Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Lower TDS Certificate for NRI: Step-by-Step Process to Application and Benefits for NRIs

Table of Contents

Selling a property in India and facing a high TDS deduction? What is the process for an NRI to get a certificate for a lower or zero TDS rate on the sale? A lower TDS certificate for NRI is an approval issued by the Income Tax Department under Section 197 of the Income Tax Act. It allows TDS to be deducted at a reduced rate based on the actual tax liability of the NRI. This is particularly important when selling a property, as buyers are otherwise required to deduct TDS at 20%–30% on the full sale value, regardless of the actual capital gains. By obtaining this certificate, NRIs ensure that only the correct tax amount is deducted, avoiding excess tax outflow and long refund delays. This guide explains why it’s useful and how to obtain one, helping you manage your taxes more effectively from afar.

What is TDS for NRIs?

Tax Deducted at Source, or TDS, is a method used by India to collect taxes on earnings before the individual receives them. For Non-Resident Indians (NRIs), this means when they earn money from Indian sources, the government takes part of it as tax right away. This helps make sure taxes are paid on time. For NRIs, knowing about TDS is crucial because it affects their income from India. Learning about TDS can help individuals plan better and avoid any financial surprises.

When Do NRIs Need a Lower TDS Certificate?

NRIs who receive income from India, such as rent, interest, dividends, or capital gains, often face a default TDS on rent paid to NRIs, imposed at the maximum marginal rate. To avoid high tax deductions, NRIs can apply for a lower TDS deduction certificate under Section 197 of the Income Tax Act .

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Here are the key points when NRIs need a lower TDS certificate:

- If the NRI's effective tax liability is lower than the default withholding rate, applying for a lower TDS certificate ensures only a certain amount is deducted.

- Without this certificate, TDS is deducted at the maximum rate, which can result in substantial amounts being frozen in refunds.

- Applying before major income events helps prevent high withholding across multiple payments.

- Under the proposed tax reform (Clause 395), nil TDS certificates will be discontinued, allowing only lower TDS certificates.

- If the NRI is eligible for lower rates under DTAA provisions or other deductions, a lower TDS certificate is necessary to reflect those in the withholding.

Documents Required for Lower Deduction Certificate for NRIs

If you are an NRI and want to apply for a Lower TDS Certificate, you need to gather several important documents. This certificate reduces the tax taken from your income in India. Here is a simple list of what you need:

- PAN Card: You must have a Permanent Account Number card.

- Tax Residency Certificate: This proves where you live for tax purposes.

- Income Proof: You need to show where your income comes from in India.

- Bank Statements: These show your financial transactions for the last six months.

- Property Documents: If your income comes from property, include these papers.

- Investment Details: If you have investments, you need to provide details about them.

Application for Lower Deduction of TDS for NRI

Applying for a lower TDS deduction Certificate for NRI is easy if you follow these steps. This certificate helps reduce the tax deducted from your income in India. Here’s what you need to do:

- Step 1- Get Ready with Your Documents: First, make sure you have all the necessary documents. You need your PAN card, Tax Residency Certificate, proof of income, recent bank statements, property documents, if applicable, and details of your investments.

- Step 2- Visit the Income Tax e-Filing Portal: Go to the official e-Filing website of the Indian Income Tax Department.

- Step 3- Log In: Use your credentials to log into your account. If you don’t have an account, you will need to create one.

- Step 4- Fill Out Form 13: This form is for applying for a Lower TDS Certificate. Fill it carefully with all the required details.

- Step 5- Attach Your Documents: Upload the documents you gathered in the first step.

- Step 6- Submit Your Application: Check all the information again to make sure it’s correct. Then, submit your application.

- Step 7- Track Your Application: Keep an eye on your application status through the e-filing portal. You can see if you need to provide any more information.

- Step 8- Get Your Certificate: After your application is accepted, your Lower TDS Certificate will be issued to you. This certificate will state the new, reduced rate of TDS for your income.

Lower TDS Certificate Process: Steps After Obtaining It

Once you receive your Lower TDS Certificate as an NRI, it’s important to use it correctly to benefit from it. Here are simple steps to follow:

- Step 1- Inform Your Payers: First, tell everyone who pays you from India, like tenants or clients, that you have this certificate. They need to know so they can deduct less tax from your payments.

- Step 2- Provide Copies: Give them a copy of your Lower TDS Certificate. This serves as proof so they can adjust the tax they deduct.

