- https://www.mudra.org/

- MUDRA Scheme Guidelines, myScheme Portal

- MUDRA Operational Framework, Ministry of Finance

- PMMY Annual Reports, RBI-aligned Lending Guidelines

- Union Budget 2024–25, Department of Financial Services

Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Table of Contents

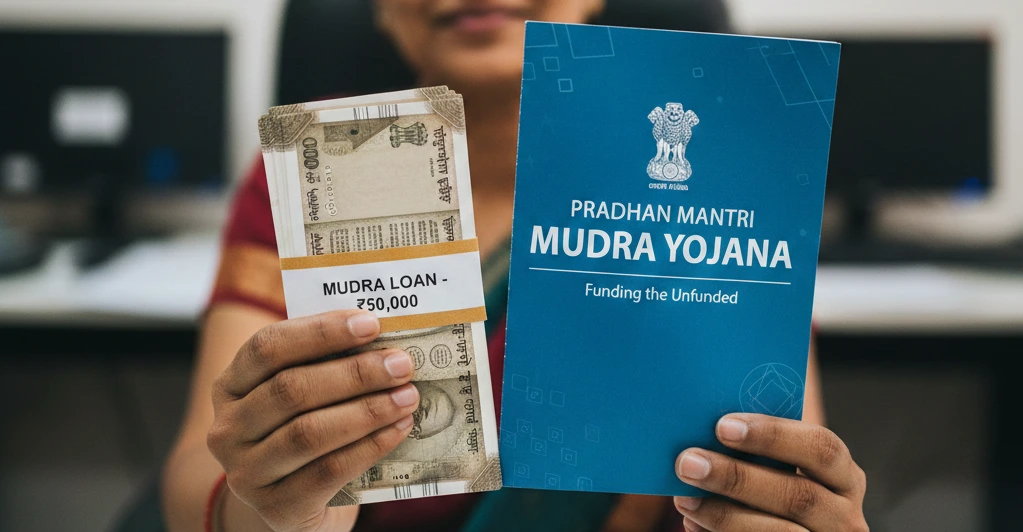

Pradhan Mantri Mudra Yojana (PMMY) is a flagship Government of India initiative that offers collateral-free Mudra loans up to ₹10 lakh to micro and small businesses across India. Introduced in 2015, the PM Mudra Loan Scheme aims to promote self-employment by providing easy access to formal credit for shop owners, traders, manufacturers, street vendors, and service providers.

Till date, PMMY has enabled loans to 47+ crore beneficiaries, making it one of the largest financial inclusion programs in the country. These loans are disbursed through banks, NBFCs, and micro-finance institutions, including SBI e-Mudra, helping entrepreneurs start new ventures, expand businesses, and reduce dependence on high-interest informal lenders.

Key Features of PM Mudra Loan Scheme (PMMY) - 2026

The Pradhan Mantri Mudra Yojana (PMMY) is a well-structured scheme designed to meet the financial needs of micro units at various stages of their business lifecycle. [1]

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

- Collateral-Free Loans: No collateral or third-party guarantee is required, making it easier for small businesses to access credit.

- Wide Loan Coverage: Loans are available under Shishu, Kishor, Tarun, and Tarun Plus categories to suit different business stages.

- Flexible Loan Amount: Funding ranges from up to ₹50,000 for beginners to ₹20 lakh for growing enterprises.

- Competitive Interest Rates: Interest rates are decided by lenders and generally remain affordable for small borrowers.

- Flexible Repayment Tenure: Repayment periods usually range from 1 to 5 years, with moratorium options in some cases.

- Easy Accessibility: Loans can be applied for through banks, NBFCs, MFIs, both online and offline.

- Support for New Businesses: Startups and first-time entrepreneurs are eligible to apply.

- Focus on Financial Inclusion: Special emphasis on women, SC, ST, and OBC entrepreneurs.

- Business Use Only: Loan funds must be used strictly for income-generating business activities.

- Pan-India Availability: The scheme is available across urban, semi-urban, and rural areas.

