Advance tax provisions are if the total amount of tax estimated for the year is more than Rs 10,000 and if they have sources of income other than their wage. This applies to income from rent, capital gains from shares, winners from the lottery, and fixed deposits, among other things. The question arises of how to deposit advance tax online or at certain banking institutions, or when does one have to pay advance tax? In this article, you will learn everything from what is advance tax to advance tax payment.

Things we covered for you

What is Advance Tax Payment?

Here the basic question arises: What is Advance tax? A percentage of your yearly taxes may be paid in advance if you make an advance tax payment. If the tax due exceeds Rs. 10,000 in a fiscal year, advance income tax must be paid. This tax must be paid in the year that you receive your income.

If you have other sources of income other than your pay, an advance tax may be applicable. The notion becomes applicable, for instance, if you make money through investments that pay interest, capital gains, a company, a home or other property, or the lottery. Utilising the National Securities Depository or the Income Tax Department’s online tax payment website are other options for making an advance tax payment.

Advance Tax: Who Should Pay?

- Salaried Individuals, Freelancers, and Businesses: If your total tax liability amounts to Rs 10,000 or more within a financial year, you are obligated to pay advance tax. This criterion applies universally to salaried individuals, freelancers, and businesses.

- Senior Citizens: Advance tax for individuals aged 60 years or more, not engaged in business activities, is exempt. Only senior citizens in this age group who have business income are required to pay advance tax.

- Presumptive Income for Businesses: Taxpayers who have chosen the presumptive taxation scheme under section 44AD must make their complete advance tax payment in a single installment by or before March 15th. They also retain the option to settle all tax dues by March 31st.

Presumptive Income for Professionals: Independent professionals like doctors, lawyers, architects, etc., falling under the presumptive scheme under section 44ADA, must clear their entire advance tax liability in a single installment on or before March 15th. Alternatively, they have the flexibility to settle the entire amount by March 31st.

Self-Employed People and Businesses Advance Tax Payment Dates

| Advance Tax Payment Dates | Self-employed People and Businesses | Both Businesses and Individuals |

| Before September 15 of Fiscal Year | At least 30% of tax due | At least 45% of tax due |

| Before December 15 of Fiscal Year | At least 60% of tax due | At least 75% of tax due |

| By March 15 of Fiscal Year | 100% of tax due | 100% tax obligation |

| Before June 15 of Fiscal Year | – | 15% or more of tax due |

How to Make an Advance Tax Payment Online and Offline?

On non-TDS deducted income from self-employment, professional services, businesses, advance tax on capital gains, or any other source, there are a few easy procedures that must be followed. Through challan 280, people may pay advance taxes both online and offline. Challan 280 is often used by a company’s accounting division to pay advance tax. Advance taxes must be paid by the 15th day of every fiscal quarter. The financial year’s quarter months are June, September, December, and March.

Online Advance Tax Payment

Advance tax payment online may be made via the National Securities Depository Limited or Income Tax Department portals. For advance tax filing, taxpayers must have an account on these platforms. PAN is connected to the taxpayer’s account. Aadhaar card and PAN card must now be linked as well. Additionally, PAN must be connected to every bank account. Debit or credit information from taxpayers’ bank accounts has been instantly connected to IT records through PAN.

How to File Advance Tax Online?

Advance tax payments may be made offline at any approved bank branch that the Income Tax Department has granted the go-ahead. Advance tax payment online can be done.

Read: Covid-19 disrupting demand for office spaces

The processes for advance tax payment online are as follows:

