- https://cleartax.in/s/capital-gain-tax-on-sale-of-property-shares-gold

- https://cafornri.com/taxability-of-long-term-capital-gains-on-immovable-property-for-nris-fy-2024-25/

- https://www.bajajfinserv.in/land-tax-online

- https://www.bankbazaar.com/home-loan/resources/land-tax.html

- https://mahe.gov.in/service/pay-property-tax-online/

- https://www.cascadebuildtech.com/comprehensive-guide-to-property-tax-rates-across-all-states-of-india/

- https://www.bajajfinserv.in/property-tax-slab

Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Land Tax in India: Calculation, Rates Across States, Payment Methods and Exemptions

Table of Contents

Land tax in India serves as an essential source of revenue, collected as a tax on land ownership, purchase, and sale of land properties. It also helps ensure that landowners participate in the community's socio-economic development by paying taxes to the central government or local municipalities. These taxes help finance infrastructure projects, such as road construction, water supply systems, and sanitation, as well as welfare initiatives. The tax on land in India serves a twofold purpose of improving the governance of real estate in the country and sustaining municipal planning in the context of a rising population. [3] [4]

Land Tax Rates in Different States in India

Land tax is calculated differently across Indian states. Below is a simplified comparison:

| State | Residential Land Tax (%) | Commercial Land Tax (%) |

| Bihar | 5–15% | 10–25% |

| Karnataka | 0.20–0.50% (Unit Area Value) | 0.20–0.50% (Unit Area Value) |

| Maharashtra | 0.316–2.296% (Capital Value) | 0.652–3.91% (Capital Value) |

| Rajasthan | 5-10% | 10-20% |

| Tamil Nadu | 6–12% | 10–20% |

For a more detailed breakdown of Indian property taxation, you can check this introduction to Indian property tax. [3] [4] [6][7]

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Importance and Uses of Land Tax

The property tax on vacant land in India and developed plots is indispensable for urban and rural management. Its importance can be summarised as follows:

- Funds community services – roads, sanitation, water supply, and public lighting

- Encourages transparent real estate transactions and regulatory compliance

- Supports municipal planning and economic stability, preventing illegal land use

- Without land tax, municipalities would lack the financial resources to manage real estate governance effectively.

Types of Land Tax in India

Broadly, there are different types of land tax in India that apply depending on ownership or transfer [1][2]:

- Property tax: Annual levy on owned or vacant land.

- Land registration tax in India: Includes stamp duty and registration charges payable during transfer.

- Capital gain tax on the sale of land in India: Levied on profits from selling land. (More details in NoBroker’s capital gains tax in India).

- Land gift tax in India: Applicable if land is gifted without adequate consideration, taxable under the Income Tax Act rules.

How Is Land Tax Calculated Today?

Municipalities conduct land tax assessment through three systems:

- Annual Rental Value (ARV): Based on potential rental income

- Capital Value (CV): Based on the market value of land/property

- Unit Area Value (UAV): Based on the per-unit area set by local authorities

Steps to calculate:

- Step 1- Identifying the Assessment Method (ARV, CV, or UAV): Based on the local municipal laws and the type of property, determine if the property will be assessed using Annual Rental Value (ARV), Capital Value (CV), or Unit Area Value (UAV).

- Step 2- Apply the respective municipal tax rate: Based on the selected assessment method, use the applicable municipal tax rate for the property to determine the base tax liability, ensuring an accurate calculation.

- Step 3- Add cess/surcharge (if applicable): Any additional taxes, whether municipal or state-mandated, such as education cess or municipal cess, must be added to the overall tax.

- Step 4- Deduct rebates or exemptions: Rebates, discounts, or exemptions for early payments or available for senior citizens or designated properties will need to be removed to pay a lower tax.

- Step 5- Compute the final payable amount: After performing all necessary calculations, determine the amount of land tax to be paid, ensuring all mandatory components are included, including those specified by the government. [1][2]

Documents Required for Land Tax Payment

To pay tax on land in India, you’ll need:

- Title deed/sale deed

- Property tax assessment notice or ID number

- Proof of ownership (property card or RTC)

- Aadhaar/PAN card for identification

- Latest payment receipts

- Valuation certificate (if property revalued)

How to Pay Land Tax Online?

Most states allow seamless digital payments:

- Step 1- Visit your municipal/state property tax portal

- Step 2- Enter property ID or assessment number

- Step 3- Check tax dues (including property tax on vacant land in India)

- Step 4- Pay via UPI, debit/credit card, or net banking

- Step 5- Save/download e-receipt [3]

How to Pay Land Tax Offline?

If digital methods aren’t accessible, you can pay offline:

- Step 1- Visit the local municipal office or designated bank

- Step 2- Submit property details and ownership proof

- Step 3- Pay via cash, cheque, or demand draft

- Step 4- Collect stamped receipt as payment proof [4].

Exemptions and Rebates on Land Tax

Certain exemptions/rebates reduce the burden of land tax in India:

| Category | Exemption/Rebate |

| Government-owned land | Full exemption |

| Slum dwellings | Partial exemption |

| Senior citizens | Rebate offered |

| Timely annual payments | 5–10% discount |

Such rebates encourage timely compliance and ease the cost of ownership.

