Paying taxes on time is not only a legal obligation but also a responsibility towards the development and maintenance of our cities. In the case of Bangalore, understanding the process of paying Property Tax is essential.

Things we covered for you

In this comprehensive blog, we introduce you to BBMP (Bruhat Bengaluru Mahanagara Palike), the governing body responsible for ensuring the smooth functioning of the city’s operations and public services. Read further how you can pay your BBMP Property Tax accurately and contribute to the overall progress and well-being of Bangalore.

What is BBMP?

BBMP (Bruhat Bengaluru Mahanagara Palike) is an administrative body responsible for civic amenities and some infrastructural assets of the Greater Bengaluru metropolitan area. It is the fourth largest Municipal Corporation in India and is responsible for the entire population of Bangalore.

BBMP is in charge of zoning and building regulations, health, hygiene, licensing, trade, and education, maintaining the quality of life by taking care of issues like public open space, water bodies, parks, and greenery.

Why do We Have to Pay Property Tax to BBMP?

In Bangalore, maintaining a high standard of living and quality of life is a priority. The city’s recognition as the best on ease of living parameters underscores this commitment. To sustain and enhance these standards, the role of BBMP (Bruhat Bengaluru Mahanagara Palike) is crucial. BBMP ensures that all citizens receive the necessary services, funded through tax collection. As responsible property owners, it is our duty to contribute our share by paying property tax to BBMP on time.

Does BBMP Collect Property Tax for all Types of Property?

You are liable to pay property tax to BBMP if you have properties like –

- An independent building (residential or commercial)

- A flat

- An apartment

- A shop

- A factory

- A godown

- A plot of land (vacant)

In Bangalore, the tax payment rules are clear and uncomplicated. Irrespective of the building type, BBMP Property Tax must be paid. Whether you reside in the property or not, rent it out, lease it, or provide it for free use, as long as the property is registered under your name, BBMP property tax payment is mandatory.

Read: An In-Depth Look at Property Registration in Bangalore

Steps for Paying Property Tax Online Bangalore

Struggling with first-time property tax payment in Bangalore? Here are the steps for house tax online payment in Bangalore:

Step 1: Know your property: If it’s your first-time property tax payment in Bangalore I’m sure you won’t know where to start and we suggest starting with getting the details of your property. Check if you have all the required documents, check the size, built-up area

Step 2: Visit the BBMP (Bruhat Bangalore Mahanagara Palike) property tax website. This site is comprehensive and has most of the information that you need, explained in a simple way. Go to: https://bbmptax.karnataka.gov.in/

Step 3: Go through the rules. The document on property tax rules is really helpful. It gives you a clear definition of terms that will make your property tax online payment easier.

Step 4: Find your Zone, sub-division and ward. Each road has been put into zones and each zone has been given a value or Guidance Value bandwidth for residential and non-residential property.

Step 5: Find out your depreciation value from the table based on the age of your building.

Step 6: Follow the online help document. This has everything that you need to know about the BBMP Property tax online filing process. If you still need additional help, the FAQ document is also there to assist you.

Step 7: Fill the form. Now that you have armed yourself with all the information you need to fill in the form, the process will be a breeze. The form is found on the homepage of the website, or you can click here.

Once you fill in your form, take screenshots or printouts. This will serve as a cheat sheet for filling out your tax forms next year.

Read: Stamp Duty and Property Registration Charges in Delhi

Where Can You Pay Your Property Tax in Bangalore?

The simplest way to pay property tax is online by using the steps provided above. If you choose to, you’re your property tax offline, then you can head to any Bangalore 1 centre or ARO office. BBMP has also tied up with a few Nationalised Banks and they are authorised to collect property tax. The approved Nationalised Banks are –

- Canara Bank

- Corporation Bank

- HDFC Bank

- IDBI Bank

- Induslnd Bank

- Indian Overseas Bank

- Kotak Mahindra Bank

- Yes Bank

- ING Vysya Bank

How Do You Calculate Your Property Tax in Bangalore?

BBMP uses three ways to calculate property tax –

- the Annual Rental Value System

- the Capital Value System

- the Unit Area System.

The Annual Rental Value System – here, the BBMP fixes the gross yearly rent that a property can get and levies a tax based on this anticipated value.

The Capital Value System – Here BBMP property tax is calculated as per the property’s market value, they use this market value to forecast the tax applicable to the property. The market value of the property is given by the area’s stamp duty department, it is not done by BBMP.