PM Mudra Loan EMI Calculator - Calculate Monthly EMI Online

| Month | Principal | Interest | Payment | Outstanding |

Steps to Calculate Pradhan Mantri Mudra Loan EMI

- Enter the loan amount you plan to borrow under the PM Mudra Loan scheme.

- Select the interest rate offered by your bank or NBFC.

- Choose the loan tenure (in months or years).

- Click on “Calculate EMI.”

- View your monthly EMI, total interest payable, and total repayment amount instantly.

Mudra Loan Categories under Pradhan Mantri Mudra Yojana (PMMY)

The Pradhan Mantri Mudra Yojana (PMMY) offers four loan categories, designed to match different stages of business growth and funding requirements. These categories are defined and periodically updated by the Government of India and MUDRA Ltd., as reflected in official scheme guidelines and Union Budget announcements.

- Shishu: Designed for new or early-stage businesses, this category provides loans of up to ₹50,000. It mainly supports first-time entrepreneurs and small vendors starting income-generating activities. [2]

- Kishore: Covers loans above ₹50,000 and up to ₹5 lakh, aimed at businesses that have moved beyond the startup phase and need funds for expansion or stabilisation. [3]

- Tarun: Offers loans above ₹5 lakh and up to ₹10 lakh for well-established micro-enterprises looking to scale operations, invest in equipment, or increase working capital. [4]

- Tarun Plus: Introduced under the Union Budget 2024–25, this category provides enhanced funding above ₹10 lakh and up to ₹20 lakh. It is available only to entrepreneurs who have successfully repaid an earlier Tarun loan, encouraging credit discipline and business growth. [5]

Mudra Loan Eligibility Criteria for PM Mudra Loan Scheme

To be eligible for the Pradhan Mantri Mudra Yojana (PMMY) loan, applicants must be Indian citizens who are running or planning to start a non-farm, income-generating micro or small enterprise, with total credit needs of up to ₹20 lakh.

Key Eligibility Criteria for PM Mudra Loan

- Applicant Status: The applicant must be an Indian citizen.

- Age Limit: The general age requirement is between 18 years and 65 years.

- Borrower Type: The scheme is open to multiple business structures, including:

- Individuals

- Sole proprietorships

- Partnership firms

- Private limited and public limited companies

- Other recognised legal entities

- Business Sector: The enterprise must operate in manufacturing, trading, or services. Allied agricultural activities such as poultry, dairy, and beekeeping are also eligible.

- Loan Purpose: The loan must be used strictly for business or income-generating purposes, not for personal expenses.

- Credit History: The applicant should have a satisfactory credit record and must not be a loan defaulter with any bank or financial institution.

- Business Plan: For higher loan categories (Kishore, Tarun, and Tarun Plus), lenders may ask for a viable business plan or project report, along with basic financial details such as sales records or balance sheets.

Exclusions

- Direct agricultural activities, such as crop cultivation, are generally not covered by this scheme.

- The applicant must not have any existing loan defaults.

How to Apply for PM Mudra Loan Online & Offline (Pradhan Mantri Mudra Yojana)

To apply for a Pradhan Mantri MUDRA Yojana (PMMY) loan, applicants can choose either the online or offline route. The scheme offers collateral-free loans to non-corporate, non-farm micro and small enterprises engaged in manufacturing, trading, or services.

Mudra Loan Online Apply Process (e-Mudra / Bank Website)

You can apply online through official government portals:

Steps to apply online:

- Visit the UdyamiMitra or JanSamarth portal

- Register or log in and select the appropriate loan category (Shishu, Kishore, Tarun, or Tarun Plus)

- Fill in personal, business, and professional details

- Upload the required documents

- Submit the application and save the application reference number

- The portal matches you with eligible lenders, after which you can choose an offer and proceed with digital approval

Offline Mudra Loan Application Process (Bank Branch)

Applicants can also apply directly through a lending institution.

