- https://www.indiacode.nic.in/bitstream/123456789/1988/1/A1999_42.pdf

- https://www.rbi.org.in/commonman/English/scripts/FAQs.aspx?Id=1855

- https://services.vfsglobal.com/one-pager/india/united-states-of-america/miscellaneous-services/pdf/PoA-Affidavit-Checklist-Final-July-29.pdf

- https://incometaxindia.gov.in/Pages/international-taxation/dtaa.aspx

Table of Contents

Loved what you read? Share it with others!

NRI Buying Property in India (2026 Guide): Rules, Taxation, Documents & Investment Strategy

Table of Contents

Buying property in India as an NRI can be confusing. Many NRIs face challenges with FEMA rules, taxation, repatriation, and legal restrictions on foreigners buying property. Unsure which city offers the best ROI? This 2026 guide on NRI buying property in India covers rules, taxes, required documents, and top investment cities like Bangalore, Hyderabad, and Pune, helping NRIs make smart, profitable, and hassle-free property investments while staying fully compliant with Indian regulations.

Can NRI Buy Property in India?

Under FEMA, 1999 [1], an NRI is an Indian citizen residing abroad for more than 182 days. The purchase of property by an NRI in India is allowed for residential and commercial properties, but not agricultural land, plantation, or farmhouses. Unlike NRIs, Overseas Citizenship of India (OCI) and Person of Indian Origin (PIO) cardholders have different rules governing property ownership in India; OCI & PIO cannot vote or hold government jobs.

FEMA Rules for Purchase of Property by NRI in India (2026 Update)

