- https://taxinformation.cbic.gov.in/content/html/tax_repository/gst/acts/2017_CGST_act/active/chapter6/section29_v1.00.html

- https://taxinformation.cbic.gov.in/content/html/tax_repository/gst/rules/cgst_rules/documents/Central_Goods_and_Services_Tax_Rules__2017_26-December-2022.html

Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

How to Cancel GST Registration: Online Process, Form REG-16 & Eligibility

Table of Contents

Learning how to cancel GST registration is important for business owners who have stopped operations, restructured their company, or whose turnover has fallen below the GST limit. Once cancellation is completed, the business is no longer required to file GST returns or charge GST to customers, helping avoid unnecessary compliance and penalties. The cancellation process is done online through the GST portal by submitting a cancellation application with the required details and documents. After approval, the GST number becomes inactive and officially closed.

Difference Between GST Cancellation and GST Suspension

Businesses often compare suspension with the cancellation of GST registration because both affect compliance, but work differently. Suspension is temporary, while cancellation permanently ends a business’s GST obligations. Understanding the difference helps avoid penalties, confusion, and filing mistakes. [1] [2]

| Aspect | GST Cancellation | GST Suspension |

| Meaning | Permanent closure of GSTIN; business no longer under GST; all dues must be cleared. | Temporary pause of GSTIN for verification or discrepancies; not a full closure. |

| Issued By | Taxpayer or department due to non-filing, fake invoices, or violations. | Usually department-initiated during checks or cancellation proceedings. |

| GST Return Filing | No future returns filed; pending returns up to the cancellation date must be completed. | Return filing halted; some returns cannot be filed until the suspension ends. |

| Ability to Issue Invoices | Cannot issue GST invoices or collect GST; doing so attracts penalties. | Cannot issue GST invoices during suspension; collecting GST may trigger disputes. |

| ITC Reversal | ITC on stock/assets must be reversed or paid in the final return. | ITC is not reversed immediately; the final outcome depends on whether it is restored or canceled. |

| Duration | Permanent unless revoked within allowed limits. | Temporary until the verification/notice process completes. |

Reasons for GST Cancellation

Businesses often review their eligibility for GST registration cancellation when operations change or compliance issues arise. Understanding the common reasons helps prevent penalties and maintain proper GST compliance.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Voluntary Cancellation

- Business discontinued: Closure of business operations renders GST registration unnecessary, prompting cancellation to stop future compliance obligations immediately.

- Change in business structure: Mergers, demergers, or conversions to a different business type require fresh registration, resulting in the voluntary cancellation of the existing GSTIN.

- Turnover falls below the GST threshold: When annual turnover falls below the mandatory threshold, the business can cancel its registration and avoid unnecessary compliance requirements.

Compulsory Cancellation

- Non-compliance: Persistent return defaults or violations allow authorities to cancel registration and restrict the taxpayer's further GST activities.

- Fraudulent registration: Fake documents or misused GSTINs result in cancellation to prevent revenue loss and safeguard the GST system’s integrity.

- Not conducting business at the declared address: Absence of business operations at the registered location allows officials to cancel the GSTIN after verification.

Death of Sole Proprietor

- Transfer of business to legal heir: Upon the owner’s death, the existing GSTIN is cancelled, and the legal heir obtains a new GST registration to continue the business.

Who Can Cancel GST Registration?

Different parties can initiate the process based on the situation, and knowing how to surrender GST registration helps taxpayers complete the procedure smoothly and without errors.

- Registered taxpayers: They can apply for cancellation when the business closes, restructures, or no longer needs an active GST registration as per the law.

- Legal heirs in case of death: They can cancel the GSTIN after the proprietor’s death and obtain a fresh registration to continue lawful business operations seamlessly.

- GST Officer (Suo moto cancellation): The officer can initiate cancellation for serious non-compliance, defaulting returns, fraudulent registration, or violations identified during verification or inspection.

Required Documents for GST Cancellation

Preparing the correct paperwork ensures a smooth, error-free cancellation of GST registration. These documents help verify business status, pending liabilities, and eligibility for completing the cancellation request.

- Proof of business closure or transfer: Documents confirming shutdown, sale, or transfer help authorities validate that the business no longer operates under the existing GST registration.

- Latest GST returns: Filing all pending GST returns ensures accurate tax reporting and prevents delays during the verification and approval of the cancellation request.

- Stock details and tax liability: Information on remaining stock, input tax credit reversal, and final tax dues helps calculate liabilities before completing the GST cancellation process.

- Authorization letter (if filed by representative): A signed authorization allows a representative to submit the cancellation request and communicate with GST authorities on the taxpayer’s behalf.

How to Cancel GST Registration Online?

Taxpayers often ask, “How can I surrender my GST registration?” when their business closes or no longer meets GST rules. The process is completed entirely on the GST portal.

- Step 1: Sign in to the GST portal with your username and password, then open your dashboard to start the cancellation process.