- Visit a participating Public Sector Bank, Private Bank, RRB, NBFC, MFI, or Cooperative Bank

- Collect the PMMY application form from the branch or download it from the bank’s official website

- Fill in the form accurately and attach all required documents

- Submit the completed application at the branch

- The lender verifies the details and disburses the loan after approval

You can find participating lenders on the official MUDRA website:

Required Documents for PM Mudra Loan Scheme

Documents may vary slightly by lender and loan category, but generally include:

- Duly filled PMMY loan application form

- Identity proof: Aadhaar Card, PAN Card, Voter ID, Passport, or Driving Licence

- Address proof: Aadhaar/Passport, recent electricity or telephone bill, or bank statement

- Photographs: 2 recent passport-size photos

- Business proof: Registration, licence, or ownership documents (if available)

- Bank statements: Last 6–12 months

- Income proof: ITR and financial statements (usually for loans above ₹2 lakh)

- Machinery or asset quotation, if applicable

- Category proof: SC/ST/OBC/Minority certificate, if applicable

Who Can Apply for Pradhan Mantri Mudra Loan Yojana?

The Pradhan Mantri Mudra Yojana (PMMY) loan is available to Indian citizens who run or plan to start micro and small income-generating businesses in the non-farm sector.

Applicant Eligibility

- Citizenship: The applicant must be an Indian citizen.

- Age Limit: The applicant should generally be between 18 years and 65 years.

- Borrower Type: The scheme supports multiple business structures, including:

- Individuals

- Sole proprietorships

- Partnership firms

- Private limited and public limited companies

- Credit History: The applicant must not be a loan defaulter and should have a satisfactory credit record with banks or financial institutions.

Business Eligibility Under Mudra Loan Scheme

- Eligible Sectors: Micro and small enterprises engaged in manufacturing, trading, and service activities.

- Allied Agriculture: Agri-allied activities such as horticulture, fisheries, dairy, beekeeping, and similar services are covered.

- Income Generation: The business must be income-generating in nature.

- Credit Requirement: The total loan requirement should be up to ₹20 lakh.

Target Beneficiaries of PM Mudra Yojana

The scheme is designed to support a wide range of small business owners, including:

- Small shopkeepers and street vendors

- Micro manufacturing units

- Food service outlets and food processing businesses

- Repair shops, artisans, and craftsmen

- Commercial vehicle operators such as truck and taxi owners

- Women entrepreneurs, who account for a significant share of beneficiaries

- Entrepreneurs from SC, ST, and OBC communities

Who Cannot Apply for PM Mudra Loan?

- Individuals seeking loans for personal or non-business expenses

- Businesses engaged only in traditional farming activities such as crop cultivation

- Applicants who have defaulted on previous loans with banks or financial institutions

PM Mudra Loan Interest Rate & Repayment Terms

The Pradhan Mantri Mudra Yojana (PMMY) provides collateral-free loans to non-corporate, non-farm small and micro-enterprises. The scheme follows flexible interest rates and repayment terms set by individual lenders.

1. Interest Rates (2025)

- Rate Structure: Interest rates are not fixed by the government. They are decided by banks, NBFCs, and MFIs as per RBI guidelines and the borrower’s credit profile.

- Typical Range: Rates usually start from 8.85%–9.30% per annum and may go up to 12% or higher, depending on the lender and risk level.

- Bank-Specific Examples (2026):

- SBI: Around 12.15% p.a. (approximately 3.25% above EBLR).

- UCO Bank: Starting from 8.85% p.a.

- Union Bank of India: Between 10.30% and 11.75%, based on loan category.

- Interest Concessions: Women entrepreneurs may receive an interest rate concession of up to 0.25%.

2. Repayment Terms

- Flexible Repayment: Designed to suit the cash flow of small businesses.

- Tenure: Generally ranges from 1 to 5 years, with some lenders extending up to 7 years for higher loan amounts.