- Step 3- Check Your Statements: Regularly check your bank statements to see if the correct, lower amount of tax is being deducted.

- Step 4- Store Your Certificates Safely: Keep your certificate in a safe place. You might need it for your tax records or to show to the tax authorities.

- Step 5- Renew If Necessary: Remember, this certificate is valid only for the specified period. If you still qualify, you need to apply for a new one before the current one expires.

Lower TDS Certificate for NRI Timeline

Applying for a lower tax deduction certificate as an NRI is important to avoid excessive TDS on income sources such as rent, property sales, or interest. Once the application (Form 13) along with the required documents is submitted to the Income Tax Department, the certificate is generally processed and issued within 3-6 weeks. However, the timeline may vary depending on the assessing officer’s workload and jurisdiction. NRIS should be applied well in advance, especially before large or recurring transactions, to ensure the certificate is available in time and avoid excess tax deduction .

Benefits of Lower TDS Certificate

When an NRI sells a property in India, the buyer is required to deduct TDS at a flat rate of 20% to 30% (plus surcharge and cess) on the entire sale value, resulting in an excess tax deduction. To avoid this, NRIs can apply for a lower deduction certificate for the sale of property by an NRI under Section 197 of the Income Tax Act.

- It ensures TDS is deducted only on taxable capital gains, not the full sale consideration.

- It prevents large amounts from getting blocked in tax refunds, giving NRIs immediate access to sale proceeds.

- It reduces the need for refund claims and simplifies income tax return filing.

- It also helps align TDS rates with applicable Double Taxation Avoidance Agreement provisions, if eligible.

- It speeds up the transactions with reduced TDS requirements.

- Clear tax deduction ensures smoother transactions and minimises the risk of non-compliance penalties.

How Does NoBroker Help NRIs with Lower TDS Certificates?

NoBroker simplifies getting and using a lower TDS certificate for NRI. If you are an NRI and want to pay less tax on your income from India, NoBroker can guide you through each step. They help you collect the right documents, fill out the needed forms, and submit everything correctly. Once you have your certificate, NoBroker shows you how to use it properly so you can really benefit from it.

If you need legal help or have questions about this process, NoBroker’s legal team is ready to assist you. They make sure you understand each step and help you handle your tax duties in India easily. Reach out to NoBroker for support with your lower TDS certificate and any other legal needs.

Frequently Asked Questions

Ans: A nil TDS certificate for NRI means no tax is taken from your income in India. NRIs who think they shouldn’t pay tax use this to save money.

Ans: You can apply for an NRI lower tax deduction certificate online through the Indian Income Tax Department’s portal.

Ans: A TDS exemption certificate for NRI lets you avoid TDS on your Indian income if you meet certain conditions.

Ans: Apply for a lower tax deduction certificate for NRI before the start of the fiscal year or before receiving your income in India.

Ans: A lower TDS certificate for NRI is usually valid for one fiscal year.

Ans: Yes, a lower TDS certificate is valid for multiple transactions within a single financial year.

Ans: Yes, without a lower TDS certificate, the TDS will be deducted at the standard rates.

Recommended Reading

TDS on Sale of Property by NRI: Rules, Exemptions & Filing Process 2026

June 1, 2025

9194+ views

TDS on Rent Paid to NRI: Understanding Section 195, Applicable Rates, Forms and Procedure

January 31, 2025

5244+ views

Lower TDS Certificate for NRI: Step-by-Step Process to Application and Benefits for NRIs

January 31, 2025

2170+ views

Loan Against Property for NRI: A Guide to Flexible Financing: Benefits, Eligibility & More in 2026

January 31, 2025

1172+ views

Loved what you read? Share it with others!

Most Viewed Articles

NRI Power of Attorney for Property in India: How to Apply, Documents Required and Format

June 1, 2025

30691+ views

Know About ICICI NRI Account: Document Required, Eligibility and Application Process in 2026

