The real estate sector in India has often had its reputation tarnished due to the amount of money laundering and corruption cases. To check this, one of the steps that the Indian Government took was to introduce Section 194ia of the Income Tax Act which allows the buyer of the property to deduct Tax at Source (TDS) before paying the seller.

Things we covered for you

In addition, the 194-is TDS rate is also standardised across all residential properties and lands (excluding agricultural lands). Thus, it cuts off any chance of foul play during the transfer of properties and makes the system more transparent.

Section 194ia of the Income Tax Act

First, let’s start with the exact legal definition of Section 194-ia. It says that “Any individual legally responsible to pay (other than the person referred to in section 194LA) to a resident transferor any sum as consideration for the transfer of any immovable property (other than agricultural land) shall, at the time of crediting such sum to the transferor’s account or at the time of payment of such sum in cash, by the issue of a cheque or draught, or by any other mode, deduct an amount equal to 1% of the sum.”

Read: Estate Planning for Pets and Their Well-being

Now let’s look closer at some of the terms here.

TDS on Rent

Before going into the details, let’s discuss what rented properties are applicable for TDS deduction under Sec 194-ia of the Income Tax Act. The “rent” here equates to any lease/sub-lease/tenancy or other arrangements for the following immovable properties:

- Building (including factory buildings)

- Land

- Land that holds any building

- An industrial/manufacturing unit

- Computer systems, machinery and other types of equipment needed for infrastructure

- Machinery

- Fittings

- Furniture

The applicable rate of TDS on rent of immovable property like land and buildings is 10% of the considered value. Usually, individuals/HUFs are not liable to pay taxes unless more than 50,000 per month. A 5% TDS will be deducted in such cases.

When is the Timeline for the Section 194ia TDS Deduction?

As mandated by the 194-ia TDS section, this TDS is deducted while transfer of property or while paying the rent to the landlord. The TDS thus deducted should be paid to the Government within seven days of the following month, albeit with a few exceptions. For example, if the amount is paid in March, the deadline would be April 30th.

Documents required during 194-ia TDS payment

- A TAN number (Tax Deduction Account Number). However, for the transfer of immovable property, the buyer need not have a TAN.

- PAN cards of both buyers and sellers. The absence of this document might lead to heavy penalties for the buyer.

- Address Proof

- Personal Details such as Name, email address and others (as mentioned in Form 26QB)

- Total consideration value

- Date of payment

- Form 16B (to be furnished by the buyer and submitted to the seller within 15 days)

Section 194ia TDS Rate

The revised TDS rate under Section 194-ia of the Income Tax Act is 1% of the total value of the property. For agricultural lands also, the TDS rate is 1% of the considered value. However, if the seller does not have a PAN, a steep 20% tax is deducted.

Read: Property Tax Chennai – Step By Step Process On How to Pay Online

TDS Section 194IA on Immovable Property

The TDS on immovable property is 1% of the total considered value. However, for properties purchased before 2019, the TDS deducted is 0.75%. In case of the absence of certain documents like the PAN of the seller, the TDS deducted is 20%, along with hefty penalty fees.

Section 194ia TDS Payment

You can pay 194-ia TDS via both offline and online modes of payment. This process involves two steps. First, the buyer will have to pay the 194-ia TDS through the 26QB challan and then obtain Form 16B for the seller. Here are some steps that you can follow:

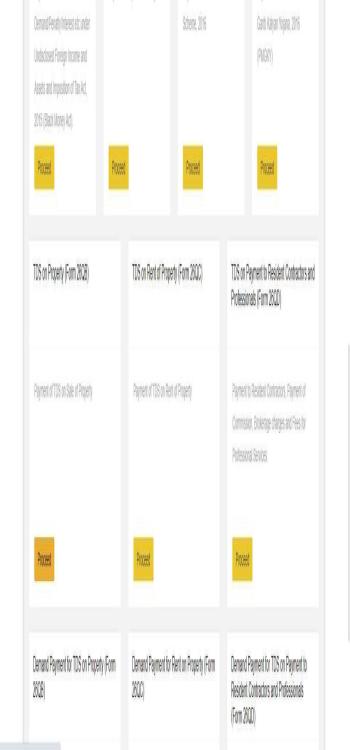

- Log in to tin-nsdl.com with your credentials. After the window appears, click on the “Services” tab and select the “e payment: Pay taxes online” option.

2) A new window with various challan options will appear before you.

3) Scroll down a little. Then, under the “TDS on Property Form 26QB” option, click on “Proceed”.

Read: Unravel the Secrets and Learn the Difference Between an Easement and a Licence

4) You will be redirected to a new window. First, you have to input all taxpayer information. In the “Tax Applicable” section, choose 0020 if you are paying corporate tax. For others, click on 0021—next, select assessment period, type of payment, and residency status. You also need to provide your details along with your PAN. You also need to input the seller’s PAN here. Then click on “NEXT”.

5) Fill in all the other necessary details, including the property details. Then, you will finally reach the “Payment” page. Here, one needs to select their preferred mode of payment and click on “Proceed”. Once you successfully pay online, you will be able to download and print a Challan 280 for future reference.