- Moratorium Period: A grace period may be provided before principal repayment begins:

- Loans below ₹5 lakh: Up to 6 months

- Loans between ₹5 lakh and ₹20 lakh: Up to 12 months

- Working Capital Loans: Overdraft (OD) and Cash Credit (CC) facilities are usually repayable on demand and reviewed annually.

3. Other Key Terms

- Processing Fees: Usually nil for Shishu loans. For Kishore and Tarun loans, fees generally range from 0% to 0.50% plus applicable taxes.

- Collateral Requirement: No collateral or third-party guarantee is required for loans up to ₹10 lakh.

Banks and Financial Institutions Offering Mudra Loans

PM Mudra Loans (PMMY) are offered through a wide network of 190+ Member Lending Institutions (MLIs) across India. These include public sector banks, private banks, regional rural banks (RRBs), small finance banks, NBFCs, and microfinance institutions (MFIs). Major banks like SBI, PNB, Bank of Baroda, HDFC Bank, ICICI Bank, and Axis Bank actively provide Mudra loans. Applicants can apply by visiting a nearby branch or through online platforms offered by participating lenders.

| Lender Type | Examples |

|---|---|

| Public Sector Banks | State Bank of India, Bank of Baroda, Punjab National Bank, Canara Bank |

| Private Sector Banks | HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra Bank |

| Regional Rural Banks (RRBs) | State-wise Gramin Banks offering local access |

| Small Finance Banks (SFBs) | AU SFB, Equitas SFB, Jana SFB |

| NBFCs & MFIs | Muthoot Fincorp, Ujjivan, Satin Credit Care |

Interest Rates by Top Lenders (2026)

Interest rates are set by individual banks based on their base rates or MCLR and are subject to change.

| Bank / Lender | Interest Rate (p.a.) | Typical Tenure |

|---|---|---|

| UCO Bank | Starts at 8.85% | Up to 7 Years |

| Punjab National Bank | 9.40% – 12.35% | Up to 7 Years |

| State Bank of India (SBI) | Starts at 12.15% | Up to 7 Years |

| Union Bank of India | 10.30% – 11.75% | 1 to 3 Years |

| HDFC Bank | 10.75% onwards | Lender's discretion |

| Axis Bank | 15% – 19.35% | Lender's discretion |

PM Aadhar Card Loan Benefits

The benefits described below are for government schemes like PM Mudra Yojana (PMMY) and PM SVANidhi, where an Aadhar card is the main requirement for fast processing.

- Collateral-Free: You do not need to provide any property, gold, or security as a guarantee to get the loan.

- Instant Verification (e-KYC): By using your Aadhar card, banks can instantly verify your identity and address, significantly reducing paperwork and approval time.

- No Processing Fees: For smaller loans (like the Shishu category under Mudra), most banks do not charge any processing fees.

- Direct Benefit Transfer (DBT): The loan amount is credited directly to the bank account linked to your Aadhar card, ensuring a transparent and secure transfer.

PMMY Loan Disbursement Data (2024–2025)

In FY 2024–25, the Pradhan Mantri Mudra Yojana (PMMY) continued its strong growth, supported by the launch of Tarun Plus, which increased the maximum loan limit from ₹10 lakh to ₹20 lakh effective October 24, 2024.

1. Overall Performance (FY 2024–25)

As of February 28, 2025, cumulative disbursement under PMMY crossed ₹32.40 lakh crore, covering more than 52.07 crore loan accounts since inception.

| Metric | Provisional Data (FY 2024–25)* |

|---|---|

| Total Loans Sanctioned | 4,79,48,320 accounts |

| Average Loan Size | ₹1.02 lakh |

| Women Borrowers | 68% of total accounts |

Data reported up to March 31, 2025 / February 28, 2025, depending on source.

