Potential homeowners or buyers have the option of availing of home loans in order to finance their undertaking. Home loans also in some cases, benefit those who wish to renovate and revamp their homes. These home loans are secured loans that an individual would procure from any bank or other financial institution at a specific interest rate, which is to be paid back over a predetermined period in equated monthly instalments or EMIs.

Things we covered for you

Yes Bank, in particular, has offered its customers a wide range of home loan options, in order to cater to their varying needs. Yes, Bank home loans aim to provide high-value loans at reasonable rates and feasible repayment tenures. Their goal is to make it easy for their customers to own their dream home without having to stress over budget constraints.

Some of the advantages of Yes Bank home loans are-

- Attractive Interest Rates

- Home Loan programs tailored for Self-Employed individuals to ensure desired loan eligibility

- Balance Transfer Facility: Easy transfer of loan from the existing financier to Yes Bank at the lower rate of interest and top-up facility upon transferring.

- Longer Tenures: Yes Bank Home Loans repayment schedule includes longer tenures of up to 35 years, to ensure smaller EMIs

- Quick processing time for faster and more efficient procurement of loans.

- No Prepayment charges on floating rate Home Loan

- Convenient doorstep service

Types of Yes Bank Home Loans

- Home Purchase Loan- Home loan offered for the purchase of a new home or resale property.

- Home Improvement Loan- Loan provided for renovation or repair of your existing home.

- Home Loan Top-up- A home loan is used to procure additional funding at Home Loan rates along with existing Home Loans on the same property.

- Home Loan Transfer- Home loan to help balance transfer of home loans from other banks and Housing Finance Companies along with a top-up

- Home Loans for Self Employed- Tailor-made home loans for self-employed professionals or individuals.

- Self-construction Loan- Loan procured for the purchase of a plot and construction of a home on said plot, or construction of a home on an existing plot.

Yes, Bank offers two distinct home loan programmes which are the regular Yes bank home loans and the Yes Khushi Home Loan.

Under the regular yes bank home loan scheme, even non-resident Indians (NRI) can apply for a loan under their special Global Indian Banking Program. The Yes Khushi home loan scheme focuses on making the process of availing of a home loan even easier by way of minimal documentation requirement, reduced monthly family income requirement of just Rs. 9000, and loan amounts ranging from Rs.1 Lakh to Rs. 35 Lakhs.

[widget_homeLoan_checkEligibility_form]

Yes Bank Home Loan Eligibility Criteria

The regular Yes Bank home loan eligibility criteria include the following-

- Must be between the ages of 21 and 70 (at loan maturity or retirement age whichever is earlier).

- Salary: INR 20,000 per month; self-employment: INR 4 lakhs per annum.

- Two years of work experience is necessary for salaried personnel (or one year for qualified individuals with degrees like CA or CS from top management institutes).

- 3 years of business stability for independent contractors

- Eligibility for loan amounts ranges from Rs. 10 lakhs to Rs. 10 crores.