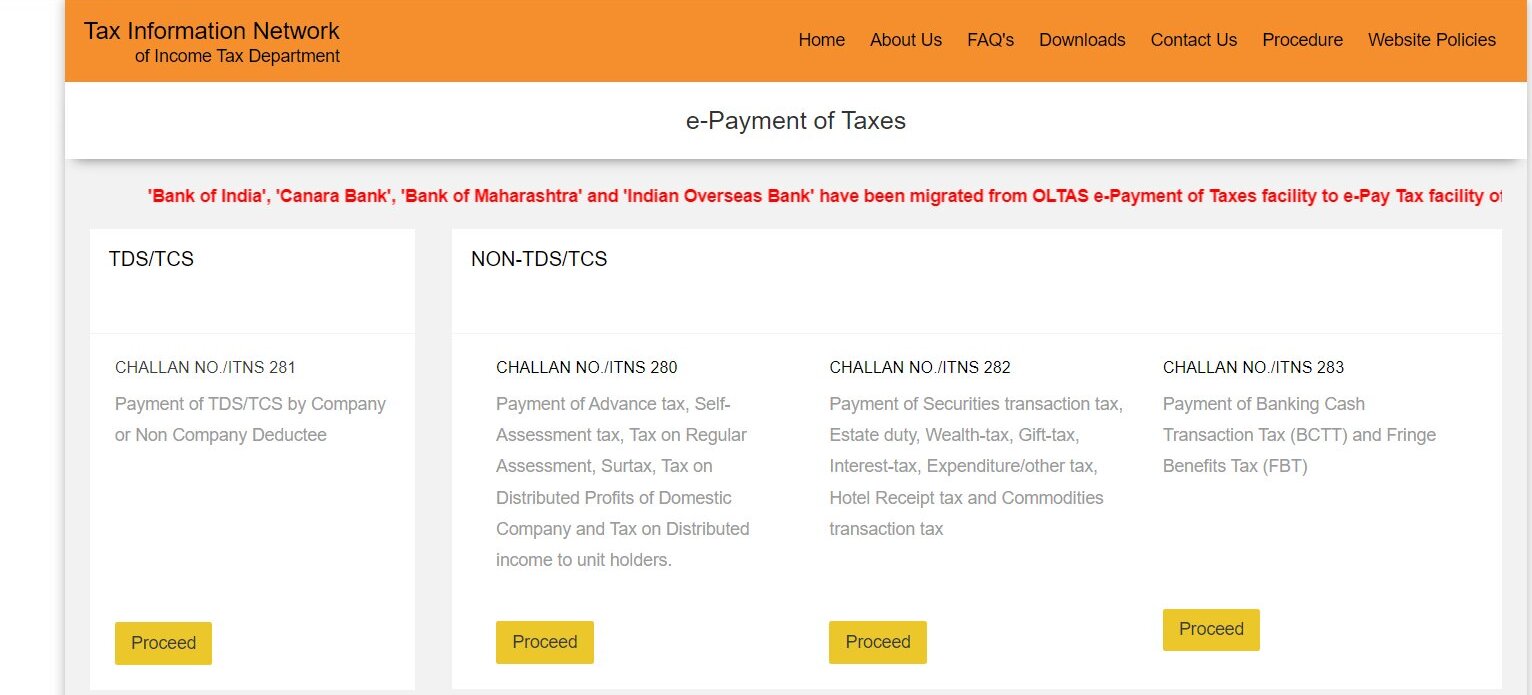

– Go to https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp to access the Tax Information Network website.

– Under “Challan No./ITNS 280” and “Non-TDS/ TCS,” choose the “Proceed” option.

– To create the challan, enter the information on the screen.

– Choose “(0020) Corporation Tax (Companies)” under “Companies.”

Applicable Taxes

– Choose “(0021) Income Tax (Other than Companies)” under the Other than Companies Tab.

Amount of Payment

To make the payment, choose ‘(100) Advance Tax’ from the list of choices.

Payment Method

You can use a debit card or net banking as your chosen payment method. It would help if you always chose the “Bank Name” option from the drop-down menu.

– Give us the specifics of your PAN (Permanent Account Number).

– The Assessment Year is now. Carefully consider your assessment year choice. Application to the assessment authority is required to correct an inaccurate AY. Take great care to prevent any hassles.

– Enter your address, email address, cell phone number, city/district, state, and PIN Code, which are all required fields.

– Fill out the captcha code.

– Select “Proceed”

– To finalise the transaction, you will go to the bank’s website.

– You will get the bank receipt after making the payment. The bank receipt may find the BSR code and challan serial number. Make care to preserve a duplicate of the challan for future use.

How Can I Get a Receipt for an Advance Income Tax Payment?

– Visit https://tin.tin.nsdl.com/oltas/index.html to see the advance tax payment challan.

– CIN (Challan Identification Number) Based View should be chosen. Enter the necessary information,

Read: TNRERA rules builders cannot deny refund to buyers on cancellations

– then click “View.” You have the choice to print or save a snapshot of the challan information once it appears on the screen.

Taxpayers may also get the receipt or challan for the advance tax payment by visiting the bank website where it was made. There will be an option to download the advance payment receipt.

Offline Advance Tax Payment

Additionally, advance tax payments may be made at bank locations approved by the IT department to receive them.The taxpayer may pay their advance tax on challan 280, accessible at the branches. The taxpayer must thoroughly complete all applicable sections and tick all boxes on the advance tax form. You may submit the paperwork and advance tax payment at the specified counter in cash or by check. The taxpayer should ensure they receive a counter receipt for their advance tax payment. A taxpayer at- may make an advance tax payment.

– ICICI bank

– Syndicate bank

– State bank of India

– Reserve bank of India

– HDFC bank

– Axis bank

– Punjab national bank penalties for Not Paying Advance Tax

– and other authorised banks

Penalties for Not Paying Advance Tax

| Situation | Penalty |

| Missing advance tax payment due date | Advance tax penalty of 1% simple advance tax interest per month on defaulted amount for three months. |

| Paying less than 30% of overall liability by September 25 | Advance tax penalty of 1% simple interest per month on shortfall for three months. |

| Entities/businesses with independent contractors | Required to pay a minimum proportion of tax obligations by deadlines. |

What are various Advance Tax Codes?

