Most middle-class families who wish to buy a home resort to home loans. But sometimes, home loan procedures might get lengthy and complicated due to many factors ranging from eligibility issues and lack of proper documents. With IIFL home loans, customers can avail of home loans easily under expert guidance. They will guide you on the various aspects of the IIFL Home loan eligibility. What’s more, home loans can get approved in as short a time as 25 minutes!

Things we covered for you

IIFL is one of the largest operating housing finance companies in the country. With a host of legal and technical experts at your disposal, they make your home-buying experience easier and hassle-free. Their home loans offer many benefits such as home loan balance transfer, PMAY interest subsidy, longer loan tenures, doorstep services and many more. You can get in touch with their customer care for detailed information about home loans and PMAY subsidy eligibility, as well as the required documents. Of course, the IIFL home loan experts will guide you through every step of your home loan journey.

Like any other lending institution, IIFL has clear guidelines for their home loans and subsidies. Going through them in detail is recommended before applying for an IIFL home loan. This article takes a deep dive into IIFL home loan eligibility criteria and how you can avail them.

IIFL Home Loan Eligibility

IIFL is a housing finance institution that provides home loans for first time home buyers and housing improvement. They also offer home loans to the lower-income groups or the Economically Weaker Sections (EWS) of the society under the PMAY scheme. The IIFL currently provides a maximum of Rs 2.67 lakhs subsidy on home loans. Even NRIs and PIOs (Persons of Indian Origin) looking to purchase residential property in India can apply for IIFL housing loans.

[widget_homeLoan_checkEligibility_form]

Home loan Balance Transfer

The IIFL also has home loan balance transfer provisions wherein individuals can transfer their outstanding home loans to IIFL at lower interest rates and better terms and conditions. Here one can choose a more significant loan tenure to pay the monthly EMIs without jeopardizing your financial situation.

Read: SBI Home Insurance – Financial Security for Your Home in India

IIFL Swaraj Home Loan Eligibility (General)

- All resident Indians, NRIs and Person of Indian Origin (PIOs) are eligible

- Applicant age should be between 18-75 years

- The credit score should ideally be more than 750

- Should have a clean record of loans and statutory payment in the past

Eligibility for Home Loan Balance Transfer

- The applicant should pay a minimum of 12 months of home loan EMIs.

- The applicant should have paid their previous EMIs without any default.

- If the property is under construction, the applicant should possess a copy of the approved design plan.

- In cases where the applicant has previously received a loan for an unregistered property, the home loan balance transfer will not be allowed.

- Registration documents for ready-to-move-in properties

Eligibility For NRI Home Loans

- Any salaried or self-employed Indian resident in the age range 18-75.

- The applicant should have a valid Indian passport.

- The passport should not have a NO ENTRY stamp. The applicant should be able to visit the country at any time.

- Passport with a valid entry visa for NRI applicants for in-person submission of documents.

- PIO/OCI applicants should have a correct PIO/OCI card copy in addition to a foreign passport.

IIFL Home Loan Eligibility Calculator

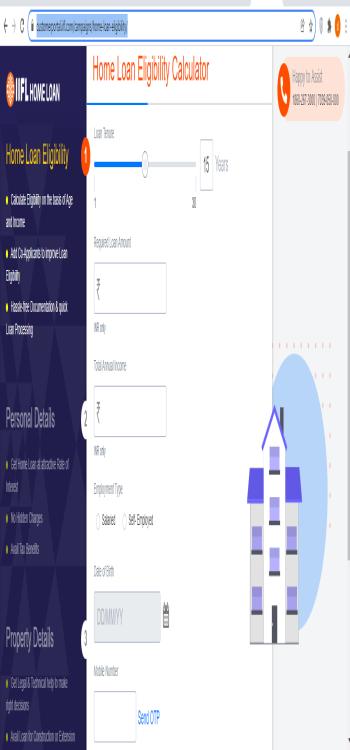

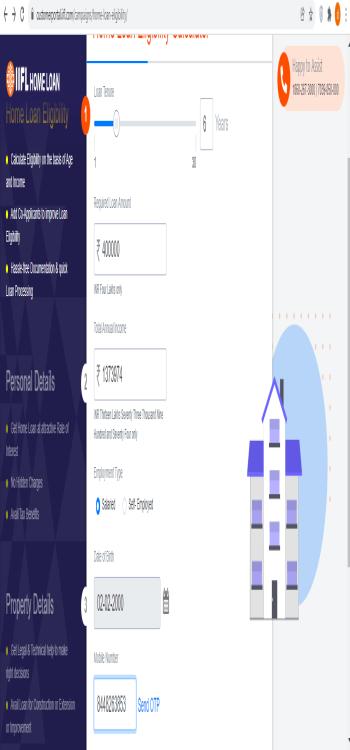

Follow these few steps to check your IIFL home loan eligibility:

- Visit IIFL official customer portal

2) Fill in all the required details like loan tenure, the loan amount you would like, your employment type, date of birth, and your mobile number. Then click on the “Send OTP” button.