6) In case you are unable to pay online, you will receive a Form 26QB along with a unique acknowledgement number (only valid for ten days from generation). You can take this form to the nearest bank along with a cheque and make your payment. On successful transactions, the bank will generate the challan for you.

After this, you need to visit the TRACES website and register on TRACES as a Taxpayer with your PAN number and challan number. Then, get your Form 16B and download it. Remember, this form is to be mandatorily issued to the seller of the property.

Read: Maharashtra Apartment Ownership Act 1970: Details and Application

Section 194ia Challan

This is a sample of the 194-ia challan or Form 280. The buyer must have a copy of this form 280 while deducting TDS on property sale.

For a closer look, visit here.

When is the latest possible date that the TDS can be deposited with the government?

The TDS, which stands for “tax deducted at source,” needs to be sent to the administration by the 7th of the month that follows the one in which it was deducted. This indicates that the tax deductions that were taken out in the month of March need to be turned over to the authorities by the 7th of April.

The repercussions of failing to make a payment toward the TDS

The rules of the legislation provide that it is the responsibility of the buyer to deduct any relevant TDS from the total value of the transaction and file it in the appropriate manner with the government. Because it is not required for purchasers to have a PAN, they are free to utilise the information from their PANin the paperwork. Those purchasers who do not submit their tax withholding payments to the government within an allotted amount of time face the possibility of being fined in the form of interests or facing a term of imprisonment that may be as long as 7 years. It is important to note that even if the seller may be compelled to make payment, the buyer would be the one to bear the penalty in this scenario.

Things to Keep in Mind: TDS on Immovable Property Section

TDS: Things for the customer to keep in mind

The total consideration for the sale should have either 1 percent or 0.75 percent TDS on the sale of property deducted from it, depending on the timing of payments. Obtain the seller’s PAN and then check it against the information on the genuine PAN card. In order to make a tax payment, you will also need your PAN. Since there is no online system for the repair of inaccuracies, you must be very careful not to make any mistakes while providing the PAN or any of the other information in the online form. It is necessary for you to get in touch with the Tax Department in order to make the necessary corrections.

TDS: Things for the Seller to Keep in Mind

Give the buyer your Permanent Account Number (PAN). In the Form 26AS Yearly Tax Statement, you need to make sure that the deposit of taxes that were deducted by the buyer is correct.

Things that are essential to keep in mind regarding TDS

If a property’s purchase price is more than Rs. 50 lakhs, the buyer is required to deduct TDS on property purchase & pay it to the government. The buyers, and not the vendor, are the ones who are accountable for deducting and submitting the TDS amount. In the event that any of this property is misappropriated, the buyer would be held accountable before the appropriate authorities. In order to credit the TDS, buyers need to fill out Form 26QB. In the event that the transaction involves more than one buyer or seller, there are separate forms that need to be filled out for each individual party.

Important Terms

- What is Immovable Property?

During the transfer of properties, an immovable property refers to a flat, building, part of the building, or any other real estate and land other than agricultural land. Land or property that is inherited also comes under the purview of immovable property.

- What is TDS?

TDS stands for “Tax Deducted at Source.” It’s a tax collection mechanism in which a person or entity responsible for making payments (such as salary, interest, rent, etc.) is required to deduct a certain percentage of the payment as tax before making the payment to the recipient. The deducted tax is then directly deposited to the government on behalf of the recipient. TDS ensures that the government collects tax revenue in advance and prevents tax evasion. The recipient then receives the net amount after the deduction of TDS. Recipients can claim credit for the TDS amount while filing their income tax returns.

As can be seen, section 194-ia TDS of Income Tax Act has successfully minimised the rampant corruption during the transfer of properties. With actual tax rates and liabilities, both buyers and sellers need to be in tandem to participate in real estate transactions, including land successfully. However, if you are still confused, you can always contact the NoBroker legal experts to understand the finer details of the TDS rules. Wish to know more about various taxes related to real estate? Visit our blog section and get knowledge on multiple taxes and their benefits. For any legal issues regarding 194ia TDS just click below.

FAQs

Ans. The Indian Income Tax Act mandates that the 194-ia TDS payment rate is 1% for all immovable property, including land. However, this does not include agricultural land.

Ans. Yes. PAN is an important document needed to file TDS for payment during the sale of the property. Both the buyer and seller need to furnish their PAN for a successful transaction of property. Without a PAN, the TDS rate might shoot up to 20%.

Ans. In the case of a buyer, a late fee of Rs 200 per day will be taxed on the buyer in the case of non-filing/late filing of TDS statements. In addition, specific penalty fees will also be applicable. For sellers, the inability to file form 26QB will fail to claim TDS credit. All dues will be redirected to the Central Government.

Ans. On payment of TDS online, you will be able to download and print a copy of your Form 280 or the TDS challan. For offline submission, visit your nearest bank with the necessary documents, and they will generate the challan for you.

Ans. Visit https://www.tin-nsdl.com/ and look under the Services tab. From there, choose e-payment and then opt for Form 26QB and click on “Proceed”. After that, you have to input the required details and make your payment.