Unit Area System – in this system of calculation, property tax is charged on the property’s per-unit price of carpet area. A property’s value is multiplied by its carpet area in order to determine the amount of tax applicable.

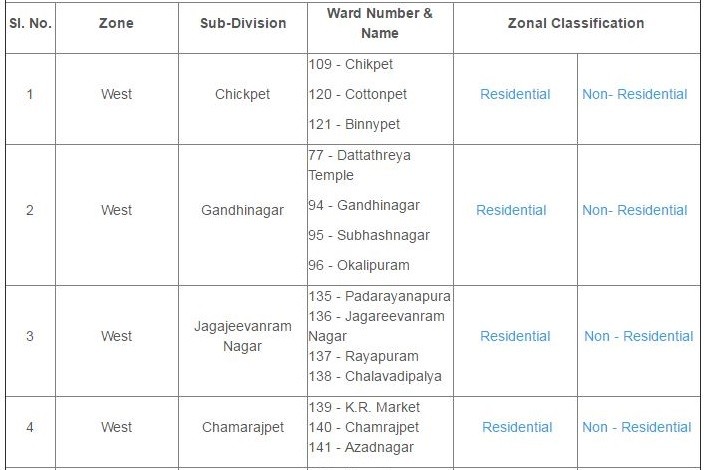

The rate at which property tax is levied is also based on the zone in which the property is located. In Bangalore there are 6 value zones, below are the zones, the sub-divisions, the ward numbers and the names you need to know –

Read: Stamp Duty and Property Registration Charges in Mumbai 2024

| Zone | Sub–Division | Ward Number and Name |

| West | Chickpet | 109 – Chikpet 120 – Cottonpet 121 – Binnypet |

| West | Gandhinagar | 77 – Dattathreya Temple 94 – Gandhinagar 95 – Subhashnagar 96 – Okalipuram |

| West | Jagajeevanram Nagar | 135 – Padarayanapura 136 – Jagareevanram Nagar 137 – Rayapuram 138 – Chalavadipalya |

| West | Chamarajpet | 139 – K.R. Market 140 – Chamrajpet 141 – Azadnagar |

| West | Govindrajanagar | 103 – Kaveripura 104 – Govindrajnagara 105 – Agrahara Dasarahalli 106 – Dr. Rajkumar Ward 125 – Marenahalli |

| West | Chandralayout | 126 – Maruthi Mandira Ward 127 – Moodalapalya 128 – Nagarabhavi 131 – Nayandanahalli |

| West | Rajajinagar | 99 – Rajajinagar 100 – Basaveshwaranagar 101 – Kamakshipalya 107 – Shivanagar |

| West | Srirammandira | 97 – Dayanandanagar 98 – Prakashnagar 108 – Srirammandira ward |

| West | Mathikere | 35 – Aramane Nagar 36 – Mathikere 45 – Malleshwaram |

| West | Malleshwaram | 64 – Rajamahal 65 – Kadumalleshwara 66 – Subramanyanagar 76 – Gayathrinagar |

| West | Nagapura | 67 – Nagapura 75 – Shankaramata 102 – Vrushabhavathinagar |

| West | Mahalakshmi Layout | 43 – Nandini Layout 44 – Marappanahalli 68 – Mahalakshmipuram 74 – Shakthiganapathi nagar |

| South | Kempegowda Nagar | 118 – Sudamnagar 119 – Dharmarayaswamy Temple Road 142 – Sunkenahalli 143 – Vishweshrapuram |

| South | Hombegowda Nagar | 144 – Siddapura 145 – Hombegowdanagar 153 – Jayanagar |

| South | Vijayanagar | 122 – Kempapura Agrahara 123 – Vijaynagar 124 – Hosahalli 134 – Bapujinagar |

| South | Gali Anjaneyaswamy Temple | 132 – Attiguppe 133 – Hampinagar 157 – Gali Anjaneya swamy Temple Ward 158 – Deepanjali Nagar |

| South | Basavanagudi | 154 – Basavanagudi 155 – Hanumanthanagar 164 – Vidyapeetha Ward |

| South | Girinagar | 156 – Srinagar 162 – Girinagar 163 – Katriguppe |

| South | Padmanabha Nagar | 161 – Hosakerehalli 181 – Kumaraswamylayout 182 – Padmanabhanagar 183 – Chikkallasandra |

| South | Banashankari | 165 – Ganeshmandira Ward 166 – Karisandra 167 – Yadiyuru 180 – Banashankari Temple Ward |

| South | B.T.M. Layout | 146 – Lakkasandra 152 – Sudduguntepalya 172 – Madiwala 176 – BTM Layout |