– Codes 100 and 300 are used to pay advance taxes, self-assessment taxes, regular assessment taxes,

Read: BBMP’s Door-to-Door Digitalization Initiative Set to Reshape Bengaluru’s Property Landscape

– Codes 106 and 107 are used to pay taxes on dividend distributions and distributed income to unit holders, respectively,

– And Advance tax code 102 is used to pay surtaxes.

What is Challan 280 for Advance Tax?

Users may submit advance income tax payments online using Challan 280 on the Income Tax Department of India website. One must choose this challan from the internet, fill out the form, and then utilise it to deposit the ITNS 280 payment advance tax online or offline. If you prefer to pay your taxes offline, download the challan ITNS 280 form from the Income Tax website, fill it out, and carry it to the bank.

Advance Tax Calculation & Advance Tax Liability Calculator

Many people are unaware of how to calculate advance tax; if you are reading this, you do not have to worry about these things. Here are some points where we discuss our services and how to calculate advance tax.

1- We provide our clients with an online advance tax calculator that calculates the precise amount that must be paid as advance tax.

Read: Investor sentiment improving, Housing Finance Companies raise money

2- To utilise this calculator properly, customers must input their name, age, residence status, TDS salary, taxable income, and the financial year for which they are paying.

3- After receiving these facts, the online advance tax calculator will calculate the amount that must be paid as tax for that fiscal year.

4- For the clients to utilise our advanced tax calculator smoothly and effectively, we make it a point to keep it routinely updated.

5- Our mobile-friendly online advance tax calculator may be utilised on PCs and mobile devices without a problem.

Advance Tax Exemptions

1- Advance tax for senior citizens and individuals who use presumed methods are excluded

2- The only people who are ever excused from paying advance taxes are those over 60, qualify as senior citizens, don’t own any commercial institution, and fall into this category.

3- Taxpayers who choose presumptive schemes—in which company revenue is always around 8% of turnover—may opt out of paying advance tax.

Procedure for Advance Tax

1- We follow a straightforward process to process advance tax payments online for our customers. Finding out whether the bank with whom our clients have online banking capabilities is registered for the online payment of advance income tax is the first step we take in this respect.

2-We cannot make such a payment on our client’s behalf if their bank is not included in the list of banks that permit online advance income tax payments.

3- Naturally, it is not required to deduct the required advance tax payment from the customer’s bank account.

4- Any account that offers the option of paying advance income tax online may also be used to make the payment. Next, we log onto tin-nsdl.com if the customer’s bank is mentioned there.

5- The final step is visiting services, choosing e-payment as an option, and selecting Challan No. ITNS 280.

6- The applicable taxes are 0021, which is income tax paid by people as opposed to businesses.

7- The Assessment Year selected is 2017–2018, and the payment method selected is 100 or Advance Tax.

8- The customer’s PAN number and other personal information are input. The PAN name appears on the screen, is confirmed, and finalises information.

9- The website of the client’s bank is then pointed out to us. The tax amount is entered into the challan after logging into the account, and payment is made.

10- We always remember to write down the transaction ID and print or keep a copy of the receiving challan file.

Difference between Advance Tax and Self-Assessment Tax

It would be an advance tax if the tax were paid for the same fiscal year using the projected income. Self-assessment tax would apply if the tax were paid after the fiscal year’s end is the basic difference between advance tax and self-assessment tax.

Difference between TDS and Advance Tax

The basic difference between TDS and advance tax is that the advance tax is not due from salaried people who come inside the TDS net. However, the advance tax will be charged on any profits derived from sources, including interest, capital gains, rent, and other non-salary income. One does not need to pay the advance tax if the TDS deducted exceeds the tax due for the year.

By now, we hope that you would have understood everything about advance tax payments in India. Taxation in India can be tricky to fully grasp and hence many people consult the tax experts at NoBroker to help with all of their taxation needs. The experts understand your requirements patiently and guide you to the perfect solution. If you’re interested, please leave a comment below this article; our executives will be in touch with you.

FAQs

Advance tax payment in India is basically a certain amount of tax that is paid much before the tax payment window closes (at the fiscal year-end). This is an alternative to paying a huge tax as a lump sum.

Advance tax due dates are March 15, 2023; you must submit the last instalment of your advance tax payment for the Fiscal Year (FY) 2022-2023. Before or on the advance tax due dates, taxpayers must pay the whole amount of their advance tax debt.

By paying in advance, you assist the government and yourself by avoiding the difficulty of paying the whole tax amount all at once; in the end, one and the foremost benefit of advance tax.

People with tax obligations of INR 10,000 or more must pay advance tax.

Any person who is a senior citizen (aged 60 years or above) and who does not have a considerable taxable income can get an exemption for advance tax payment.