Taxes on Purchase of Land in India

When buying land, multiple taxes apply:

- Stamp Duty: 5-7% of land value (varies by state)

- Registration Charges: 1% of land value

- Tax on the purchase of land in India also includes land registration tax in India, covering these mandatory costs. [1]

Capital Gains Tax on Sale of Land in India

When land is sold, profits are taxed under the capital gain tax on the sale of land in India.

- Short-term capital gains (STCG): If land held ≤24 months, taxed per income tax slab (short-term capital gains tax).

- Long-term capital gains (LTCG): If held >24 months, taxed at 12.5% without indexation or 20% with indexation (per 2024 Budget update). [2] For a deeper guide, see NoBroker’s long-term capital gain tax on property.

Selling agricultural land? Rural agricultural plots are exempt, but urban agricultural land is taxable. (capital gain on sale of agricultural land).

How to Save Tax on the Sale of Land in India?

Here are effective strategies on how to save tax on the sale of land in India:

- Invest gains in new residential property under Section 54 (capital gain on sale of property)

- Invest in agricultural land under Section 54B

- Buy government-approved bonds under Section 54EC

- Deposit unutilized gains into the Capital Gains Account Scheme

- Use indexation benefits for LTCG (how to save capital gain tax on residential property)

Due Date, Penalties & Legal Consequences of Non-Payment

Ignoring land tax can have consequences:

- Due dates: Usually annual or quarterly, varying by state

- Penalties: 5–10% surcharge or monthly interest on delayed amounts

- Legal issues: Authorities can attach property, restrict transfer, or initiate legal action

How can NoBroker help with Legal Services?

Managing tax on selling land in India or even paying land registration tax in India can be complex. NoBroker simplifies this with end-to-end property legal services. Their experts assist in documentation, capital gains planning, and compliance, helping you avoid penalties. NoBroker ensures smooth and hassle-free land transactions.

Frequently Asked Questions

Ans: Property tax encompasses both buildings and land, whereas land tax may also apply to vacant plots.

Ans: Yes. Land gift tax in India applies if land is gifted without adequate consideration, subject to Income Tax rules.

Ans: It depends on whether gains are short-term or long-term. STCG is taxed according to the slabs. LTCG is taxed at 12.5% without indexation or 20% with indexation.

Ans: Yes, you must pay stamp duty, registration charges, and applicable land registration tax in India.

Ans: Yes. Using Sections 54, 54B, and 54EC or reinvestment schemes, you can reduce tax on selling land in India.

Recommended Reading

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

200793+ views

Leave and License Agreements: Meaning, Calculator, Format and Registration in 2026

January 31, 2025

68114+ views

A Comprehensive Guide to Karnataka Rent Control Laws and Tenant Rights

January 31, 2025

62095+ views

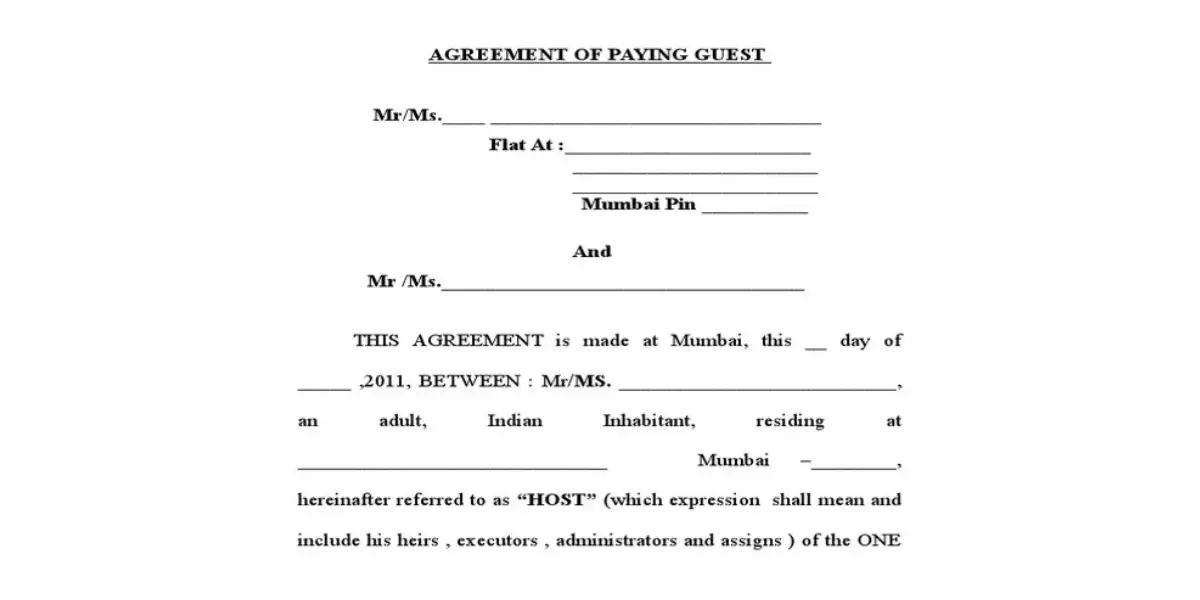

Paying Guest Agreement Format: Rules, Terms, Sample and Legal Rights in India

January 31, 2025

38177+ views

Uttar Pradesh Rent Control Act Explained

January 31, 2025

35721+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116872+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

200793+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

145461+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135870+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!