| South | Koramangala | 147 – Adugodi 148 – Ejipura 151 – Koramangala 173 – Jakkasandra |

| South | Jayanagar | 168 – Pattabhiramnagar 169 – Byrasandra 170 – Jayanagar East 171 – Gurappanapalya |

| South | J.P.Nagar | 177 – J.P.Nagar 178 – Sarakki 179 – Shakambarinagar |

| East | Hebbal | 18 – Radhakrishna Temple Ward 19 – Sanjaynagar 20 – Ganganagar 21 – Hebbal |

| East | J.C. Nagar | 22 – Vishwanatha Nagenahalli 33 – Manorayanapalya 34 – Gangenahalli 46 – Jayachamarajendra Nagar |

| East | K.G. Halli | 31 – Kushalnagar 32 – Kavalbyrasandra 48 – Muneshwaranagar 60 – Sagayapuram |

| East | Pulikeshinagar | 47 – Devarajeevanahalli 61 – S.K. Garden 78 – Pulikeshinagar |

| East | Maruthisevanagar | 27 – Banasawadi 28 – Kammanahalli 49 – Lingarajapura 59 – Maruthiseva Nagar |

| East | H.B.R. Layout | 23 – Nagavara 24 – HBR Layout 29 – Kacharakanahalli 30 – Kadugondanahalli |

| East | Jeevanbhimanagar | 80 – Hoysalanagar 88 – Jeevanbhimanagar 113 – Konena Agrahara |

| East | C.V. Ramannagar | 50 – Benniganahalli 57 – C.V. Ramannagar 58 – Hosathippasandra 79 – Sarvagnanagar |

| East | Shanthinagar | 111 – Shanthala Nagar 116 – Neelasandra 117 – Shanthinagar |

| East | Domlur | 89 – Jogupalya 112 – Domlur 114 – Agaram 115 – Vannarpet |

| East | Shivajinagar | 90 – Ulsoor 91 – Bharathinagar 92 – Shivajinagar |

| East | Vasanthanagar | 62 – Ramaswamy palya 63 – Jayamahal 93 – Vasanthnagar 110 – Sampangiramnagar |

| Yelahanka | Yelahanka | 1 – Kempegowda Ward 2–Chowdeshwari Ward |

| Yelahanka | Yelahanka Satellite Town | 3 – Attur 4 – Yelahanka Satellite town |

| Yelahanka | Byatarayanapura | 5 – Jakkur 6 – Thanisandra |

| Yelahanka | Kodigehalli | 7 – Byatarayanapura 8 – Kodigehalli |

| Yelahanka | Vidyaranyapura | 9 – Vidyaranyapura 10 – Doddabommasandra 11 – Kuvempunagar |

| Mahadevapura | Horamavu | 25 – Horamavu 26 – Ramamurthynagar 51 – Vijinapura |

| Mahadevapura | K.R.Puram | 52 – K.R.Puram 53 – Basavanapura 55 – Devasandra |

| Mahadevapura | HAL Airport | 56 – A. Narayanapura 81 – Vignananagar 87 – HAL Airport |

| Mahadevapura | Hoodi | 54 – Hoodi 82 – Garudacharpalya 85 – Doddanekkundi |

| Mahadevapura | Whitefield | 83 – Kadugodi 84 – Hagadooru 149 – Varthur |

| Mahadevapura | Marathalli | 86 – Marathalli 150 – Bellandur |

| Bommanahalli | Bommanahalli | 175 – Bommanahalli 188 – Bilekahalli 189 – Hongasandra |

| Bommanahalli | Arakere | 186 – Jaraganahalli 187 – Puttenahalli 193 – Arakere |

| Bommanahalli | HSR Layout | 174 – HSR Layout 190 – Mangammanapalya |

| Bommanahalli | Begur | 191 – Singasandra 192 – Begur |

| Bommanahalli | Anjanapura | 194 – Gottigere 196 – Anjanapura |

| Bommanahalli | Yelachenahalli | 195 – Konanakunte 185 – Yelachenahalli |

| Bommanahalli | Uttarahalli | 184 – Uttarahalli 197 –Vasanthapura |

| Rajarajeshwari Nagar | Rajarajeshwari Nagar | 160 – Rajarajeshwarinagar 129 – Jnanabharathi ward |

