Understanding Stamp Duty and Property Registration Charges in Haryana is crucial. These costs are mandatory fees levied by the government to register the transfer of ownership. This guide will explain the different stamp duty rates applicable in Haryana, depending on factors like property location, the gender of the buyer, and the type of property transaction. We’ll also cover property registration charges and how to benefit from tax deductions as per 2024.

Things we covered for you

(Note – The stamp duty rates are annually announced on the 31st of January of each year. So, the rates given below are those which were established by the government of India on the 31st January 2021).

Importance of Stamp Duty in Haryana

Importance of Stamp Duty in Haryana

Stamp duty in Haryana plays a crucial role in ensuring a smooth and secure property transaction. Here’s why it holds significant importance:

- Legal Recognition: Paying stamp duty validates the property sale, acting as a government-approved stamp of legitimacy. This strengthens your claim of ownership and provides legal recourse in case of disputes.

- Record of Ownership: The registration process, which necessitates stamp duty payment, creates an official record of the property transfer. This documented record serves as vital evidence of ownership in the future.

- Curbing Fraud: Stamp duty discourages property fraud by making undocumented transactions impractical. The official record ensures transparency and discourages attempts to bypass legal channels.

Government Revenue: The revenue collected from stamp duty contributes to the state’s development initiatives. These funds are used for infrastructure projects, public services, and social welfare programs.

Stamp Duty in Haryana for Property Registration

Registration charges in Haryana vary according to the requirement or usage of the immovable property. Plot registry charges in Haryana have been clearly laid out by the state government to avoid any confusion and ensure a smooth function of the system. Below are a few properties registration charges in Haryana to help you get an idea of how stamp duty in Haryana works.

Conveyance deed charges in Haryana

- Rural Areas – 5%

- Urban Areas – 7%

Exchange Deed charge

- Rural Areas – 6% of the greatest value of one share

- Urban Areas – 8% of the greatest value of one share

Gift Deed stamp duty in Haryana

- Rural Areas – 3%

- Urban Areas – 5%

General Power of Attorney

- Rural Areas – Rs 300

- Urban Areas – Rs 300

Special Power of Attorney

- Rural Areas – Rs 100

- Urban Areas – Rs 100

Partnership deed stamp duty in Haryana

- Rural Areas – Rs 22.50

- Urban Areas – Rs 22.50

Stamp duty on loan agreement in Haryana

- Rural Areas – Rs 100

- Urban Areas – Rs 100

Trust Deed

- Rural Areas – Rs 45

- Urban Areas – Rs 45

Adoption Deed stamp duty in Haryana

- Rural Areas – Rs 37.50

- Urban Areas – Rs 37.50

Above are a few of the most commonly used stamp duty rates in Haryana. Stamp duty for property registration is easily payable and makes further discrepancies impossible.

Stamp Duty in Haryana for Females

The state government of Haryana provides special provisions for women to help them gain independence and encourage them to make personal financial securities. The rate of Stamp duty in Haryana for women is –

- Rural Areas – 3%

- Urban Areas – 5%

Rent Agreement Stamp Duty in Haryana

A Leave and License Agreement (or Rent Agreement) is a legal document that contains information on the property, the rent and deposit due, and other terms and conditions related to the property rental transaction. A legally binding rent agreement protects the rights of both the renter and the landlord. In the event of any future legal proceedings, only a registered rent agreement will be considered admissible in court. The terms and conditions of the rental agreement have to be followed by both the tenant and the landlord. Stamp duty in Haryana on the rental agreement is mentioned below –

Read: Stamp Duty and Property Registration Charges in Hyderabad

| Rental Period | Stamp duty charges in Haryana | Registration Fee |

| Up to 5 years | Rs 15 for Consideration Value up to Rs 1,000Rs 7.50 for every additional Rs 500 of Consideration Value | Rs 200 |

| Greater than 5 years | Rs 30 for Consideration Value up to Rs 1,000Rs 15 for every additional Rs 500 of Consideration Value |

Registration Charges in Haryana

Registration fees were previously set at INR 15,000, but the state government increased them to INR 50,000 in 2018. Gift deeds, sale deeds, lease deeds, exchange deeds, division deeds, collaboration agreements, mortgage deeds, settlement deeds, and sale certificates are all subject to the increased fees.