Read: ICICI Home Loan Statement: Steps to Download the Loan Statement

3) Type in the OTP and click on “Continue”. You will be redirected to the “Personal Details” page. Here fill in all the required fields like PAN, email, address, gender and marital status. Then click on “Continue”.

4) You will again be redirected to a page wherein you have to fill in all the required details regarding the plot/property you are interested in purchasing. On completion, IIFL will show you if you are eligible or not for the loan. Also, if you qualify, IIFL will help you choose the best EMI plan that suits your budget.

IIFL Home Loan Details

Here are the components required for availing of home loans:

- Loan amount

- Tenure of loan

- Rate of interest

IIFL Home Loan Interest Rate

The IIFL home loan interest rates for 2024 starts from a minimum of 8.20% per annum. Your IIFL home loan interest rate will depend on a host of factors like the credit score of the borrower, the borrower profile, the amount of loan, property type and many others.

IIFL Home Loan Processing Fees

The processing fees of an IIFL home loan can go up to 1.75% of the loan amount.

IIFL Home Loan Foreclosure Charges

During any time of your loan tenure, you can foreclose your IIFL home loan by paying the remaining amount in one single payment instead of multiple instalments. For this purpose, you can contact the IIFL branch from where you availed of the loan.

Read: Axis Bank Home Loan Interest Rates – Updated in May 2024

IIFL Home Loan Prepayment Charges

For personal loans, prepayment refers to situations where the borrower pays back the whole loan amount fully or partially before the end of the personal loan agreement. The IIFL home loan prepayment charges are as follows:

- For full prepayment- 5% of the prepaid amount if done within a year of the first disbursement. After a year has passed, the borrower pays 3% of the prepaid amount.

- For partial prepayment-Borrower pays 5% of the prepaid amount within the first year of disbursement, while prepayment charges are 3% of your prepaid amount post one year.

IIFL Home Loan Pre-Closure Charges

According to a notice released by RBI, all NBFCs (Non-Banking Financial Corporations) are barred from charging the borrower for early closure of the loan before the agreed tenure.

IIFL Home Loan Application Status

It is possible to check your IIFL Home loan status both online and offline. The borrower can track their home loan status via reference number, mobile number, net banking etc.

IIFL Home Loan Emi Calculator

IIFL Home loan EMI calculator estimates your monthly EMI based on the following factors:

Read: Home Loan for Women in India – Interest Rates and Benefits

- The principal amounts

- Rate of interest

- Tenure of the home loan

- Method of calculation

Visit the official IIFL website and click on the “Calculate your EMI” option by filling in the required information. Be sure to include the cost of IIFL home loan insurance as you will surely need to get it in the process.

Transferring Balance in IIFL Home Loan

- Loans to borrowers who would be caught in high-interest mortgages and wish to transfer the amount of their existing mortgages.

- With an IIFL balance transfer loan, you may lower your interest payments.

- You can plan and reevaluate the home loan rates as well as their monthly payments (EMIs).

- Loan terms up to twenty years.

- There are not any hidden charges

- Complete end-to-end support and prompt house loan approval.

IIFL Home Loan Documents Required

Here is the complete list of documents you need to apply for an IIFL Home Loan successfully:

- A duly filled loan application form

- Identity proof

- Address proof

- Proof of Address of Business Entities (if applicable)

- Income proof for Salaried individuals:

- Last two months’ salary slip

- Salaried account bank statement of last six months

- Latest Form 16 / ITR

- Proof of Income for Self Employed individuals:

- ITR along withcomputation for the last 2 FYs.

- Balance Sheet as well as the Profit & Loss account along with all annexures (duly CA certified and audited if applicable)

- Last six months statement of the business entity current account as well as the saving account statement of individual

- Copy of complete property documents (wherever applicable)

- Copy of Sell Agreement (if executed)

- Copy of the Allotment Letter/Buyer Agreement (Wherever applicable)

- Copy of Receipt/(s) of payment/(s) made to the developer (if applicable)

With a host of home loan benefits, the IIFL is an excellent choice for prospective homebuyers. Go through this article to know all about IIFL home loan eligibility. For more home loan related information, you can check our blog blogs. If you are still confused about anything, give us a call. NoBroker financial experts will guide you through the whole loan application process. So, what are you waiting for?

Top Indian Bank Home Loan Intrest Rates

FAQ’s

Ans- The IIFL home loan interest rate starts from a minimum of 8.20% per annum.

Ans- Yes, you can check the IIFL home loan application status online and offline.

Ans- There are no pre-closure charges for IIFL home loans as notified by the RBI.

Ans- The IIFL home loan processing fee can go up to 1.75% of the loan amount.

Ans- Certainly. NRIs can easily apply for IIFL home loans provided they have a foreign passport and have no “No entry” stamp for entering India (submission of application in person).