are easing congestion and boosting accessibility. The upcoming Navi Mumbai International Airport is accelerating growth in Panvel and Kharghar.

3. Stable Demand & High Rental Yields

The rental yield in Mumbai averages 2%–4% for residential properties, with Navi Mumbai and Thane achieving 5%–7% due to affordability and workforce density. Commercial assets in BKC and Andheri East can deliver 7%–9% yields, making Mumbai suitable for diversified investment strategies.

Top 5 Localities for Investment in Mumbai in 2026

Choosing the best place to invest in property in Mumbai requires balancing connectivity, affordability, and long-term infrastructure growth.

1. Andheri West

Andheri West offers excellent metro and highway connectivity and a strong employment presence. While entry prices are premium, rental demand is consistently high. Average property prices are around ₹29,000 per sq. ft., with projected growth of 8–12%, making it attractive to professionals and rental-focused investors.

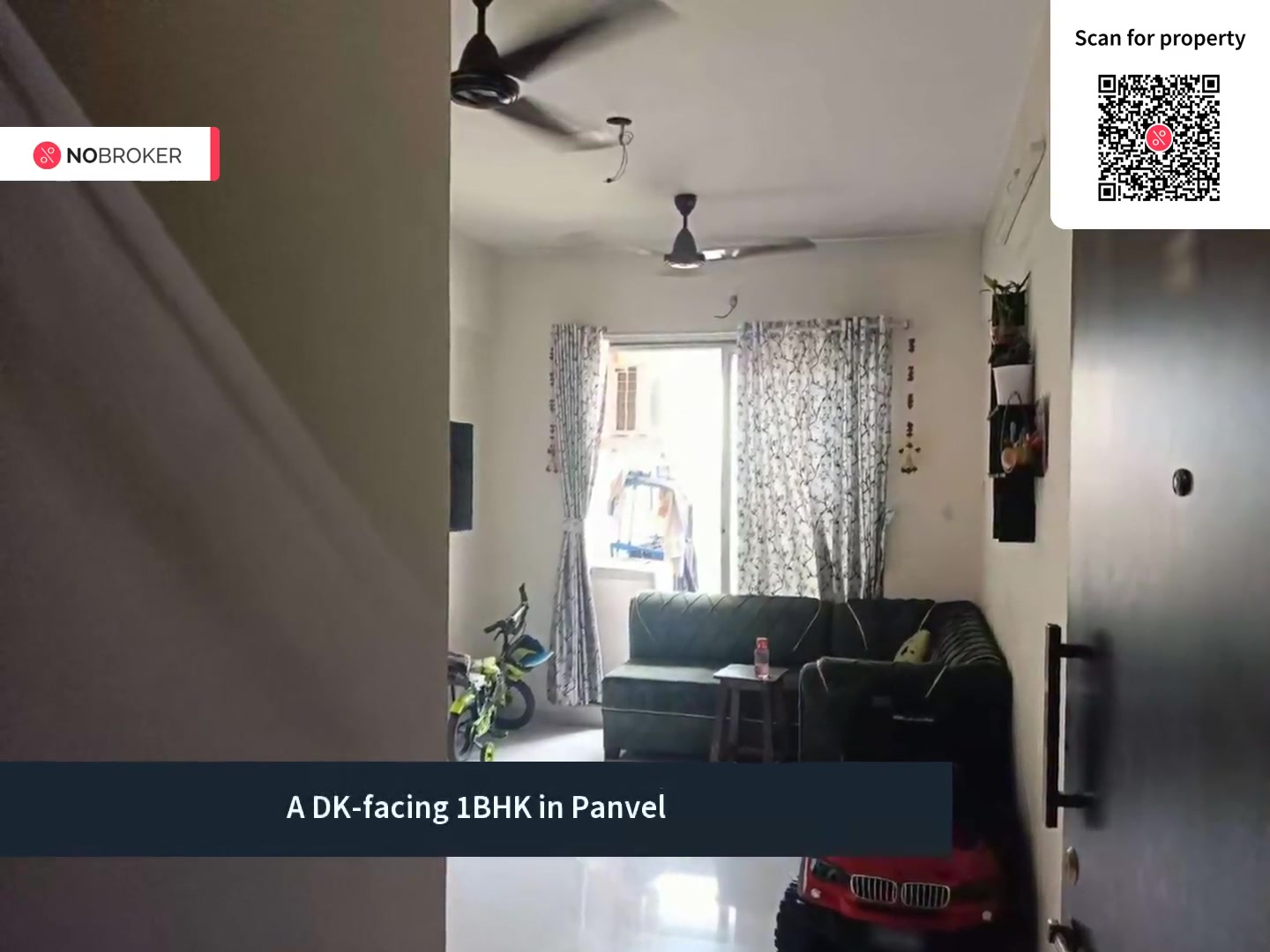

2. Panvel

Panvel stands out for affordability and future growth near the upcoming airport and Mumbai–Pune Expressway. Though social infrastructure is still developing, prices between ₹10,000 and ₹14,000 per sq. ft. offer strong appreciation potential, ideal for long-horizon investors and first-time buyers.

3. Thane West

Thane West balances affordability and urban living with excellent connectivity via highways and Metro Line 4. Despite rising density, commercial growth remains strong. Average prices stand near ₹19,800 per sq. ft., with projected growth of 8–12%, appealing to families and mid-income buyers.

4. Chembur

Chembur benefits from strategic connectivity through the Eastern Freeway, Metro, and Monorail. Although redevelopment causes temporary disruptions, property values remain stable. Average prices are about ₹25,000 per sq. ft., making it suitable for end-users and investors seeking central accessibility.

