Considering buying a property? Bank Auction Property could be an excellent option for you. Banks undertake numerous kinds of property auctions to recoup their losses. This includes all types of properties, including residential, commercial, and agricultural ones. They invite people to take part in the auction from all over the country. These participants were permitted to make bids following their preferred spending caps.

Things we covered for you

Why are Properties Auctioned by Banks?

The property is sold at auction because the borrower missed a payment. A bank auction is often started after a borrower misses three consecutive EMI payments on a home loan, which results in foreclosure.

The consumer is given 60 days to respond to a notification asking them why the bank shouldn’t start an auction of their property owing to payment default. If the borrower makes the required payments, this notification is withdrawn. If not, the borrower may object within 60 days and provide a cause for not making EMI payments.

If the borrower doesn’t respond or the bank is unsatisfied with the response, the bank may start the bank auction process. After this notice has expired after 60 days, the bank has 30 days to hold an auction for the property. REO auction properties offer a chance to find hidden gems at below-market prices but require some research and planning before diving in.

Reasons to Buy a Bank Auction Property in India

Here are some reasons why you should consider buying at a bank auction.

1. Reduced Property Rates

A property purchased at a bank auction has several incredible advantages. Lower and more reasonable prices are one of these advantages. The worth of the property is estimated by the banks to be 15% to 20% less than the going market rate.

2. Ready-To-Use Properties

Bank auction properties in India are often ready for move-in. After the sale is completed, the buyer can start moving into the property right away. Thus, these properties offer a great deal of convenience and time savings.

3. No Legal Barriers

Banks inspect each auction item. Therefore, they are not subject to any legal disputes.

4. Great Locations

The majority of the properties up for auction at banks are situated in upmarket locations. They are therefore very lucrative options for everyone.

Risks Associated with Buying Bank Auction Properties for Sale

Despite all the previously mentioned benefits, buying a house at a bank auction involves risks. Continue reading to learn more about them.

Read: TNHB Ongoing and Upcoming Projects For 2024

Remaining Dues: Purchasers are liable for covering any unpaid obligations related to the bank auction property. These dues include things like utility bills, society dues, statutory dues, municipal taxes, and other costs. They also include encumbrances like leases tied to property and legal activities.

Buyers Must Do Additional Work: As part of their due diligence, buyers must conduct a title search and verify the property’s ownership. Banks neither take possession of the property nor take on any liability for it.

Pre-Bidding Deposits: When buying a property in a bank auction, buyers must pay down 10% to 15% of the total property value as a pre-bidding deposit. Furthermore, if they submit the winning bid and fail to make the required payment, they lose the pre-bid cash.

May Require Repairs and Renovation: With houses for sale at bank auctions, buyers have few alternatives regarding location or price. It might be difficult for buyers to inspect a home and ascertain its exact physical state.

Illegal Occupants: As the new owner, evicting unauthorised residents is your responsibility. Visit the property, and confirm emptiness before buying. After the transaction, clear property of squatters. Prior renters may also be unwilling to leave.

READ ALSO: How To Plan A Home Purchase in India?

Property Bank Auction Process in India

Here are the steps involved in buying a bank auction property in India–

1. Finding Bank Auction Property Listings

As there was no organised data in India, this used to be one of the most unpleasant steps. Some websites might offer details about Bank Auction Property. This information is typically only accessible for a fee. These websites are not frequently updated. Newspapers notices posted at bank branches, and notices put in the community are some more information sources. On the websites of asset reconstruction firms like ARCIL, you may also view the auction notice.

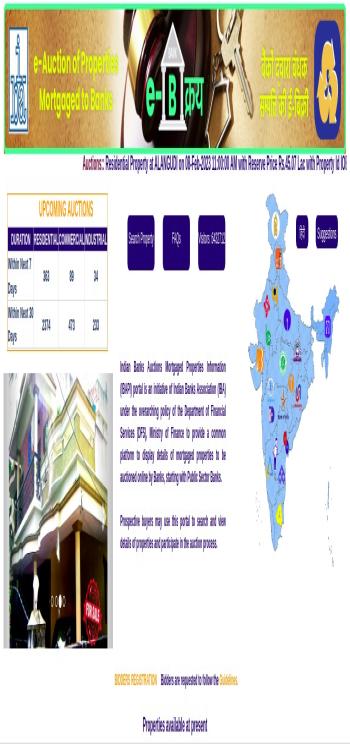

However, this process has now been simplified. The Indian Banks Association (IBA) launched the Indian Banks Auctions Mortgaged Properties Information (IBAPI) portal as part of the Department of Financial Services (DFS), Ministry of Finance, overarching policy to provide a common platform to display information about mortgaged properties to be sold at an online auction by Banks, starting with Public Sector Banks.

Read: Is This the Best Time to Shift from Your Rented House to Your Own House?

2. Conduct Inspections

Make a preliminary check on your own after you’ve narrowed down the bank auction properties. The obvious cause for a bank auction is a payment default, but you should also look into any legal disputes, bank auction-related information, and how you might participate in a bank auction.

