Table of Contents

Loved what you read? Share it with others!

NRI Non-Repatriable Funds: Meaning, Rules, Taxation & Limits in 2026

Table of Contents

For any Non-Resident Indian (NRI) managing their finances in India, understanding the terms ‘repatriable’ and ‘non-repatriable’ is essential. This guide focuses on explaining the concept of NRI non-repatriable funds and investments. In simple terms, this means that the money earned or held in India has certain restrictions on being transferred abroad. We will explore the NRI non-repatriable meaning in detail, helping you manage your Indian income and investments with clarity and confidence.

NRI Non-Repatriable - Quick Info

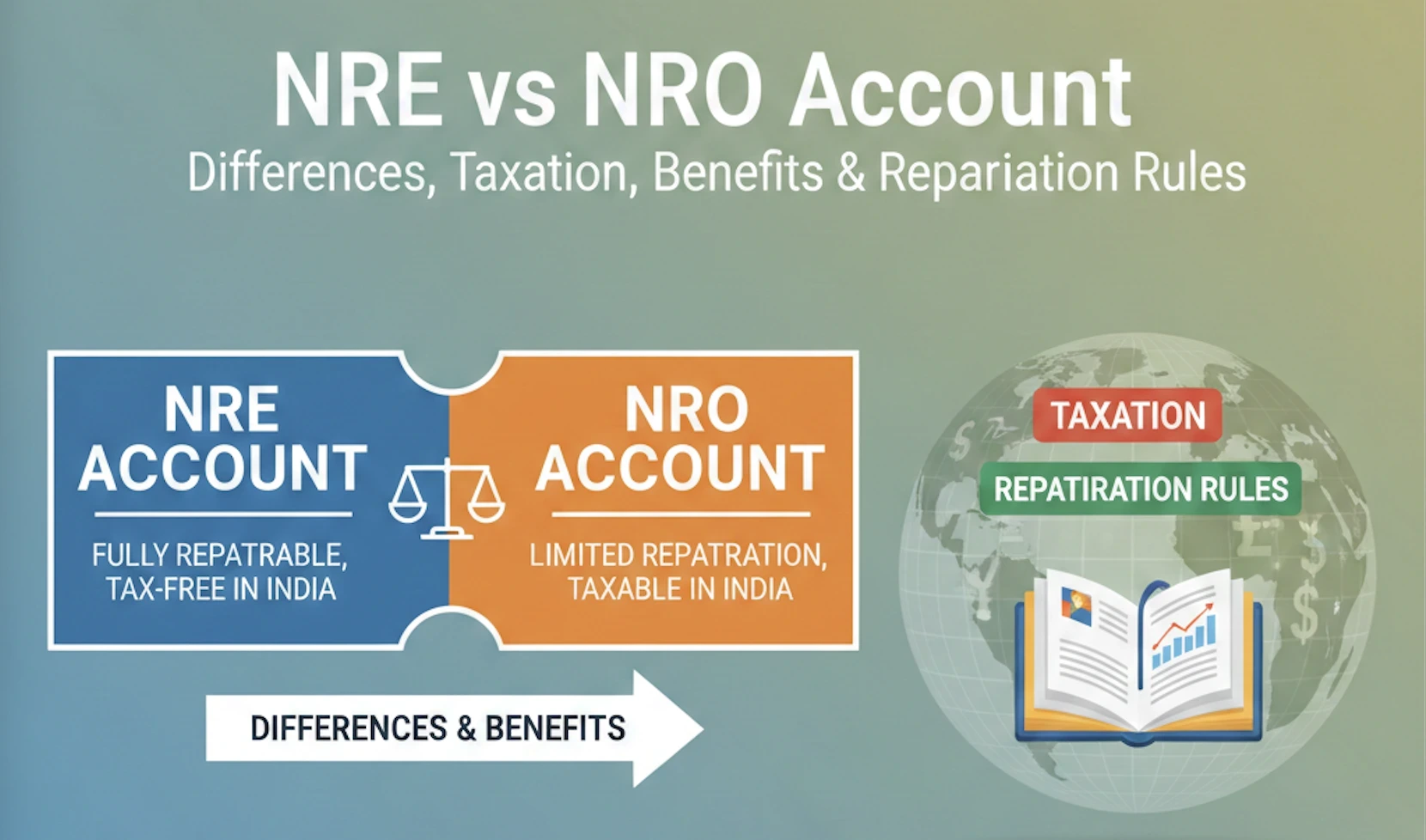

Here is a quick comparison to help you understand the core difference between repatriable and non-repatriable funds, which are primarily managed through different types of NRI accounts.

