Have you heard of a Succession Certificate? Why is it needed? How much does a succession certificate cost? What is a Succession Certificate for a property? Don’t worry. As in this blog, we will cover everything you need to know about it. Legal matters can be quite daunting when we try to understand them. Even more so in the case when there’s no rulebook available that will simplify the facts and present them together.

Things we covered for you

When a person dies intestate (without a will), their assets are passed on to their legal heirs after the court has verified the legitimacy of ownership. A situation in which a deceased person who has not left behind a will or has left it for an illegitimate cause, is known as dying intestate. This means a will has not been prepared to establish the authority and authenticity of the successor of the deceased person. This is where a Succession Certificate comes into the picture to give the certificate holder the authority to take over the securities as well as debts of the deceased person. According to sections 380, 381 and 382 of the Indian Succession Act, 1925, a succession certificate holder can take hold of the assets of the deceased person along with the debts owed.

Read: The Concept of Ancestral Property Acquisition Broken Down

What is a Succession Certificate for Property?

A succession certificate, as defined under the Indian Succession Act of 1925, is a legal document granted by Indian civil courts. It validates the legitimate claim of legal heirs when someone dies without a valid will. This certificate identifies the rightful successor to the deceased’s assets, such as Mutual Funds, Insurance, Pension, Bank Balances, and more. It empowers the holder to manage the deceased’s assets, settle debts, and ensure transfers even before the legal heir’s identification. Institutions might require this certificate as proof before processing transactions involving the deceased’s assets. It outlines assets, debts, securities, details of heirs, and their relationship to the deceased. However, it doesn’t apply to immovable properties.

Read: Ensure The Smooth Transfer of Properties by Obtaining Your Tamil Nadu Varisu Certificate

Some of the instances when succession certificate is required:

- If an overseas citizen gets into a situation where a parent or close relative has died without passing on a will

- Where you know that a property belongs to you but you need this document to prove it

It is important here to know the difference between a Legal Heir Certificate and Succession Certificate as both are not the same, despite connoting something similar in the succession certificate meaning. While a legal heir of the deceased person can apply for a succession certificate for transferring electricity/telephone connections, bank accounts etc., it is not the same as a legal heir certificate, which is issued for the approval of family pensions or transfer of movable and immovable assets. We will cover more differences later in the blog. Let us now understand what the succession certificate procedure is like.

Who issues the Succession Certificate?

A succession certificate is issued by the District Judge of the appropriate jurisdiction, where the deceased person was living at the time of death. If the authority is unable to find such a place, jurisdiction is transferred to where assets of the deceased person could be found.

What is the Procedure to Obtain a Succession Certificate? How To Get a Succession Certificate?

Legal heirs wanting to claim ownership of the assets of the deceased person should file a petition. Succession certificate petition format be done in the authorized manner and submitted after verifying it in the civil court, under the relevant jurisdiction. A copy of the death certificate should also be attached along with the petition.

Read: What is an Immovable Property: Laws and Cases?