5. Goregaon East

Goregaon East offers strong connectivity and proximity to Film City and business zones. While traffic congestion exists, residential demand remains steady. Prices range between ₹22,000 and ₹24,000 per sq. ft., with projected growth of 8–11%, attracting corporate professionals and families.

Investment Types & Strategies in Mumbai

To maximise returns in investment in Mumbai real estate, investors must select the asset class that best matches rental income or capital appreciation objectives within the city’s high-demand environment.

1. Residential Apartments

For steady rental income, 2BHK and 3BHK apartments in high-density areas like Andheri, Powai, and Chembur perform consistently well. Properties in gated developments near metro stations ensure low vacancy. A 2BHK in suburban areas such as Thane typically costs ₹1.5 crore–₹3 crore.

2. Villas & Gated Communities

Luxury villas in Juhu, Bandra West, and Worli represent the pinnacle of investment property in Mumbai. Scarcity of land drives appreciation, with average villa prices around ₹16.59 crore, and sea-facing assets commanding significantly higher values.

3. Plots & Land Investment

Due to limited availability within Mumbai, land investments focus on peripheral growth zones such as Ulwe, Panvel, and Kharghar. These regions benefit from major infrastructure like the Mumbai Trans Harbour Link (MTHL). Land prices range from ₹10,000 to ₹30,000 per sq. ft.

Financials and Legal Checklist Before Investing in Mumbai

Securing the best real estate investment in Mumbai requires careful financial analysis and detailed legal verification, given the city's high property values and active redevelopment.

1. ROI Projections

Over the last decade, the Mumbai real estate market has generated an average annual return of nearly 6.7%, while select micro-markets such as Panvel have recorded appreciation exceeding 10% per year. ROI is influenced by metro connectivity, infrastructure upgrades, the developer's reputation, and the property's exact location.

2. Legal Due Diligence

Strict adherence to RERA norms is essential, and investors must confirm project registration through the official MahaRERA portal. The Sale Deed must clearly establish the transfer of ownership; the Encumbrance Certificate must confirm the absence of legal or financial liabilities; the Khata or Mutation Certificate must reflect ownership in municipal records; and the Occupancy Certificate must verify that the building is legally approved for occupation.

3. Financing Options

Banks and housing finance companies offer competitive home loan options for Mumbai properties. Tax benefits under Section 80C and Section 24(b) reduce the effective investment burden, while a high credit score allows investors to negotiate lower interest rates and reduced processing fees.

Expert Tips for Success in the Mumbai Market

A successful investment in Mumbai real estate requires infrastructure-led decision-making, legal caution, and patience in a mature property market.

- Target Infrastructure Growth: Focus on locations benefiting from Metro expansion and the Mumbai Trans Harbour Link (MTHL), including Chembur and Navi Mumbai.

- Prioritise Connectivity: Properties near railway stations or Metro stops typically command higher rents and better resale value.

- Verify RERA Status: Always confirm valid RERA registration before committing to any project.

- Plan for the Long Term: Maintain a holding horizon of 5–10 years to unlock substantial capital appreciation.

- Diversify Investments: Balance exposure between emerging suburbs for growth and established areas for income stability.

How NoBroker Can Help?

Making informed decisions in a high-value market requires transparency. For those planning real estate investment in Mumbai, NoBroker provides verified listings, accurate pricing data, and zero-brokerage access to properties. NoBroker also supports legal due diligence, loan assistance, and end-to-end documentation. This technology-driven approach helps investors reduce costs, manage risks, and confidently invest in Mumbai’s competitive real estate market.

Frequently Asked Questions?

Ans: Yes, limited land supply, strong rental demand, and infrastructure upgrades support long-term value, making investment in Mumbai real estate attractive.

Ans: Navi Mumbai locations like Panvel, Ulwe, and Kharghar offer comparatively lower entry prices and higher growth potential.

Ans: Residential rental yields in Mumbai typically range from 2% to 4%, with higher returns in select suburban and transit-oriented areas.

Ans: Luxury homes in premium zones offer strong capital appreciation due to land scarcity, though they require a longer holding period.

Ans: Apartments suit rental-income goals, while land in peripheral corridors offers better long-term appreciation tied to infrastructure projects.

Recommended Reading

Mumbai-Pune Expressway: Route Distance, Tolls, Rental and Property Trends in 2026

January 31, 2025

102643+ views

Market Value in Andhra Pradesh: District-Wise Rates and Latest Market Trends in 2026

February 12, 2025

97821+ views

Property Rates in Mumbai: Price per Sq. Ft. and Rental Trends in Top Areas 2025

February 12, 2025

94119+ views

10 Best Real Estate Companies in India for Investment & Property Development (2026)

May 2, 2025

75192+ views

Top 15 Largest States in India by Area, Population, Real Estate Insights and GDP Data in 2026

May 7, 2025

73504+ views

Loved what you read? Share it with others!

Most Viewed Articles

GFRG Panels: A New Technology in Building Construction

January 31, 2025

261920+ views

Top Cleanest Cities in India: Swachh Survekshan Top Ranked List

July 25, 2025

225041+ views

February 6, 2026

215079+ views

How Mivan Construction Technology Is Transforming the Art of Building!

January 31, 2025

183981+ views

CIDCO Lottery: Application Process, Eligibility, Flat Prices and Dates in 2026

April 30, 2025

138688+ views

Recent blogs in

February 19, 2026 by Krishnanunni H M

Top 10 Construction Companies in Ghaziabad: Leading Builders and Developers List in 2026

February 19, 2026 by Kruthi

Top 10 Construction Companies In Jaipur for Residential and Commercial Projects in 2026

February 19, 2026 by Krishnanunni H M

10 Best Construction Companies In Pune: Trusted Builders and Contractors in 2026

February 18, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!