2. Category-Wise Trends

A clear shift toward higher-value loans has emerged in 2025:

- Shishu: Continues to dominate by number of accounts

- Kishore: Share increased sharply to 44.7% in FY 2024–25, from 5.9% in 2016

- Tarun & Tarun Plus: Showing steady growth as businesses expand and scale operations

3. Top States by Disbursement (Cumulative till Feb 2025)

The states with the highest Mudra loan disbursements since 2015 are:

- Tamil Nadu: ₹3,23,647.76 crore

- Uttar Pradesh: ₹3,14,360.86 crore

- Karnataka: ₹3,02,146.41 crore

- West Bengal: ₹2,82,322.94 crore

- Bihar: ₹2,81,943.31 crore

4. Previous Year Snapshot (FY 2023–24)

Before the Tarun Plus expansion, PMMY recorded its strongest performance in FY 2023–24:

- Total Sanctioned: ₹5.41 lakh crore

- Total Disbursed: ₹5.32 lakh crore across 6.68 crore accounts

- Top Lending Bank: State Bank of India, with ₹43,714.32 crore disbursed

Things to Keep in Mind Before Applying

To ensure a smooth application and maximize approval chances, applicants must carefully prepare their documentation and business plan.

- Viable Business Plan: Lenders scrutinize the business plan to ensure viability. A clear, well-documented plan outlining the loan's purpose and expected financial outcomes is crucial.

- Credit History: While collateral-free, the scheme still requires the applicant to have a decent credit history and no prior loan defaults with banks or financial institutions.

- Correct Category Selection: Applying for the correct category (Shishu, Kishor, or Tarun) based on the current business stage and funding requirement is essential for quick processing.

- KYC Accuracy: All identity and address proofs must match perfectly with the details furnished on the application form and the Aadhaar card.

Get an Instant Cash Loan Via NoBroker

For urgent personal or business needs outside the structured government process, NoBroker offers a modern, fast, and transparent lending solution. Our platform provides instant cash loans designed for quick disbursement, utilizing a completely digital process accessible via our best personal loan app in India. We partner with RBI-regulated institutions to offer competitive rates and minimal documentation, ensuring you get the funds you need quickly and securely, complementing the overall mission of financial access initiated by the PM Mudra loan scheme.

Frequently Asked Questions

Ans: The maximum loan amount sanctioned under the Pradhan Mantri Mudra Yojana is ₹10 lakh, available under the Tarun category.

Ans: No, the PM Mudra loan is a government scheme that offers collateral-free loans to micro and small enterprises.

Ans: Yes, Basic Registration (Shishu) usually does not require GST. However, a business registration certificate or a trade license is necessary for all categories.

Ans: Approval typically takes 7–10 days, depending on the financial institution and whether the application is complete and accurate.

Ans: While there is no fixed interest subsidy, the scheme promotes loans to disadvantaged sections, who may receive preferential rates and support from lending institutions.

Loved what you read? Share it with others!

Most Viewed Articles

Low CIBIL Score Loan Apps List: Best Apps for Instant Loans with Bad Credit for 2026

May 20, 2025

263761+ views

7 Days Loan Apps List in India with Quick Approval and Fast Disbursal in 2026

January 13, 2026

150084+ views

Top 20 RBI Approved Loan Apps List in India (2026): Verified and Safe Platforms

March 12, 2025

124419+ views

Top 15 Loan Apps in India: Fast Approval, Low Interest Rates (2025)

September 1, 2025

93337+ views

15 Best 500 Rs Loan Apps in India with Minimal Documentation and Fast Bank Transfer

September 18, 2025

85209+ views

Recent blogs in

MGVCL Bill Payment: Online Process, Payment Methods, Due Date and Receipt Download 2026

January 28, 2026 by Anda Warner

₹8 Lakh Personal Loan EMI: Monthly Payment, Calculation and Interest in 2026

January 13, 2026 by Vivek Mishra

7 Days Loan Apps List in India with Quick Approval and Fast Disbursal in 2026

January 13, 2026 by Krishnanunni H M

PM Mudra Loan Explained: Eligibility, Benefits & Online Application Process in 2026

December 18, 2025 by Priyanka Saha

What is NPS Vatsalya Scheme – Benefits, Eligibility and How It Works

December 16, 2025 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!