Yes, Bank Khushi home loan eligibility criteria include the following-

- The family’s monthly income must be greater than or equal to Rs.9000

- The property area must be a minimum of 200 sq. ft

- The loan amount ranges from Rs. 1 Lakh to Rs. 35 Lakhs

Yes Bank Home Loan Interest Rate

Regular Yes Bank Home Loan

| Applicant Type | Interest Rate |

| Salaried Applicants | 6.70% p.a. onwards |

| Woman Applicants | 6.65% p.a. onwards |

Yes Bank Khushi Home Loan

| Minimum Interest Rate | 10.25% p.a. |

| Maximum Interest Rate | 12.00% p.a. |

Comparing Yes Bank Home Loans with Other Banks and Financial Institutions

| Name of Lender | Up to 30 Lakhs | 30 Lakhs to 75 Lakhs | Above 75 Lakhs |

| SBI Home Loan | 7.55%-8.55% | 7.55%-8.45% | 7.55%-8.45% |

| HDFC | 7.55%-8.75% | 7.55%-9% | 7.55%-9.10% |

| Axis Bank | 7.60%-12.50% | 7.60%-12.50% | 7.60%-8.05% |

| ICICI Bank | 7.60%-8.20% | 7.60%-8.35% | 7.60%-8.45% |

| Kotak Mahindra Bank | 7.50% onwards | 7.50% onwards | 7.50% onwards |

| PNB Housing Finance | 7.50%–16.75% | 7.50%–16.75% | 7.60%–10.70% |

| Punjab National Bank | 7.45%-8.85% | 7.40%-8.55% | 7.40%-8.50% |

| Bank of Baroda | 7.45%-8.95% | 7.45%-8.95% | 7.45%-9.20% |

| Union Bank of India | 7.40%- 9.15% | 7.40%- 9.15% | 7.40%- 9.35% |

| IDFC First Bank | 7.50% onwards | 7.50% onwards | 7.50% onwards |

| L&T Housing Finance | 7.70%-8.70% | 7.70%- 8.70% | 7.70%- 8.70% |

| Bajaj Housing Finance | 7.20% onwards | 7.20% onwards | 7.20% onwards |

| Godrej Housing Finance | 7.49%- 10.99% | 7.49%- 10.99% | 7.49%-10.99% |

| Tata Capital | 7.75% onwards | 7.75% onwards | 7.75% onwards |

| LIC Housing Finance | 7.50%- 8.60% | 7.50%- 8.80% | 7.50%- 9% |

Yes Bank Home Loan Fees and Charges

| Type | Charges/Fee |

| Yes Bank Home Loan Processing Fee | 2% or Rs. 10,000 whichever is higher(Rs. 7,500 is non-refundable in case the loan disbursal has not been availed) |

| Part-Payment/Prepayment/Loan Pre-closure/Foreclosure Fees | None for floating rate loans2.5% on the principal outstanding for fixed-rate loans |

| Late Payment Fees | 2% per month on the overdue instalment(s) |

| Additional Interest | 2% p.a. over the applicable interest rate on the loan outstanding |

| Repayment Mode / Cheque Swap Charges | Rs. 500 |

| Cheque Bounce / Return Charges | Rs. 750 |

| Statement of Account /Amortisation Schedule | Rs. 100 per request |

| Prepayment Statement Charges | Rs. 100 per request |

| Duplicate No Objection Certificate (NOC) | Rs. 100 per request |

| Loan cancellation/Rebooking | Rs. 2,000 (additional franking/stamping norms as per actuals, if applicable) |

| Document retrieval charges (per advice) (Photocopy/scanning, etc.) | Rs. 500 |

| Switch charges- Floating to prevailing fixed rate only if the same is permitted by the bank at the time of the request | 0.5% of the outstanding loan amount |

| Switch charges- Fixed to prevailing floating rate only if permitted by the bank | 1% of the outstanding loan amount |

| Conversion charges- Higher Floating rate to lower floating rate, only if permitted by the bank | 0.5% of the outstanding loan amount |

| Conversion charges- Higher Fixed rate to lower Fixed-rate, only if permitted by the bank | 1% of the outstanding loan amount |

| EMI cycle date change | Rs. 500 |

Yes Bank Home Loan Documents Required

For self-employed applicants:

Read: ICICI Home Loan Interest Rates – Updated in April 2024

- Aadhar Card

- PAN Card or Form 60

- Fully-filled application along with passport-sized photographs

- Bank statement of the past 6 months from operative account

- Signature proof

- The last two years IT returns with income computation, an audited balance sheet, a profit and loss account, and, if appropriate, a tax audit report as well as evidence of turnover from the most recent sales/service tax returns.

- Qualification proof

For salaried applicants:

- Fully-filled application along with passport-sized photographs

- Aadhar Card

- PAN Card or Form 60

- Bank statement of the past 6 months from operative account

- Signature proof

- IT returns/ form 16 and the last two years’ salary slips

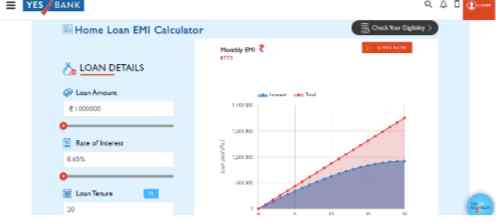

Yes Bank Home Loan EMI Calculator

Your Yes Bank home Loan EMI (equated monthly instalments) can be calculated easily with the help of the Yes Bank EMI calculator.

Yes Bank Home Loan Customer Care Details

Customers can contact Yes Bank at the numbers listed below with any questions they may have regarding home loans-

Read: PMAY Subsidy Calculator: Calculate Your PMAY Subsidy Instantly

Text “YES HL” to 9223390909 or dial 1-800-419-1717

Top Indian Bank Home Loan Intrest Rates

FAQ’s

Ans. Self-employed individuals can avail of Yes Bank home loans by providing adequate documents regarding their income.

Ans. Applicants with minimal or no income documentation can apply for Yes Khushi home loans from Yes Bank. In addition, Yes Bank takes into account the banking habits of house loan applicants without income documentation.

Ans. A co-applicant for a YES Bank House Loan may be the home loan applicant’s spouse or an immediate family member. However, every co-owner of the property must be the co-applicant.

Read: Types of Home Loans Available in India

Q. What is the minimum loan amount you can avail of through Yes Bank home loans?

Ans. With the Yes Khushi Affordable Housing Scheme the minimum loan amount would be Rs.1 lakh.

Ans. You can find a list of all approved projects under the Yes Khushi Affordable Housing Scheme sorted based on state and city here.