January 31, 2025

27145+ views

NRI Accounts in India: List of Best NRE, NRO & FCNR Accounts in 2026

June 1, 2025

18093+ views

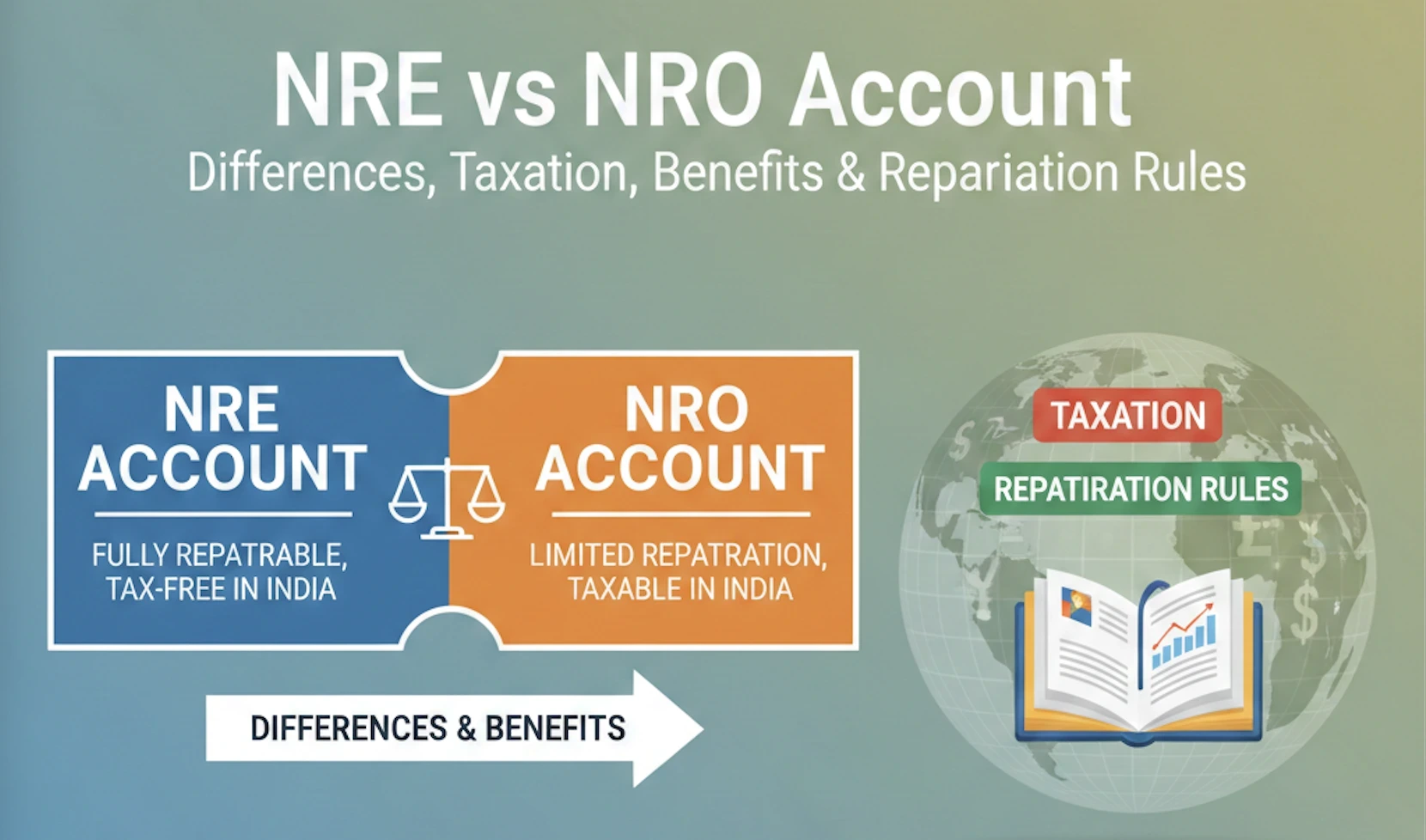

NRE vs NRO Account: Differences, Taxation, Benefits & Repatriation Rules

January 31, 2025

9976+ views

TDS on Sale of Property by NRI: Rules, Exemptions & Filing Process 2026

June 1, 2025

9194+ views

Recent blogs in

NRI Rights in India for Property: Ownership, Inheritance & Legal Rules for 2026

November 21, 2025 by Vivek Mishra

What is NRI Certificate: Meaning, Uses, Documents Required & Procedure in India

August 25, 2025 by Vivek Mishra

Power of Attorney from UAE to India: Format, Documents & Legal Process in 2026

August 25, 2025 by Vivek Mishra

Power of Attorney for India Property from UK: Format, Documents & Legal Process in 2026

August 25, 2025 by Vivek Mishra

DTAA Between India And France: Tax Relief, TDS Rules & Benefits in 2026

August 22, 2025 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!