| Rajarajeshwari Nagar | Laggere | 69 – Laggere 73 – Kottigepalya |

| Rajarajeshwari Nagar | Lakshmidevinagar | 38 – H.M.T 42 – Lakshmidevinagar |

| Rajarajeshwari Nagar | Yeshwanthpur | 16 – Jalahalli 17 – J.P.Park 37 – Yeshwanthpur |

| Rajarajeshwari Nagar | Kengeri | 130 – Ullalu 159 – Kengeri 198 – Hemmigepura |

| Rajarajeshwari Nagar | Herohalli | 40 – Doddabidarakallu 72 – Herohalli |

| Dasarahalli | T–Dasarahalli | 14 – Bagalagunte 15 – T. Dasarahalli |

| Dasarahalli | Shettyhalli | 12 – Shettyhalli 13 – Mallasandra |

| Dasarahalli | Hegganahalli | 70 – Rajagopalanagar 71 – Hegganahalli |

| Dasarahalli | Peenya Industrial Area | 39– Chokkasandra 41– Peenya Industrial Area |

https://bbmptax.karnataka.gov.in/Forms/Calculator.aspx

Read: SMC Property Tax for New Property Owners: What You Need to Know

Here you must choose the right option from the dropdowns and click submit! It’s an easy and error-free way to get your property tax amount.

The basic formula to calculate property tax in Bangalore is – Gross Unit Area Value – Depreciation Amount * 20%.

Here is a sample of how the property tax is calculated – https://bbmptax.karnataka.gov.in/documents/samplePTCalculation.pdf

How can I Get a BBMP Property Tax Rebate?

If you’re looking for a rebate on your BBMP property tax, then you’re in luck, there is one way to get a rebate. You need to pay your full property tax amount in one instalment to be applicable to get a 5% BBMP property tax rebate.

Read Everything You Need to Know About Income Tax Benefits on Home Loans

Do You Get a BBMP Tax Paid Receipt When You Pay Your Property Tax in Bangalore?

For BBMP property tax online payment, you can get a tax-paid receipt by going to – https://bbmptax.karnataka.gov.in/forms/PrintForms.aspx?rptype=3

Here you need to enter your assessment year, application number and captcha. Hit enter and you will get a printable BBMP tax-paid receipt.

If you are paying BBMP property tax offline through DD or CASH, a tax-paid receipt can be generated instantly. If you are paying your property tax through cheques, then a receipt will be generated only after your cheque clears.

Is there any Fine for Late Payment of Property Tax in Bangalore?

Yes, if you fail to pay your BBMP property tax by 31st March 2023., you will have to pay a penalty. The penalty or fine is calculated at the rate of 2% extra on your property tax per month. If you find it hard to make your property tax payment in one instalment you can break it up into 2, but this way you will not be eligible for the 5% BBMP property tax rebate.

Latest News on BBMP Property Tax for 2023

If you possess an unoccupied site measuring less than 1,000 sq ft., you are now exempt from property tax payment! For other property owners, there’s still good news: the computation method for property tax has been revised. Previously calculated at 50% of the guidance value, it has now been reduced to just 25% of the guidance value.

If you’re currently searching for a house to buy, look no further than NoBroker. We offer a wide selection of homes for you to choose from. And if you’re planning to sell your house, we can assist you with that as well! Click below to discover how NoBroker can support you in your real estate endeavours.

Frequently Asked Questions

Ans. It’s easy to pay your property tax online if you have a property in Bangalore. All you need to do is visit the BBMP property tax portal and follow the simple instructions given. You can even read the detailed instructions in this article.

Ans. The last date to pay your BBMP property tax 2023 dues is by 31st March 2023.

Ans. No, to pay your property tax you can do it offline at any Bangalore 1 centre, or Assistant Revenue Officer offices. There are a few banks that are also authorised to collect property tax such as –

Canara Bank

Axis Bank

HDFC Bank

ICICI Bank

You can even pay online using the BBMP portal, this is the most suggested payment method.

Ans. To calculate how much property tax you have to pay, you need to visit – https://bbmptax.karnataka.gov.in/forms/forms.aspx

Here you need to fill in the complete self-assessment form and you will get the amount that you need to pay as property tax. You can even decide if you want to make the full payment or pay by instalments.

Ans. If you are not comfortable making online payments, the next best thing is going offline and making your property tax payments in Bangalore. You can pay at any Bangalore 1 centre, or Assistant Revenue Officer’s office. There are a few banks that are also authorised to collect property tax.

I’ll right away grab your rss as I can not in finding your e-mail subscription link or newsletter

service. Do you’ve any? Please let me know so that I could subscribe.

Thanks.

good work, this will makes ease for every one to pay a tax.