Documents Required for Property Registration in Haryana

- Proof of Ownership (Original old sale or MC).

- Proof of Identification of both buyer, seller, and witnesses (Aadhar Card, PAN card, etc).

- No-objection certificate (NOC) from the society.

- Building plan, map, etc.

- Digital photograph of the property.

Land Registration Fees in Haryana

Haryana flat registration costs vary according to the usage of the property and also the area. According to the Registration Act, buyers must register their purchase within four months after the date of purchase. Unlike most states, Haryana charges a flat price depending on the property’s worth, rather than requiring the buyer to pay 1% of the property’s value as a registration fee. Below is the breakdown of Haryana property registration charges –

| Property value | Registration charge |

| Up to Rs 50,000 | Rs 100 |

| Rs 50,001 to Rs 5 lakhs | Rs 1,000 |

| Rs 5 lakhs up to Rs 10 lakhs | Rs 5,000 |

| Rs 10 lakhs up to Rs 20 lakhs | Rs 10,000 |

| Rs 20 lakhs up to Rs 25 lakhs | Rs 12,500 |

| Over Rs 25 lakhs | Rs 15,000 |

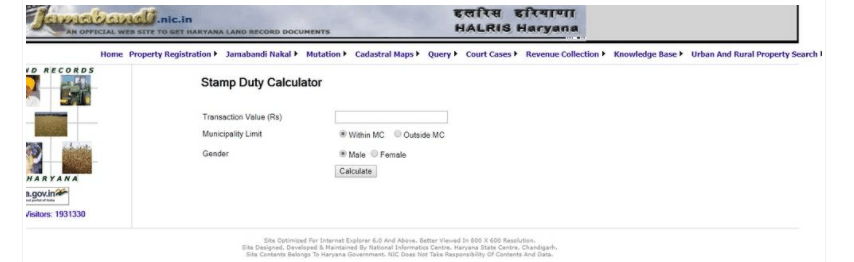

Stamp Duty Calculator Haryana

The stamp duty is calculated based on the transaction amount mentioned in the sale agreement and must be paid by the buyer. The property cost, on the other hand, must be determined using current *circle rates and the stamp duty must be computed appropriately. If the house is valued higher than the circular rate, the buyer will be responsible for paying stamp duty on the difference. If the value of the property is less than the circle rate, the stamp duty will be determined according to the circle rate.

Read: Kaveri 2.0: Karnataka’s Portal for Property Registration and Online Encumbrance Certificate

(*The Haryana government approved a raise in circle rates in April 2021-22, which would result in property costs jumping by up to 80% in some areas of Gurgaon).

Alternatively, buyers can calculate stamp duty by visiting the Haryana Jamabandi website. Stamp duty in Haryana can easily be calculated with this website with a few easy steps. First key the transaction value, then select the municipality (of the property) and then your gender. After this click on the ‘calculate’ icon on the screen – the stamp duty and registration charges appear on the screen.

Buyers can calculate These charges by visiting the Haryana Jamabandi website.

Stamp Duty in Haryana has been made fairly clear by the government for the smooth functioning of the state’s system. The state government also provides special provisions for women to boost their independent existence in the state. The article above informs of the varying stamp duty rates of Haryana, but if you have more queries – then head to NoBroker Forum. For any legal issues, NoBroker is here to help just click on the below link for legal support.

Read: Property Tax Gurgaon Online: About Property Tax in Gurugram

FAQ’s

Ans. Within 4 months of the transaction, the sale deed must be registered. Otherwise, a fee is levied.

Ans. Buyers can calculate stamp duty by visiting the Haryana Jamabandi website. The link for the same is – https://jamabandi.nic.in/

Ans. Haryana charges a flat price depending on the property’s worth, rather than requiring the buyer to pay 1% of the property’s value as a registration fee.

Ans. Registration fees were previously set at INR 15,000, but the state government increased them to INR 50,000 in 2024.

Ans. The stamp duty is calculated based on the total property value and then divided amongst the buyers based on their share in the ownership.