The major issue with bank auctions is that you won’t have access to property records for title searches before purchasing. Banks are reluctant to divulge a lot of information. The bank’s only goal is to sell the property. It is advised to contact a lawyer or other specialist for this process if you are sincere about wanting to purchase the property. Checking the defaulter’s balance due is a vital step.

Many times, the outstanding balance is significantly higher than the reserve price. Please confirm how the bank will recover the remaining money if the property is auctioned off for less than the balance owed. In these situations, the defaulter must pay the remaining sum, however, it is preferable to clarify. If the final bid amount exceeds the outstanding sum, the bank will pay the difference to the defaulter.

Read: MHADA Lottery Mumbai 2024: Dates, Results, Registration, Eligibility & More

Physically inspecting the property is also advised. For example, if you currently reside in Chennai, look for bank auction properties in Chennai or if you live in Delhi look for bank auction properties in Delhi. If you live in Bangalore it would be much easier for you to conduct physical inspections of bank auction properties in Bangalore.

The inspection date and time are now being mentioned by banks in auction notices. To inspect the property, you can go to the location at the appointed time. You can reach the concerned officer using the information provided in the e-auction notice. It is best to get in touch with him and ask for all the information.

READ ALSO: 7 Biggest Mistakes You Can Make as a Home Buyer

3. Submit a Tender Form and Pay Earnest Money Deposit

You should deposit EMD (Earnest Money Deposit) with the tender form, which you can collect. EMD is often deposited using a demand draft or banker’s check. Please review all of the information on the tender form before submitting it before the deadline. Bank also requires KYC papers in addition to the tender document. Since there is little time left, you should prepare all of your paperwork in advance.

Read: Real Estate vs Mutual Funds: Which is the Best Investment for You?

4. Start Bidding

You can submit your bid in a variety of ways. You can use the bid form to make your offer. Tender forms and bid forms are typically interchangeable. You can, in essence, submit a bid using the tender form. If you want to make several bids in “multiples of increase in bid amount,” you must submit different Tender forms or bid forms. Sometimes a physical tender form is submitted, and a separate online bid form is used to submit the bid.

In some circumstances, the bank permits competitive bidding among the bidders to raise the total value of the winning bid. During the e-auction window, you can place several bids in an e-auction. Except for e-auctions, there is no set procedure for placing bids.

5. Check Results on the Auction Date

Visit the webpage, bank, or auction location on the designated auction day to find out if you won the bank auction. All qualified bids will be opened by the bank in front of all bidders if bids are filed via tender orbid form. The winning bidder in a bank auction is declared. If you win the auction, you must deposit 25% of your bid within 24 hours, including any EMD that was submitted with the tender form. After the bank auction, you have between 15 and 30 days to deposit the remaining 75% of your bid. It is advised to apply for a home loan from the bank that held the property’s auction if you intend to use one. Home loans are typically dangerous in general, and the majority of bank auctions of properties are closed without the availing of a loan.

6. Registration of Sale Certificate at the Sub-Registrar’s Office

You will receive a sale certificate from the bank once the remaining 75% payment has been made. However, the title transfer is not complete until the sale certificate is registered in the sub-registrar office.

You should request that the defaulter be listed as a confirming party when registering the Sale Certificate. When registering a property, the authorised bank executive must also sign the sale certificate.

Required Finance for Buying Property at Auction

Here is how a buyer of real estate can finance properties being sold at bank auctions-

- Make a pre-bidding deposit equal to 10% to 15% of the total property value.

- In the specified number of days, pay an additional 15%. This time frame differs from bank to bank.

- Depending on the date assigned by the bank, the remaining balance must be paid in about a month.

Financing a Bank Auction Property

Financing plays a crucial role in the process of buying a bank auction property. While purchasing a property through bank auctions can offer attractive deals and opportunities, it is essential to understand the financing options available. Let’s explore the various aspects of financing a bank auction property:

Loan Pre-Approval: Before participating in a bank auction, it is advisable to obtain a loan pre-approval from a financial institution. This step helps determine your eligibility for a loan and gives you a clear understanding of your budget. NoBroker provides resources to help you know how to buy a bank auction property and navigate the financing process smoothly.

Loan Amount: The loan amount for financing a bank auction property typically depends on the property’s market value or the auction reserve price. Financial institutions usually provide loans up to a certain percentage of the property’s value, which can range from 70% to 90%. It is crucial to consider your financial capabilities and choose a loan amount that suits your repayment capacity.

Loan Repayment Tenure: The repayment tenure for a loan on a bank auction property can vary from 5 years to 30 years, depending on the financial institution and your preferences. It is advisable to consider the tenure carefully and opt for one that aligns with your financial goals and ability to repay the loan.

Interest Rates: The interest rates on loans for bank auction properties may vary based on various factors such as the financial institution, loan amount, tenure, and your creditworthiness. It is essential to compare interest rates offered by different lenders and choose the one that offers the most favourable terms.