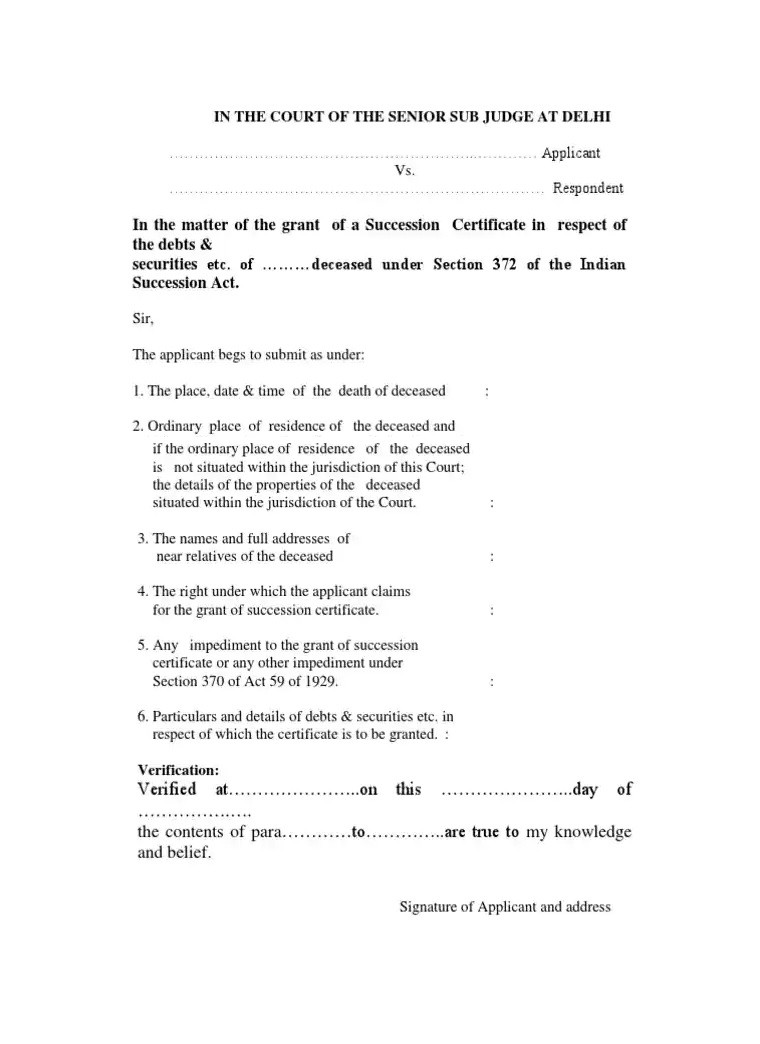

Step 1 – Filing a Petition

Legal heirs wanting to claim ownership of the assets of the deceased person should file a petition. This should be done in the authorized format and submitted after verifying it in the civil court, under the relevant jurisdiction. A copy of the death certificate should also be attached along with the petition.

The petition should mention the details written below clearly.

- Time, date and place of the death of the deceased person.

- Details of other legal relatives or heirs.

- Residence or details of properties of the deceased at the time of death within which Judge the jurisdiction falls under.

- Rights of petitioner

- Absence of any impediment to the grant of certificate.

- Identification documents like Ration Cards or Passports.

- List of the debts or securities for which the certificate is applied for.

- No objection certificates from other legal heirs

Step 2 – Submitting the Fees

According to The Court Fees Act, 1870, a specific percentage of the value of the estate is imposed by the court. This value has to be paid by the petitioner in Judicial stamps.

Step 3 – Publishing of Notice in the Newspaper

The court will now examine the petition and then make it public through a national newspaper. Along with that, the court will also notify all the other heirs and respondents. The notice gives a specific period of 45 days for anyone to raise objections against the petition with required documents to support their claim.

Step 4 – Granting the Certificate

If no one claims ownership of the assets of the deceased person or raises objections within 45 days, the court then grants the succession certificate to the petitioner given that the authenticity of the claim is established.

Read: Difference Between an Equitable Mortgage and a Registered Mortgage in India

In the case of multiple petitioners, the court may issue a joint succession certificate. But for a single asset, only one certificate will be granted.

Step 5 – Signing the Indemnity Bond

In some cases, the judge may ask the petitioner to sign an Indemnity bond, to make sure that no losses occur due to the misuse of the granted succession certificate. Signing this bond might require the petitioner to present some kind of security to the court.

What is the Fee for a Succession Certificate?

According to The Court Fees Act, 1870, a specific amount has to be paid in the form of judicial stamps when the petition is filed. The succession certificate court fees are the specific percentage of the value of the estate that is imposed by the court. This specific percentage varies from one state to the other throughout the country. Normally, it is around 2-3% of the value of the estate.

Read: Understanding a Coparcener and Property Rights in a Hindu Undivided Family

What are the Documents Required for Succession Certificate?

Before issuing a succession certificate, the court has to legally verify the ownership claimed by the petitioner. For the inspection of the petition, the court requires a certain set of documents that must be attached and verified beforehand.

Read: Karnataka Land Records: Revolutionising Access with Bhoomi Portal

Documents Needed to Obtain a Succession Certificate are

- The time of the death of the deceased person.

- Address of the deceased person at the time of death.

- Details of properties of the deceased person.

- Complete details of the family of the deceased person.

- Complete details of all the legal heirs of the deceased person.

- No Objection Certificates from other legal heirs.

- Rights of the person petitioning for a succession certificate.

- Lists of assets, debts and securities of the deceased person.

The Validity of the Succession Certificate

The Succession Certificate is valid everywhere in the country. In case the holder is a resident of some other country and has been granted a legal succession certificate by a government-appointed Indian representative, for that particular nation, the document must be stamped following the guidelines of the Court Fees Act, 1870.

Rules Of Succession Certificate in India

A succession certificate is a legal document that authorizes the heir of a deceased person to inherit and transfer their property to their name. The certificate is a valuable document that simplifies the process of inheritance and provides legal protection for the heirs. In this blog, wewill discuss the Rules of Succession Certificate in India.

When Is Succession Certificate Required?