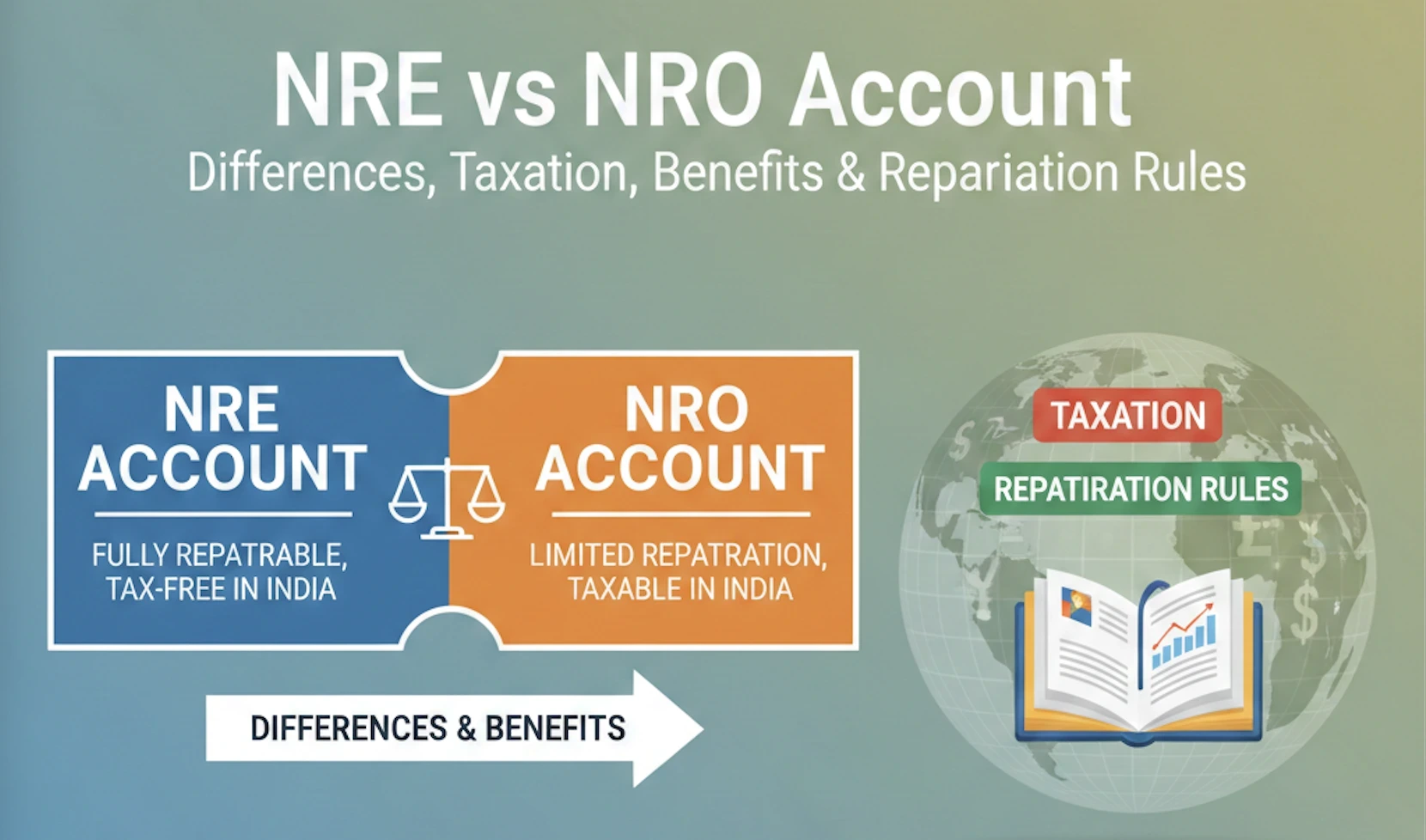

NRIs can buy residential and commercial property in India under FEMA 1999 (Sections 5 & 6) [2] with RBI approval. Payments should be made using NRE/NRO accounts or foreign funds only. Agricultural land, plantation and farmhouses are not allowed. Following legal guidelines, RBI permissions, and proper documentation ensures the NRI property purchase is fully compliant and hassle-free.

Documents Required for an NRI to Buy Property in India

Buying property in India as an NRI requires proper paperwork. The documents required for an NRI to buy a property in India ensure smooth, legal, and hassle-free property ownership. Below is the list of documents required:

- Passport copy: Proof of identity

- Visa or OCI card: Valid residency status

- PAN card: Tax identification in India

- Overseas address proof: Bank statement, utility bill, or driver’s license.

- NRE/NRO bank details: For payment and transactions

- Power of attorney [3]: If buying through a representative

Step-by-Step Process of NRI Buying Real Estate in India

Buying real estate in India as an NRI involves several steps to ensure compliance and safety. Following the proper procedure makes the purchase smooth, legal, and profitable. Below is the step-by-step process for buying:

- Verify eligibility: Confirm NRI status under FEMA and restrictions on property types.

- Choose property type: Residential or commercial, avoiding agricultural land and farmhouses.

- Legal due diligence: Check title, approvals, and encumbrances.

- Open NRE/NRO account: Required for transaction and repatriation.

- Transfer funds: Use legal banking channels for payments.

- Execute agreement: Sign the sale deed with the seller

- Register property: Complete property registration at the local authority.

- Pay stamp duty: As per state regulations.

- TDS compliance: Deduct tax if applicable for NRIs

Taxation on NRI Property in India (Rental Income & Capital Gains)

Buying NRI real estate in India comes with taxation on rental income and capital gains. Understanding rules ensures compliance and maximises benefits.

Tax on Rental Income

- 30% standard deduction: An NRI can claim 30% of the rental income as a deduction for maintenance and repair.

- TDS rules: Tenants must deduct 30% TDS on rental payments to NRI and deposit it with the government.

Capital Gains Tax (Short vs long term)

| Holding Period | Tax Rate | Indexation | TDS |

| ≤ 24 months (residential/commercial) | 30% (plus surcharge & cess) | Not applicable | 10% |

| > 24 months | 20% (with indexation) | Available | 20% |

DTAA Benefits

NRIs can claim tax relief under the Double Taxation Avoidance Agreement [4] to avoid paying tax twice in India and their country of residence.

NRI Home Loan in India: Eligibility, Interest Rates & Documents

NRIs can avail of home loans in India to invest in or purchase property. Understanding eligibility, documents, and banks ensures a smooth borrowing process.

- NRIs can take home loans in India to buy residential and commercial properties.

- Eligible applicants: Indian citizens, OCI/PIO card holders, aged 21-65 with stable overseas income.

- Loan-to-Value (LTV) ratio: 75%-90% of property value, depending on bank and profile.

- Required documents: Passport, Visa/OCI, PAN, income proof, bank statements, property papers, NRE/NRO account, Power of Attorney (if applicable)

- Top banks: SBI, HDFC, ICICI & Axis Bank have competitive rates and easy processing.

Best Cities for NRI Investment in India Real Estate (2026 ROI Analysis)

Investing in property can be tricky for NRIs. This guide on NRI investment in India real estate highlights the top cities in 2026, showing prices, rental yields, and growth potential.

| City | Avg Price (₹/sq. ft) | Rental Yield | Growth Potential | Ideal For |

| Bangalore | ₹7,500-₹12,000/sq/ft | 3-3.6% rental return | High | It professionals, long-term growth |

| Hyderabad | ₹6,000-₹8,500/sq/ft | 3-3.5% | High | Affordable, tech jobs |

| Pune | ₹6,000-₹10,000/sq.ft | 3-3.4% | Moderate | Families, long-term rental |

| Mumbai | ₹25,000+/ sq.ft | 2.2.6% | Very high | Premium, stable investment |

| Chennai | ₹5,500- ₹9,000/ sq.ft | 2.8-3.2% | Moderate | Steady rental income |

| Gurgaon | ₹9,000- ₹10,500/ sq.ft | 3-3.5% | High | Corporate rentals, luxury |

NRI vs Resident Buying Property in India: Key Differences

| Factors | NRI | Resident |

| Eligibility | Must qualify under FEMA (indian citizen living abroad) | Indian resident citizen |

| Property Types | Residential & commercial only | Can buy all property types, including agricultural land |

| Payment Mode | Through NRE/NRO/FCRN accounts or foreign remittance | Through Indian bank accounts |

| TDS on Purchase | Higher TDS applicable when selling property | Standard TDS rules apply |

| Home Loan | Based on overseas income, stricter checks | Based on Indian income |

| Repatriation | Allowed with limits under RBI rules | Not applicable |

| Documentation | Passport, visa/OCI, overseas proof required | Standard KYC documents |