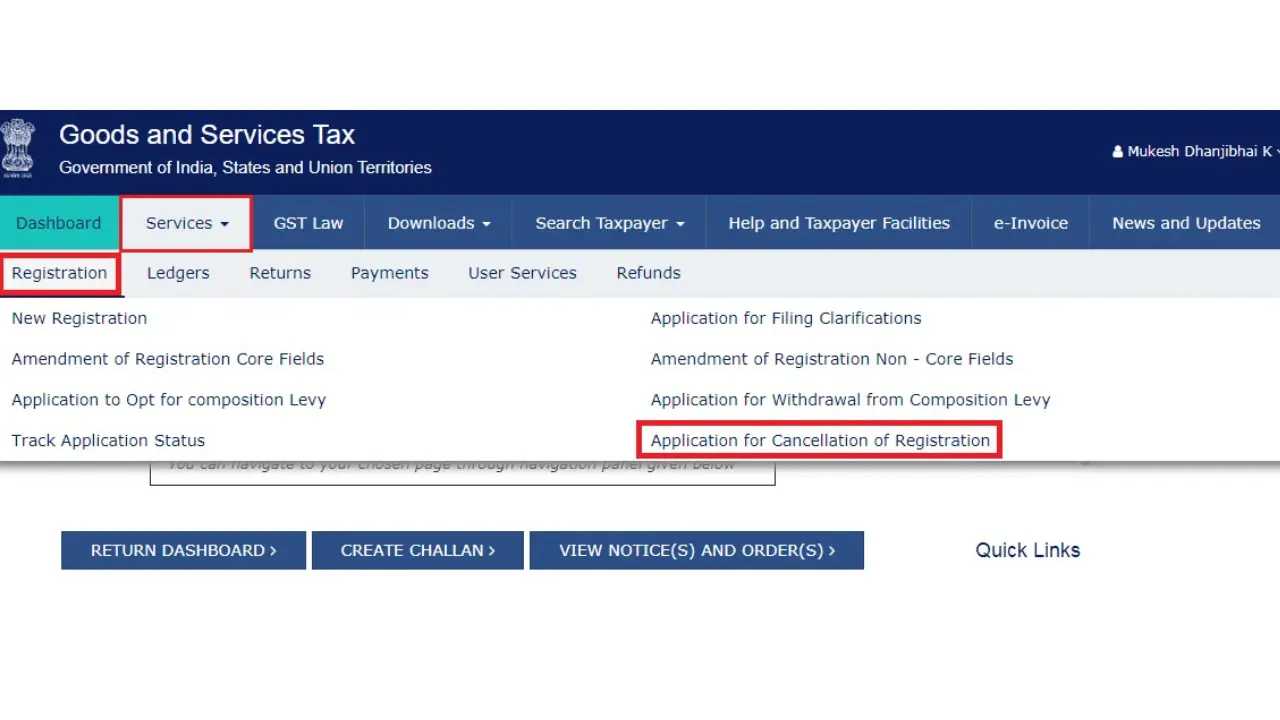

- Step 2: From the top menu, click Services, then choose Registration, and select Application for Cancellation to open the online cancellation form.

- Step 3: Fill out the GST REG-16 form on the portal by entering business details, address, contact information, registration type, and the proposed cancellation date.

- Step 4: Upload proofs supporting your reason, enter stock details, calculate tax liability, and confirm any input tax credit reversal required carefully.

- Step 5: Verify all entered information, then submit the cancellation application for approval using a Digital Signature Certificate or an Electronic Verification Code.

What Happens After GST Registration Cancellation?

After the cancellation of GST registration, the taxpayer must settle all pending liabilities, clear outstanding returns, and confirm accurate tax calculations before closure. Once the GSTIN is cancelled, the number becomes inactive and cannot be used to issue invoices or collect tax. The taxpayer must also file the final GST return, known as GSTR-10, to report closing stock details and pay tax on the remaining inventory, to properly complete the compliance process and ensure all obligations are fully settled responsibly today.

NoBroker Assistance for GST Registration and Cancellation

NoBroker makes GST registration cancellation simple, organised, and error-free for businesses of every size. The team prepares all required documents, verifies closure details, and ensures that every form is completed correctly before submission. From collecting information to uploading files, calculating closing stock liability, and filing the application on the GST portal, NoBroker manages the entire workflow with accuracy!

Frequently Asked Questions?

Ans: GST cancellation approval usually takes a few weeks, depending on the accuracy and verification of the documents. If no discrepancies are found, the officer can process the request more quickly through the portal system.

Ans: A cancelled GST number can be reactivated only through revocation. This is allowed when the cancellation was initiated by the department and the taxpayer applies within the permitted timeline, with the required compliance.

Ans: Yes, filing GSTR-10 is mandatory. The final return reports the closing stock, pending liabilities, and tax dues, completing compliance before the GST registration is officially cancelled.

Ans: Yes, composition dealers can request cancellation when business closes, turnover reduces, or registration becomes unnecessary. They must clear any outstanding taxes and file the required returns before the GSTIN is cancelled.

Ans: Yes, GST can be cancelled, but outstanding dues must be paid. Authorities require liabilities, interest, penalties, and stock-related tax to be cleared before approving the cancellation request fully.

Recommended Reading

How to Register a Company in India: Legal Requirements & Compliance Checklist (2025)

May 1, 2025

25261+ views

GST Laws - All You Need to Know

December 2, 2022

10093+ views

GST on Flats Below 45 Lakhs: Everything You Need to Know

January 31, 2025

9392+ views

GST Registration Process: Meaning, Types, Charges and Documents in 2025

May 24, 2025

7955+ views

Offences and Penalties Under GST

December 2, 2022

4525+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116721+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

199460+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

144116+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

134997+ views

Recent blogs in

Supplementary Lease Deed: Meaning, Purpose and Documents Required in India

February 5, 2026 by Ananth

What Is a Ground Lease: Types, Registration, Benefits and Risks in India

February 5, 2026 by Ananth

How to Register a Lease Deed Online and Offline: Registration Process and Charges in India

February 5, 2026 by Vivek Mishra

Full RM + FRM support

Full RM + FRM support

Join the conversation!