A succession certificate is required when there is no will, and the deceased person’s legal heirs want to inherit their property. The succession certificate in family law is necessary to transfer ownership of the property to the heirs. It is also required in case of disputes between family members regarding the property.

Is Succession Certificate Required for Immovable Property?

Yes, a succession certificate is required for immovable property like land, house, or any other immovable assets. The certificate is essential to transfer ownership of the property to the legal heirs.

Succession Certificate Stamp Duty

The stamp duty for a succession certificate varies from state to state. In most states, the stamp duty is a percentage of the value of the property. In some states, the stamp duty is fixed. It is essential to pay the stamp duty to get the certificate.

Latest Insights on Succession Certificates in India

- According to a report by the Indian Express, the Delhi High Court has recently held that a succession certificate is not necessary for the transfer of shares of a deceased person in a private limited company. (Source: Indian Express)

- The Madras High Court has recently observed that a succession certificate is not required if the legal heirs of the deceased person are in agreement about the inheritance of the property.

A succession certificate is a valuable document that simplifies the process of inheritance and provides legal protection for the heirs. It is required for immovable property, and the stamp duty varies from state to state. NoBroker provides legal services that can help you obtain a succession certificate quickly and efficiently. Contact us today to learn more about our legal services.

Succession Certificate format

The Succession Certificate format essentially covers the petition no, date of the institution, date of the decision, name of petitioners, their address, and the issuance that the petitioner has been granted the authority for a specific purpose, for example, collecting debts on behalf of the deceased or change the electricity connection ownership.

How is a Succession Certificate Different from a Legal Heir Certificate?

| Criteria | Succession Certificate | Legal Heir Certificate |

| Purpose | Grants power for transactions on behalf of the deceased. Allows takeover of assets/securities and debt payment. | Identifies holder as the legal heir of the deceased. |

| Issuing Authority | District court judge | Municipality or Tehsildars |

| Specifications | Lists assets, debts, securities, and relationship of the petitioner to the deceased. | Lists all legal inheritors of the deceased. |

| Effect | Doesn’t guarantee the holder is the ultimate estate beneficiary. | Holder is entitled to inherit the estate. |

| Time Required | Minimum of 45 days | 15-20 days |

| Assets Covered | Only movable properties | All kinds of properties |

Revocation of the Succession Certificate

Succession Certificate can be revoked under the following circumstances –

- If it is obtained fraudulently by deceiving the court.

- If the proceeding that took place to grant the certificate was proven defective or incomplete.

- If the allegation of succession made by the petitioner turns out to be false.

- The certificate is no longer useful or operative due to the circumstances.

Succession laws are meticulously crafted to ensure the equitable distribution of a deceased individual’s responsibilities and assets. In the absence of a legal will, the court and the rightful heirs collaborate to settle the financial matters. Initiation of this process sees the rightful heir pursuing the Succession Certificate, a process that spans roughly 45 days from the moment a petition is submitted in court. Once the court confirms the heir’s legitimacy and resolves any disputes from other potential heirs, the District Judge issues the Succession Certificate.

This document empowers the heir to assume control of the deceased’s financial assets and obligations, ensuring that all outstanding debts are repaid to the relevant parties. If the process seems daunting, consider seeking guidance from professionals like NoBroker. They offer top-tier legal documentation services at competitive rates, ensuring a hassle-free and stress-free experience.

FAQ’s

Ans. The process of issuing the succession certificate usually takes 45 days after the petition has been filed. The court publishes the petition in the national newspaper and 45 days are given to raise any kind of objections. Post that duration, the judge can grant the succession certificate if the authenticity of the petitioner is proved.

Ans. No. The succession certificate only gives the right to take hold of the assets, securities and debts of the deceased person. It does not apply for ownership over immovable properties.

Ans. When more than one petition is filed, the court can grant a shared succession certificate. However, there’s only one succession certificate for a single asset.

Ans. A succession certificate cost is based on The Court Fees Act, 1870. The court imposes a specific percentage of the value of the estate as the fee. It states that the amount is to be paid in the form of judicial stamps. This percentage may vary from one state to another.

Ans. In case some debts or securities don’t get mentioned for some reason, the holder can file for extension or amendment as per Section 376. The amended certificate has the same value as the original certificate.

Ans. According to the Indian Succession Act, 1925, a district judge from a relevant jurisdiction can grant the succession certificate.

Ans. An application for a succession certificate is a formal request made to a court of law to grant a certificate which authorizes the rightful heir to claim the deceased person’s assets and debts.

Ans. Yes, you can apply for a succession certificate online in many jurisdictions. The process may vary by location, but it generally involves submitting an application, supporting documents, and paying the requisite fees through the designated online portal.

Enjoyed the read