Common Mistakes NRIs Make While Buying Property in India

NRIs often make costly common mistakes due to a lack of legal clarity, tax planning, and proper financial guidance. Check below for common mistakes:

- Skipping proper title checks can lead to legal disputes, fraud, or ownership issues later.

- Buying a restricted property type and ignoring FEMA regulations may lead to compliance issues and penalties.

- Without understanding RBI limits, transferring sale proceeds abroad becomes difficult.

- Overlooking TDS, capital gains, or rental tax reduces overall investment returns.

Is NRI Investment in India Real Estate Worth It in 2026?

Investing in Indian property in 2026 appears promising for NRIs seeking stable returns and long-term wealth growth. Below are a few points to keep an eye on:

- Real estate moves hand in hand with inflation. As construction costs and property demand rise, property values tend to increase, helping protect long-term purchasing power.

- If the Indian rupee weakens against currencies such as USD, AED, or GBP, NRIs can invest at relatively lower effective costs, gaining a currency advantage.

- Major cities like Bangalore, Mumbai, Hyderabad, and Gurgaon have shown steady appreciation over the past decade, especially in IT & infrastructure-driven markets.

- Growing urban migration, startup growth, and corporate expansion are increasing rental demand, particularly in tech hubs, leading to 3-5% average rental yields in top cities.

- For NRIs with a 5-10-year horizon, Indian real estate in 2026 offers a balanced mix of capital appreciation, rental income, and currency appreciation.

Frequently Asked Questions

NRIs can buy multiple residential and commercial properties in India without limit, but agricultural land and farmhouses remain restricted.

GST applies only to under-construction properties at applicable rates; completed properties with occupancy certificates are exempt from GST.

NRIs can purchase under construction property in India, subject to FEMA compliance, proper documentation, and payment through approved banking channels.

Yes. NRIs can buy residential and commercial property without RBI approval. Agricultural land and farmhouses are restricted.

Aadhaar is not mandatory for NRIs living abroad, but PAN is compulsory for property transactions and tax compliance.

NRIs can gift residential or commercial property to relatives in India, following FEMA guidelines and applicable stamp duty rules.

TDS for NRI sellers is 20% on long-term gains and 30% on short-term gains, plus applicable surcharge and cess.

Recommended Reading

NRI Buying Property in India (2026 Guide): Rules, Taxation, Documents & Investment Strategy

January 31, 2025

7944+ views

Buying A Resale Home from NRIs: Required Documents, Eligibility and Calculations in 2026

June 1, 2025

7715+ views

NRI Property Registration Process: Know Eligibility and Required Documents for 2026

January 3, 2025

4411+ views

New Rules for NRI in India: Essential Tax Updates

January 31, 2025

2674+ views

Loan Against Property for NRI: A Guide to Flexible Financing: Benefits, Eligibility & More in 2026

January 31, 2025

1172+ views

Most Viewed Articles

NRI Power of Attorney for Property in India: How to Apply, Documents Required and Format

June 1, 2025

30920+ views

Know About ICICI NRI Account: Document Required, Eligibility and Application Process in 2026

January 31, 2025

27172+ views

NRI Accounts in India: List of Best NRE, NRO & FCNR Accounts in 2026

June 1, 2025

18148+ views

NRE vs NRO Account: Differences, Taxation, Benefits & Repatriation Rules

January 31, 2025

10019+ views

TDS on Sale of Property by NRI: 2026 Tax Rates, Rules & Process

June 1, 2025

9374+ views

Loved what you read? Share it with others!

Recent blogs in

NRI Rights in India for Property: Ownership, Inheritance & Legal Rules for 2026

November 21, 2025 by Vivek Mishra

What is NRI Certificate: Meaning, Uses, Documents Required & Procedure in India

August 25, 2025 by Vivek Mishra

Power of Attorney from UAE to India: Format, Documents & Legal Process in 2026

August 25, 2025 by Vivek Mishra

Power of Attorney for India Property from UK: Format, Documents & Legal Process in 2026

August 25, 2025 by Vivek Mishra

DTAA Between India And France: Tax Relief, TDS Rules & Benefits in 2026

August 22, 2025 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!