EMI Calculation: To determine the Equated Monthly Installment (EMI) for your loan, you can use online EMI calculators or consult with your lender. EMI calculators take into account the loan amount, interest rate, and tenure to provide you with an estimate of your monthly repayment amount. NoBroker offers a bank auction property registration and EMI calculator to assist you in the process.

Loan Documentation: When applying for a loan to finance a bank auction property, you will need to provide certain documents such as identity proof, address proof, income proof, bank statements, property documents, and auction-related documents. Ensure that you have all the necessary documents ready to expedite the loan approval process.

Loan Disbursement: Once your loan application is approved, the financial institution will disburse the loan amount based on the payment schedule and terms agreed upon. It is important to review the terms and conditions of the loan agreement carefully before signing.

Income Tax Deduction on Buying a Bank Auction Property

When it comes to buying a bank auction property, one of the significant advantages for buyers is the potential income tax deduction. The Indian Income Tax Act provides certain provisions that can help buyers save on taxes when purchasing bank auction properties. Let’s explore the income tax deductions available and how they can benefit buyers:

Interest Deduction on Home Loan: Buyers who finance the purchase of a bank auction property through a home loan are eligible for income tax deductions on the interest paid. Under Section 24(b) of the Income Tax Act, buyers can claim deductions of up to Rs. 2 lahks per year on the interest component of their home loan. This deduction is available for self-occupied properties as well as properties that are let out.

Principal Repayment Deduction: Additionally, buyers can avail of income tax deductions on the principal repayment of the home loan under Section 80C of the Income Tax Act. The deduction limit for Section 80C is Rs. 1.5 lakh per year, which includes other eligible investments such as EPF, PPF, and life insurance premiums. Buyers can include the principal repayment amount in this limit and reduce their overall taxable income.

Stamp Duty and Registration Charges: Another income tax deduction available to buyers is for the expenses incurred on stamp duty and registration charges. Buyers can claim a deduction on these charges under Section 80C, subject to a maximum limit of Rs. 1.5 lakh. This deduction can further reduce the tax liability associated with purchasing a bank auction property.

Rental Income Deduction: If the bank auction property is rented out, buyers can benefit from deductions on the rental income. Under Section 24 of the Income Tax Act, buyers can claim a deduction on the municipal taxes paid, as well as a standard deduction of 30% on the net rental income. This deduction helps reduce the tax liability associated with rental income generated from the property.

It is essential to consult a tax advisor or chartered accountant to understand the specific income tax deductions applicable to your situation when purchasing a bank auction property. They can guide you through the process and ensure you maximize the available deductions.

| Deduction | Maximum Limit |

| Interest on Home Loan (Section 24(b)) | Up to Rs. 2 lakh per year |

| Principal Repayment (Section 80C) | Up to Rs. 1.5 lakh per year |

| Stamp Duty and Registration Charges (Section 80C) | Up to Rs. 1.5 lakh |

| Rental Income Deduction (Section 24) | Municipal taxes and 30% standard deduction |

By taking advantage of these income tax deductions, buyers can significantly reduce their tax liability and make buying a bank auction property even more financially beneficial. Remember to keep track of all relevant documents and consult with professionals to ensure a smooth and hassle-free process.

Key Points to Remember When Buying a Bank Auction Property in India

While buying a bank auction property, remember–

- Obtain important documents before purchase

- Banks keep the money if unpaid on time

- Promptly evacuate after inspection

- Verify unpaid dues before buying

- Avoid properties with squatters

- Make a budget, organise funds

- PSU bank auctions cheaper than private

As a potential buyer, you must carry out your due diligence and ensure all aspects of the property are in their place. The property must be the subject of a legal title search by all prospective buyers. They can use this to confirm the authenticity of important documents. The original sale deed and the non-encumbrance certificate are two examples of these documents.

Once sold, the property will be the sole responsibility of the buyer and hence any issues related to the property will also be the buyer’s responsibility.

If a bank auction property does not seem like your cup of tea, NoBroker offers a wide range of homes to choose from in the cities of your choice. Obtaining financing for these homes are also easy since NoBroker also offers home loan assistance in partnership with leading banks in the country. Head over to our website at NoBroker.in to know more.

FAQ’s

A bank real estate auction, also known as a bank foreclosure auction, is a public sale of property that a borrower has defaulted on their mortgage for. The bank seizes the property and sells it to the highest bidder to recoup their losses.

There are several ways to find bank e-auction properties. You can check the websites of individual banks, online auction platforms like “IBAPI: ibapi.in” (Indian Banks Auctions Portal).

Bank seized properties can be a good way to find properties below market value. However, there are also risks involved, such as needing repairs or facing competition from other bidders. It’s important to do your research on the property before bidding.

Buying bank seized houses for sale can potentially offer properties below market value. However, there can also be risks involved, so thorough research is crucial.

Before bidding on bank seized property, investigate the property’s condition, research fair market value, understand the auction process and any associated fees, and be prepared with financing options.

Hello nobroker.in admin, Thanks for the well-researched and well-written post!