| Attribute | Repatriable (Primarily NRE Account) | Non-Repatriable (Primarily NRO Account) |

|---|---|---|

| Source of Funds | Foreign currency earnings remitted to India. | Income earned within India (e.g., rent, dividends). |

| Repatriability | Principal and interest are freely and fully repatriable. | Principal is non-repatriable, but funds up to USD 1 million can be remitted per year with conditions. |

| Taxation in India | Interest earned is tax-free in India. | Interest earned and other credits are taxable in India. |

| Account Currency | Maintained in Indian Rupees (INR). | Maintained in Indian Rupees (INR). |

Types of NRI Accounts and Repatriability

The concept of repatriability is directly tied to the type of bank account an NRI uses to manage their funds in India. Each account is designed for a specific purpose.

- Non-Resident External (NRE) Account: This is a repatriable account. You open it to park your foreign earnings in India in Indian Rupees. Both the principal amount and the interest earned are fully and freely repatriable. The interest is also tax-free in India.

- Non-Resident Ordinary (NRO) Account: This is the primary non-repatriable account. It is used to manage the income you earn in India, such as rent, salary, dividends, or pension. The funds in this account are subject to Indian tax laws.

- Foreign Currency Non-Resident (FCNR) Account: This is also a repatriable account, similar to an NRE account. The main difference is that the account is maintained in a foreign currency (like USD, GBP, etc.), which protects it from fluctuations in the Indian Rupee exchange rate.

Understanding the Difference Between NRI, PIO and OCI status can also help navigate these financial regulations.

Examples of Non-Repatriable Transactions

Non-repatriable transactions are essentially any income or funds that are earned in India and credited to your NRO account. Here are some common examples.

- Rental Income: Rent collected from a property you own in India.

- Dividends and Interest: Earnings from your investments in Indian stocks, mutual funds, or fixed deposits.

- Salary or Pension: Any salary, pension, or professional fees credited in India.

- Sale Proceeds: Money received from selling an asset, such as property or investments, that was originally purchased using Indian Rupees.

- Gifts: Monetary gifts received from Indian residents.

RBI Rules on Non-Repatriable Investments

The Reserve Bank of India (RBI), through the Foreign Exchange Management Act (FEMA), sets the rules for all NRI transactions. The NRO account is the designated channel for any investment by nri on a non-repatriation basis. The most important rule to understand is the exception to the non-repatriable nature of the NRO account. While the account is fundamentally designed to keep funds within India, the RBI has made a significant provision: an NRI can remit up to USD 1 million per financial year from their NRO account balance to their overseas account. This remittance is subject to the payment of all applicable taxes and requires specific documentation. These regulations are a key part of the broader FEMA Rules for NRIs.

Taxation of Non-Repatriable Income in India

A crucial aspect of non-repatriable funds is that they are subject to Indian tax laws. Any income credited to your NRO account is taxed at the source or when you file your returns.

| Type of Income (in NRO Account) | Taxability in India | Applicable TDS (Tax Deducted at Source) |

|---|---|---|

| Interest on NRO Deposit | Taxable at applicable slab rates. | 30% (+ surcharge and cess). |

| Rental Income | Taxable at applicable slab rates. | 31.2% of the rent paid by the tenant. |

| Dividends from Indian Companies | Taxable at applicable slab rates. | 20% (+ surcharge and cess). |

| Long-Term Capital Gains | Taxed at specific rates (e.g., 20% for property). | TDS at 20% (+ surcharge and cess). |

Managing your tax obligations is a vital part of handling non-repatriable funds. A clear understanding of Income Tax for NRIs is essential for compliance.

Investing in India Using Non-Repatriable Funds

You can use the balance in your NRO account to make various non-repatriable investments by an NRI. These investments allow you to grow your Indian earnings within the country. Popular NRI non-repatriable investment options include purchasing Indian company shares, investing in mutual funds, buying real estate, and subscribing to the National Pension System (NPS).

How to Convert Non-Repatriable to Repatriable (if possible)?

While you cannot directly convert non-repatriable funds into repatriable funds, you can effectively achieve this by transferring money from your NRO account to your NRE account under the USD 1 million scheme.

- Step 1: Place a request with your bank for the transfer of a specific amount from your NRO to your NRE account.

- Step 2: Submit Form 15CA online. This is a self-declaration stating that you have paid all due taxes on the funds being remitted.

- Step 3: Submit Form 15CB. This is a certificate from a qualified Chartered Accountant verifying the tax details mentioned in Form 15CA.

- Step 4: Provide any other supporting documents requested by the bank to prove the source of funds.

- Step 5: Once the bank is satisfied with the documentation and tax compliance, the funds will be transferred.

This process is a key part of the [NRO account repatriation rules].

How NoBroker Can Help with NRI Services?

Understanding the difference between repatriable and non-repatriable is the first step, but managing the actual remittance process can be daunting from abroad. Navigating the paperwork for tax compliance and fund transfers, such as filing Form 15CA and 15CB, requires careful attention to detail and professional oversight. NoBroker’s network of financial and legal experts can assist NRIs with this complex documentation, ensuring a smooth, compliant, and hassle-free process for managing and remitting your funds from India.

Frequently Asked Questions

Ans: It means that funds earned or held in India, typically in an NRO account, cannot be freely transferred abroad and are subject to RBI rules and limits.

Ans: Yes, while the principal amount in an NRO account is non-repatriable, the interest earned on it can be repatriated after the deduction of applicable taxes.

Ans: Remittances above the USD 1 million limit per financial year require special permission from the Reserve Bank of India (RBI).

Ans: The core rules are generally stable, but the government may make amendments. It's always advisable to check for the latest updates or consult with a financial expert.

Ans: For NRIs, the maturity proceeds from a PPF account are credited to the NRO account and are therefore considered non-repatriable, subject to the USD 1 million remittance limit.

Recommended Reading

Income Tax for NRI in India (2026 Guide): Tax Slab, Foreign Income, TDS & Capital Gains Explained

January 31, 2025

7168+ views

NRO Account Taxation: Rules on Interest, Rent, Dividends, and TDS Deduction in India 2026

January 15, 2025

6888+ views

Demystifying Tax Residency Certificates for NRIs and Business Owners

January 31, 2025

5773+ views

NRI Gift Tax in India: Understanding Rules, Exemptions, and Tax Liability for NRIs

January 31, 2025

4274+ views

New Rules for NRI in India: Essential Tax Updates

January 31, 2025

2673+ views

Most Viewed Articles

NRI Power of Attorney for Property in India: How to Apply, Documents Required and Format

June 1, 2025

30855+ views

Know About ICICI NRI Account: Document Required, Eligibility and Application Process in 2026

January 31, 2025

27165+ views

NRI Accounts in India: List of Best NRE, NRO & FCNR Accounts in 2026

June 1, 2025

18133+ views

NRE vs NRO Account: Differences, Taxation, Benefits & Repatriation Rules

January 31, 2025

10009+ views

TDS on Sale of Property by NRI: 2026 Tax Rates, Rules & Process

June 1, 2025

9310+ views

Loved what you read? Share it with others!

Recent blogs in

NRI Rights in India for Property: Ownership, Inheritance & Legal Rules for 2026

November 21, 2025 by Vivek Mishra

What is NRI Certificate: Meaning, Uses, Documents Required & Procedure in India

August 25, 2025 by Vivek Mishra

Power of Attorney from UAE to India: Format, Documents & Legal Process in 2026

August 25, 2025 by Vivek Mishra

Power of Attorney for India Property from UK: Format, Documents & Legal Process in 2026

August 25, 2025 by Vivek Mishra

DTAA Between India And France: Tax Relief, TDS Rules & Benefits in 2026

August 22, 2025 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!